Between November 5 and 6, Coinbase Global (NASDAQ: COIN) experienced a 31% stock price increase, rising from $193.96 to $254.31 in response to the election results. This report provides an in-depth analysis of Coinbase’s current financial position and the performance metrics of its Layer 2 blockchain, Base.

For a detailed breakdown of all aggregated data sourced from Coinbase's official filings, access our Google Sheets here:

Coinbase Core Team:

Co-Founder & Chief Executive Officer: Brian Armstrong

Co-Founder & Board Director: Fred Ehrsam

President & Chief Operating Officer: Emilie Choi

Chief Financial Officer: Alesia Haas

Chief People Officer: L.J. Brock

Chief Legal Officer: Paul Grewal

Revenue Analysis

Revenue

Q3 2024 Total Revenue: $1,205.2 million, down from Q2 2024 ($1,449.6 million) but up year-over-year from Q3 2023 ($772.5 million).

Revenue Trend: After peaking in Q4 2021, total revenue has stabilized within a lower range since Q2 2022.

Breakdown by Segment

Consumer Transactions: $483.3M in Q3 2024, down from $664.8M in Q2, highlighting sensitivity to market volatility yet remains a core revenue driver.

Institutional Transactions: Slight dip to $55.3M from $63.6M in Q2 2024, showing less volatility but contributing a smaller revenue portion.

Blockchain Rewards: $154.8M in Q3 2024, a drop from $185.1M in Q2, though growing YoY, offering consistent income linked to blockchain growth.

Stablecoin Revenue: $246.9M, steady across quarters, underscoring Coinbase's strategic role within the digital currency space.

Interest and Finance Fees: $64M in Q3, demonstrating stability and providing a reliable income stream despite market shifts.

Subscription and Services: $556.1M in Q3, down from $599M in Q2, indicating growth in services but facing current market pressures.

Expense Analysis

Transaction Expense: $171.8 million (15% of net revenue), a 10.3% decrease from Q2 2024.

Technology and Development: $377.4 million, a 3.6% increase quarter-over-quarter.

Sales and Marketing: $164.8 million, marginally down by 0.3%.

General and Administrative: $330.4 million, a 3.2% increase.

Other Operating Income, Net: -$8.6 million, indicating net income in this category.

Total Operating Expenses: $1,035.7 million, a 6.4% decrease from Q2 2024.

Trading Volume and Asset Revenue Contribution

Total Volume in Q3 2024: $185 billion, down from $226 billion in Q2 2024 and lower than Q3 2023 ($92 billion).

Consumer Trading: $34 billion, a decline from $37 billion in Q2 2024.

Institutional Trading: $151 billion, down from $189 billion in Q2 2024.

Asset Revenue Breakdown

Bitcoin: 37% of total trading volume, up from 35% in Q2 2024

Ethereum: Steady at around 15% of volume, indicating stable interest.

Note: For the past two quarters, Solana has been highlighted as the third asset, increasing its share of total transaction revenue from 10% to 11%.

Other Assets: Declined to 33% in Q3 2024, reflecting diversification efforts but with a current focus on Bitcoin and Ethereum.

Resource Allocation and Investment Analysis

Liquidity Overview

USDC Holdings: $508 million in Q3 2024, slightly down from $589 million in Q2 2024. This suggests USDC remains a stable liquidity source, with the decrease possibly indicating strategic asset redeployment.

Corporate Cash at Third-Party Venues: $92 million, marginally down from $97 million, implying minimized exposure to third-party risks.

Money Market Funds and Government Bonds: Increased to $6,088 million, up from $4,068 million in Q3 2023, indicating a conservative shift toward low-risk, liquid instruments amid market volatility.

Corporate Cash: Reduced to $1,544 million from a peak of $3,549 million in Q2 2022, possibly due to strategic investments or operational needs.

Total Liquidity Resources: Grew to $8,232 million in Q3 2024, indicating a solid financial foundation and preparedness for strategic opportunities or market downturns.

Investment and Financing Activities

Operating Cash Flow: $687 million in Q3 2024, showing resilience and a solid capacity to generate cash from core operations.

Capital Expenditures: Low at $19 million, reflecting a conservative approach to fixed costs, supporting financial flexibility.

Strategic Investments: Minimal outflows, including $14 million in venture investments (details of Coinbase Ventures' activity are available in the Google Sheet), $18 million in crypto investments, and $173 million for fiat loans and collateral, emphasizing careful risk management.

Financing Activities: No new long-term debt issued in Q3 2024, signaling a strategy focused on organic growth and internal liquidity use.

Workforce Metrics and Alternative Data

Total Employees in Q3 2024: Increased to 3,672 from 3,486 in Q2 2024.

Monthly Transacting Users (MTUs): 7.8 million, a 4.9% decrease from Q2 2024 and a 16.4% decline year-over-year.

Web Traffic: Declined to 37.8 million from 40.7 million in Q2 2024, indicating possible waning interest or seasonal trends.

Google Trends: Peak value of 74 in September, showing fluctuations in public interest.

App Downloads: Decreased to 8,928 in September from 14,189 in August, suggesting a slowdown in new user acquisition.

Job Postings: Dropped to 818 in October, possibly indicating hiring stabilization or restructuring.

Financial Ratios

Note: The following interpretations provide insights based on current data and are not definitive conclusions. We recommend an independent review of the data, available in Google Sheets

Liquidity Analysis

Current Ratio (Q3 2024: 1.03): Remained stable, indicating a minimal cushion of current assets over liabilities.

Operating Cash Flow to Current Liabilities Ratio (Q3 2024: 0.0025): Slight increase, reflecting some recovery in cash flow generation.

Cash Ratio (Q3 2024: 0.03): Low and unchanged, emphasizing the need for strict cash management.

Leverage Ratios

Debt-to-Equity Ratio (Q3 2024: 32.29): High leverage suggests increased financial risk.

Debt Ratio (Q3 2024: 0.97): Liabilities nearly equal assets, indicating high reliance on debt.

Interest Coverage Ratio (Q3 2024: 8.09): Positive, showing operating income sufficiently covers interest expenses.

Profitability and Efficiency Ratios

Net Profit Margin (Q3 2024: 6.26%): Improved from a loss in Q3 2023, reflecting better net income generation.

Return on Assets (ROA) (Q3 2024: 0.03%): Modest asset utilization, indicating potential inefficiencies.

Return on Equity (ROE) (Q3 2024: 0.86%): Slight increase but remains low, suggesting suboptimal equity returns.

Gross Margin Ratio (Q3 2024: 71.00%): Improved, signaling effective cost control.

Operating Margin Ratio (Q3 2024: 13.78%): Substantial improvement, indicating stronger control over operating expenses.

Market Performance Ratios

Earnings Per Share (EPS) (Q3 2024: $0.28): Recovery from negative earnings, highlighting profitability improvements.

Price-Earnings (P/E) Ratio (TTM Net EPS) (Q3 2024: 31.93): Moderate P/E suggests cautious investor optimism.

Summary and Outlook

Balance Sheet Strength: USD resources rose by $417M to $8.2B, with $1.3B in crypto assets, totaling $9.5B in available resources. In October 2024, board of directors authorized a $1.0 billion share repurchase program

Strategic Initiatives: Expanded product offerings, including new crypto futures in the U.S. and deeper USDC integration. Base Network led Layer 2 networks in transactions and value.

Regulatory Advocacy: Engaged policymakers, supported Fairshake and StandWithCrypto, and continued litigation with the SEC to push for regulatory clarity.

Regulatory Environment: Bipartisan attention on crypto may result in favorable legislation after the 2024 U.S. elections, with advocacy efforts amplifying the industry's influence.

Risks and Challenges: Market volatility, regulatory uncertainty, and high operational costs remain critical challenges impacting revenue and margins.

Outlook: Q4 revenue expected between $505M–$580M, with expenses in tech and admin projected at $690M–$730M, focusing on product, market, and regulatory growth.

Base

For a detailed overview of Base’s origins and development, see our June newsletter. Led by Jesse Pollak, Base officially launched on July 13, 2023.

Overview

Platform Mission: Base, Coinbase’s Layer 2 solution on Ethereum, is designed to create a global on-chain economy, prioritizing innovation, creativity, and economic freedom in a secure, low-cost environment for decentralized application (dApp) development.

Infrastructure and Governance: Built on the OP Stack for scalability and cost efficiency, Base has confirmed it will not issue a native token (as stated by CEO Brian Armstrong on Dec 1, 2023). In partnership with OP Labs, Base is actively working on decentralized governance and research projects, including EIP-4844 and the op-geth client, aligning with Coinbase’s vision for progressive decentralization.

Ecosystem Development: Base has seen strong developer adoption with a focus on substantive product innovation over token-based incentives. Internal teams at Coinbase use Base for smart contract deployment, enhancing both consumer-facing and institutional offerings, supported by accessible onboarding and intuitive interfaces to drive on-chain adoption.

Core Products: Positioned as a decentralized “app store,” Base provides an open platform for developers and includes Base Names for streamlined on-chain identity, along with Smart Wallets that offer users secure, programmable asset management.

Strategic Positioning: Base is set to compete not only within the Layer 2 ecosystem but also with traditional online platforms by delivering on-chain experiences designed to rival conventional web applications.

Key Metrics

In Base’s application activity, the DeFi category leads with address activity increasing markedly from 143.6K in Q2 2024 to 405.7K in Q3. However, Q3 revenue saw a reduction to $7.3 million, down from $24.2 million in Q2. Stablecoin Transfer volume demonstrated significant growth, rising from $97.8 billion in Q2 to over $415 billion in Q3, indicating heightened transactional demand. The New vs. Returning Users ratio also shifted: from 107K to 278K in Q2, to 420K versus 450K in Q3, and now reaching 509K to 827K in Q4. Sybil addresses have decreased in Q4 to 178K compared to 1.2 million non-sybil addresses, whereas Q3 recorded 550K sybil and 320K non-sybil addresses.

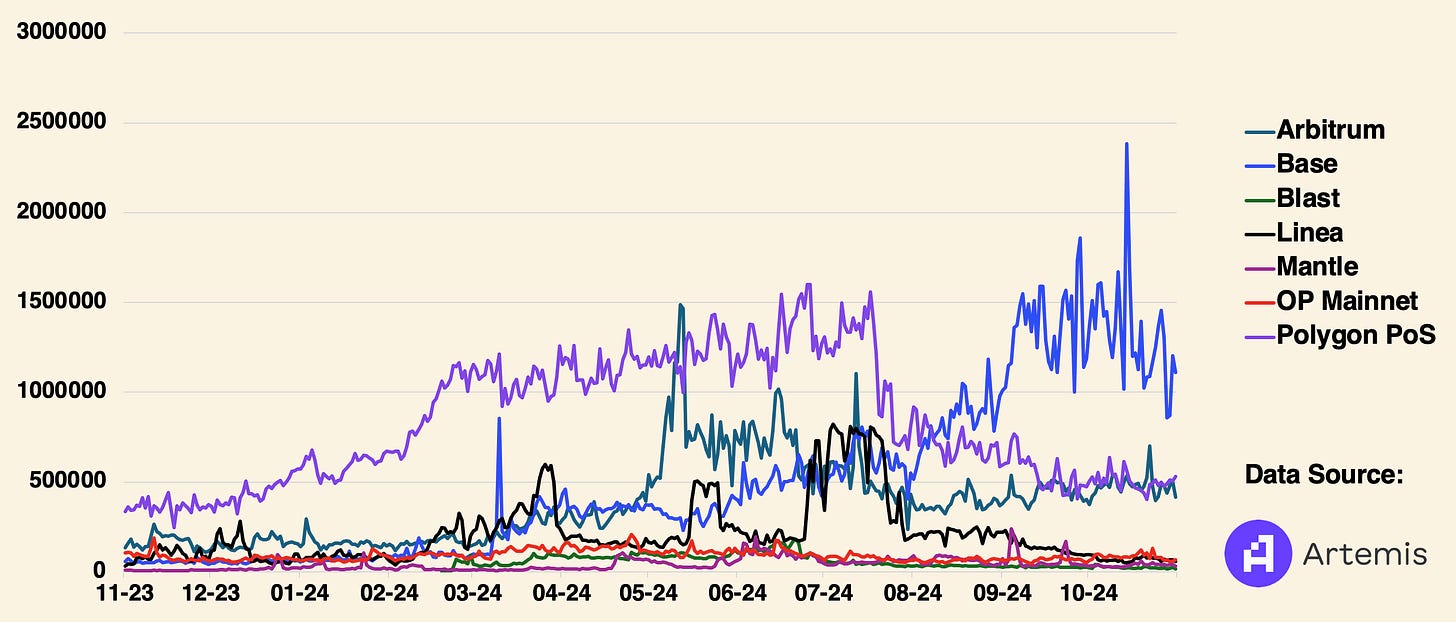

As we can observe in the charts below, as of November 7, Base is the leading Layer 2 blockchain. A few weeks ago, it surpassed Arbitrum in Total Value Locked (TVL) and has consistently maintained its position as the number one Layer 2 for months in the categories of Daily Active Addresses and Daily Transactions.

Sources

Note: All Base Data Metrics Provided by Artemis.xyz Platform:

https://investor.coinbase.com/

https://finance.yahoo.com

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Thanks for the link to the spreadsheet