Coinbase reported a strong financial performance for 2024, with full-year revenue reaching $6.6 billion (up 111% YoY) and net income at $2.6 billion. The company also posted an Adjusted EBITDA of $3.3 billion, demonstrating solid profitability despite a volatile crypto market.

Q4 revenue hit $2.3 billion, marking an 88% QoQ increase, driven largely by higher transaction volumes and strong engagement in subscription and services revenue.

The financial results were largely boosted by:

A 172% QoQ increase in transaction revenue, reaching $1.6 billion in Q4.

A 15% QoQ rise in subscription and services revenue, reaching $641 million.

Higher crypto asset prices, especially Bitcoin and Ethereum, towards the end of 2024.

Strategic expansion into derivatives trading, institutional adoption, and regulatory clarity in the U.S.

Coinbase also strengthened its balance sheet, closing Q4 with $9.3 billion in USD resources, reflecting a $1.1 billion QoQ increase. A significant portion of its profits came from unrealized gains on crypto investments ($687 million for the year), highlighting Coinbase’s exposure to market volatility.

For a detailed revenue breakdown from Coinbase's official filings, access our Google Sheets here: https://docs.google.com/spreadsheets/d/102wIrI88-cZFEBdlnaQDzD4aBE5_3Tn57e01wRQKMnk/edit?usp=sharing

Coinbase Core Team:

Co-Founder & Chief Executive Officer: Brian Armstrong

Co-Founder & Board Director: Fred Ehrsam

President & Chief Operating Officer: Emilie Choi

Chief Financial Officer: Alesia Haas

Chief People Officer: L.J. Brock

Chief Legal Officer: Paul Grewal

Regulatory Environment

The U.S. regulatory landscape is shifting, with the Trump administration prioritizing crypto leadership, moving away from restrictive regulation-by-enforcement policies. This opens doors for stablecoin and market structure legislation, enhances the operating environment for centralized exchanges (CEXs), and reduces institutional compliance uncertainties.

Coinbase also secured key international approvals, including VASP registration in the UK and Argentina and progress toward a MiCA license in the EU, enabling European expansion. Additionally, Coinbase won an interlocutory appeal in its SEC litigation, a pivotal step in shaping U.S. crypto regulations.

Growth Strategy

Coinbase aims to boost transaction volumes and expand market share, particularly in:

Institutional trading, which saw 139% YoY growth in 2024.

Derivatives markets, where Coinbase added 92 new assets on its international exchange.

Subscription-based services, such as Coinbase One, which exceeded 600,000 subscribers in Q4.

Stablecoin adoption, where USDC remains a key focus, with over $12 billion in onchain USDC payments facilitated in 2024.

Market Dependence & Competition: As a top 3 crypto exchange, Coinbase's revenue is highly tied to market sentiment, while rising DEX competition pressures CEXs to innovate.

Regulatory Uncertainty: Despite progress in U.S. regulations, Coinbase still faces global risks, particularly in Asia and Europe, where policies remain unpredictable.

Institutional Adoption and Crypto ETFs

Coinbase is successfully building an institutional flywheel, benefiting from:

ETFs driving record inflows, pushing Coinbase's assets under custody (AUC) from ETFs to $93.2 billion.

7% of RIAs now investing in crypto ETFs, up 41% since Q1 2024.

Growing derivatives volume, particularly for perpetual contracts and structured products.

This momentum indicates stronger demand for institutional-grade crypto products, which could further drive derivatives adoption and prime brokerage services.

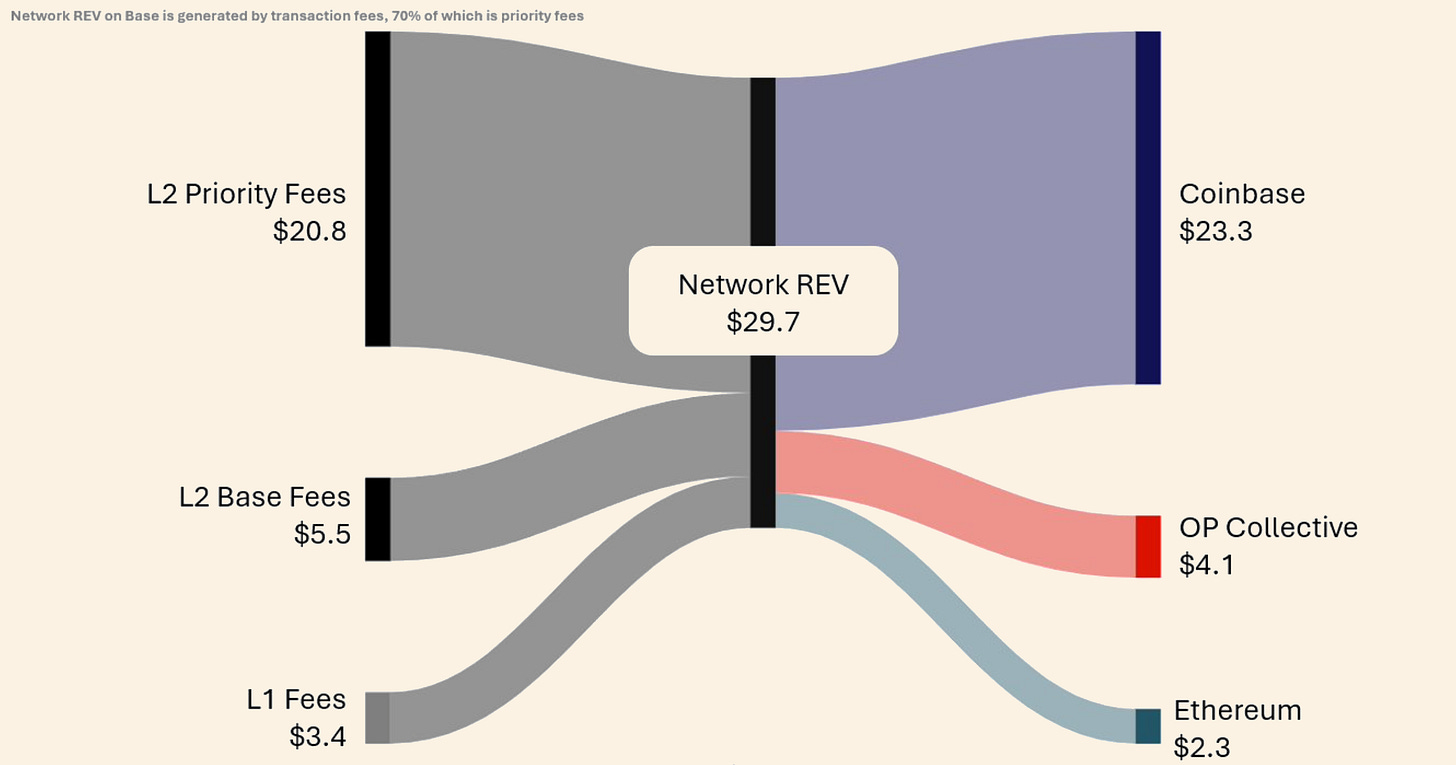

The Role of Base and Onchain Expansion

Base, Coinbase’s Layer 2 scaling solution, continues to be a standout success:

Assets on Base surged 89% to $14 billion in Q4.

Stablecoin transaction volume exceeded $25 billion.

More developers are building on Base, reinforcing its role as a foundational layer for onchain finance.

Coinbase’s BTC-backed loan program is another major innovation, allowing users to borrow USDC against BTC holdings without selling their assets. This could create a new DeFi-native borrowing model directly integrated with Coinbase’s ecosystem.

Coinbase (COIN) vs. Robinhood (HOOD)

Coinbase navigated the crypto bear market and regulatory challenges by continuing to invest in infrastructure, compliance, and global expansion, reinforcing its position as a leading regulated exchange. Robinhood, balancing its role as a brokerage firm, adopted a more measured approach—focusing on cost efficiency, achieving profitability, and delisting certain assets like Solana and Polygon in response to regulatory concerns.

Despite these different strategies, Robinhood strengthened its presence in crypto trading. When the 2024 U.S. presidential election renewed retail trading interest, Robinhood was well-positioned. In Q4 2024 alone, its customers traded $71 billion in crypto—nearly matching its total volume from the first three quarters combined. Unlike Coinbase, Robinhood leveraged its established brokerage clientele, integrating crypto within its broader trading ecosystem.

Trading Volume

Robinhood’s crypto trading volume surged to $143 billion in 2024 (+259% YoY), compared to Coinbase’s $221 billion (+195% YoY) in retail trading. Historically, Robinhood has occasionally surpassed Coinbase in trading volume, as seen in Q2 2021, when a surge in DOGE trading drove its activity. At that time, Robinhood supported only seven cryptocurrencies, yet DOGE transactions accounted for 62% of its crypto revenue. A key differentiator for Robinhood is its ability to cross-sell crypto trading to its brokerage clients, with nearly half (12M of 25M) participating in crypto markets.

Revenue Comparison

While Robinhood’s crypto trading volume grew, its crypto-related revenue reached $626 million in 2024 (+363% YoY), significantly lower than Coinbase’s $3.43 billion (+157% YoY).

This discrepancy is largely due to a lower take rate—Robinhood’s 0.50% in Q4 2024, up from 0.23% in Q1 2022, compared to Coinbase’s higher fee structure. Robinhood has room to adjust its pricing model without compromising its competitive advantage in affordability.

The Bitstamp Acquisition

Robinhood’s planned acquisition of Bitstamp, expected to close in H1 2025, represents a strategic expansion into international and institutional markets. Combined, their 2024 trading volume ($252B) aligns closely with Coinbase’s retail volume. Bitstamp’s presence in institutional trading provides Robinhood with a new avenue for growth, complementing its existing retail-focused approach. Coinbase, however, remains the dominant platform for institutions, with $941 billion in institutional trading volume in 2024 (+140% YoY).

Robinhood’s acquisition suggests an effort to transition from a U.S.-centric retail broker to a more diversified global crypto exchange. The success of this expansion will depend on regulatory conditions and Robinhood’s ability to integrate Bitstamp’s operations effectively.

Institutional trading continues to be an area of strength for Coinbase, though it operates at a lower take rate than retail, generating $346 million in institutional revenue in 2024. Institutions prioritize liquidity, regulatory compliance, and market depth, areas where Coinbase has an established advantage. While Bitstamp strengthens Robinhood’s institutional positioning, it will take time for Robinhood to gain meaningful market share in this segment.

Blockchain Strategy: Base vs. Robinhood’s Approach

Coinbase has been investing in blockchain infrastructure with Base, its Layer 2 blockchain launched in Q3 2023. Although Base currently contributes a small portion of revenue, Coinbase sees it as a long-term driver of profitability and an avenue for deeper integration with decentralized finance (DeFi). Robinhood has yet to introduce a blockchain initiative, which could limit its ability to compete in emerging DeFi and on-chain finance sectors.

Beyond Trading: Subscription & Services as a Growth Driver

Coinbase has successfully diversified its revenue streams beyond trading. Its "Subscription & Services" segment expanded from $45M in 2020 to $2.31B in 2024, incorporating staking, stablecoin revenue (USDC), custody, and interest income. Staking alone generated $706M in 2024. Robinhood, while offering staking services in the EU, faces U.S. regulatory constraints that limit its ability to scale this revenue stream. The Bitstamp acquisition could provide additional international market opportunities in this area, but regulatory considerations remain a key factor.

Stablecoins: Robinhood’s Expansion into Digital Dollar Markets

Coinbase’s collaboration with Circle resulted in $910M in stablecoin-related revenue in 2024. In contrast, Robinhood partnered with Galaxy Digital, Kraken, Nuvei, and Paxos to launch USDG under the Global Dollar Network. The revenue-sharing structure for USDG remains unclear, but it signals Robinhood’s ambition to establish a presence in the stablecoin sector. If successful, stablecoins could serve as an additional revenue stream for Robinhood.

Tokenized Securities

Both companies are exploring opportunities in tokenized real-world assets. Robinhood’s background in traditional finance and brokerage gives it a potential advantage in this space, while Coinbase’s expertise in crypto infrastructure could enable it to enter the market through a blockchain-native approach. While Coinbase has expressed limited interest in traditional brokerage operations, its expansion into tokenized securities could alter this stance. The regulatory landscape will play a crucial role in shaping this market’s trajectory.

Coinbase: Q1 2025 Outlook

Coinbase provided guidance for Q1 2025, expecting:

Transaction revenue to reach approximately $750 million as of Feb 11, 2025.

Subscription and services revenue projected to be between $685M - $765M.

Higher transaction expenses, estimated to be in the mid-to-high teens as a percentage of net revenue.

Technology & Development and General & Administrative expenses to range between $750M - $800M, reflecting increased market activity and payroll expenses.

Sales and marketing expenses projected between $235M - $375M, influenced by performance marketing initiatives and USDC rewards expansion.

These projections highlight Coinbase’s confidence in continued strong market performance, but also reflect potential increases in spending to capture further growth in both institutional and retail sectors.

Coinbase's three main goals for 2025 revolve around:

Driving Revenue: Expanding trading market share, growing the USDC market cap, and increasing subscription and services revenue.

Expanding Crypto Utility: Improving stablecoin adoption, expanding onchain products like Base, SmartWallet, and Coinbase Developer Platform.

Scaling Foundations: Strengthening regulatory engagement and ensuring Coinbase remains the most trusted and scalable crypto platform.

Robinhood: 2025 Outlook

Crypto & Institutional Expansion

Robinhood's crypto volumes surged 400% YoY to $71B in Q4 2024, with a Bitstamp acquisition planned for H1 2025 to attract institutional flow. Ethereum staking in the EU and new U.S. listings strengthen its position, though regulatory risks persist globally.

Active Trading & Derivatives Growth

Robinhood is expanding into advanced trading with index options, futures, and Robinhood Legend to compete with Interactive Brokers and Fidelity. With 477M options contracts traded in Q4 (+61% YoY), it dominates retail derivatives, but engagement and risk management are key challenges.

Global Expansion & Monetization

The firm is growing in Asia-Pacific, establishing Singapore as a regional HQ, and expanding UK operations with options trading. Robinhood Gold now has 2.6M subscribers (10% penetration), while its credit card business exceeds 100K cardholders, requiring execution efficiency amid regulatory complexities.

Investment Advisory & Wealth Management

The TradePMR acquisition (H1 2025) signals a move into investment advisory and RIA services, targeting high-net-worth clients. Retirement AUC soared 600% YoY to $13.1B, positioning Robinhood as a multi-asset wealth platform, though retention and cross-selling remain key risks.

Financial Outlook & Risks

Robinhood projects $2.0B–$2.1B in adjusted expenses, excluding credit losses, regulatory costs, and acquisitions. Strong growth in equities (+154% YoY), margin lending (+126%), and cash sweep (+59%) highlights financial strength, but market cyclicality and execution risks remain.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

great!

Interesting Analysis of Coinbase and Robinhood Results