On August 1, Coinbase (COIN) published its results for the second quarter of 2024. In today's newsletter, we will concisely present the developments and current key metrics of one of the largest cryptocurrency exchanges in the world.

Origins and Roadmap

Brian Armstrong, born into a family of engineers in San Jose, displayed an early interest in entrepreneurship. After graduating from Rice University in 2006, he founded his first startup, a service connecting tutors with students, while living in Buenos Aires. He later returned to a regular job as a programmer at Airbnb, where he gained insight into the potential of cryptocurrencies. In 2010, inspired by Satoshi Nakamoto's manifesto on Bitcoin, Armstrong invested $1,000 in Bitcoin, buying BTC at $9 per coin, which later fell to $2. Despite the loss, he remained committed to the idea.

Armstrong developed software in Ruby and JavaScript to buy and store cryptocurrency, likening his work to the development of the first internet browsers. In 2012, his startup attracted $150,000 from Y Combinator, with support from Fred Ersam, a former Goldman Sachs manager, helping Coinbase establish trust with banks.

Andreessen Horowitz Fund, led by Chris Dixon, invested $500 million in Coinbase, describing the technology as "Gmail for Bitcoin." The last round valued Coinbase at $8.1 billion. Although Ersam left the startup, he remained a major shareholder and invested in companies building corporate payment systems based on cryptocurrencies and blockchain.

In 2016, Coinbase announced the listing of Ethereum and rebranded as GDAX (Global Digital Asset Exchange). Although rumors of Ethereum support circulated for some time, it was only confirmed after discussions and research, particularly following Ethereum's partnership with Microsoft Azure.

In early 2017, Coinbase obtained a BitLicense and trading licenses for Ethereum and Litecoin from the New York State Department of Financial Services. In November 2017, the U.S. Internal Revenue Service mandated Coinbase to report users with transactions exceeding $20,000 per year.

In April 2018, Coinbase launched Coinbase Ventures, a venture fund investing in blockchain and cryptocurrency companies. Later, Coinbase launched Coinbase Pro, a new interface built on the existing GDAX trading engine, automatically migrating balances and transaction histories for users.

Coinbase became a publicly traded company on April 14, 2021. Subsequently, on September 20, 2021, Coinbase Prime was launched with enhanced capabilities, extending its services to institutional clients.

In February 2022, Coinbase closed its San Francisco headquarters to promote a decentralized office strategy and a remote work model.

Coinbase Funding Insights - Total Raised: $1.9B (cc: Crunchbase)

Funding Rounds:

Seed:

Date: 26 Sep 2012 | Amount Raised: $600.00K

Selected Investors: Y Combinator, Alexis Ohanian, IDG Capital, Trevor Blackwell

Series A:

Date: 7 May 2013 | Amount Raised: $5.00M

Selected Investors: Union Square Ventures (Lead), Ribbit Capital (Lead), Digital Currency Group (DCG), SV Angel, Version One

Series B:

Date: 12 Dec 2013 | Amount Raised: $25.00M

Selected Investors: Andreessen Horowitz (a16z) (Lead), Union Square Ventures, Ribbit Capital

Series C:

Date: 13 Jan 2015 | Valuation: $475M | Amount Raised: $75.00M

Selected Investors: DFJ Growth (Lead), Andreessen Horowitz (a16z), Blockchain Capital, Union Square Ventures, Boost VC, Initialized Capital, +11 more

Extended Series C:

Date: 7 Jul 2016 | Amount Raised: $10.50M

Selected Investors: Mitsubishi UFJ Capital, SOZO VENTURES

Series D:

Date: 10 Aug 2017 | Amount Raised: $108.10M

Selected Investors: Institutional Venture Partners (IVP) (Lead), Greylock Partners, 35Ventures, Tusk Venture Partners, Kindred Ventures, True Capital Management, +3 more

Undisclosed:

Date: 30 Oct 2018 | Amount Raised: $300.00M

Selected Investors: Polychain Capital, Y Combinator, Tiger Global Management, Initialized Capital, Wellington Management, Manhattan Venture Partners, +3 more

Post-IPO Rounds:

IPO DATE: April 14, 2021 | Total Amount Raised: $1.3B+

Core Team:

Co-Founder & Chief Executive Officer: Brian Armstrong

Co-Founder & Board Director: Fred Ehrsam

President & Chief Operating Officer: Emilie Choi

Chief Financial Officer: Alesia Haas

Chief People Officer: L.J. Brock

Chief Legal Officer: Paul Grewal

Key Developments and Current State of Coinbase (Q2 2024)

Regulatory Clarity and Advocacy

Regulatory Progress:

Coinbase achieved substantial progress in regulatory clarity, crucial for the crypto industry's growth.

Crypto legislation is now a mainstream issue in the US, gaining bipartisan support. The Financial & Innovation Technology Act for the 21st Century (FIT21) passed with significant majorities, clearly defining the roles of the CFTC and SEC in regulating digital assets.

The IRS issued final regulations for reporting digital assets, a critical step towards regulatory transparency.

Stand With Crypto Campaign:

Over 1.3 million crypto advocates have joined this grassroots initiative, significantly influencing political support and driving regulatory changes.

This movement has become a recognized critical voting block in battleground states, prompting bipartisan recognition of the importance of crypto regulation.

Global Compliance:

USDC achieved compliance with the European Union's Markets in Crypto-Assets (MiCA) regulatory framework, marking a significant milestone in expanding compliant access to USD-backed stablecoins in Europe.

Product and Service Innovations

Base Layer 2 Solution (a more detailed overview of the Base L2 in the previous newsletter):

Coinbase's Layer 2 solution, Base, saw a 300% quarter-over-quarter (Q/Q) growth in transactions. The network now processes transactions with sub-1 cent fees and faster speeds, enhancing scalability and reducing costs.

Base is now the #1 Layer 2 in terms of contracts deployed and transactions processed, surpassing Ethereum's transaction numbers.

Smart Wallets:

Coinbase launched smart wallets to simplify onchain transactions, reducing setup friction, eliminating network fees, and removing the need for recovery phrases.

These wallets support multi-chain integration and easy integration with major applications, improving user experience and broadening crypto adoption.

Partnership with Stripe:

Coinbase's collaboration with Stripe aims to expand USDC's global adoption. This partnership enables faster, cheaper transfers to over 150 countries and quick fiat-to-crypto conversions.

Stripe's integration of USDC into its payment infrastructure leverages its vast network, significantly enhancing USDC's reach and utility.

Expansions in Trading and Financial Markets

Trading Platform Enhancements:

Updates to Simple and Advanced trading platforms have increased user engagement through new order types, price alert notifications, and added derivatives functionality.

Coinbase One, a premium subscription product, showed promising user retention despite slower trading volumes in Q2, driven by boosted USDC rewards.

Coinbase Financial Markets (CFM):

CFM expanded its futures trading offerings, including new contracts for Dogecoin, Bitcoin Cash, and Litecoin, and introduced up to 20x leverage on commodity futures and 5x leverage on crypto futures.

This expansion aims to make futures trading more accessible to a broader range of traders in the US.

Coinbase Prime:

Coinbase Prime secured custodial mandates with 8 of 9 ETH ETFs, reinforcing its position as the primary custodian for BTC ETF products.

The SEC's approval of ETH ETFs in May 2024 confirmed that ETH is not a security, providing further regulatory clarity and attracting institutional capital.

Coinbase (COIN) Key Metrics (August 8, 2024)

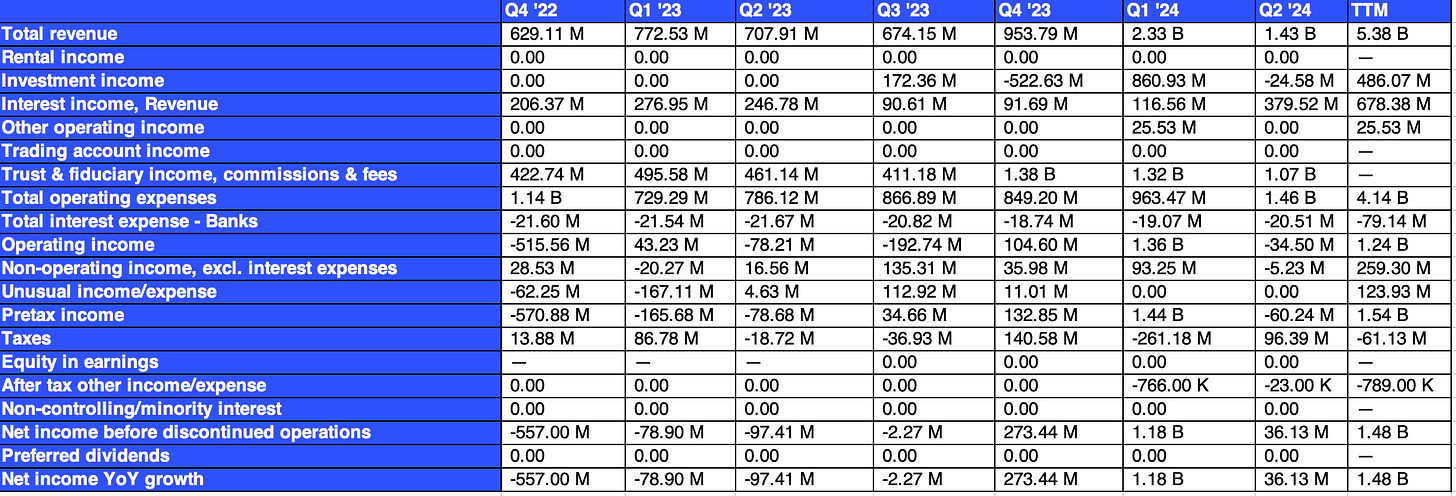

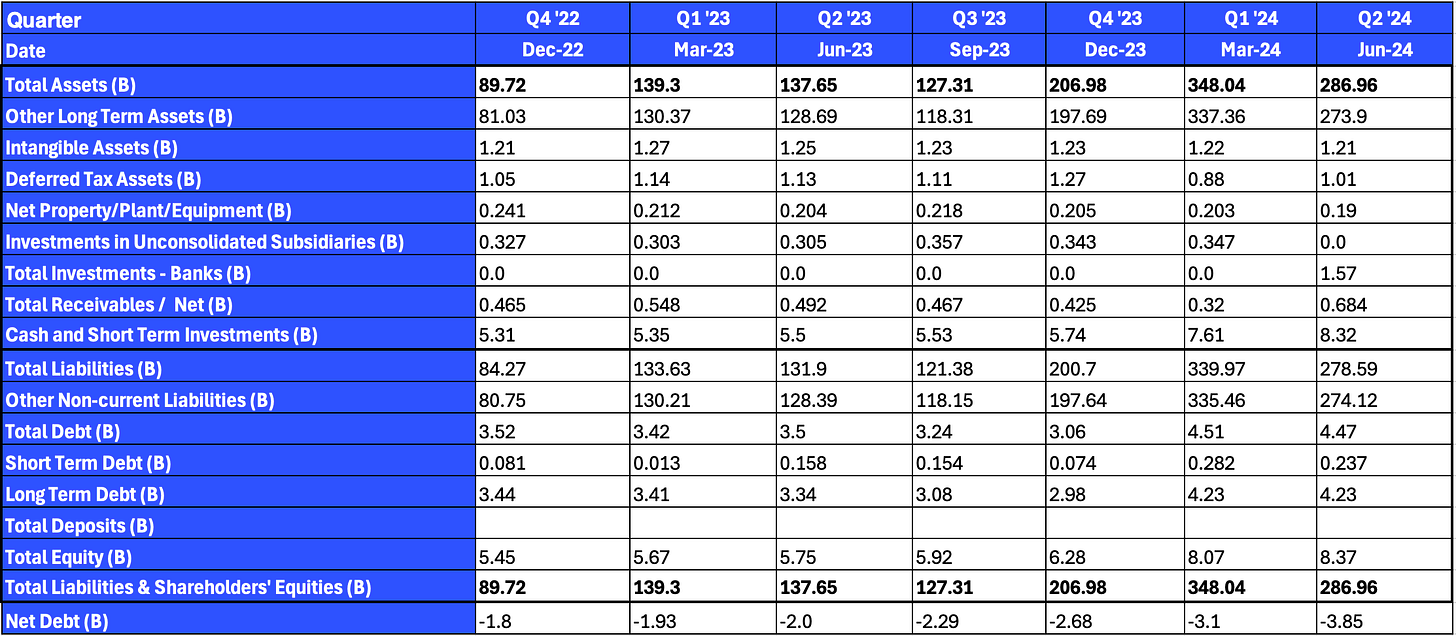

Financial Analysis

Transaction Revenue ($M)

Data Source

All data used for the calculation of ratios can be found below. Should you wish to delve deeper into the data from the last quarter, they are available in the links provided below.

Latest Shareholder Letter: https://s27.q4cdn.com/397450999/files/doc_financials/2024/q2/Q2-24-Shareholder-Letter.pdf

Links:

Website: coinbase.com

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.