Bitcoin Miners Pivot to AI Data Centers

CoreWeave's recent five-year, $11.9 billion agreement to supply computing power to OpenAI is just one example of the ongoing shift from cryptocurrency mining to providing AI infrastructure. As part of this landmark deal, OpenAI will invest $350 million in CoreWeave, highlighting the surging demand for specialized AI data centers.

In the following segments, we’ll take a deep dive into leading Bitcoin mining companies, exploring their operating models and why nearly every major player is pivoting toward AI-focused data centers.

Leading Bitcoin Mining Companies

Marathon (MARA)

Marathon, currently valued at approximately $4.32 billion, reported a record quarterly profit of $528 million in Q4 2024, with full-year results pending announcement. Operating around 40 EH/s of Bitcoin mining hashrate, Marathon maintains over 600 MW of data center capacity across strategic sites in North Dakota, Texas, and the UAE. The company is also piloting AI inference projects, signaling its transition towards broader GPU deployments, with renewable sources supplying approximately 40-50% of its energy needs.

Riot Platforms (RIOT)

Riot Platforms, with a market capitalization of roughly $2.6 billion, achieved a notable 29% profit margin, generating $109.4 million in net income for FY2024. The company operates 31.5 EH/s hashrate across multiple data center locations, including a substantial presence in Rockdale and Corsicana, Texas, with an overall capacity of 1 GW. Riot has engaged advisors for its strategic expansion into high-performance computing (HPC), with plans to dedicate up to 600 MW toward AI-focused cloud joint ventures.

CleanSpark (CLSK)

CleanSpark, valued at about $2.24 billion, delivered a strong financial turnaround with approximately $242 million net profit in Q4 2024. The company operates around 40 EH/s of mining hashrate, maintaining a data center footprint of 726 MW in Georgia, with planned expansion up to 915 MW. Unlike peers, CleanSpark currently has no major plans to pivot into AI infrastructure, opting instead to intensify its focus on maximizing Bitcoin mining efficiency, largely powered by nuclear and zero-carbon sources.

Hut 8 Mining (HUT)

Hut 8 Mining, with an approximate market cap of $1.16 billion, reported a net loss in FY2024, largely due to the closure of its Alberta facility, though this loss was partially mitigated by revenue from hosting and HPC segments. Post-merger developments significantly expanded its infrastructure to around 675 MW across Canada and the U.S., and the company is aggressively pivoting into AI, having launched five dedicated HPC data centers and an advanced GPU cloud platform.

CoreWeave

CoreWeave, anticipating an IPO with a valuation around $35 billion, recorded an $863.4 million net loss for FY2024. The firm has fully transitioned from crypto mining into AI and high-performance computing, now operating 32 dedicated data centers across the U.S. and Europe with more than 250,000 GPUs deployed. CoreWeave recently secured a landmark five-year, $11.9 billion contract with OpenAI, underscoring the significant growth potential in AI infrastructure, and emphasizes renewable energy utilization, targeting 100% renewable power for future expansions.

Bitfarms Ltd. (BITF)

Bitfarms, valued near US$750 million, operates 13 mining facilities across Canada, the U.S., Paraguay, and Argentina, reaching 15.2 EH/s by January 2025. Known for its favorable energy profile leveraging hydropower, Bitfarms is considering expansion into HPC and AI infrastructure, recently hiring senior leadership to drive this strategy.

HIVE Digital Technologies (HIVE)

HIVE, valued around US$370 million, was among the first publicly listed crypto miners and operates facilities in Sweden, Canada, and Iceland, fully powered by renewable energy. Post-Ethereum’s shift, HIVE repurposed its GPU resources into AI and HPC, recently making a notable $30 million investment in NVIDIA AI GPUs, positioning itself as a hybrid crypto-and-AI infrastructure provider with a strong ESG focus.

Additional examples

Argo Blockchain (LSE/NASDAQ: ARBK) – a UK-based miner that once boasted 2.5 EH/s, faced distress in 2022 and had to sell its Texas facility to Galaxy Digital in 2023. Argo’s market cap fell below $100M, exemplifying the risks of overleveraging in a down market.

Iris Energy (NASDAQ: IREN) – an Australia-based miner with ~5.6 EH/s and focus on renewable energy, pivoted some capacity to HPC rentals.

Terawulf (NASDAQ: WULF) – a U.S. miner utilizing nuclear and hydro power, recently began leasing 70 MW of its New York site to an AI firm (G42) to boost revenues.

Overall, the U.S. market dominates public Bitcoin mining by scale (MARA, RIOT, CLSK alone mined ~25% of BTC in Jan 2025). Canadian firms like Hut 8, Bitfarms, and HIVE provide additional capacity and often lead in sustainability. Market capitalizations in the sector range from a few hundred million to ~$6B+, reflecting investor optimism as Bitcoin hit new highs (over $100k in late 2024). Many miners turned profitable in 2024 after surviving the prior crypto winter, but face new challenges post-2024 halving (which in April 2024 halved block rewards)

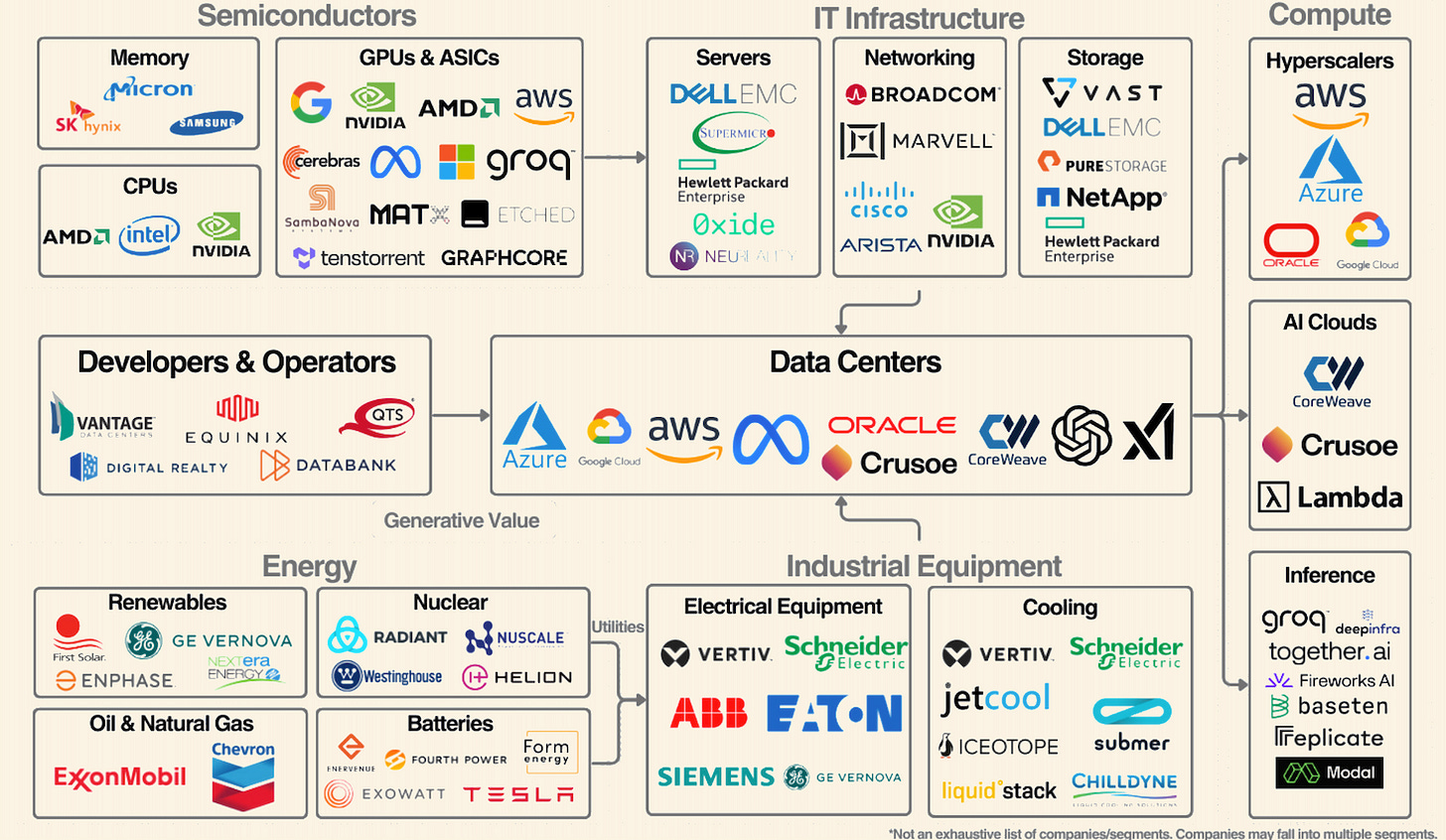

Data Center Infrastructure and Hardware Specifications

Bitcoin miners operate large-scale data centers optimized for SHA-256 hashing, often in regions with cheap and abundant power. Below we detail each major company’s infrastructure – number and location of facilities, scale (power capacity and hash rate), and the critical hardware and partnerships enabling their operations.

Marathon Digital

Marathon operates mining sites across the U.S. and internationally. In 2023–2024, it transitioned from third-party hosting to owned facilities, acquiring two major data centers totaling 390 MW, including a 100 MW site in Garden City, Texas, expandable to 200 MW and using air and immersion cooling. It also hosts at Applied Digital’s Ellendale and Jamestown, North Dakota sites (180 MW and 100 MW). Internationally, Marathon opened a state-of-the-art, 250 MW immersion-cooled facility in Abu Dhabi via a joint venture with UAE’s Zero Two. By early 2025, Marathon’s total capacity exceeded 500 MW, supporting around 40 EH/s hash rate, primarily using Bitmain Antminer S19 (Pro, XP) and next-gen Antminer S21 units. Marathon maintains strong hardware procurement relationships, notably with Bitmain, and previously with Intel for Blockscale ASICs. To vertically integrate renewable energy, Marathon partners with Beowulf Energy and Applied Digital, and notably acquired a 114 MW wind farm in Texas, directly linking data centers to dedicated green power.

Riot Platforms

Riot operates some of the largest Bitcoin mining campuses in North America, led by its flagship 750 MW Whinstone facility in Rockdale, Texas (acquired 2021). Riot is expanding with a new 1 GW Corsicana, TX facility—the first 400 MW launched in 2024, leaving ~600 MW unused. It also runs a 95 MW Navarro County site, a smaller immersion-cooled farm in Limestone, TX, and a ~42 MW facility in Paducah, Kentucky (acquired in 2021). Currently controlling over 700 MW active capacity, Riot aims to surpass 1 GW, primarily deploying 95,000+ Bitmain Antminer S19 units(late 2024). Vertical integrations—like acquisitions of ESS Metron (electrical equipment) and E4A (engineering)—enable customized infrastructure (transformers, switchgear, cooling). Riot’s flexible power strategy leverages ERCOT grid programs, turning its data centers into dynamic energy resources. Major partners include Bitmain (hardware), Priority Power (energy management), and Navarro County officials (site incentives).

CleanSpark

CleanSpark’s mining footprint centers on the U.S. Southeast, particularly Georgia, where it operates four large campuses: a 20 MW site in College Park and 50 MW in Norcross (both acquired in 2020–21), and two new campuses from 2023—the 230 MW Sandersville site (from Mawson Infrastructure) and another in Dalton. By late 2024, CleanSpark had 726 MW of power (423 MW added via M&A in the past year), reaching a hash rate of ~33.5 EH/s from roughly 250,000 latest-gen ASIC miners. A 2023 fleet refresh with discounted Bitmain S19 XP units improved fleet efficiency to ~17 J/TH, among the industry’s best.

CleanSpark emphasizes owned infrastructure and self-operation of data centers, leveraging its origins as an energy and microgrid firm for reliability. Sites mostly use standard air-cooled rigs with conventional HVAC, benefiting from Georgia’s access to cost-effective nuclear and solar power. CleanSpark also explored sites in Massachusetts (20 MW development) and Texas. Key suppliers include Bitmain (ASIC miners) and Telescent (data center automation). Uniquely, CleanSpark dynamically allocates hash power across sites using its proprietary OwnOS software.

Hut 8

Prior to merging with US Bitcoin Corp, Canada-based Hut 8 operated three mining sites: Medicine Hat, Alberta (67 MW); Drumheller, Alberta (primarily gas-powered, 42 MW, idled in 2023 due to rising costs); and North Bay, Ontario (data center hosting, 35 MW). Hut 8 offset Drumheller’s closure by boosting efficiency at other locations. Uniquely, Hut 8 also runs five traditional HPC data centers (in Ontario and British Columbia), offering GPU servers, CPU clusters, and storage solutions to clients in gaming, AI, and Web3.

Post-merger, Hut 8 inherits US Bitcoin’s assets, notably King Mountain, Texas (220 MW) and Niagara Falls, NY. Its hardware comprises approximately 65,000 MicroBT WhatsMiners and Bitmain Antminers. Facilities are mostly air-cooled, with experimental immersion cooling in Alberta due to harsh winters. Key partnerships include Nvidia and AMDfor HPC hardware (e.g., Nvidia A100 GPUs) and Validus Power for potential flare-gas energy projects. Hut 8 integrates HPC and ASIC mining within flexible, multi-purpose campuses as part of its evolving strategy.

Bitfarms

Bitfarms operates 13 geographically distributed mining farms, primarily in Québec, Canada, leveraging cheap hydropower (e.g., Sherbrooke, Farnham, Magog farms with tens of MW each). It also has a 24 MW site in Washington, a 50 MW facility in Río Cuarto, Argentina, and a 10 MW operation in Paraguay, along with hosting arrangements in Paraguay/Canada. As of February 2025, total energized capacity reached 437 MW, notably including 256 MW from renewable hydropower, emphasizing underutilized energy infrastructure. Sites typically consist of standardized warehouse-style buildings housing Bitmain ASIC miners, cooled by ambient cold air in Canada and evaporative cooling in warmer climates (Paraguay, Argentina). Bitfarms’ vertical integration, including in-house engineering and equipment refurbishment, minimizes downtime. Strategic partnerships include Strategic Pipeline for new hydro sites, MicroBT (WhatsMiner M50 units in 2024) for hardware diversification, and hosting deals (e.g., with Stronghold Digital) to monetize spare capacity.

HIVE Digital

HIVE's infrastructure stands out due to its legacy as an Ethereum miner, operating GPU-focused data centers in Sweden (Boden), Iceland, and Québec, Canada, previously totaling ~25 MW for GPU mining (now repurposed). It also deploys Bitcoin ASICs in Québec and Sweden, reaching 5–6 EH/s by late 2024. Though smaller than Marathon's or Riot's facilities, HIVE’s centers emphasize high-tech and sustainability: Sweden leverages its cold climate for free-air cooling with hydro and wind energy, while Iceland is fully geothermal-powered. Key hardware includes Bitmain S19j Pro miners, thousands of repurposed AMD/Nvidia GPUs, and new Nvidia A40/H100 datacenter GPUs introduced in 2023 for AI cloud computing. Additionally, HIVE built custom Intel Blockscale ASIC rigs (~1 EH/s added in 2023), diversifying beyond Bitmain. Close partnerships with Intel, Nvidia, and SuperMicro underline its technological strength, including immersion-cooled Intel miners. HIVE has also launched an AI-ready cloud facility in Québec and developed software for dynamically shifting GPUs between mining and HPC workloads, effectively transforming its data centers into GPU cloud clusters. Despite increased complexity and staff retraining, HIVE maintains its core strategy of reliable green energy, efficient cooling, and cutting-edge chip performance.

Across the industry, miners primarily use specialized ASIC hardware for Bitcoin (e.g., Bitmain, MicroBT, Canaan), regularly upgrading to latest-gen models like Bitmain’s Antminer S21 Pro (over 200 TH/s). Cooling techniques differ by climate: immersion cooling is rising in hot regions (UAE, Texas), while traditional airflow dominates cooler areas (Canada, Northern U.S.). Data center formats vary—from mobile containerized modules near power plants, to fixed warehouses (e.g., Marathon’s container farms in ND, brick-and-mortar facilities in TX). Regardless of form, robust power infrastructure (transformers, substations, backup generators) is essential, with many miners securing long-term power supply agreements for favorable rates (e.g., Riot in Texas, Bitfarms with Hydro-Québec). Additionally, miners leverage specialized software and AI-driven tools for hardware monitoring and optimization. In short, public miners operate massive, purpose-built data centers housing tens of thousands of ASICs, sophisticated power and cooling systems, and increasingly, GPU clusters and cloud infrastructure.

Transition Strategies Toward AI Data Centers

Facing slimmer margins and an evolving compute landscape, many Bitcoin miners in 2024–2025 have begun pivoting towards high-performance computing (HPC) and AI workloads. These strategic shifts aim to leverage miners’ existing infrastructure (cheap power, large data centers) for new revenue streams beyond cryptocurrency.

Diversification Drivers

Several factors are pushing miners toward AI/HPC: declining Bitcoin hashprice, rising network difficulty, and halving block rewards have squeezed profits, while demand and valuations for AI infrastructure surge. CoreWeave demonstrated GPU data centers can generate significantly higher revenue per MW compared to crypto mining—for instance, HIVE estimates 10 MW of Nvidia H100 GPUs yield revenue similar to 100 MW of Bitcoin mining. Investors have rewarded miners pivoting into AI/HPC with stock price premiums throughout 2024, even as pure-play Bitcoin miners sometimes lagged.

As CoinDesk noted in October 2024: “Investors continue to pay a premium for miners diversifying into AI and HPC data centers.” Ultimately, higher-margin computing and reduced crypto-dependence drive this strategic transition.

Marathon Digital

Marathon Digital, primarily a Bitcoin miner, is openly moving into AI computing. In its Feb 2025 shareholder letter, Marathon’s CEO framed the firm as an “energy transformation” company converting energy into digital value. Marathon confirmed plans to explore AI inference computing, initiating pilot projects in 2025—reinforced during its Q4 2024 earnings call. This diversification involves repurposing part of Marathon's infrastructure (currently ASIC-based) toward GPU-driven AI workloads, necessitating new hardware acquisitions. Marathon is already expanding flexible data centers for digital asset compute, aiming for 50% international energy expansion by 2028. Early AI initiatives, including pilot tests, remain small-scale. However, Marathon’s recent wind farm acquisition and focus on vertical integration could provide a competitive advantage in low-cost AI hosting. Success depends on acquiring AI hardware and expertise—potentially through partnerships or startup acquisitions. Although no major AI customers have been announced as of Mar 2025, Marathon’s transparent communication suggests active progress.

Riot

Riot Platforms is actively repurposing capacity for AI/HPC workloads. In early 2025, Riot engaged financial advisors to explore opportunities leveraging 600 MW spare capacity at its Corsicana, Texas site, one of the largest U.S. data centers near Dallas—a location described by Riot’s CEO as a “rare offering.” Management confirmed this AI/HPC focus in its 2024 results, emphasizing “exciting opportunities.”

Riot is currently in talks for hosting third-party AI compute or joint ventures, similar to competitor Terawulf’s recent 70 MW lease to AI firm G42 (~$1.5M/MW annually). Riot’s clear advantage is immediate availability of significant metro-area power and internal engineering capabilities for rapid HPC retrofits. Interest from potential partners appears strong, though timing and balancing this new direction with core mining operations remain critical. Overall, Riot’s shift toward AI represents a prudent strategy that could significantly enhance returns on infrastructure investments.

Hut 8

Hut 8 has advanced furthest among miners toward becoming an AI/cloud infrastructure provider. Since 2022, it developed its Hut 8 HPC division, offering cloud and colocation services via five data centers. Following Ethereum mining’s end in 2023, Hut 8 repurposed GPUs for client workloads like rendering, machine learning, and VFX. By early 2024, the company branded itself a "digital asset mining + cloud computing" hybrid. A significant milestone occurred in late 2023 when Hut 8 launched a GPU-as-a-service platform deploying 1,000 Nvidia H100 GPUs (~$25M investment), immediately competing with boutique AI cloud providers. It also partnered with Nvidia and AI software companies to attract clients needing GPU clusters.

Key lessons from Hut 8’s pivot: AI/HPC revenue buffered mining volatility, notably doubling total revenue YoY in Q3 2024 despite mining disruptions. However, operating AI data centers requires different expertise, prompting investments in personnel and R&D. Strategically, the pending merger with US Bitcoin, which operates large mining sites and third-party management, could leverage Hut 8’s HPC expertise, potentially converting capacity or creating mixed-use data centers. Hut 8’s early mover advantage and existing AI client base offer competitive differentiation.

HIVE Digital

HIVE was among the first public miners to pivot into HPC, starting in 2022 ahead of Ethereum’s end. By mid-2023, it launched pilot AI training projects using GPUs and began reporting initial HPC revenues. In July 2023, HIVE announced plans to provide GPU-based AI cloud computing services, securing Nvidia’s A40 GPUs. By late 2024, the company invested $30M in advanced Nvidia H100 and H200 GPU clusters at its Québec facility, set to go live by Q1 2025 and projected to generate ~$35M annually. This strategic bet aims to diversify revenue, utilizing Bitcoin mining profits amid the post-halving hashprice squeeze, as emphasized by Executive Chairman Frank Holmes. By Q3 2024, HPC revenue had grown rapidly to 8.3%, up from 1.3% in Q1 2023. HIVE’s competitive edge lies in its GPU expertise from Ethereum mining, 100% renewable energy, and strategic partnerships (e.g., CFD Direct for simulations, universities for AI research). Although scaling sales and competing against established providers remain challenges, HIVE’s relatively smaller scale means even moderate AI success could notably enhance earnings.

Other Noteworthy Moves

Several public miners have announced or executed AI/HPC transitions:

Core Scientific (CORZQ) – Once the largest Bitcoin miner, it filed for Chapter 11 in late 2022. As part of its restructuring, Core Scientific explored non-mining workloads and, in mid-2024, secured a 200 MW AI compute deal (CNBC), signaling a pivot in its bankruptcy exit.

Cipher Mining (NASDAQ: CIFR) – Still focused on Bitcoin (13.5 EH/s as of Dec 2024) but evaluating HPC opportunities at its Texas site. Its CEO (early 2025) stated they’d consider any compute workload that monetizes their power and facilities. No major AI contracts yet.

Bitfarms – Hired an SVP with HPC experience and aims to become a “North American energy and compute infrastructure company,” indicating plans to allocate some facilities to HPC.

Argo Blockchain – After selling its Texas mine, Argo refocused on Quebec hydro-based facilities. In 2024, it began exploring HPC uses during low mining profitability, rebranding a division as “Argo Labs” for GPU cloud services, albeit on a small scale.

Ault Alliance / BitNile (NYSE: AULT) – Owner of Sentinum, announced a full pivot to AI in 2023, planning to divest non-data-center assets and rebrand entirely.

Miners are increasingly rebranding as “digital infrastructure” or “computing” companies, often partnering with cloud providers (e.g., CoreWeave with Microsoft/OpenAI, Hut 8 with Nvidia, Terawulf with G42) to serve as capacity providers. Some also benefit from government incentives promoting AI data centers as tech job creators.

Competitive Advantage & Feasibility

Bitcoin miners have key advantages in pivoting to AI:

Low-cost power & energy contracts – AI data centers need as much (or more) power as mining, making miners well-positioned.

Existing infrastructure – Warehouses, cooling, and security can be quickly repurposed for HPC.

Rapid deployment experience – Miners scale fast, deploying thousands of machines in months.

Strong balance sheets – Some, like Riot ($277M cash, $1.65B BTC), can fund diversification.

However, miners must navigate a steep learning curve, competing with cloud giants (AWS, Azure) and AI-specialized firms (CoreWeave, Lambda Labs). AI data centers require enterprise engagement (SLAs, support, software), a shift from mining’s autonomy. Execution and timing are crucial.

The upside? AI compute demand is soaring in 2025. Miners who offer lower costs (via cheap power) or rapid deployment can carve out a niche—Terawulf’s 70MW AI deal, HIVE’s HPC growth, and Hut 8’s enterprise clients are early success cases.

A hybrid model could be a game-changer: mining BTC when prices are high, leasing AI capacity when mining dips—maximizing revenue per MW.

CoreWeave Case Study: From Ethereum Mining to AI

CoreWeave is a prime example of a successful pivot in the space, transitioning from crypto mining to a leading AI cloud provider. Its journey highlights how mining infrastructure can be repurposed for the AI data center boom.

Background

Founded in 2017 as an Ethereum mining operation in New Jersey, CoreWeave initially focused on GPU-based ETH mining. In 2019, it shifted gears, launching a specialized GPU cloud platform for 3D rendering and machine learning. This early diversification paid off.

By 2022, CoreWeave’s revenue was just $30M, but with the 2023 AI boom, it surged, initially projecting $500M in revenue (actual: $229M). With GPUs in high demand for AI training, CoreWeave aggressively expanded, securing cutting-edge Nvidia A100/H100 chips. In August 2023, it raised $2.3B in debt, collateralizing its Nvidia GPU inventory—effectively using GPUs as financial assets to fuel rapid growth.

Strategic Partnerships and Deals

CoreWeave’s big break came through partnerships with AI industry leaders. Notably, in early 2023 it was reported that Microsoft had signed a multi-year deal worth billions with CoreWeave to ensure OpenAI’s ChatGPT had enough compute power. In effect, CoreWeave became an auxiliary capacity provider to Microsoft’s Azure cloud (which hosts OpenAI). This was game-changing: Microsoft quickly became CoreWeave’s largest customer. Indeed, by 2024, Microsoft accounted for 62% of CoreWeave’s revenue (about $1.2 billion of CoreWeave’s $1.92B 2024 revenue). Microsoft’s investment in OpenAI indirectly flowed to CoreWeave as it supplied GPUs to run OpenAI’s workloads. Then, in early 2025, CoreWeave struck a direct deal with OpenAI: a five-year contract worth $11.9 billion to provide dedicated AI infrastructure. As part of this deal, OpenAI will receive $350M of CoreWeave stock at the IPO – essentially becoming a stakeholder. Sam Altman, OpenAI’s CEO, lauded CoreWeave as an “important addition” to OpenAI’s infrastructure alongside Microsoft and others. This deal not only validates CoreWeave’s capabilities but secures a massive revenue stream (~$2.4B/year) for the next five years, positioning CoreWeave as a key player in AI compute. CoreWeave’s partnerships extend to cloud/data center players too: it works with Oracle Cloud (OpenAI also uses Oracle, which CoreWeave complements) and teamed up with Digital Realty to host some of its hardware in Digital Realty’s colocation facilities (e.g., new data centers in the UK to serve AI clients in Europe). Another partner is Nvidia itself – Nvidia not only supplied GPUs, but also took a stake (~6%) in CoreWeave and provided early access to next-gen hardware (critical in outpacing competitors) . This symbiotic relationship (a GPU supplier investing in a top customer) underscores how CoreWeave became deeply integrated in the AI hardware ecosystem.

Operational Scale and Innovation

CoreWeave's growth has been staggering. By late 2024, it operated 32 data centers with 250,000+ Nvidia GPUs across the US and Europe—likely the largest specialized GPU cloud outside the big three. Many centers were repurposed mining sites or quickly built with cheap power, reflecting its mining roots in prioritizing scale and efficiency.

Its innovations include a GPU-optimized cloud orchestration platform, high-speed networking, and advanced cooling (e.g., direct liquid cooling). A key project was deploying Nvidia HGX superclusters, linking thousands of H100 GPUs into a distributed AI supercomputer.

CoreWeave's bespoke data center design achieved higher power density and faster deployment than traditional setups. By pre-installing transformers and substations—like in crypto mining—it brought facilities online in weeks. This "move fast" approach gave it an edge over incumbents.

Financially, CoreWeave used GPU-backed loans to raise capital and long-term contracts (e.g., OpenAI) to secure lender confidence.

Financial Performance

CoreWeave’s pivot transformed its financials: revenue surged from $30M in 2022 to $1.92B in 2024—a 60x increase in two years. This growth came with steep losses, reaching $863.4M in 2024 (up from $593.7M in 2023) due to heavy investments in data centers and hardware. Despite this, investors remain bullish, driven by top-line expansion and future contracts. Valuation soared from ~$2B in early 2023 to a targeted $35B IPO in March 2025, making it one of the biggest tech IPOs of the year. Dubbed “one of the hottest AI startups in the U.S.” by Reuters, CoreWeave also made TIME100’s Most Influential Companies list in 2024. If the IPO holds, early backers like Nvidia and Magnetar stand to gain significantly.

Major Deals and Clients

CoreWeave powers key AI workloads, including ChatGPT and OpenAI services, as well as Stability AI’s Stable Diffusion, having been an early cloud provider in 2022. It serves enterprise clients via its cloud API, reportedly including fintechs, animation studios, and research labs. Notable partnerships include Anyscale (scalable AI training with Ray) and LMNT/EleutherAI (open-source AI training). It also formed Stargate, a JV with SoftBank, aligning with OpenAI’s cloud expansion. Hardware-wise, CoreWeave primarily relies on Nvidia GPUs but also offers AMD MI250 and potentially Intel Gaudi AI accelerators—positioning itself as a key player in AI infrastructure while expanding Nvidia’s footprint beyond cloud giants.

Key Takeaways

CoreWeave’s success offers a roadmap for Bitcoin miners considering a pivot:

Leverage existing strengths: CoreWeave thrived by repurposing its expertise in GPU and power management for AI. Bitcoin miners can do the same by using their infrastructure and operational know-how, even if ASICs aren’t AI-compatible. Installing GPU clusters or other high-demand computing setups could be a viable path.

Bold investments and partnerships: CoreWeave took big risks—massive loans, bulk GPU purchases—positioning itself early in AI. Miners may need to make similarly aggressive moves, securing key partnerships to share risk and gain expertise. CoreWeave’s OpenAI/Microsoft deal was a game-changer; miners will likely need an anchor AI client to justify large-scale shifts.

Speed matters: CoreWeave scaled fast, repurposing mining facilities in months while traditional data centers took years. Miners have a similar speed advantage—if they act quickly, they could meet surging demand before cloud giants dominate. CoreWeave’s potential ~$35B IPO highlights the valuation gap: AI infrastructure commands far higher multiples than crypto mining, pressuring miners to adapt.

Commitment to the pivot: CoreWeave went all-in on AI, exiting crypto entirely. While Bitcoin miners may not do the same, a half-hearted approach could backfire. Hiring AI cloud engineers and possibly spinning off AI divisions could ensure real traction.

Energy Sources and Sustainability

Energy is the lifeblood of Bitcoin mining, and it is both a major cost factor and an ESG focal point for public companies. Here we examine the energy sources and sustainability measures of the leading miners, including their use of renewables, geographical advantages, regulatory compliance, and notable green initiatives. Each company’s approach to power procurement and environmental impact mitigation is slightly different, reflecting local resources and corporate strategy.

Marathon Digital

Marathon has shifted toward renewable and off-grid energy, exiting a coal-powered Montana facility in 2022 to focus on cleaner sources. A key move was acquiring a 114 MW wind farm in Hansford County, TX, in Feb 2025, with 240 MW of grid interconnection for its mining operations. Marathon colocates miners at renewable sites, like Garden City, TX, and North Dakota, using wind-heavy grids. While it hasn’t disclosed its exact renewable mix, it aims for a majority over time. Marathon’s ESG reports highlight Bitcoin mining’s role in grid stabilization, and it targets 100% carbon neutrality, joining initiatives like the Bitcoin Mining Council. It’s also exploring nuclear partnerships, holding 2024 talks with plant operators. Internationally, its Abu Dhabi JV uses off-peak grid power for efficiency. Marathon positions itself as an ESG-conscious miner, investing in renewables for sustainability and cost-effective power.

Riot Platforms

Riot operates primarily in Texas, connecting to the ERCOT grid, which is powered by natural gas (~50%), wind (~20%), solar (~5%), and coal (~15%). While not fully renewable, Texas offers some of the lowest electricity costs in the U.S. and growing wind/solar capacity. Riot leverages this with a dynamic power strategy—mining intensively when demand is low (typically at night with strong wind generation) and curtailing operations during peak demand (hot afternoons) to stabilize the grid. This flexibility not only supports grid reliability but also generates substantial revenue ($33.7M in power credits in 2024).

Riot functions as a demand response asset, shutting down operations during extreme events like the 2021 winter storm and 2022 summer peaks to aid local communities. Its Texas power contracts secure fixed low rates (~2.5¢/kWh at Rockdale), incorporating wind energy when available. While Riot hasn’t built its own renewables, its facilities benefit from Texas’s high wind output, particularly at night. In 2023, it expanded with a 100 MW Corsicana site near a large solar farm, enabling potential behind-the-meter solar use.

Riot emphasizes sustainability through efficiency and grid integration. Its ESG report highlights a relatively low carbon footprint given the grid mix, nearly full hardware recycling, and compliance with Texas environmental regulations. As a Bitcoin Mining Council member, Riot disclosed that over 50% of its 2023 energy mix was "carbon neutral" (including renewables and nuclear). Notably, its Texas immersion cooling system uses biodegradable, non-toxic dielectric fluid, improving mining efficiency and reducing overall energy consumption.

CleanSpark

CleanSpark operates mainly in Georgia, where the grid is ~60% nuclear and natural gas, ~6% renewables, with the rest from coal. Georgia’s nuclear plants (Vogtle, Hatch) provide steady, carbon-free baseload, likely powering CleanSpark’s facilities indirectly. While not explicitly branded as “green,” CleanSpark originated as a microgrid company and has experimented with solar + battery solutions at smaller sites. In 2022, one Georgia farm reported ~90% non-fossil power (thanks to nuclear), though company-wide figures weren’t disclosed.

The company focuses on efficiency, reducing energy per TH to lower its carbon footprint per BTC mined. It also supports community projects, training workers in renewable energy and data center tech. Regulatory compliance is key—CleanSpark collaborates with utilities to ensure load shedding if needed, though Georgia’s grid is more stable than Texas’s.

A unique sustainability angle: CleanSpark often buys existing data centers rather than building new, reducing construction-related environmental impact. It provides emissions data (scope 1 & 2) to investors and adheres to U.S. environmental laws, contrasting with miners in regions with lax regulations. While it doesn’t market itself as aggressively on green energy as HIVE or Bitfarms, CleanSpark operates with a nuclear-heavy, relatively clean power mix and is mindful of its role in energy systems.

Hut 8

Hut 8’s mining operations have a mixed energy profile. Its Alberta sites historically relied on fossil-heavy Alberta’s grid, contributing to Drumheller’s 2024 shutdown. To offset this, Hut 8 shifted focus to its Ontario site (94% non-emitting: nuclear, hydro, renewables) and British Columbia’s grid (98% hydroelectric), reducing its carbon footprint. Its merger with US Bitcoin adds Niagara Falls' hydropower and flared gas projects, cutting methane emissions. Sustainability efforts include a Head of Sustainability, carbon tracking, RECs for offsets, and waste heat reuse (e.g., heating a greenhouse in Alberta). With an HPC pivot, Hut 8 aims to provide green computing services using Canada’s clean energy.

Bitfarms

One of the most renewable-focused miners, Bitfarms sources 79% of its power from hydropower (256 MW of 324 MW). Most Canadian sites use Hydro-Québec, with Paraguay’s site drawing from Itaipú dam. Even in Argentina, Bitfarms optimizes mining for peak renewable availability. Efficiency gains (21 W/TH in early 2025, a 40% YoY improvement) reduce energy demand. It also taps into “underutilized energy” (e.g., surplus hydro in Québec) and actively engages with communities, mitigating noise concerns in Sherbrooke. Ranked highly in the Crypto Climate Accord, Bitfarms aims for net-zero by 2030 but could reach it sooner.

HIVE Digital

A green mining pioneer, HIVE runs nearly 100% on renewables across Sweden (hydro, wind), Iceland (geothermal), and Québec (hydro). It was early to adopt ambient air cooling (reducing energy use) and solar augmentation in Sweden. HIVE’s shift to HPC offers “green AI cloud” services, leveraging its clean energy. Rather than e-waste, it repurposes legacy GPUs for AI/ML. ESG efforts include near-zero BTC carbon footprint, reforestation offsets, and grid balancing (reducing load during peak hours in Iceland). HIVE actively aligns with the Crypto Climate Accord, supporting renewable expansion.

Other Notable Strategies

Stranded natural gas mining: Some U.S. miners use waste gas from oil fields to power mobile units, reducing emissions by ~63% vs. flaring. Crusoe Energy and Cantheon (via a subsidiary) are active in this space, with support from regulators in Texas and North Dakota.

Nuclear-powered mining: Terawulf’s Nautilus facility in Pennsylvania runs on 50 MW of nuclear power, making it one of the first to use nuclear directly. Oklo, a startup, plans to supply miners with microreactors by the late 2020s. Nuclear’s steady baseload aligns with miners' 24/7 demand.

Grid services & energy management: Miners like Riot and Core Scientific curtail power use on demand, supporting grid stability. In Texas (2022), miners returned power during a heat wave, fueling the “virtual power plant” narrative. Marathon argues miners help balance renewable energy fluctuations.

Regulatory compliance & ESG reporting: Public miners now disclose energy mix and emissions. The Bitcoin Mining Council reported 58.9% sustainable power in Q4 2024. Some regions, like New York, enforce sustainability rules, pushing miners toward renewables or offsets.

Carbon offsets & reforestation: Some miners, like Core Scientific, buy offsets to appeal to ESG investors. Others fund local environmental projects, though direct renewable use remains more impactful.

Additional Cases

Genesis Mining’s Sweden Facility: Operates entirely on renewable energy, utilizing excess heat to warm local homes through integration with municipal heating systems—a rare example of sustainable innovation.

DMG Blockchain (TSXV: DMGI): Employs hydroelectric power and AI-driven load adjustments to align mining operations with renewable availability, notably achieving ISO 14001 certification for environmental management—a distinction uncommon among crypto miners.

Future Outlook

Post-Halving Profitability and Consolidation

The April 2024 Bitcoin halving cut miners’ BTC rewards, pressuring margins. By late 2024, Bitcoin's rise to ~$100khelped offset this, but stagnant or falling prices could squeeze profits in 2025. This typically drives industry consolidation, as smaller or less efficient miners face acquisitions by larger players. We’ve already seen M&A moves (Riot’s bid for Bitfarms, Hut 8’s merger with US Bitcoin), and more deals are likely in 2025–2026. Marathon and Riot, with strong capital, may acquire distressed assets, while smaller miners struggling with high costs could fade. Meanwhile, new entrants—energy firms or foreign miners—might go public or expand into North America, increasing competition. The overall trend: fewer, larger miners dominating, led by firms like Marathon, Riot, and CleanSpark.

Technological Upgrades (ASICs and Cooling)

By late 2025, next-gen ASICs (e.g., Antminer S22) could reach 300 TH/s at ~20 J/TH, further lowering costs for well-funded miners. This will widen the gap between top players and those unable to upgrade. Immersion cooling—boosting efficiency by 20-30%—may become standard, with Riot and Marathon expanding adoption. Renewables and nuclear integration might advance, with pilots emerging where small nuclear reactors power mining sites (e.g., Oklo, Terawulf). AI-driven mining software could also optimize revenue by switching pools or computational tasks dynamically.

Regulatory and Policy Environment

Mining remains under scrutiny for energy use. Texas may formalize payments for miners providing grid support, while other regions could impose carbon taxes. In Europe, MiCA mandates ESG disclosures, favoring miners with renewable energy. Global hash rate shifts are key: China’s covert mining resurgence could face crackdowns, while Middle Eastern nations (UAE, Oman, Saudi Arabia) show growing interest. U.S. public miners control ~20-25% of global hash rate, which could rise if hostile regulations elsewhere push mining to North America. However, energy price spikes remain a risk, making long-term power contracts and energy ownership increasingly critical.

Bitcoin Price & Market Cycles

Bitcoin’s price dictates miners’ fortunes. With BTC near $100K in March 2025 and some forecasting $150K+ in 1-2 years, miners enjoy strong revenues and expansion opportunities. High prices also attract more competition, increasing difficulty and squeezing margins. Many miners, like CleanSpark (50 EH by 2025) and Riot (1 GW at Corsicana), are expanding aggressively. A crash (as in 2018, 2022) could force highly leveraged miners into distress, leading to bankruptcies and fire sales. Established miners hedge risks with large BTC reserves and cash (e.g., Riot, Marathon). Key to watch: breakeven costs (~$20K-30K per BTC)—as long as BTC stays well above, miners remain profitable. Risk management (treasury strategies, hedging, diversification into HPC) will determine the winners.

AI Infrastructure Opportunity

Miners pivoting to AI must act fast to secure credibility and market share. Expect more AI partnerships—possibly a Marathon/Riot joint venture with big tech, akin to CoreWeave x OpenAI/Microsoft. Such deals could boost stock sentiment, but execution is critical. By late 2025, miners must show tangible AI revenue (e.g., HIVE’s HPC revenue run-rate). Risks include an AI bubble cooling or fierce competition compressing GPU compute margins. Miners must leverage cheap power to stay competitive. By end of 2025, either AI will be a major revenue stream or just a side experiment. Some, like CleanSpark, are choosing to double down on mining instead of diversifying.

Conclusion

Public Bitcoin miners in March 2025 are at an intriguing crossroads: enjoying the fruits of a Bitcoin bull market that’s bolstered their financials, yet keenly aware of the need to prepare for the future – be it the next halving, tighter environmental scrutiny, or the rise of AI.

The largest firms have fortified themselves with scale, strong balance sheets, and increasingly diverse operations. Their data centers – once single-purpose Bitcoin factories – are evolving into multi-purpose digital infrastructure hubs. Sustainability is no longer an afterthought but a core part of their strategy (for cost and compliance reasons).

We can expect the sector to continue maturing, looking more like the mainstream data center industry in operations, while still retaining the unique cyclical and innovative character of the crypto world.

Sources:

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.