The value of venture funding in Q2 2024 increased by approximately 8% compared to the previous quarter, reaching $65.7B. This represents the third consecutive quarter of growth (Q4 2023 - $54.3 billion, Q1 2024 - $60.9 billion). Capital invested by crypto venture capital firms exceeded $3 billion, with AI currently leading the sectors, accounting for 28% of total venture funding.

Following a strong first quarter for Bitcoin and liquid cryptocurrencies, the markets have cooled slightly, though they remain significantly elevated year-over-year. The rebound in venture capital observed in the first quarter appears to be continuing. Founders and investors are generally reporting a more active fundraising environment compared to previous quarters.

Valuation and Deal Size: A Comparison of Crypto and Traditional Venture Capital

Median Pre-Money Valuation:

Crypto: Represented by the black bars, the median pre-money valuations for crypto projects show a significant upward trend beginning around 2020. This trend peaks in early 2021, followed by notable volatility, culminating in a sharp rise again in Q2 2024.

All VC: Depicted by the blue line, the median pre-money valuations for all VC investments exhibit a more gradual and steady increase over the years, with less pronounced volatility compared to the crypto-specific valuations.

Median Deal Size:

Crypto: The grey line indicates the median deal sizes for crypto projects, displaying greater fluctuations than the valuations. There is a marked spike in 2021 and another significant rise in Q2 2024.

All VC: The blue line representing the median deal sizes for all VC investments shows a smoother, more gradual upward trend, with less volatility compared to the crypto-specific data.

Comparison Between Crypto and All VC

Valuations: Crypto valuations are characterized by more pronounced peaks and troughs, reflecting the speculative nature and higher risk associated with the crypto market. Despite the volatility, the overall trend in crypto valuations aligns with the broader VC market, albeit with greater amplitude.

Deal Sizes: Similarly, the deal sizes for crypto projects demonstrate higher volatility. The notable peaks suggest periods of heightened investment interest, likely driven by market hype or significant technological advancements within the crypto sector.

Crypto Fundraising 2016 1Q - 2024 2Q

The following graph demonstrates a consistent increase in venture capital funding for WEB3 projects since Q4 2023. Moreover, there is a notable rise in the number of deals. However, as depicted in the second graph, for the first time, there is no correlation between the rise in Bitcoin prices and the funding of startups within the crypto industry.

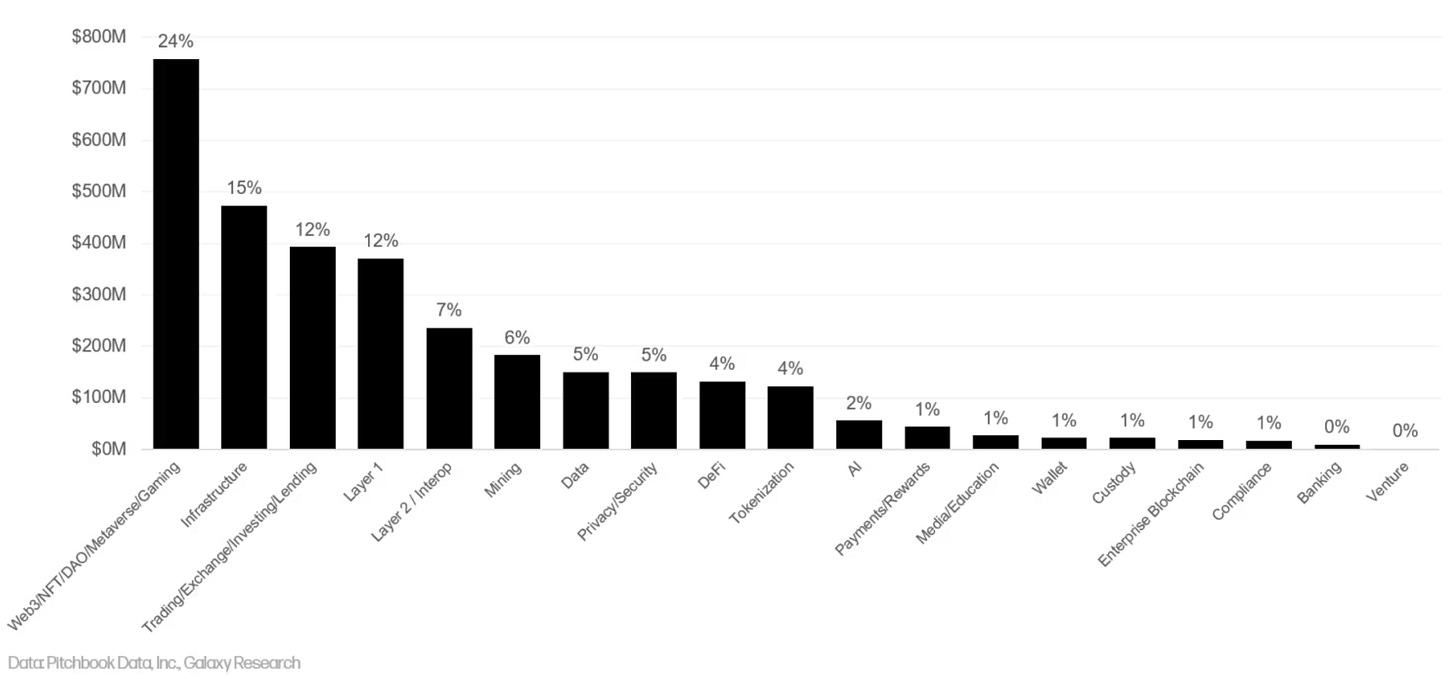

Overview of Crypto VC Investments in Q2 2024

The announced fundraising round values in April ($1.08B), May ($1.01B), and June ($892M) have collectively contributed to surpassing the $3B threshold invested in WEB3 projects, representing an approximate 25% increase compared to Q1 2024. The July data, depicted on the graph as $638M, may draw attention given that only one-third of the month has elapsed. However, this figure is primarily attributed to a substantial over $400 million round secured by the bitcoin mining company Iris Energy.

Between April 1, 2024, and July 9, 2024, Animoca Brands emerged as the most active fund, with 37 investments, surpassing OKX Ventures, a subsidiary of the OKX exchange, which made 31 investments, and Cogitent Ventures, which recorded 26 investments. Below, we present a summary of the key data for the five funds with the highest number of announced investments in WEB3 projects.

1. Animoca Brands

Investments: 382 | Jurisdiction: Hong Kong | Retail ROI: 3.19x +218.9% |

Average Rounds Size:

less than $1M: 0%/ $1-3M: 30%/ $3-10M: 55%/ $10-20M: 10%/ $20-50M: 5%/ more than $50M: 0%

Co-Investors (Co-investments):

The Spartan Group (42), SkyVision Capital (35), Double Peak (31), Morningstar Ventures (30), Shima Capital (28)

2. OKX Ventures

Investments: 183 | Jurisdiction: Seychelles | Retail ROI: 0.32x -67.7%

Average Rounds Size:

less than $1M: 5%/ $1-3M: 25%/ $3-10M: 45%/ $10-20M: 20%/ $20-50M: 5%/ more than $50M: 0%

Co-Investors (Co-investments):

Animoca Brands (22), LD Capital (22), HTX Ventures (18), HashKey Capital (15), The Spartan Group (14)

3. Cogitent Ventures

Investments: 71 | Jurisdiction: United Kingdom | Retail ROI: 0.96x -4.33%

Average Rounds Size:

less than $1M: 10%/ $1-3M: 55%/ $3-10M: 30%/ $10-20M: 5%/ $20-50M: 0%/ more than $50M: 0%

Co-Investors (Co-investments):

Big Brain Holdings (13), MH Ventures (11), Moonrock Capital (8), NxGen (8), Laser Digital (7)

4. HashKey Capital

Investments: 242 | Jurisdiction: Hong Kong | Retail ROI: 2.65x +164.9%

Selected Core Team Members: Deng Chao, Xiao Feng, Michel Lee

Average Rounds Size:

less than $1M: 0%/ $1-3M: 15%/ $3-10M: 45%/ $10-20M: 25%/ $20-50M: 5%/ more than $50M: 10%

Co-Investors (Co-investments):

SNZ Holding (32), SevenX Ventures (23), Fenbushi Capital (22), Animoca Brands (19), The Spartan Group (18)

5. The Spartan Group

Investments: 201 | Jurisdiction: Hong Kong | Retail ROI: 13.74x +1,274%

Selected Core Team Members: Kelvin Koh, Melody He, Casper Johansen

Average Rounds Size:

less than $1M: 5%/ $1-3M: 10%/ $3-10M: 55%/ $10-20M: 15%/ $20-50M: 10%/ more than $50M: 5%

Co-Investors (Co-investments):

Animoca Brands (42), CMS Holdings (20), Alameda Research (19), Mechanism Capital (18), HashKey Capital (18)

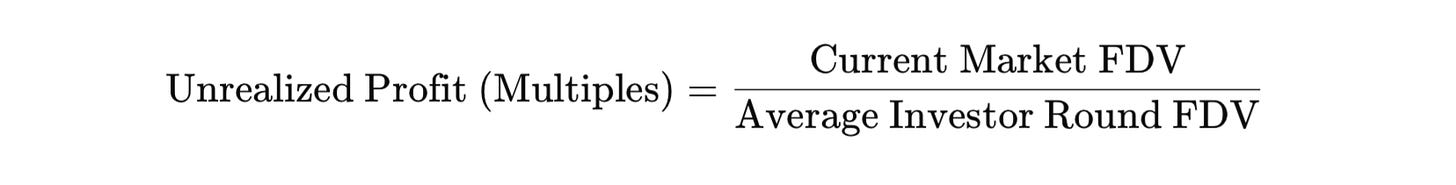

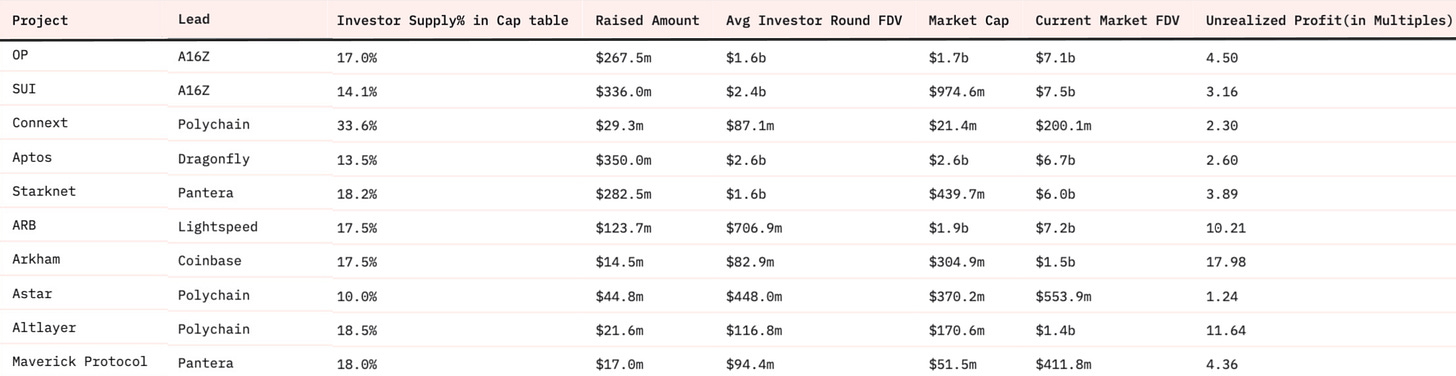

Overview of Venture Capital Investments in Selected WEB3 Projects

Methodology:

Venture Capital (VC) Dominance:

If the Investor Supply percentage in the capitalization table is greater than the median Investor Supply percentage, then the VC Dominance is considered HIGH.

If the Investor Supply percentage in the capitalization table is less than the median Investor Supply percentage, then the VC Dominance is considered LOW.

Dump Pressure:

If Unrealized Profit (in Multiples) is greater than the median of Unrealized Profit, then the Dump Pressure is considered HIGH.

If Unrealized Profit (in Multiples) is less than the median of Unrealized Profit, then the Dump Pressure is considered LOW.

VC Supply Allocation Benchmark - 17.50% (Median of All VC Supply Allocations)

VC Unrealized Profits Benchmark - 7X (Median of All VC Unrealized Profits)

VC Dominance and Dump Pressure:

Projects like Connext, Starknet, and AltLayer show high VC dominance, indicating significant influence by venture capital investors.

Of the projects with the upcoming unlocks, ARB, Arkham, and AltLayer face high dump pressure, suggesting potential sell-offs by investors.

Supply Metrics:

Total supply ranges from 100m (OMNI & CyberConnect) to 15.0B (Ethena), with circulating supply reflecting tokens currently in the market.

Key unlocks are scheduled from June 30, 2024 (OP) to June 20, 2025 (LayerZero), which could impact token availability and market dynamics.

Financial Performance:

Raised amounts vary from $6.7M (Dymension) to $458.0M (ZKsync).

Current market FDVs range from $1.5B (Arkham) to $6.3B (Ethena).

Unrealized profits highlight potential returns, with Ethena showing the highest multiple at 76.23x.

Conclusion

The latest data on crypto venture capital investments for Q2 2024 indicates significant growth, with over $3 billion invested. Despite a slight market cooling post-Q1, investor confidence remains strong, marking the third consecutive quarter of growth. Investment firms such as Animoca Brands and OKX Ventures were prominent leaders in funding during the last quarter, with substantial capital directed towards the Gaming, Web3, and Metaverse sectors. Noteworthy is the $150 million funding round for Farcaster in the socialfi category, previously highlighted in our newsletter. While this does not constitute investment advice, monitoring venture capital activity, particularly regarding vesting and unlock schedules in specific projects, may prove insightful.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

👏