The rapid expansion of decentralized finance (DeFi) has underscored the critical role of blockchain oracles in bridging on-chain and off-chain ecosystems. Smart contract applications, ranging from derivatives and synthetic assets to cross-chain interoperability, rely on timely and verifiable external data to execute trustless agreements. However, blockchains operate in isolated environments, unable to directly access external information—necessitating oracle solutions to facilitate secure data transmission.

Blockchain oracles function as intermediaries that query, verify, and authenticate off-chain data before relaying it to smart contracts. They are not primary data sources but instead serve as a trust layer, ensuring the accuracy and reliability of external inputs, such as market prices, real-world events, and IoT sensor readings. Given the deterministic nature of smart contracts, the integrity and security of these inputs are paramount. Consequently, Decentralized Oracle Networks (DONs) have emerged to enhance data resilience, mitigate single points of failure, and uphold the decentralized ethos of blockchain ecosystems.

As DeFi and broader Web3 applications continue to evolve, oracles will remain foundational to unlocking new financial primitives and expanding the functional scope of smart contracts. This paper examines the design, security considerations, and ongoing advancements in oracle architectures, with an emphasis on their role in fostering a robust, decentralized future.

Core Components of Oracle Systems

Data Aggregation and Verification: To mitigate risks associated with single points of failure and data manipulation, oracles aggregate data from multiple independent providers. Techniques such as cryptographic signatures, multi-party computation (MPC), and consensus-based validation enhance the reliability and security of onchain data inputs.

Node Operators: Oracle networks consist of decentralized node operators responsible for retrieving, validating, and submitting offchain data onchain. These nodes may function autonomously or as part of a consortium, employing cryptographic proofs and economic incentives to ensure accuracy and reliability.

Onchain Data Delivery: Once verified, data is transmitted to smart contracts via onchain transactions. Secure delivery mechanisms include threshold signatures, zero-knowledge proofs, and trusted execution environments (TEEs), ensuring data integrity and preventing unauthorized tampering.

Reputation and Economic Incentives: Oracle performance is assessed through onchain reputation systems that track reliability based on historical accuracy and uptime. Many decentralized oracles incorporate staking mechanisms, requiring node operators to lock collateral, which can be slashed in the event of malicious behavior or inaccurate data submissions.

Oracle Architectures

Oracle solutions vary according to blockchain application requirements. The most widely used architectures include:

Input Oracles: Fetch external data (e.g., financial market prices, sports results) and deliver it onchain for smart contract execution.

Output Oracles: Enable smart contracts to trigger offchain events, such as processing payments or controlling IoT devices.

Cross-Chain Oracles: Facilitate interoperability by enabling seamless data exchange and asset transfers between different blockchains.

Compute-Enabled Oracles: Perform complex offchain computations, including verifiable randomness generation, zero-knowledge proof verification, and automated smart contract execution.

Data Security and Integrity

Given their role in extending blockchain functionalities, oracles require rigorous security measures to maintain trust and reliability. These measures include:

Multi-Signature Data Aggregation: Data from multiple sources is aggregated, cryptographically signed, and validated by independent oracle nodes before submission.

Encryption and Secure Hardware Implementation: TEEs and cryptographic proofs prevent unauthorized data manipulation and maintain confidentiality.

Decentralization Strategies: Distributed data sources and diverse node operators eliminate single points of failure and enhance network resilience.

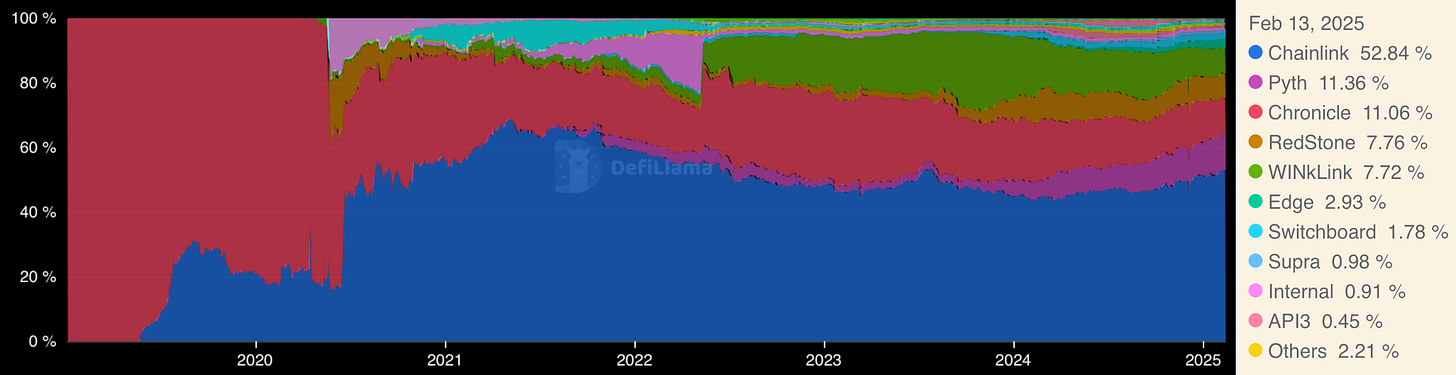

In this paper, we present a comparison of some of the leading entities in the blockchain oracle sector: Chainlink, the longest-established provider, alongside RedStone and Pyth Network.

Chainlink

Chainlink Core Team:

Co-Founder: Sergey Nazarov

Co-Founder & CTO: Steve Ellis

Chief People Officer: Giovana Totini

Chief Business Officer: Johann Eid

Chainlink Funding Insights (Total Raised: $32.00M)

Funding Rounds:

Initial Coin Offering (ICO)

Date: September 18, 2017 | Amount Raised: $32.00M

Selected Investors: 2020 Ventures, Outlier Ventures, Innovating Capital, Unify Fund, Fundamental Labs, Bauhaus Group, Framework Ventures, Next Play Ventures, Monday Capital, AlphaCoin Fund, 8 Decimal Capital, Youbi Capital, Origin Capital, BirdStone Capital, Chainfund Capital, Akwan, SkyChain Capital, SWS Venture Capital, SYD Crypto, Kintsugi Ventures, Validation Capital, Joswig Capital, Zog Capital, Sweat Equity Ventures, STC Capital, Koji Capital, The Whites Holding, FRF Capital, Abstraction Capital, Marshland Capital, Northbund Capital

Chainlink (LINK):

Token Generation Event (TGE): Chainlink's TGE occurred in September 2017

Current Price: $18.83 | Market Capitalization: $11.92 billion

Architecture

Chainlink pioneered decentralized oracles by implementing a network of independent data providers that continuously update blockchain smart contracts with verified off-chain data. Its core infrastructure relies on a federated model where multiple node operators fetch, validate, and submit price feeds.

This system underpins two primary offerings:

Market and Data Feeds: Chainlink operates a push oracle mechanism where predefined price feeds are updated on-chain at set intervals. These feeds serve a broad range of financial applications, including:

Price Feeds: Real-time price data for cryptocurrencies, commodities, and equities.

Smart Data Feeds: Enabling integration of real-world economic indicators.

Rate and Volatility Feeds: Capturing interest rates and risk metrics for structured financial products.

L2 Sequencer Uptime Feeds: Monitoring the availability of Layer 2 network sequencers to mitigate downtime risk.

Data Streams: Unlike Market and Data Feeds, Chainlink’s Data Streams function as a pull oracle, fetching data on demand instead of pushing periodic updates. This architecture allows high-frequency trading applications to access near-instantaneous price data without incurring redundant transaction costs.

Security and Governance

While Chainlink secures the highest Total Value Secured (TVS) among all oracle providers, it faces limitations in economic security:

Limited Crypto-Economic Security: Chainlink’s staking model is still in its early stages, with slashing only applied to the ETH/USD feed. This limits its deterrence against oracle manipulation.

Dispute Resolution Gaps: Whistleblower incentives exist but are confined to a subset of feeds, reducing the ability to penalize malicious behavior at scale.

Network Expansion Constraints: Chainlink predominantly operates within EVM-compatible ecosystems, requiring additional infrastructure to integrate with non-EVM chains.

A key aspect of Chainlink's strategy is the development of the Cross Chain Interoperability Protocol (CCIP). This protocol is crucial for seamless cross-chain transactions, which are essential for integrating capital markets and Real-World Assets (RWAs) into the blockchain. Chainlink's potential to facilitate the tokenization of RWAs underscores its important role in the future of blockchain technology.

Pyth Network

Pyth Core Team:

Co-Founder & CEO: Michael Cahill

Co-Founder & CTO: Jayant Krishnamurthy

Co-Founder & COO: Ciaran Cronin

Pyth Network Funding Insights (Total Raised: Not Disclosed)

Funding Rounds:

Strategic Round

Date: December 5, 2023

Selected Investors: Delphi Ventures, Multicoin Capital, CMT Digital, Wintermute, Distributed Global, Borderless Capital, Castle Island Ventures, Bodhi Ventures

Pyth Network (PYTH):

Token Generation Event (TGE): Pyth Network's TGE took place in December 2023, with an initial price of approximately $0.39.

Current Price: $0.203 | Market Capitalization: $757 million

Architecture

Pyth Network diverges from Chainlink’s federated model by sourcing price data directly from first-party providers such as centralized exchanges (CEXs), decentralized exchanges (DEXs), market makers, and hedge funds. This model reduces reliance on intermediaries, ensuring price integrity by mitigating tampering risks from third-party nodes.

Pythnet & Wormhole Integration: Pyth’s oracle infrastructure operates through Pythnet, an independent blockchain built using the Solana client. Pythnet aggregates price feeds and distributes them cross-chain via the Wormhole bridge.

Staking and Security: The Oracle Integrity Staking (OIS) mechanism requires data publishers to stake PYTH tokens as collateral, with over $100 million staked as of January 2025. This ensures economic security through slashing conditions when malicious activity is detected.

Dispute Mechanism: If a price deviation exceeding 250 basis points persists for over 60 seconds, the Pythian Council—a semi-centralized governing body—reviews the discrepancy and enforces slashing penalties where necessary.

Potential Weaknesses

Dependence on Wormhole: Any vulnerability in the Wormhole bridge poses systemic risks to Pyth’s cross-chain operations.

Limited Dispute Decentralization: Governance oversight still relies on a committee structure rather than fully decentralized arbitration.

Restrictive Expansion Model: Pyth can only provide data to networks supported by Wormhole, constraining broader adoption.

RedStone

RedStone Core Team:

Co-Founder & CEO: Jakub Wojciechowski

Co-Founder & COO: Marcin Kazmierczak

Co-Founder: Alex Suvorov

Head of BD: Matt Gurbiel

RedStone Fundraising Insights (Total Raised: $22.00M)

Funding Rounds:

Series A Round

Date: July 2, 2024 | Amount Raised: $15.00M

Selected Investors: The Spartan Group (Lead), Arrington Capital, IOSG Ventures, Kenetic Capital, Amber Group, SevenX Ventures, HTX Ventures, gumi Cryptos, Chorus One, Selini Capital, White Star Capital, Fourth Revolution Capital, Samara Asset Group, Alphemy Capital, Smokey (Angel Investor)

Angel Round

Date: May 22, 2023

Selected Investors: Stani Kulechov, Sandeep Nailwal, Alex Gluchowski, Emin Gün Sirer

Seed Round

Date: August 30, 2022 | Amount Raised: $7.00M

Selected Investors: Coinbase Ventures (Lead), Blockchain Capital (Lead), Maven 11 Capital, Distributed Global, Lemniscap, SevenX Ventures, Folius Ventures, Arweave, Compute Ventures, Permanent Ventures

$RED Tokenomics Overview

On February 12, 2025, RedStone introduced RED, a utility token designed to enhance the decentralization, security, and scalability of its blockchain oracle network. The RED token will serve as the foundation for incentivizing participants, reinforcing economic security, and scaling RedStone’s infrastructure as it expands across new blockchain ecosystems.

Key Highlights of RED Tokenomics

Max Supply: 1 billion RED (ERC-20 on Ethereum, with multi-chain expansion via Wormhole)

Initial Circulating Supply at TGE: 30%

Staking Utility: Integrated with EigenLayer AVS, allowing data providers and token holders to stake RED and secure the oracle network while earning rewards in ETH, BTC, SOL, and USDC.

Supply Unlock Schedule: 70% of tokens locked, unlocking over 4 years.

Strategic Positioning

Fastest-growing oracle: 130+ clients across 70+ chains, including Berachain, Story, TON, Monad, and MegaETH.

Economic sustainability: First staking-enabled blockchain oracle with scalable value accrual.

DeFi Infrastructure Backbone: RedStone's modular architecture enables secure and efficient cross-chain data delivery.

RED is not live yet.

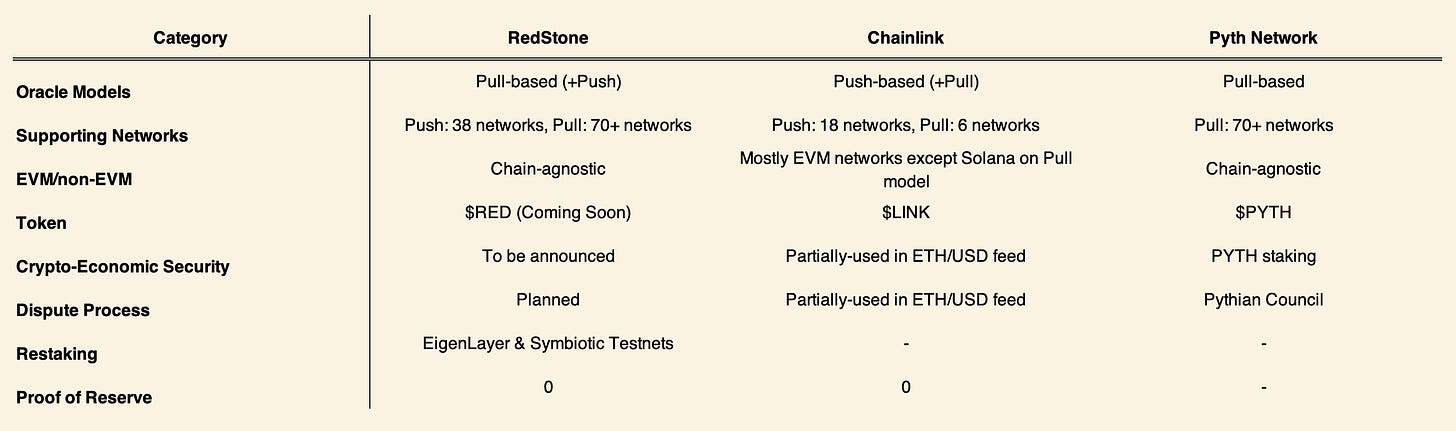

Hybrid Pull-Push Architecture

RedStone introduces an innovative hybrid oracle model that integrates a modular pull-based design with optional push functionality. This architecture enhances efficiency by enabling decentralized applications (dApps) to retrieve off-chain data on demand while preserving the push mechanism for protocols requiring continuous updates.

Data Distribution Layer (DDL): RedStone nodes aggregate data from multiple sources, including centralized (CEXs) and decentralized exchanges (DEXs), alongside alternative financial data providers. The data is signed and stored off-chain, significantly reducing gas costs by ensuring on-chain retrieval only when necessary.

Multi-Layered Storage Mechanism: Historical price data is archived on Arweave, ensuring an immutable and verifiable record of past feeds to enhance transparency and auditability.

Cross-Chain Compatibility: Unlike Chainlink and Pyth, RedStone natively supports over 70 blockchain networks without relying on a centralized cross-chain bridge, making it one of the most versatile oracle solutions.

Crypto-Economic Security and Restaking

RedStone aims to establish an advanced security framework through staking and cryptoeconomic incentives:

Staking & Slashing via RED Token: The upcoming RED token will enable a staking-based security model where data providers must stake RED tokens, subject to slashing in cases of incorrect or fraudulent reporting.

Restaking Mechanism: RedStone integrates EigenLayer and Symbiotic restaking, allowing for security scaling without overburdening liquidity providers. This approach enhances trust minimization and capital efficiency beyond traditional staking-based oracles like Chainlink and Pyth.

Dispute Resolution Protocol: An on-chain arbitration system empowers users to challenge inaccurate data submissions, with fraudulent providers facing slashing penalties to compensate affected parties.

RedStone's Pull Oracle Model

In January 2022, RedStone pioneered the pull oracle model to address inefficiencies inherent in traditional push-based oracles. Unlike push oracles, which continuously publish data on-chain regardless of demand, pull oracles enable dApps to retrieve off-chain data only when required. This model significantly optimizes cost-effectiveness by reducing unnecessary gas expenditures and on-chain congestion.

While Chainlink and Pyth later introduced pull oracle capabilities (Chainlink in October 2023 and Pyth in December 2022), RedStone maintained a first-mover advantage and has expanded its reach across over 60 blockchain networks—vastly exceeding Chainlink’s limited five-chain coverage in this category.

RedStone’s modular oracle design allows seamless customization for diverse blockchain applications. The architecture operates under two primary models:

The pull model integrates data into transactions only when necessary, maximizing flexibility and cost efficiency. Key components include:

Diverse Data Sources: RedStone aggregates pricing data from CEXs (e.g., Binance, Coinbase, Bybit), DEXs (e.g., Uniswap, Trader Joe, Sushiswap), and aggregators (e.g., CoinGecko, CoinMarketCap).

Oracle Nodes: These nodes fetch, aggregate, and validate data using methodologies such as time-weighted average price (TWAP) and liquidity-weighted average price (LWAP), signing the data for verification.

Data Distribution Layer (DDL): This off-chain data availability layer distributes signed price feeds via RedStone’s open-source gateway or Streamr’s decentralized infrastructure, while Arweave archives historical data for auditability.

RedStone Push Model

For protocols requiring continuous data updates, RedStone supports a push model layered on its pull architecture. This approach allows permissionless relayers to fetch and periodically submit validated data on-chain, ensuring real-time availability without introducing additional trust assumptions.

RedStone’s Role in the Future of Decentralized Oracles

RedStone’s modular architecture and pull-based design position it as a premier oracle solution for modern blockchain ecosystems. Its flexible off-chain data accessibility enables seamless deployment across diverse networks, including EVM-compatible chains and non-EVM platforms such as Starknet, Fuel Network, NEAR, TON, Tron, Casper, and Stacks. With a Total Value Secured (TVS) ranking third among general-purpose oracles—trailing only Chainlink and Pyth—RedStone has rapidly gained traction across DeFi protocols such as Pendle, Morpho, Lombard, EtherFi, and Renzo.

The Road to Full Decentralization

Despite its rapid adoption, RedStone’s current architecture retains elements of centralization, operating with five permissioned oracle nodes and lacking immediate penalization for inaccurate data submissions. However, upcoming developments aim to enhance decentralization, including:

The Launch of the RED Token: This token will facilitate oracle payments, staking incentives, and governance mechanisms for dispute resolution.

Introduction of RedStone AVS: Leveraging EigenLayer’s cryptoeconomic security model, RedStone AVS will reinforce decentralization and trust minimization.

Permissionless Oracle Nodes: Plans to introduce a permissionless node structure will further distribute data validation responsibilities across a broader network.

With these advancements, RedStone is poised to redefine the oracle landscape, balancing scalability, efficiency, and decentralization while offering one of the most capital-efficient security models in the industry.

Conclusion

As blockchain adoption scales, oracle networks are advancing beyond basic data feeds to provide more sophisticated decentralized services. Innovations such as fully homomorphic encryption (FHE) for privacy-preserving computations, AI-driven oracles for predictive analytics, and multi-layered governance frameworks are shaping the next generation of decentralized oracles. With increasing integration into global financial infrastructures, oracles are becoming indispensable for bridging blockchain systems with the broader economy, cementing their role in the verifiable web of the future.

Links

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.