Bitcoin & Ethereum ETFs Surpass $120B AUM

Bitcoin ETFs marked a pivotal moment on November 7, with record inflows of $1.36 billion in a single day, reflecting intensified institutional interest. By November 23, total assets under management (AUM) for these funds exceeded $108 billion, underscoring their expanding role in professional portfolio construction. In the following sections, we will present the performance of Spot Bitcoin ETFs, Ethereum ETFs, and the ETF filing pipeline.

Spot Bitcoin ETFs

Spot Bitcoin ETFs represent a transformative step in digital asset investment, offering direct exposure to Bitcoin through secure institutional custody, including platforms like Coinbase. The SEC's landmark approval of 11 spot Bitcoin ETFs in January 2024 marked a significant moment in the integration of digital assets into traditional financial markets. These funds began trading on January 11 across major exchanges such as NYSE and CBOE. On October 18, 2024, the SEC expanded this innovation by approving options trading tied to three leading Bitcoin ETFs: Fidelity’s Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and Grayscale Bitcoin Trust (GBTC). This decision allows institutional investors to hedge or enhance their Bitcoin exposure using options—tools that provide cost-effective, flexible strategies for managing risk and optimizing returns.

Spot vs. Futures Bitcoin ETFs

Unlike derivatives-based ETFs, spot Bitcoin ETFs hold actual Bitcoin rather than relying on futures contracts, delivering greater price transparency and operational simplicity. These funds simplify access to Bitcoin by enabling faster transactions and potentially offering tax efficiencies.

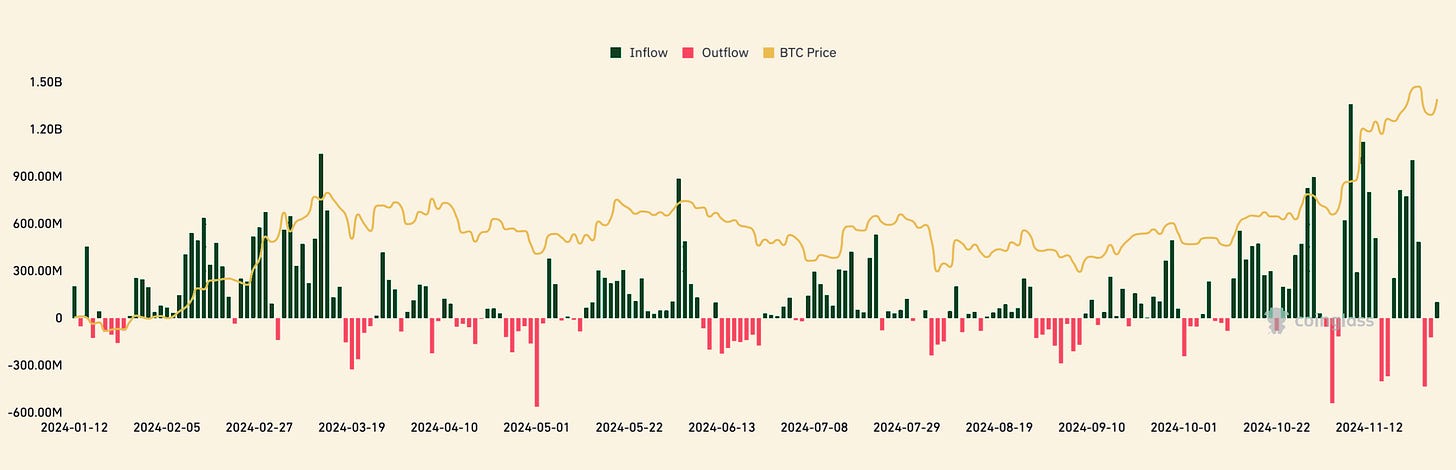

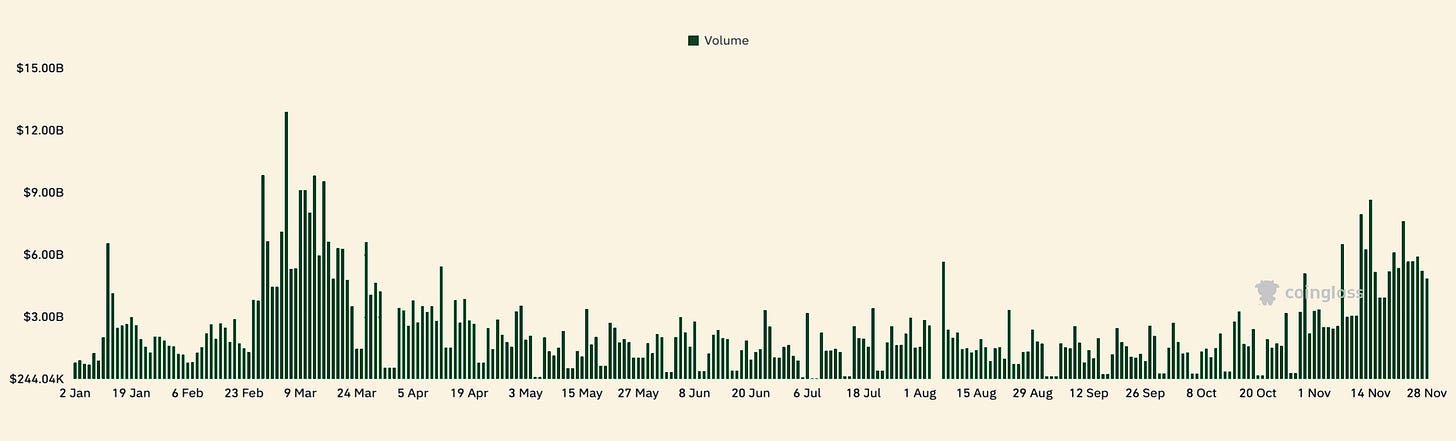

Bitcoin ETF flows in 2024 have reflected Bitcoin's price trajectory and shifting investor sentiment, with notable inflows and volume spikes in November signaling renewed institutional interest. The highest volume day of the year occurred on March 6, reaching $12.9 billion, amid heightened market activity. Following a period of subdued volumes from May to October, November saw a resurgence, peaking at $8.66 billion on November 14. Inflows on November 7 surpassed $1.36 billion, highlighting increased capital allocation as Bitcoin rallied to year-to-date highs.

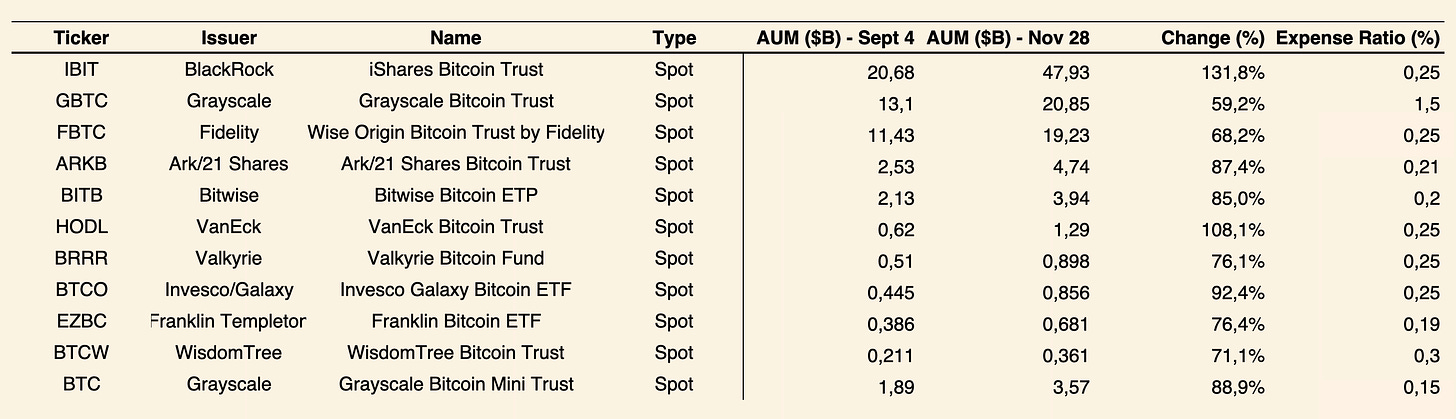

Note: It is important to highlight that two of the ETFs mentioned in the table above have a distinct structure.

Hashdex Bitcoin ETF (Ticker: DEFI)

The Hashdex Bitcoin ETF is a distinctive offering, providing direct exposure to Bitcoin by holding spot Bitcoin as its primary asset. Trading on NYSE Arca, the ETF allocates at least 95% of its assets to spot Bitcoin, with the remaining up to 5% invested in CME-traded Bitcoin futures, cash, and equivalents. This structure is designed to balance direct Bitcoin exposure with enhanced liquidity management. Managed by Hashdex, the ETF’s performance is benchmarked to the Nasdaq Bitcoin Reference Price - Settlement, which aggregates pricing data from multiple public sources to accurately reflect Bitcoin's spot market price.

Grayscale Bitcoin Mini Trust (Ticker: BTC)

The Grayscale Bitcoin Mini Trust, launched on July 31 on NYSE Arca, delivers spot Bitcoin exposure at an industry-leading annual management fee of 0.15%. The trust was seeded by transferring 10% of the Bitcoin held in Grayscale’s flagship Bitcoin Trust (GBTC), introducing a novel approach to attract a broader investor base. With its direct Bitcoin holdings and highly competitive fee structure, the Mini Trust stands out as an appealing option for cost-conscious investors seeking efficient Bitcoin exposure.

Comparison of ETFs

The comparison between traditional ETFs and Bitcoin ETFs underscores the evolving dynamics between established financial instruments and the emerging digital asset ecosystem. Traditional ETFs, such as SPY (SPDR S&P 500 ETF Trust), maintain dominance in the market with a daily trading volume of $20.18 billion and a market capitalization of $608.58 billion, offering institutional investors broad and liquid exposure to the S&P 500 Index. Similarly, VOO (Vanguard S&P 500 ETF) and IVV (iShares Core S&P 500 ETF) are pivotal in this space, with market capitalizations of $585.47 billion and $570.92 billion, respectively, providing cost-efficient access to large-cap equity performance. Niche strategies, including QQQ (Invesco QQQ Trust Series 1), with its focus on Nasdaq-100 technology companies, and IWM (iShares Russell 2000 ETF), which targets small-cap U.S. equities, demonstrate the versatility of traditional ETFs in meeting diverse portfolio objectives.

In contrast, Bitcoin ETFs are emerging as a critical gateway for institutional investors seeking regulated exposure to digital assets. The iShares Bitcoin Trust (IBIT) leads this nascent sector with a trading volume of $3.37 billion and a market capitalization of $47.93 billion, reflecting robust institutional demand for Bitcoin. The Grayscale Bitcoin Trust ETF (GBTC), with a market capitalization of $20.85 billion, highlights the early adoption phase of cryptocurrency ETFs, while Fidelity's Wise Origin Bitcoin Fund (FBTC), valued at $19.23 billion, and the ARK 21Shares Bitcoin ETF (ARKB), with a $4.74 billion market capitalization.

By comparison, Bitcoin ETFs, led by IBIT, represent an evolving asset class with significantly smaller volumes and market capitalizations. This divergence underscores the maturity of traditional ETFs, while the growth trajectory of Bitcoin ETFs highlights their increasing relevance as institutional investors diversify portfolios to include digital assets.

Leading Bitcoin ETFs Beyond U.S. Borders

Purpose Bitcoin ETF (Ticker: BTCC)

The Purpose Bitcoin ETF, the world’s first Bitcoin ETF, is listed on the Toronto Stock Exchange. It holds physical Bitcoin, providing direct exposure to Bitcoin’s price movements. With assets under management totaling approximately $2.4 billion, this ETF remains a global benchmark in Bitcoin-focused exchange-traded products.

3iQ CoinShares Bitcoin ETF (Ticker: BTCQ)

Managed by 3iQ in partnership with CoinShares, this ETF is also listed on the Toronto Stock Exchange. It offers direct exposure to Bitcoin, backed by physical holdings, and has gained prominence among investors seeking secure and regulated Bitcoin investment vehicles.

CI Galaxy Bitcoin ETF (Ticker: BTCX)

The CI Galaxy Bitcoin ETF, managed by CI Global Asset Management, is designed for both institutional and retail investors. Trading on the Toronto Stock Exchange, the ETF holds Bitcoin directly and closely tracks daily price movements, making it an attractive option for those seeking precise market exposure.

WisdomTree Bitcoin ETP (Ticker: BTCW)

The WisdomTree Bitcoin ETP is a European-listed exchange-traded product backed by physically settled Bitcoin stored securely in cold storage. Available on major European exchanges, including the SIX Swiss Exchange and Börse Xetra, it provides a straightforward and secure pathway for European investors to gain exposure to Bitcoin's price movements.

Hong Kong Spot ETFs

Hong Kong has launched its first-ever spot Bitcoin and Ethereum ETFs, signaling a pivotal step in the region’s ambition to establish itself as a global hub for cryptocurrency investments. Approved by the Hong Kong Securities and Futures Commission (SFC) on April 15, 2024, these ETFs began trading on April 30, 2024. Key participants in this groundbreaking initiative include China Asset Management (ChinaAMC), Bosera Asset Management, and HashKey Capital.

Unlike U.S.-based offerings, ChinaAMC’s Spot Bitcoin and Spot Ethereum ETFs introduce a dual subscription and redemption mechanism, allowing for both spot and physical settlement. These funds cater to a diverse investor base with options for settlement in Hong Kong dollars, US dollars, and Renminbi, and are offered in both listed and unlisted formats. This innovation provides institutional and retail investors with a secure, regulated pathway to gain direct exposure to Bitcoin and Ethereum, eliminating the need for physical custody of the assets.

Hong Kong-listed Bitcoin ETFs have not experienced significant inflows beyond their first day of trading, during which inflows reached 3,880 BTC. The net asset value (NAV) fluctuated between $250 million and $350 million but saw a substantial increase to over $450 million in early November. However, daily inflows remain markedly lower compared to U.S.-based Bitcoin ETFs, averaging approximately $30 million per day.

Ethereum ETFs Overview

The launch of spot Ethereum ETFs has been met with underwhelming performance, despite initial optimism. Since their debut on July 23, 2023, the funds have experienced significant market volatility, recording outflows of $476 million in their first month. The iShares Ethereum Trust ETF (ETHA) stands out with the highest trading volume of 493.6M, suggesting it has captured a significant share of investor activity, although it faces high turnover rates of 21.65%. Meanwhile, Grayscale's Ethereum Trust ETFs (ETHE and ETH) dominate in terms of AUM at $5.42B and $1.51B, respectively, supported by Coinbase as custodian. Fidelity’s Ethereum Fund (FETH), with a competitive expense ratio of 0.25%, lags in AUM at $839.83M but reflects steady interest among institutional players.

The latest trends in BTC and ETH ETF flows reveal significant shifts, with ETH flows as a percentage of BTC flows showing remarkable variability. Over the observed period, BTC flows generally maintained a strong positive trend, while ETH flows were more volatile, frequently switching between inflows and outflows. Notably, on November 26 and 27, ETH flows reached 87.48% of BTC flows, reflecting a sharp increase in relative activity for ETH compared to prior weeks, where percentages often hovered below 30%. These surges suggest growing investor interest or repositioning toward ETH ETFs relative to BTC ETFs. Additionally, instances of ETH flows significantly outpacing BTC on specific days, like November 13 (28.80%), highlight moments of heightened ETH preference.

Ethereum ETFs: Staking

The concept of staking Ethereum through ETFs presents a theoretical appeal but faces practical limitations within the current regulatory and operational framework. Staking, which requires active participation in Ethereum’s proof-of-stake network, demands technical infrastructure incompatible with the passive, tradable structure of ETFs. As a result, Ethereum ETFs focus solely on offering investors simplified exposure to Ethereum price movements without engaging in staking activities. This approach underscores the trade-off between ease of access and the inability to capture staking-related yields, leaving investors to rely on separate strategies for staking benefits.

Crypto ETF Filing Pipeline

As of November 28, 2024, the landscape for cryptocurrency ETFs is evolving rapidly, driven by increasing institutional interest and diversification across digital assets. Notable filings include Hashdex and Franklin’s BTC and ETH index ETFs, with final deadlines set for February 2025 and June 2025, respectively, reflecting their commitment to broader exposure to the leading cryptocurrencies. Solana-focused ETFs from VanEck, 21Shares, and Canary signal growing institutional confidence in this alternative blockchain network, with final review deadlines extending into August 2025. Additionally, Bitwise and Canary have filed multiple XRP ETF proposals, emphasizing the market's appetite for regulated access to Ripple's asset amid ongoing legal clarity. Multi-asset index ETFs from Grayscale and Bitwise, such as the Grayscale Digital Large Cap Conversion and Bitwise 10 Crypto Index Conversion, remain under extended regulatory review, with deadlines stretching into mid-2025.

Portfolio Overview of the Three Largest Spot Bitcoin and Ethereum ETF Issuers by AUM

Blackrock Portfolio (BTC & ETH) - Arkham Platform

Grayscale Portfolio (BTC & ETH) - Arkham Platform

Fidelity Custody (BTC & ETH) - Arkham Platform

Links - Bitcoin Spot ETFs:

BlackRock: iShares Bitcoin Trust

Grayscale: Grayscale Bitcoin Trust (GBTC)

Fidelity: Fidelity Bitcoin ETF (FBTC)

Ark/21 Shares: Ark 21Shares Bitcoin ETF (ARKB)

Bitwise: Bitwise Bitcoin ETF

VanEck: VanEck Bitcoin ETF (HODL)

Valkyrie: Valkyrie Bitcoin ETF (BRRR)

Invesco/Galaxy: Invesco Bitcoin ETF (BTCO)

Franklin Templeton: Franklin Bitcoin ETF (EZBC)

WisdomTree: WisdomTree Bitcoin ETF (BTCW)

Grayscale (Mini): Grayscale Bitcoin Trust

Links - Ethereum Spot ETFs:

Grayscale: Grayscale Ethereum Trust

BlackRock: iShares Ethereum Trust ETF

Fidelity: Fidelity Ethereum Fund (FETH)

VanEck: VanEck Ethereum ETF (ETHV)

Invesco/Galaxy: Invesco Galaxy Ethereum ETF (SATO)

Ark Invest/ 21Shares: Ark 21Shares Ethereum ETF (ARKY)

Hashdex: Hashdex Ethereum Nasdaq Ethereum ETF

Grayscale (Mini): Grayscale Ethereum Trust

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.