How Did AngelList Democratize Seed Funding?

Founded in 2010 by Naval Ravikant and Babak Nivi, the platform’s mission was to democratize fundraising and eliminate gatekeepers. AngelList has transformed early-stage venture by connecting startups with capital, talent, and infrastructure online. It pioneered innovations like online syndicate investing (2013), a startup jobs marketplace (launched 2012), rolling venture funds (2020), and integrated cap-table tools. Over $3.5 billion has been invested via AngelList into 7,000+ startups, with 200+ reaching unicorn status. Notable companies such as Notion and Cruise leveraged AngelList to raise early capital and later became multi-billion-dollar successes. Today, AngelList supports over $170 billion in assets on its platform and has spun off complementary services like Republic (for retail crowdfunding) and CoinList (for token offerings). As it expands globally and moves into new products (e.g. AngelList Treasury for fund banking, secondary marketplaces), the company remains guided by Ravikant’s vision of democratized capital formation. AngelList’s outlook is optimistic, though it faces challenges from regulatory changes, macroeconomic cooling, and emerging competitors. Overall, it stands as an influential, data-driven engine of startup financing built for the modern era.

Origins and Founding Thesis

AngelList was founded in 2010 by serial entrepreneur Naval Ravikant and Babak Nivi to fix a clear gap: early-stage startups struggled to access seed capital beyond the Silicon Valley elite. Ravikant and Nivi had been running the Venture Hacks blog and saw an opportunity to streamline fundraising. They started by circulating a list of promising startups to 25 angel investors via email. This “AngelList” quickly grew to dozens of angels willing to invest collectively (angels pledged ~$80 M in that first year). Naval’s core thesis was to leverage the internet to open up startup investing, allowing founders anywhere to pitch accredited investors, and allowing angels to syndicate deals online. In effect, AngelList aimed to replace closed networking with a transparent marketplace for venture funding.

Key to this vision was the 2012 JOBS Act, which Naval actively supported, helping to legalize online private fundraising. By 2013, AngelList was formally launched as a platform, promising to democratize access to early-stage deals and streamline how startups find money. This founding ethos of “venture for everyone” set the stage for AngelList’s rapid growth.

Evolution of the Platform

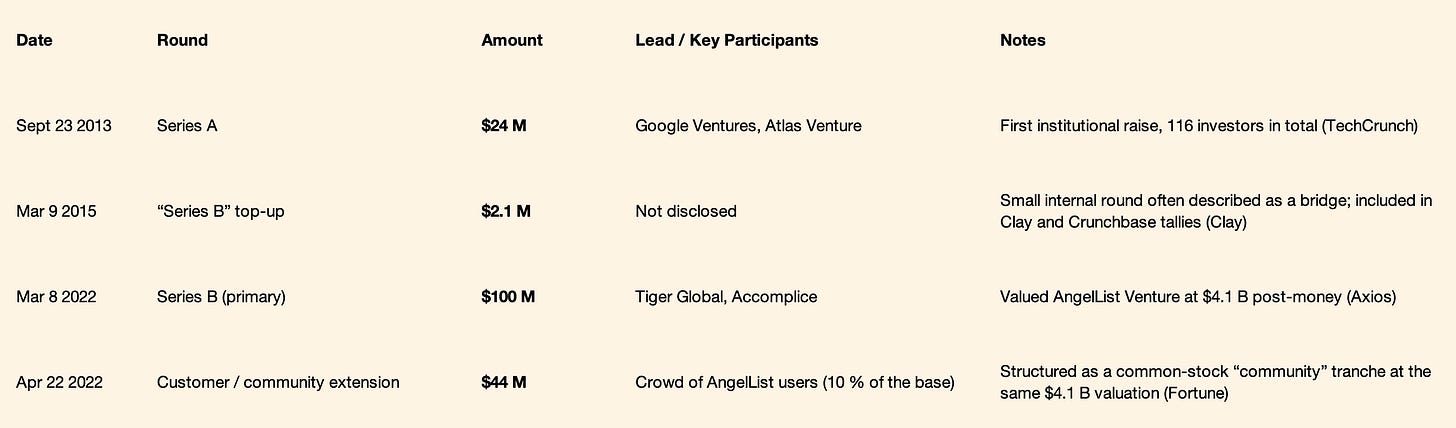

Over 2010–2024, AngelList evolved via major product expansions and spin-offs, becoming a full-stack service for startup investing. Below is a timeline of key milestones:

Throughout this evolution, AngelList’s footprint grew from a Silicon Valley experiment into a global platform. By 2021 it had backed ~190 unicorns and supported over 12,000 startups; by 2024 those figures surpassed 200 unicorns and 7,000 startups funded. The platform’s trajectory reflects a constant broadening—across geographies (India, Southeast Asia), asset classes (from venture to crypto tokens to private equity funds), and services (from fundraising to hiring to banking).

Each product innovation reinforced AngelList’s core flywheel: more capital attracted -> more quality startups funded -> more success stories -> more investors drawn in. As CEO Avlok Kohli noted, AngelList’s team is “transforming venture itself” by innovating on the infrastructure for innovation.

Selected Success Stories

To illustrate AngelList’s impact, we examine three startups that leveraged the platform in their early funding and went on to major success. These mini-cases span different sectors and show how AngelList can catalyze a company’s rise:

Uber (Ride-hailing) – Founded: 2009. In 2010 Uber tapped First Round Capital’s AngelList syndicate led by Rob Hayes, securing a $1.25 M seed with 40+ angels joining for checks as small as $5 K. The company listed in May 2019 at an $82 B market cap, turning that original $1.25 M into roughly $3 B (≈2 600×). Uber shows how AngelList can democratize entry into once-in-a-generation consumer platforms.

Notion (Productivity software) – Founded: 2013. Notion raised a modest $2 M seed in 2013 from angel investors including Naval Ravikant. The company shunned traditional VC for years, using AngelList to gather follow-on capital (e.g. a $10 M angel round in 2019 at an $800 M valuation). In 2020, Notion finally welcomed institutional money at a $2 B valuation with minimal dilution. Notion’s total funding is only ~$70 M to date, and the startup has been profitable, illustrating how angel-backed companies can grow sustainably without heavy VC funding. Today Notion is valued around $10 B, making early AngelList backers’ stakes worth over 100× – a testament to how an angel-led approach via AngelList can produce outsized returns.

Cruise (Self-driving cars) – Founded: 2013. In 2015, Cruise’s $12.5 M Series A (led by Spark Capital) included a $100 K allocation raised through an AngelList syndicate run by investor Zach Coelius. This gave dozens of angels entry into a hot autonomous-vehicle startup. Just a year later, General Motors acquired Cruise for an estimated $1 B+; AngelList syndicate investors enjoyed a rapid multi‑x exit. Cruise demonstrated how AngelList could turbocharge a startup’s round and deliver liquidity via a strategic buyout. The company now operates as GM’s autonomous-driving subsidiary (valued at $30B+ in 2023), and continues to scale.

OpenSea (NFT marketplace) – Founded: 2017. Amid the early Web3 startup scene, OpenSea secured seed funding from crypto-focused angels on AngelList. The platform’s crypto investors helped the company survive the 2018 ICO bust when traditional VCs were hesitant. As NFTs boomed in 2021, OpenSea raised venture rounds at $1.5 B and then $13 B valuations. AngelList’s role was critical in OpenSea’s nascency – providing capital and community when few others would. OpenSea remains the largest NFT trading platform, and exemplifies how AngelList’s infrastructure in crypto (via CoinList) facilitated token-based fundraising that propelled a Web3 startup to unicorn status.

Crypto and Web3 Angle

AngelList’s influence extended into the cryptocurrency realm through its infrastructure and the spin-off of CoinList. As the 2017 ICO boom unfolded, AngelList recognized both an opportunity and a regulatory imperative: many startups were raising money by selling tokens directly to the public, often skirting securities laws. In response, AngelList (with Protocol Labs) launched CoinList in mid-2017 as a compliant platform for token offerings, enabling accredited investors to participate in ICOs under U.S. regulation. The first major sale was Filecoin – which raised a resounding $205 M on CoinList in late 2017. Unlike the free-for-all ICOs elsewhere, CoinList sales imposed KYC and investor accreditation, giving crypto startups a regulated way to raise funds.

Other notable projects followed: Blockstack (which raised over $20 M in 2019 via a SEC-qualified token sale), privacy platform Algorand, smart contract network Solana – all conducted token sales on CoinList, often with heavy oversubscription. CoinList’s focus on high-quality projects and legal compliance distinguished it from the wild-west ICO marketplaces. By early 2018, CoinList had processed over $400 M in investments from thousands of users.

ICO Boom vs. Today

The 2017 ICO frenzy often lacked investor protections, whereas CoinList set a template for regulated token fundraising. This bridged AngelList’s world with crypto: accredited AngelList users could diversify into tokens, and crypto founders could tap AngelList’s community for capital. Today, token funding is more mature (many projects raise via exchanges or DAOs), but CoinList remains a major platform for vetted sales. Naval Ravikant had hinted as early as 2017 that AngelList was “always looking at secondary marketplaces” for crypto assets – and indeed AngelList’s compliant approach (via CoinList and an upcoming secondary pilot) has helped legitimize on-chain fundraising. In sum, AngelList’s crypto infrastructure accelerated big raises like Filecoin’s while protecting investors and issuers from regulatory fallout.

Key Individuals Who Amplified AngelList’s Reach

A cadre of super-angels and early-stage investors embraced AngelList in its formative years, turbocharging the platform’s growth through their deal activity and influence. Five individuals stand out:

Cyan Banister – One of the first prominent female angel investors in Silicon Valley (early Uber seed investor), Cyan was an early adopter of AngelList. Check Size & MOIC: She typically invested five-figure to low six-figure checks; her early bets (like Uber) turned small stakes into huge returns (Uber raised $30B+ over its lifetime). Influence: As a well-connected operator, Banister attracted more women and diverse investors to AngelList. She also provided product feedback on features for lead angels, and by successfully syndicating deals she proved that angels could compete with traditional VCs.

Ramtin Naimi – A “young phenom” who by his mid-20s ran one of the largest AngelList syndicate networks. Check Size & Strategy: Naimi writes $250K–$750K seed checks via special purpose vehicles (SPVs), and by age 26 had backed 30+ startups through AngelList. He innovated in syndicate structures – carving out allocation for founders of his portfolio companies to co-invest – and dedicating 5% of carry to charitable causes. Influence: Naimi is among AngelList’s most active syndicate leads, with multiple unicorn exits. By leveraging AngelList’s platform funds (like CSC Upshot co-investing in his deals), he demonstrated that a solo GP can rapidly scale a venture franchise on AngelList. His success has drawn numerous other young investors to follow a similar path.

Elad Gil – A renowned angel (Airbnb, Coinbase, Stripe, etc.) who leveraged AngelList to scale his investing. Check Size & Results: Gil often invests six- or seven-figure personal checks; his portfolio boasts 40+ unicorns with hefty multiples. While he doesn’t run a public syndicate, he’s an active LP and advisor on AngelList. Influence: Gil’s endorsement of AngelList’s model lent credibility. He has publicly championed new funding mechanisms, and his playbook (“High Growth Handbook”) is widely followed. Elad’s participation signaled to other elite angels that they could use AngelList infrastructure (e.g. Rolling Funds) to raise capital – fueling the solo capitalist trend that AngelList enabled.

Alex Karp – The CEO of Palantir, Karp is an unconventional tech figure who became an AngelList participant. Role: As a later-stage executive, Karp personally backed a few startups via AngelList syndicates. Influence: His involvement showed that even Fortune 500 CEOs sought deal flow on AngelList. Karp’s presence attracted other corporate executives and family offices to join as LPs on the platform. This helped AngelList move upmarket beyond traditional angels. His feedback also pushed for features catering to bigger investors (e.g. privacy settings, larger minimums). Karp’s participation thus broadened AngelList’s reach into a new investor segment.

Julie Sandler – A Seattle-based VC who helped expand AngelList’s geographic reach. Role: As a former Madrona partner and Pioneer Square Labs co-founder, Sandler led one of the first regional AngelList syndicates, bringing Pacific Northwest startups onto the platform. Influence: She introduced dozens of new investors (many from Seattle’s tech scene) to AngelList. Julie also advocated for female founders and investors on the platform, contributing to AngelList’s efforts to improve diversity. Her work helped AngelList go national, proving that its model could thrive outside Silicon Valley and encouraging more localized syndicate communities.

Each of these individuals achieved strong investment outcomes and influenced AngelList’s evolution – whether through product input, evangelism, or pioneering new use cases. By amplifying AngelList’s reach, they helped transform it from a novel experiment into an entrenched part of venture deal-making.

Competitive Landscape

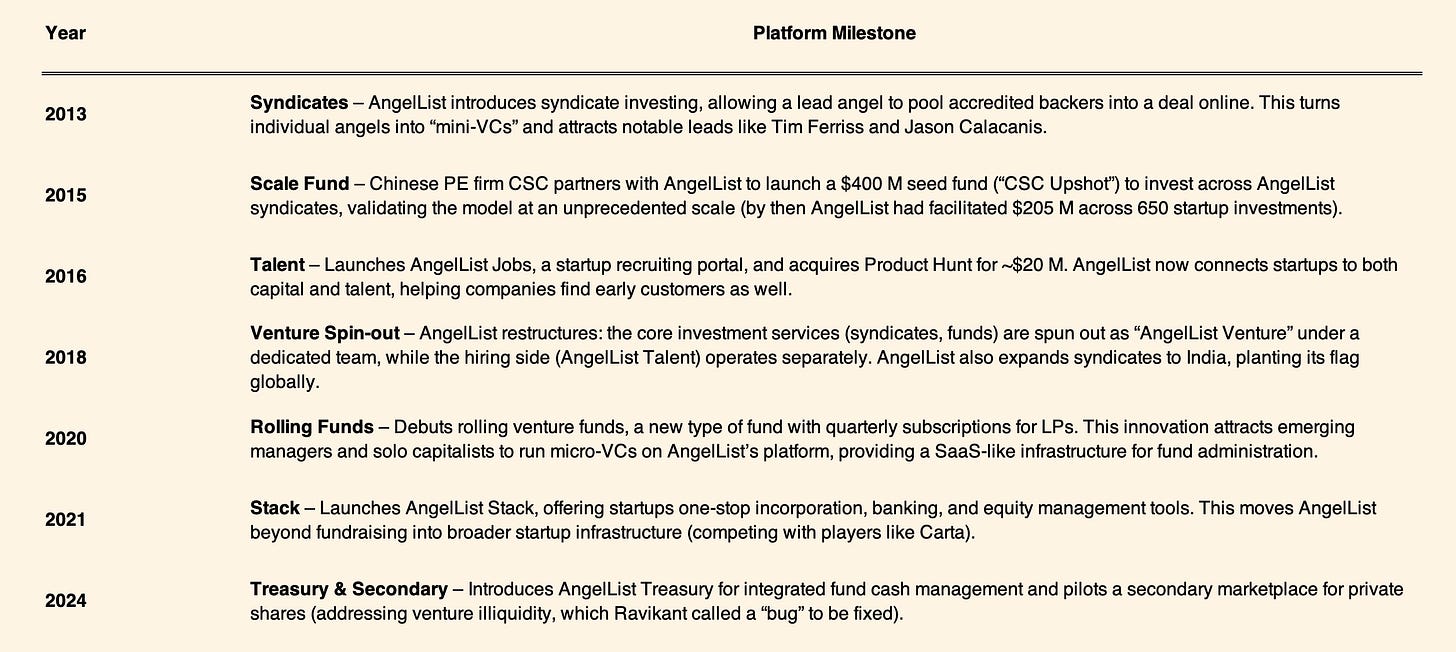

AngelList operates in a broader ecosystem of online startup investing platforms. Key competitors include traditional equity crowdfunding sites and newer blockchain-based fundraising protocols. The table below compares a few major players:

Competitive dynamics

AngelList’s edge lies in its scale and network effects. By 2021 it had over 38,000 accredited investors (LPs) on the platform – far more than any individual VC firm or crowdfunding portal. Its software infrastructure also gives it a low-cost advantage in assembling SPVs and funds. Traditional VC firms have attempted to mimic AngelList with scout programs, but many pulled back due to negative signaling issues (if the firm didn’t follow on). AngelList avoids that dilemma by not being tied to a single lead investor’s brand. Meanwhile, retail-focused sites like SeedInvest and Republic compete by tapping a broader audience, but typically handle smaller rounds and fewer high-growth startups. Emerging crypto fundraising protocols present a longer-term threat or complement – but regulatory uncertainty has limited their adoption for mainstream startups. Overall, AngelList commands a unique position as an institutional-grade platform for venture financing, blending the reach of a marketplace with the curation of a traditional VC network.

Current State and Forward Outlook

As of Q2 2025, AngelList stands as a critical artery of the startup funding ecosystem, but it faces an inflection point with new opportunities and risks ahead. Key performance indicators remain strong: assets under administration have soared to $171 B, active investment vehicles on the platform exceed 25,000, and 108 unicorn startups have been funded via AngelList syndicates or funds. The platform continues to launch products to streamline private markets – e.g. the Limited program for high-net-worth investors, and systematic fund-of-funds (e.g. Strawberry Tree) to funnel more capital into AngelList funds. It is also moving into treasury management, letting fund managers manage idle cash across accounts in one dashboard.

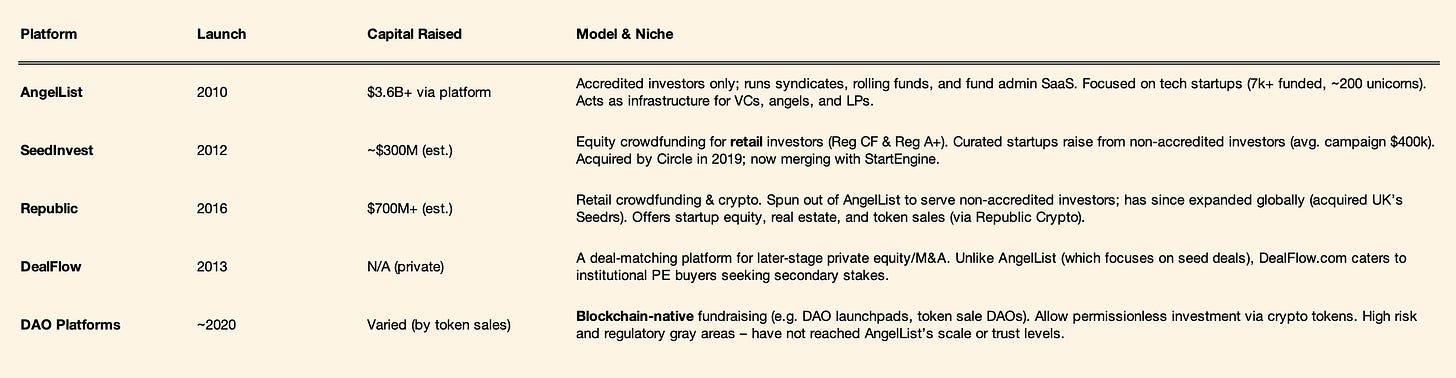

Geographically, AngelList is expanding its footprint. It now operates dedicated platforms in India and Europe (via partnerships), adapting to local regulations to replicate its model abroad. The late-2022 spin-out of AngelList Talent (rebranded as Wellfound) freed the company to focus solely on its venture business – and even move upmarket. In July 2023, AngelList acquired fintech startup Nova to better serve private equity investors, hinting at ambitions beyond venture. The firm’s $100 M Series B in 2022 (led by Tiger Global at a $4B valuation) provided capital to further develop its technology and perhaps make additional strategic acquisitions.

Risks and opportunities

On the regulatory front, AngelList must continuously adapt to securities laws across jurisdictions. Any tightening of private-market rules (or negative SEC attention) could pose a challenge, whereas further liberalization (e.g. expanding the accredited investor definition) could enlarge its user base. Macroeconomic conditions also influence AngelList’s trajectory – the VC downturn of 2022–2023 tested its model, but early-stage valuations remained “uncharacteristically resilient” during that period. If high interest rates persist, LPs may allocate less to venture; conversely, a tech rebound would rekindle deal flow. Competition is evolving too: solo GPs are rising (AngelList itself now supports 250+ rolling funds), and brand-name VC firms are building their own syndicate platforms. Meanwhile, blockchain-based funding models (like investment DAOs) could one day bypass intermediaries – though to date none have matched AngelList’s trust or success.

Naval Ravikant’s updated vision for AngelList remains ambitious. He argues that venture fundraising infrastructure needs as much innovation as startups themselves. As he told Wired, the private capital market is “slow and stupid” and AngelList is fixing it. The company’s goal is to “increase the rate of innovation” by opening the innovation economy to more participants. In practical terms, that means continuing to streamline fundraising (with software), lower barriers for new fund managers, and eventually providing liquidity where none existed (via secondary markets). If AngelList executes well amidst these challenges, it is poised to remain a cornerstone of the startup ecosystem – powering a more efficient, transparent, and democratized model of venture capital.

Key Takeaways

AngelList was founded in 2010 to democratize startup funding (co-founder Naval Ravikant even helped push the 2012 JOBS Act that enabled equity crowdfunding), enabling founders to reach angels beyond traditional Silicon Valley networks.

The platform’s major innovations – from online syndicates (2013) to rolling funds (2020) – have reshaped how early-stage investments are made.

To date, AngelList has facilitated $3B+ in funding to over 7,000 startups, and counts more than 200 unicorns in its portfolio. Early-stage investments on AngelList that become unicorns have delivered a median ~31× return multiple.

Success stories like Notion (seeded by AngelList angels, now valued $10B+) and Cruise (AngelList-backed, acquired by GM) demonstrate the platform’s impact on company trajectories.

AngelList spun off Republic (for retail crowdfunding) and CoinList (for compliant token sales) to serve markets beyond its core accredited investor base.

Competitors exist – e.g. SeedInvest, Republic, blockchain DAOs – but AngelList’s scale and network effects among top angels and LPs give it a strong advantage in venture deal-making.

Going forward, AngelList is expanding globally and exploring secondary markets for private equity. It aims to continue streamlining venture capital while navigating regulatory changes and market cycles.

AngelList

https://www.angellist.com/

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.