$3.6B Bitcoin Vehicle Backed by SoftBank and Tether

Twenty One Capital, Inc. is being brought public through a reverse merger with special-purpose acquisition vehicle Cantor Equity Partners, Inc. (Nasdaq: CEP). In April 2025, the firms announced a Business Combination Agreement, which values Twenty One at about $3.6 billion enterprise value (based on a ~$85,000 Bitcoin price). Under the deal, Cantor Equity Partners (a SPAC sponsored by Cantor Fitzgerald) will merge into Twenty One. Cantor’s Nasdaq-listed shares (currently trading as CEP) will continue to trade until closing, after which the new public company intends to use ticker “XXI.” The transaction is expected to close once shareholders approve, at which point Twenty One will become a Nasdaq-traded company led by co-founder and CEO Jack Mallers.

Financial structuring is a critical component of the deal. Twenty One and CEP arranged $585 million of new financing at closing. This includes $385 million in convertible senior secured notes and $200 million in common equity PIPE (private investment in public equity). The net proceeds from these financings will be used to purchase additional Bitcoin and for general corporate purposes. Cantor Fitzgerald & Co. served as placement agent for the notes and PIPE, and top law firms are advising the parties. In summary, the reverse-merger/SPAC mechanism allows Twenty One to go public with a large Bitcoin treasury and fresh capital: the combined company will trade on Nasdaq as a bitcoin-centric vehicle.

Capitalization and Asset Allocation

Twenty One’s initial strategy centers on amassing bitcoin. The company plans to launch with an initial treasury of over 42,000 BTC (roughly 3.6 billion USD at current prices), which would make it the third-largest corporate bitcoin holding in the world. For context, MicroStrategy (now Strategy) holds ~538,200 BTC and Marathon Digital Holdings (MARA) holds ~47,531 BTC as of March 2025. To fund the Twenty One portfolio, the backers have already contributed the bulk of the capital: Tether will contribute about $1.6 billion worth of bitcoin, Bitfinex ~$600 million, and SoftBank ~$900 million. On top of these contributions, Twenty One is raising the $585 million described above through debt and equity PIPE. All net proceeds will go toward further bitcoin purchases.

This capitalization produces a balance sheet heavily weighted in bitcoin (offset by debt). The rationale is explicitly to maximize “bitcoin ownership per share,” as investors seek direct exposure to bitcoin via the public markets. In fact, the company has defined new performance metrics for this purpose: a Bitcoin-per-Share ratio (BTC held divided by shares outstanding) and a Bitcoin Return Rate (the fund’s return expressed in bitcoin terms). These metrics align management’s incentives to grow the bitcoin treasury rather than pursue fiat-denominated revenue. In sum, Twenty One’s asset allocation strategy is simple but aggressive: hold and accumulate bitcoin with the capital raised, creating a pure-play bitcoin company on the public markets.

Key Stakeholders and Ownership Structure

Major Investors

Key equity investors in Twenty One include Tether, Bitfinex, and SoftBank Group. According to filings, Tether (the issuer of the USDT stablecoin) and Bitfinex (the affiliated crypto exchange) will together hold a majority stake in the combined company. SoftBank Group will hold a significant minority stake. In practical terms, Tether is committing roughly $1.6 billion of bitcoin and Bitfinex ~$600 million, while SoftBank is providing about $900 million in cash-equivalent. These contributions fund the initial bitcoin holdings.

Tether: The world’s largest stablecoin issuer by market cap. Tether’s involvement brings deep crypto-reserve expertise. Cantor Fitzgerald, Twenty One’s partner, actually manages ~99% of Tether’s USD reserves and owns ~5% of Tether. Tether CEO Paolo Ardoino has publicly endorsed the venture’s goal. He stated that Twenty One will “take a Bitcoin-first approach” and help bring Bitcoin’s “decentralized money” to public investors. In effect, Tether’s motivation is to strengthen Bitcoin’s dominance as a store of value, aligning with this strategy.

Bitfinex: A major cryptocurrency exchange tightly linked to Tether (they share management). Bitfinex will inject ~$600 million into the venture. Together with Tether, it will be one of the largest equity holders. Bitfinex’s interest is aligned with Tether’s: both stand to benefit if Bitcoin demand and legitimacy grow.

SoftBank Group: The Tokyo-based technology investment conglomerate. SoftBank will invest about $900 million for its stake. SoftBank (led by Masayoshi Son) has been an active tech investor (notably in Silicon Valley and Asia). Its participation signals strong institutional support. SoftBank’s strategic motivation may be to diversify into crypto assets or capitalize on the bullish case for Bitcoin under a pro-crypto policy environment.

These investors combine crypto-native firms (Tether/Bitfinex) with a traditional tech investor (SoftBank). The ownership structure aligns their interests: all partners want Bitcoin adoption to succeed. Cantor Fitzgerald itself (the SPAC sponsor) has a long relationship with Tether – managing its $134 billion treasury and holding equity. This network of relationships gives Twenty One access to deep crypto financial resources.

Leadership Profiles

Brandon Lutnick (Cantor Fitzgerald / Cantor Equity Partners): Lutnick is Chairman and (as of early 2025) CEO of Cantor Fitzgerald, the broker-dealer and financial firm behind the CEP SPAC. He is the son of Howard Lutnick (who recently became U.S. Commerce Secretary). Brandon was named Chair of Cantor in early 2025, inheriting leadership as his father stepped into public service. He has deep Wall Street experience and has guided Cantor’s expansion into technology and crypto services. As a principal architect of the Twenty One deal, he brings Cantor’s placement and advisory capabilities (Cantor Fitzgerald placed the PIPE financings). Lutnick leverages Cantor’s expertise in capital markets (e.g. having managed Tether’s reserves) to execute this venture. His influence is seen in the deal structure and in rallying marquee backers.

Jack Mallers (Strike / Twenty One Capital): Mallers is co-founder and the chief executive of Twenty One Capital. He is best known as the founder and CEO of Strike (formerly Zap), a Bitcoin payments platform. Mallers (born 1994) earned attention as a fintech innovator; he was named to Forbes “30 Under 30” in Finance for his work on Strike. Strike allows users to send and receive Bitcoin over the Lightning Network without directly holding cryptocurrency (it auto-converts USD to BTC under the hood). Under Mallers, Strike has forged major partnerships – for example, with Visa to issue Lightning-enabled debit cards and with payment firms like Bittrex for global expansion. He played a central role in El Salvador’s adoption of Bitcoin as legal tender, relocating Strike’s operations to San Salvador and meeting with President Bukele to integrate the Lightning infrastructure. Mallers also raised significant venture capital (an $80 million round in 2022) to scale Strike’s team and product.

Mallers’ experience in building Bitcoin-focused products and communities is a key asset for Twenty One. He has said of the new company: “Our mission is simple: to become the most successful company in Bitcoin… We’re not here to beat the market, we’re here to build a new one.” In other words, Mallers and Lutnick are positioning Twenty One as a wholly bitcoin-driven enterprise.

Operational Goals and Strategic Initiatives

Mission and Vision

Twenty One Capital’s stated mission is to maximize Bitcoin ownership per share. In practice, this means all corporate decisions – from capital deployment to product development – are evaluated by their impact on the company’s Bitcoin holdings. The company promotes two key performance metrics: a Bitcoin-per-Share (BPS) ratio (total BTC held divided by outstanding shares) and a Bitcoin Return Rate (BRR) (the fund’s return measured in bitcoin). These metrics replace traditional accounting measures, reflecting that management is judged by how much more bitcoin it can accumulate.

Co-founder Jack Mallers encapsulated the vision in the equity prospectus: “Our mission is simple: to become the most successful company in Bitcoin… We’re not here to beat the market, we’re here to build a new one.” This conveys that Twenty One will prioritize Bitcoin growth over conventional earnings. Tether’s Paolo Ardoino has echoed this vision, noting that Twenty One will bring Bitcoin’s “reliable money” to public investors. Under a potentially pro-crypto U.S. administration, the expectation is that such a company could thrive on facilitating retail and institutional Bitcoin investment.

Product Development and Innovation

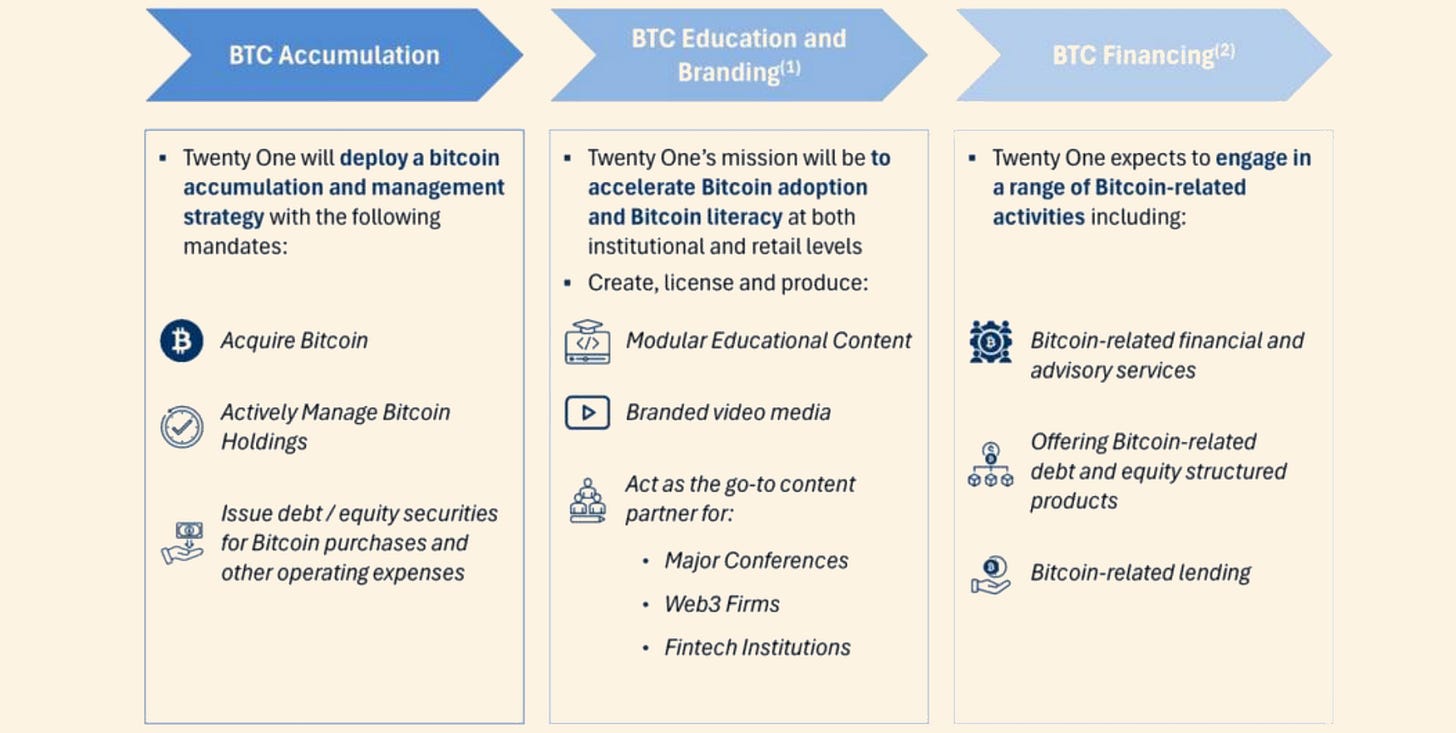

Beyond accumulating bitcoin, Twenty One aims to be a Bitcoin-native financial platform. The company plans to develop and offer bitcoin-centric financial products leveraging its treasury. For example, it may introduce lending models (loans collateralized by bitcoin), structured products tied to bitcoin price, or tokenized-fund shares for fractional BTC ownership. The firm also intends to create Bitcoin-focused media and research for its shareholders, educating investors about the cryptocurrency.

In summary, Twenty One plans to evolve MicroStrategy’s model: not only holding bitcoin on its balance sheet, but also innovating new capital-market instruments and content built around bitcoin. This could include, for instance, Bitcoin-themed ETF-like instruments or interest-bearing accounts, subject to regulatory approval. In all cases, the underlying theme is “Bitcoin first” – every product or service is designed to drive Bitcoin adoption or usage.

Leadership Spotlight: Jack Mallers and Strike

Entrepreneurial Journey

Jack Mallers has been a prominent Bitcoin evangelist and entrepreneur long before Twenty One. In 2020 he launched Strike (via Zap) as a user-friendly Lightning Network payments app. Strike’s technology lets users make instant, near-zero-fee Bitcoin transactions using a regular bank account or debit card (the app handles Bitcoin conversion invisibly). Mallers’ leadership at Strike earned him Forbes 30 Under 30 recognition and multiple partnerships. In 2020–2022, Strike teamed up with Visa (issuing prepaid Lightning cards) and expanded globally through agreements like the one with Bittrex.

Mallers also played a key role on the policy side: he met with El Salvador’s President Bukele and helped deploy Lightning payments as that country adopted Bitcoin as legal tender. He even moved parts of Strike’s operations to El Salvador and made Strike the country’s principal Bitcoin payment rail. Under his tenure, Strike raised major funding (including an $80M round led by Bitcoin-focused VC Ten31 Capital) to scale its team and open new markets. Through these efforts, Mallers built a reputation as a visionary of Bitcoin adoption – a reputation he brings to Twenty One.

Strategic Synergies

Jack Mallers’ leadership of both Strike and Twenty One suggests intentional synergies between payments and corporate treasury. For example, Strike’s wide user base and payment network could be leveraged to onboard more investors into Twenty One’s stock or future products. Conversely, Twenty One’s large bitcoin reserves and capital could support Strike’s growth – for instance, through joint promotions or by providing institutional liquidity. While detailed plans have not been announced, the integration of Mallers’ payments technology and marketing savvy with Twenty One’s investment focus is poised to reinforce each venture. Mallers has framed Twenty One as “a public stock… built by Bitcoiners, for Bitcoiners,” indicating that he views both Strike and Twenty One as parts of a unified Bitcoin ecosystem aimed at mainstream adoption.

Regulatory and Market Context

U.S. Regulatory Landscape

The timing of Twenty One’s launch coincides with a shifting regulatory backdrop. Under the previous U.S. administration (Biden era), crypto firms faced heightened scrutiny from the SEC and CFTC. In contrast, Donald Trump – who took office January 2025 – had publicly promised a friendlier stance on digital assets, pledging to “ease regulations” on crypto. Wall Street strategists noted that President Trump’s crypto-friendly signals helped ignite rallies in Bitcoin-related stocks in late 2024. By launching a major new crypto venture under a pro-crypto administration, Twenty One is positioning itself to benefit from looser regulatory constraints (e.g. easier approval of Bitcoin ETFs, less enforcement action). Nevertheless, the company will still be subject to SEC reporting rules as a public firm. Twenty One’s executives may also see an opportunity to help shape emerging regulations, given the participation of high-profile players (e.g. SoftBank) and the U.S. Commerce Secretary’s family in the project.

Competitive Positioning

Twenty One enters a competitive landscape with two well-known peers: MicroStrategy (now Strategy, ticker MSTR) and MARA Holdings (formerly Marathon Digital). MicroStrategy set the blueprint for corporate bitcoin acquisition: it holds roughly 538,200 BTC (as of April 2025) and a market capitalization of ~$91 billion. MARA is one of the largest Bitcoin miners; by March 2025 it held about 47,531 BTC. By comparison, Twenty One’s ~42,000 BTC (valued at ~$3.6 billion) is smaller than both peers, though still substantial. (In fact, its holdings would exceed many other public Bitcoin strategies.)

Asset-wise, MicroStrategy (Strategy) and Twenty One share a similar profile: both invest company capital into bitcoin and carry minimal other businesses. Marathon is different – as a miner it actively produces new BTC and also holds some as treasury. All three have shown strong conviction in bitcoin’s future. However, perceptions differ: Michael Saylor (Strategy CEO) is a Bitcoin icon, and Marathon is seen as a resilient infrastructure play. Twenty One’s identity is still forming. Its novelty – a pure acquisition vehicle backed by a stablecoin issuer and tech conglomerate – may attract attention and capital, but it will have to establish a track record. Market analysts note that these companies behave like financial instruments in the crypto ecosystem. For example, after Trump’s 2024 election, MicroStrategy’s stock jumped over 50% (on hopes of regulatory relief), illustrating how politics and bitcoin strategy combine to move markets. Twenty One will be watched to see if it can emulate or improve on that success. Ultimately, its strategic positioning is as an explicitly bitcoin-focused investment fund, distinct from software companies or miners, which could set it apart as a vehicle for pure bitcoin exposure.

Future Outlook and Strategic Implications

Market Expansion and Innovation

Twenty One’s long-term growth will depend on expanding its influence in both crypto markets and financial innovation. With the initial $3.6 billion capitalization, the company could scale up its bitcoin holdings substantially in future market dips or through new fundraising. The founders have signaled interest in creating new capital-market products, so Twenty One may launch additional investment vehicles (e.g. bitcoin-index funds, yield-bearing protocols, or even acquiring related crypto businesses). Its public listing on Nasdaq also provides a platform to issue more shares or debt to buy bitcoin if market conditions are favorable.

Geographically, the company could leverage international demand for bitcoin exposure. Given Mallers’ global reach with Strike, Twenty One might form partnerships or listings outside the U.S. in due course. Additionally, innovations from its management team – such as bitcoin-backed loans or tokenized securities – could broaden the financial ecosystem. Essentially, Twenty One is positioning itself not just as a holding company but as a launchpad for bitcoin-based financial innovation. As one analysis observed, the consortium aims to replicate the success of MicroStrategy by absorbing large amounts of bitcoin in a public format. If it achieves early performance, this model could be repeated in other crypto assets or markets, further diversifying the crypto-financial landscape.

Impact on Financial Ecosystem

The broader impact of Twenty One’s strategy could be significant. By normalizing large-scale corporate bitcoin accumulation, it may encourage other firms and funds to consider bitcoin in their capital allocation. This could accelerate institutional adoption: after all, MicroStrategy’s pivot to bitcoin helped transform it into a quasi-price proxy for Bitcoin itself. Similarly, if Twenty One’s share price or reported treasury grows with BTC, it effectively offers an on-ramp for traditional investors to gain bitcoin exposure.

On the markets, Twenty One’s purchases may support the bitcoin price (additional demand), especially if it continues to buy when prices dip. The presence of an official corporate buyer backed by stablecoin reserves and Wall Street capital could dampen volatility. It might also influence lending markets: banks and crypto lenders may devise new products (e.g. loans to Twenty One against its BTC holdings, or custody services tailored for such companies).

Regulatory attention will follow. Tether’s prominent role could renew scrutiny of stablecoin regulation, while SoftBank’s entry highlights the cross-over between tech investment and digital assets. Policymakers might respond by clarifying how existing financial laws apply to large crypto treasuries.

Finally, on Bitcoin adoption: Tether’s Paolo Ardoino suggests that Twenty One will reinforce Bitcoin as “the foundation of the new financial system” and “a reliable money.” If Twenty One succeeds, it will underscore Bitcoin’s legitimacy as a corporate treasury asset. This could help Bitcoin’s case as a global store of value and medium of exchange. In sum, Twenty One Capital’s strategy – by marrying Silicon Valley and Wall Street approaches to bitcoin – has the potential to reshape how investors and companies engage with cryptocurrency in the years ahead.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.