Decentralized Energy Protocols

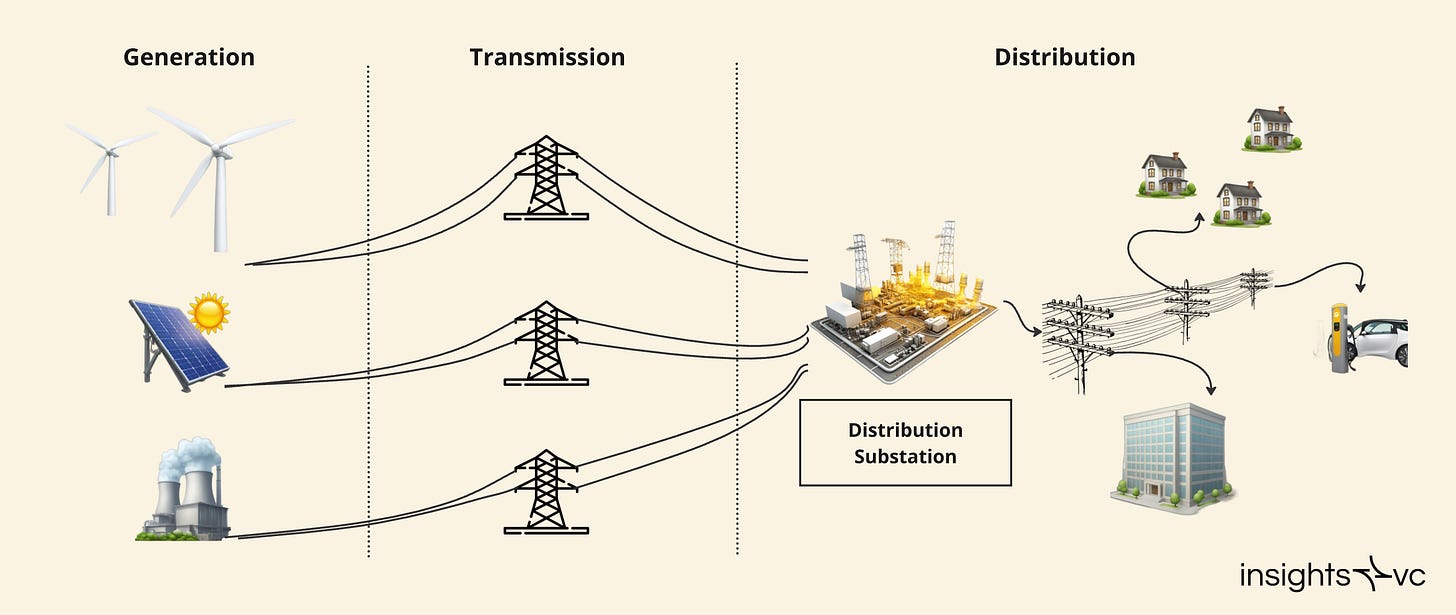

The energy landscape is undergoing profound transformation, with global electricity demand set to nearly double by 2040. This surge, driven by the rapid expansion of AI-driven computing, the reshoring of industrial operations, and widespread electrification, is straining aging, centralized power grids. The traditional one-way flow of electricity—from large, centralized plants to end-users—can no longer keep pace with the complexities of modern energy requirements, especially as renewable and distributed energy resources (DERs) become integral to the mix.

This year marks a pivotal moment in energy investment, with global spending forecasted to exceed $3 trillion, of which approximately $2 trillion is allocated to clean energy technologies and infrastructure. For the first time, investments in renewables, grid upgrades, and storage are expected to surpass the combined spend on oil, gas, and coal. By 2030, renewables are projected to constitute nearly 20% of global energy consumption, up from 13% in 2023, propelled primarily by advancements in solar and wind.

The Role of Distributed Energy Resources (DERs)

Distributed Energy Resources (DERs), such as solar, wind, battery storage, and demand-response technologies, are reshaping the energy landscape by enabling decentralized energy production and consumption. These innovations challenge the traditional hub-and-spoke model, necessitating a transition toward a decentralized, bidirectional grid that accommodates an expanding network of smaller producers and consumers.

While DERs offer greater efficiency and resilience, their integration introduces new complexities in grid management. Conventional grids lack the flexibility to handle the dynamic interactions within a network of diverse energy sources, particularly the intermittent nature of renewables.

Blockchain and Decentralized Physical Infrastructure Networks (DePINs): A Transformative Solution

Blockchain technology and decentralized physical infrastructure networks (DePINs) provide critical frameworks for decentralizing energy systems. Blockchain’s transparent, peer-to-peer energy trading capabilities empower energy producers and consumers to engage in a more efficient and equitable marketplace. Through smart contracts and tokenization, transactions are streamlined, costs are lowered, and renewable energy generation and consumption are incentivized. Furthermore, blockchain’s real-time data functionality enhances grid reliability by enabling precise supply-demand balancing.

Key Benefits of Blockchain in Decentralized Energy Networks

Enhanced Grid Efficiency and Reliability: Local generation and storage reduce transmission losses, while blockchain's real-time verification bolsters grid stability and mitigates outages.

Support for Renewable Integration: Blockchain platforms align supply and demand across DERs, helping manage renewable energy intermittency and reducing dependency on fossil fuels.

Empowerment of Prosumers: Decentralized grids democratize energy markets, allowing consumers to monetize excess energy, enhancing energy independence, and driving competitive pricing.

Streamlined Compliance and Financing: Blockchain’s transparency simplifies regulatory reporting, and tokenization introduces new funding channels, attracting investment to renewable energy projects through tokens linked to energy assets or environmental attributes.

The decentralization of the power grid is central to advancing DER innovations. However, modernizing the grid remains a challenge, hindered by legacy infrastructure, insufficient real-time data, and limited automation. Stakeholders across the industry recognize the need for transformation to meet rising energy demands, enhance resilience, and expand services to underserved areas. Decentralized solutions provide a pathway forward, addressing challenges in supply-demand balance, grid reliability, and rural access. Yet, significant capital and regulatory coordination are needed to achieve scalable impact.

In the sections that follow, we will explore several key energy protocols that exemplify noteworthy progress in this decentralized energy landscape.

Project Zero (Developed by Fuse)

Focus: Decentralized renewable energy network with integrated DER services

Core Team: Alan Chang (CEO), Charles Orr (COO)

Funding Insights (Total Raised: $90.00M):

Seed Round - Date: 7 Sep 2022 | Amount Raised: $78.00M

Selected Investors: Ribbit Capital, Accel, Balderton Capital (Lead), Lakestar (Lead), BoxGroup, Creandum, Lowercarbon CapitalStrategic Round - Date: 12 Sep 2024 | Amount Raised: $12.00M

Investors: Multicoin Capital (Lead), Anatoly Yakovenko

Fuse, co-founded by ex-Revolut executives Alan Chang and Charles Orr, is tackling the energy crisis with a vertically integrated, data-intensive approach to renewable energy. Leveraging their experience scaling Revolut, Chang and Orr built Fuse to operate utility-scale solar and wind plants, a DER (Distributed Energy Resource) installation business, and to serve tens of thousands of UK households as a regulated electricity provider.

Key Figures:

Energy Demand: Globally, 4,000 terawatt-hours of generation capacity must be added annually through the next decade to meet energy needs—essentially rebuilding the U.S. power grid each year.

Investment Requirement: $4 trillion in annual investment is essential for grid modernization and infrastructure through 2030.

Fuse addresses inefficiencies in traditional energy stacks by building real-time data monitoring and vertically integrating energy generation, distribution, and retail. Through Project Zero, Fuse incentivizes participants to shift energy consumption to renewable sources, aiding in grid stability and promoting DER adoption. By aggregating DERs, Fuse also operates as a Virtual Power Plant (VPP), offering grid services that can yield up to $100,000 per megawatt in revenue, optimizing profitability while promoting renewable integration.

Fuse combines advanced data collection, real-time monitoring, and a vertically integrated model to outperform traditional utilities. By leveraging DERs, Project Zero, and real-time analytics, Fuse seeks to provide cleaner, cheaper energy while transforming the energy retail sector into a consumer-responsive ecosystem.

Daylight

Focus: Distributed energy resources (DER) protocol

Core Team: Jason Badeaux (CEO), Dallas Griffin (COO), Udit Patel (CTO), Evan Caron (CSO)

Funding Insights:

Series A - Date: 31 Jul 2024 | Amount Raised: $9.00M Investors: Andreessen Horowitz (a16z) (Lead), Framework Ventures, Lattice, Escape Velocity (EV3), Lerer Hippeau

Daylight is a decentralized protocol focused on transforming the energy grid through the use of distributed energy resources (DERs). Currently, DERs—like solar panels, smart thermostats, and batteries—operate in a fragmented manner, with little to no incentive for individual owners to actively contribute to grid stability. Daylight’s protocol bridges this gap by aggregating DER data, which energy companies can purchase to improve grid management.

Initially, Daylight will collect and sell real-time DER data to energy companies, helping them better optimize grid performance. In the long term, the protocol aims to enable users to form virtual power plants (VPPs) from connected DERs. These VPPs act as consolidated energy sources, feeding back into the grid during peak demand or adjusting consumption patterns. Through Daylight’s marketplace, individual households and businesses can sell excess energy directly or even auction access to their resources, creating a competitive market where responsibility for energy assets can be delegated to the highest bidder in real time.

StarPower

Focus: Decentralized energy network via IoT

Core Team: Laser Ding (CEO), Darcy Jia

Funding Insights:

Pre-Seed Round - Date: 4 Jun 2024 | Amount Raised: $2.00M Investors: Alliance DAO (Incubator), Arweave, IoTeX, Bas1s Ventures, Maximillian Jungreis (Angel), Sal Gala (Angel), Shen Bo (Angel)

Starpower operates a decentralized energy network connecting distributed energy devices (DERs) like air conditioners, home batteries, and electric vehicles, focusing on optimizing energy use and stabilizing grid operations. The platform uses usage-based algorithms to coordinate device charging/discharging, aiming to reduce energy volatility and improve efficiency.

Key Data:

Global VPP Market: Virtual Power Plants (VPPs) are expected to exceed $100 billion in market size, with DERs accounting for 5-20% of total electricity in regions with high renewable energy adoption.

Electricity Demand: Forecasts suggest demand will triple by 2045, driven by AI and EV adoption, underscoring the need for connected energy networks.

Environmental Impact: VPPs could cut 60 million tons of greenhouse gas emissions by 2050, according to NREL data.

Starpower aggregates DERs globally, coordinating energy distribution regionally to form a "virtual power plant." This network effect allows devices—from household appliances to commercial storage batteries—to dynamically respond to grid demands, providing energy stability similar to a "dam" for electrons, stabilizing power from renewable sources. The platform rewards connected devices with $STAR tokens, creating an incentive for users to participate and optimize their energy use.

Using a DePIN approach, Starpower shares CapEx and OpEx across participants, allowing cost-efficient operations. The $STAR token drives network growth, supporting VPP creation, demand response, and data monetization, all while lowering operational costs compared to traditional energy providers. With a long-term vision, Starpower is building a comprehensive energy management ecosystem to accelerate the global transition to sustainable, decentralized energy.

Plural Energy

Focus: SEC-compliant on-chain financing for clean energy investments

Core Team: Adam Silver (CEO), Kent Kolze (CTO), Alexander Fong, Jason Grissino

Funding Insights:

Pre-Seed Round - Date: 30 May 2024 | Amount Raised: $2.30M

Investors: Compound VC (Lead), Necessary Ventures (Lead), Maven 11 Capital, Volt Capital

Plural Energy is an on-chain platform designed to make renewable energy investing as accessible as traditional stock market investments. Over $4 trillion is still required to meet 2030 climate goals, and Plural addresses this funding gap by bringing institutional-grade renewable energy assets to a broader audience.

Key Data and Investment Structure:

Capital Needs: $4 trillion annual investment needed in renewable energy to meet climate targets.

First Offering: A tokenized portfolio of U.S.-based solar projects by Solaris Energy.

Investor Interest: 40,000+ sign-ups on the waitlist for the first on-chain asset launch.

Plural leverages blockchain to tokenize renewable assets, making them easily accessible to both institutional and retail investors. This approach allows investors to buy, hold, and trade fractionalized tokens representing ownership in clean energy projects. The platform automates fund flows and reduces intermediary costs, thereby delivering higher yields and lower capital costs to renewable energy developers.

Plural focuses on projects typically under $100 million, which often lack sufficient financing due to high transaction costs and logistical challenges. By lowering the barriers to entry and enhancing transaction efficiency, Plural opens up these mid-sized projects to a new class of investors, addressing the “missing middle” of renewable energy that’s essential for local energy reliability.

In addition to project funding, Plural ensures compliance with SEC regulations, working directly with registered broker-dealers and implementing KYC/AML protocols. Through blockchain-enabled transparency, Plural’s model allows anyone to invest in renewable energy and track both the financial performance and the environmental impact of their investments.

Glow

Focus: Decentralizing solar energy grids to achieve 100% renewable energy

Core Team: David Vorick (CEO)

Funding Insights:

Undisclosed Round - Date: 31 Oct 2024 | Amount Raised: $30.00M Selected Investors: Framework Ventures (Lead), Union Square Ventures (Lead)

The traditional carbon credit market often fails to distinguish between solar farms that are financially self-sustaining and those requiring support, resulting in inefficient incentive distribution. Without effective mechanisms to verify the additionality (impact beyond what would occur without incentives), much of the potential carbon reduction from solar remains unrealized.

Transitioning global power generation to solar could reduce CO₂ emissions by over 40%, a significant impact in addressing climate change.

Token Distribution: Glow mints 230,000 GLW tokens each week, distributed as follows:

Solar Farms: 175,000 tokens for carbon offset contributions.

On-Chain Grants: 40,000 tokens to fund ecosystem initiatives.

Certification Agents: 10,000 tokens to support verification and audits.

Veto Council: 5,000 tokens to monitor governance and ensure network integrity.

Annual Token Supply: Glow produces 12 million GLW tokens per year, maintaining a fixed inflation rate.

Glow operates on Ethereum and incentivizes solar farms through two tokens:

GLW Token: A fixed-inflation reward token that powers the economic incentives in Glow’s ecosystem.

GCC Token: Each GCC represents one ton of CO₂ emissions avoided. These tokens are generated by verified solar farms and can be auctioned, traded, or redeemed for cash. The price follows a descending auction model, with weekly carbon credit batches to incentivize efficient market participation.

Impact Mechanisms: Solar farms must allocate 100% of their electricity revenue to the Glow pool, a measure ensuring that only non-profitable farms qualify for carbon credits, thus addressing the additionality problem. Incentives are distributed based on verified carbon credit volume, promoting cost-efficiency among competitors in a model similar to Bitcoin’s proof-of-work. Glow Certification Agents (GCAs) conduct regular audits, issuing on-chain reports for transparency and receiving weekly rewards of 10,000 GLW tokens to incentivize accuracy and consistency.

Economic Impact: GCC tokens represent one ton of CO₂ avoided, offering a reliable and tradeable measure for emissions offset, linking carbon credits to blockchain transparency. Glow’s "Impact Catalyst" liquidity pool stabilizes GCC’s market value via a GCC/USDC pair on Uniswap, maintaining price stability and allowing users to reach carbon neutrality through a self-sustaining market structure.

Governance & Security: Glow employs a "propose, select, review, ratify" model, empowering token holders to propose and vote on protocol changes, including electing the Veto Council and GCAs. The Veto Council, rewarded with 5,000 GLW tokens weekly, safeguards protocol integrity by halting suspicious activities if needed. Glow’s immutable code prohibits token supply or inflation adjustments, guaranteeing long-term economic stability and trust.

Sourceful

Focus: Dual-mining renewable energy network

Core Team: Fredrik Ahlgren (CEO), Tobias Olsson (CTO), Viktor Olofsson (BD), David Mozart Andraws, Johan Leitet

Funding Insights:

Pre-Seed Round - Date: 31 Jul 2024 | Amount Raised: $500K+

Selected Investors: Borderless Capital (Lead), Helium Foundation

Sourceful addresses core challenges in renewable energy by creating a blockchain-enabled ecosystem that combines Distributed Energy Resources (DERs) with incentives and accessible technology, facilitating a more decentralized, sustainable energy grid.

Key Figures and Approach:

Barriers to Entry: Sourceful’s platform challenges non-renewable dominance by lowering barriers for DER integration through Virtual Power Plant (VPP) structures. The VPP, powered by the Helium network and supported by IoT devices, leverages DERs to provide grid stability and flexibility.

Incentive Mechanism: Modeled after Helium’s token economics, Sourceful incentivizes DER owners through an ENERGY token system, rewarding users for availability in grid services and flexibility contributions. Beta participants currently earn points; post-launch, participants receive tokens for actions like grid balancing.

Cost Reduction: By standardizing DER connections via the Energy Gateway—an IoT device with crypto security features—Sourceful minimizes upfront costs and operational inefficiencies. The gateway communicates directly with inverters using Modbus protocol, streamlining data flow and verifying contributions through Helium’s LoRaWAN network, enhancing security and reducing third-party costs.

How It Works:

Energy Gateway: Sourceful’s IoT-based gateway securely connects DERs to the grid, facilitating seamless energy data transmission and control.

Virtual Power Plant (VPP): Sourceful aggregates DERs, allowing small producers to participate in services like grid stabilization. During peak demand, connected DERs provide flexibility, stabilizing supply and demand balance. Rewards are earned for both availability and active participation, supporting grid stability.

Tokenomics and Mint-Burn Model: The ENERGY token operates on a Mint-Burn Equilibrium, where tokens are minted for contributors and burned as energy services are utilized, stabilizing token supply and rewarding both users and grid operators.

By lowering entry barriers, offering robust incentives, and implementing cost-effective DER integration, Sourceful facilitates decentralized energy adoption. Through the ENERGY token and a scalable VPP, Sourceful is reshaping the energy market into a resilient, community-driven ecosystem.

Power Ledger

Focus: Energy trading and traceability software

Core Team: Jemma Green, John Bulich

Funding Insights:

Initial Coin Offering - Date: 4 Sep 2017 | Amount Raised: $34M

Selected Investors: Galaxy, Blockchain Capital, Bill Tai, George Burke, Fundamental Labs, Alexis Berthoud, Limitless Crypto Investments, Andreas Schwartz

Grant - Date: 17 Nov 2017 | Amount Raised: $8M

Investors: Government of Australia

Seed Round - Date: 1 Sep 2018 | Amount Raised: $3M

Investor: BetterLabs Ventures

Venture Round - Date: 16 Jun 2022 | Amount Raised: Undisclosed

Investor: Sangha Capital (Lead)

Power Ledger is the only project we are presenting today with a publicly traded token, offering users the ability to engage in peer-to-peer (P2P) energy trading and to market distributed energy resources (DERs) to energy companies. The platform is organized around two main pillars: energy trading and traceability, and environmental commodities trading. The energy trading and traceability component enables individuals to monitor their energy consumption and facilitates P2P transactions of excess grid energy. The environmental commodities trading aspect provides traders with access to a marketplace for carbon credits, renewable energy certificates, and other energy derivatives. While the long-term viability of the carbon credit market remains uncertain, the potential and scale of P2P energy trading are highly significant. The distributed energy sector faces numerous challenges and is arguably one of the most complex and nuanced verticals within decentralized physical infrastructure networks (DePIN). In addition to requiring regulatory clarity, substantial infrastructure reform is essential. Although this landscape presents considerable obstacles, it offers significant opportunities for those capable of expediting the transition to a decentralized energy future.

In addition to the projects described in more detail above, we also recommend exploring the following ones:

PowerPod (website | x.com) focuses on building a shared ownership charging network, offering a collaborative approach to charging infrastructure

DeCharge (website | x.com) is dedicated to enhancing electric vehicle infrastructure by adhering to the OCPP global standard, which allows for universal compatibility across EV charging stations. This project is particularly focused on the Indian market.

Arkreen (website | x.com) leverages Web3 technology to create a digital infrastructure supporting distributed renewable energy resources worldwide.

Sources:

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.