Inside the $19B Flash Crash

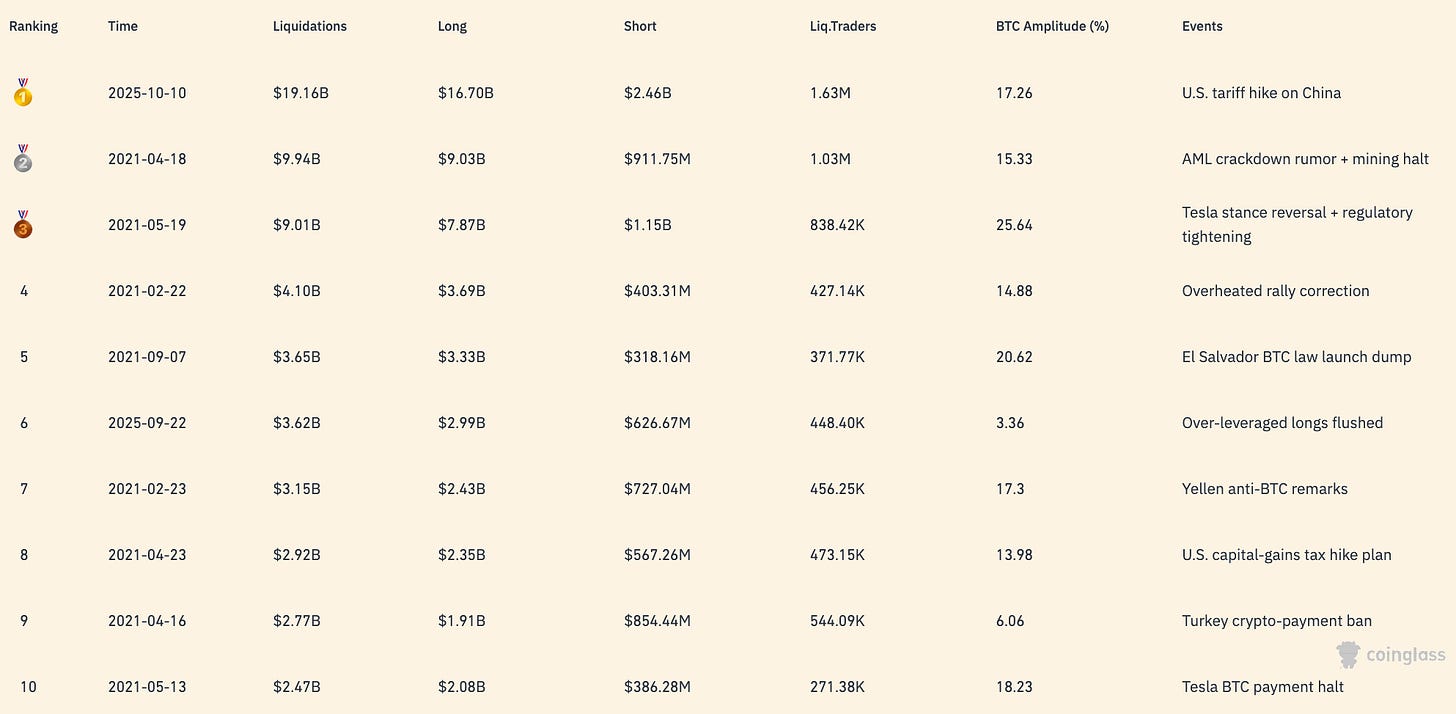

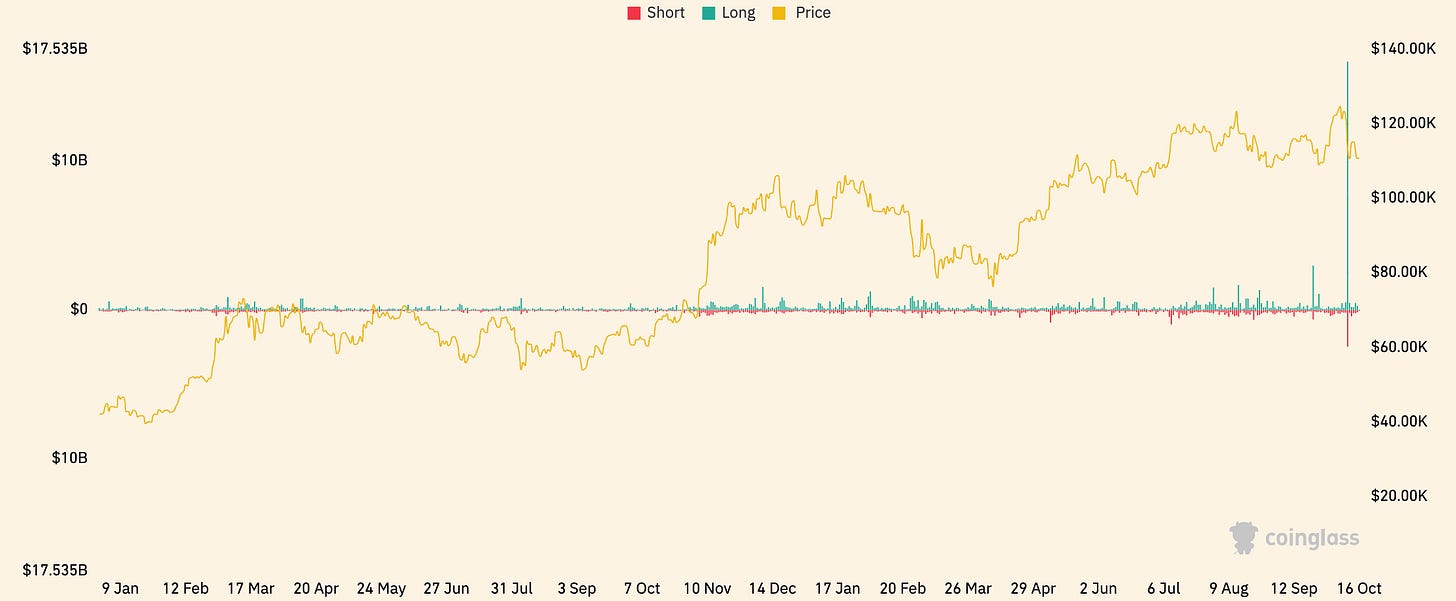

This was the biggest crash in crypto ever. On Friday, October 10, 2025, over $19 billion in leveraged positions were wiped out within hours in a flash crash triggered by geopolitical news. The liquidations were about nine times larger than any previous single-day total, marking the largest deleveraging in market history.

Steep price declines

Bitcoin fell about 14% from about $122,000 to about $105,000 in the crash’s worst phase. Ether dropped 12% to around $3,436. Major altcoins saw extreme intraday collapses, for example Solana plunged over 40% at one point, Toncoin briefly traded at $0.50 (−80%), and Worldcoin lost 70% of its value before partial rebounds. Some smaller tokens like Cosmos (ATOM) momentarily printed near-zero prices amid “zero-liquidity” wick drops.

Market paralysis and exchange issues

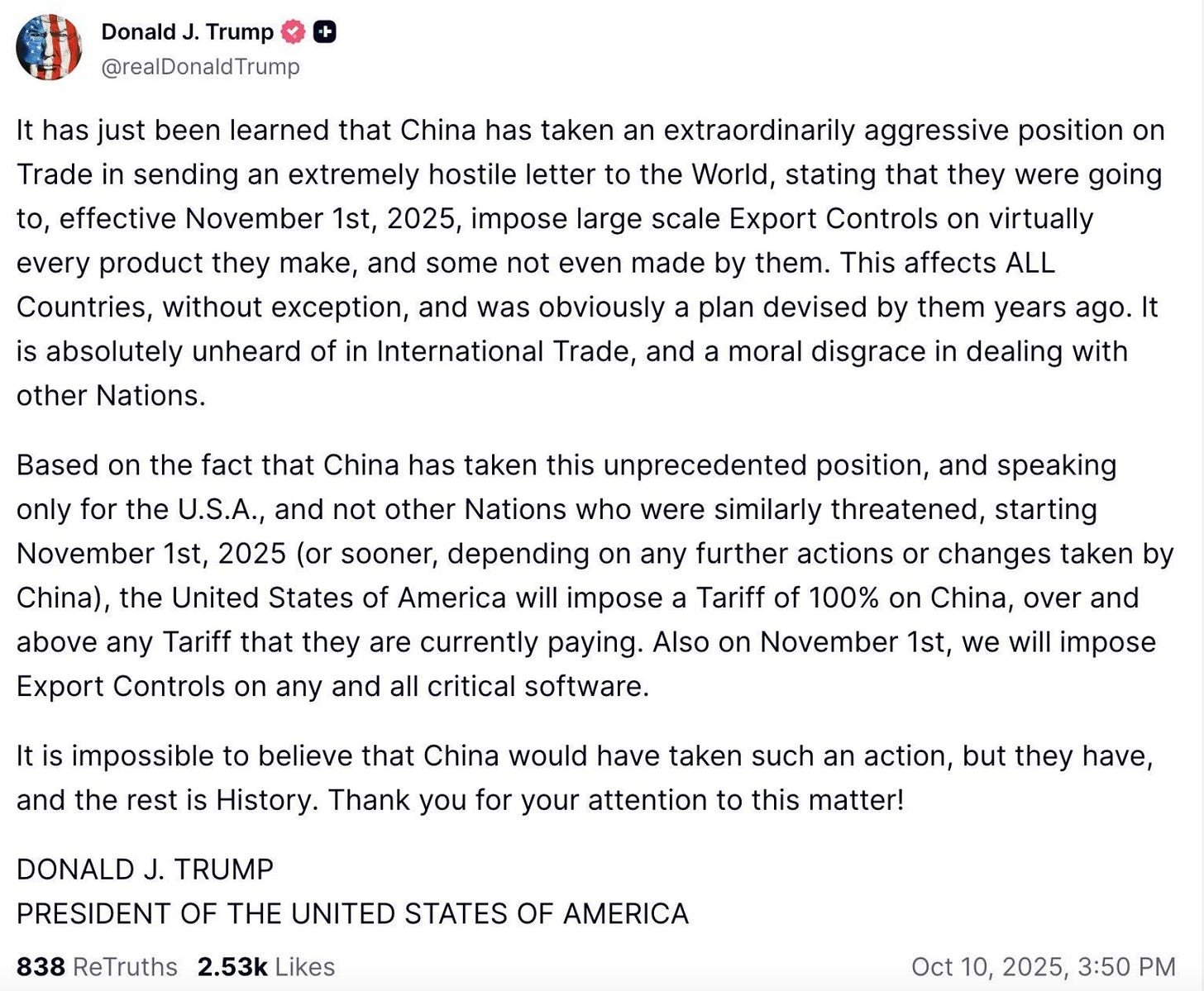

The sell-off began after 16:30 ET on Oct 10 with a shock U.S. tariff announcement. Within 25 minutes, non-BTC and non-ETH crypto prices sank about 33%. As cascading margin calls kicked in, several major exchanges experienced outages and delays. Binance’s platform struggled under load. Some users’ stop-loss orders failed and accounts were frozen during the peak turmoil. Coinbase and Robinhood also reported brief trading halts. These technical failures prevented many traders from adding collateral or arbitraging price gaps, which exacerbated the crash’s severity.

Unprecedented liquidations and ADL activations

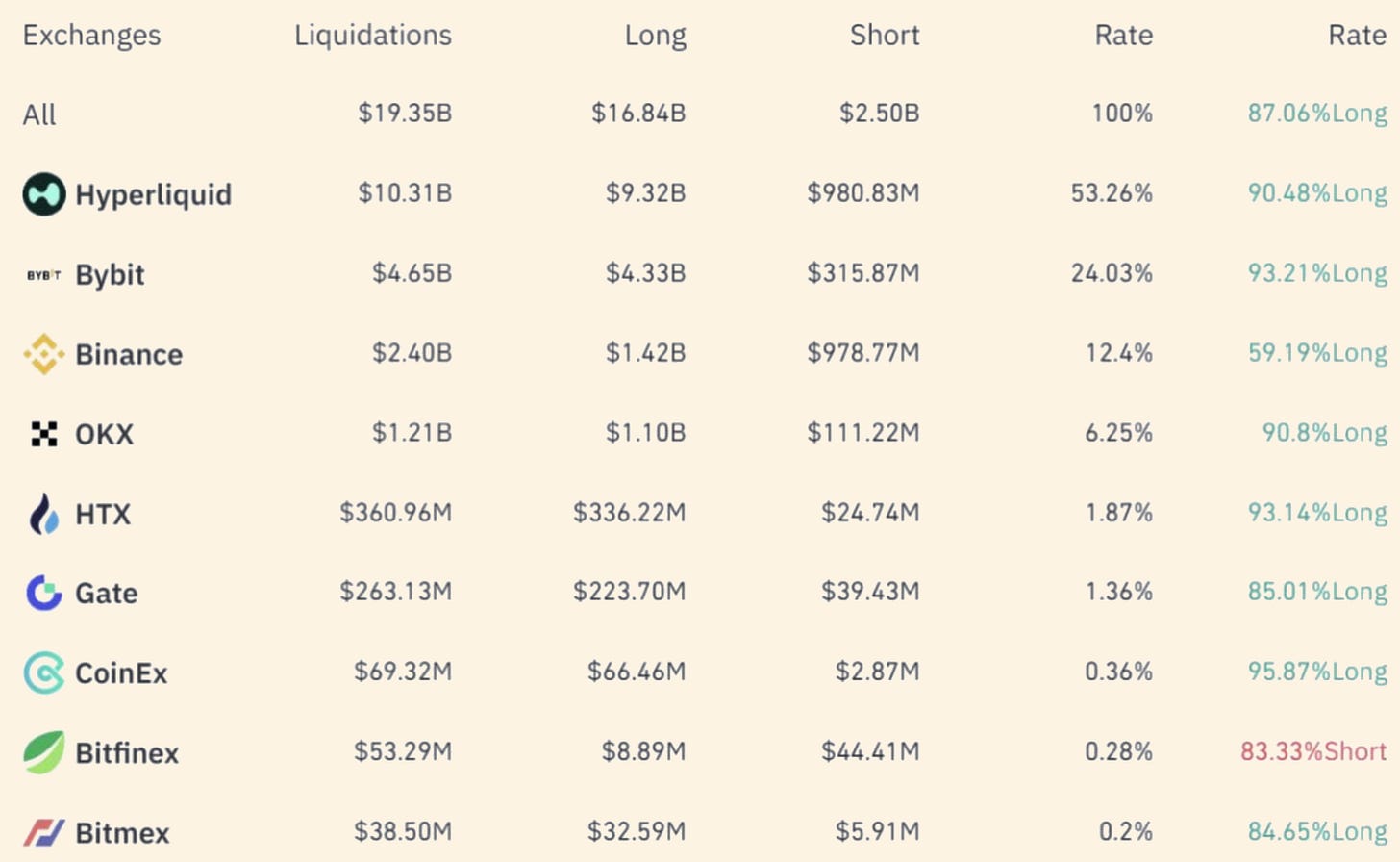

In total, 1.62 million trader accounts were liquidated across centralized and decentralized venues. An estimated 87% of positions liquidated were longs, indicating an extreme long-side leverage buildup before the crash. Several exchanges’ insurance funds were tapped. Binance alone used about $188 million to cover bad debt. The sell pressure was so intense that many platforms resorted to Auto-Deleveraging (ADL). That forcibly reduced even winning short positions to maintain solvency when there were no buyers left. Market makers withdrew, leaving order books effectively one-sided, and “flash crash” prints occurred on thin books. Notably, Hyperliquid, an on-chain perp DEX, saw over $10 billion of positions force-closed, the highest of any venue, as its transparent on-chain engine liquidated positions to avoid any bad debt, triggering its first ADL event in over two years.

Aftermath and outlook

By Oct 12, crypto prices had stabilized off their lows. Bitcoin rebounded to about $112,000 and the total market regained about $550 billion in value from the trough. Crucially, no major lender or exchange has collapsed from this event. The damage appears contained to trading losses rather than broad contagion. Observers note that the episode flushed out excessive leverage and may strengthen market resiliency going forward. Still, the scale of this mechanical crash has intensified scrutiny of crypto market structure. Industry leaders and regulators are now discussing structural safeguards, from better circuit breakers to more transparent liquidation protocols, to prevent a repeat of such an extreme cascade.

What Happened and When (Oct 10 to 12, 2025) - Timeline of the Flash Crash

Initial shock: Reports surfaced of a massive new U.S. tariff plan on Chinese goods, shortly after U.S. equity markets closed earlier in the week’s sessions. Global risk assets turned downward. Bitcoin, which had hit a record $125k earlier in the week, quickly fell below $120k. By 10:00, major altcoins were also weakening, foreshadowing the liquidity strain to come.

Oct 10, 15:00 to 16:00 EDT - Cascade ignition: U.S. President Donald Trump announced a 100% tariff on Chinese imports (effective Nov 1) via social media in this window. The confirmation of aggressive trade measures sparked a violent sell-off. Within minutes, automated orders overwhelmed the market. Bitcoin plunged through key support levels, dropping from about $122k toward $110k and then as low as about $104k on some futures exchanges, a roughly 15 to 17% intraday fall. Ether broke below $3,500, down about 20%. Solana and many mid-cap alts crashed over 30 to 40% in the same hour. Roughly $7 billion in positions were liquidated in under one hour during this peak panic, a record pace of forced selling.

Oct 10, about 16:30 to 17:00 EDT - Market free-fall and exchange disruptions: As prices cascaded, liquidity evaporated. Order books on several exchanges went nearly blank on the bid side, which led to extreme “wick” lows. On Binance, assets like Cosmos (ATOM) and Enjin (ENJ) briefly traded near $0 as margin collateral was sold off in bulk. Stablecoin markets were also rattled. Ethena’s USDe, an on-chain USD stablecoin, de-pegged to about $0.62 on Binance amid oracle misfires and thin liquidity. Exchange withdrawals and transfers started stalling. Many users reported that Binance’s interface froze and API connections lagged or failed completely by this time. Coinbase likewise had intermittent outages, and Robinhood temporarily paused crypto trading as a flood of stop-loss orders and reconnections hit their systems. These technical issues effectively trapped traders. Some could not top up collateral or execute trades to catch the bottom, which amplified losses.

Oct 10 late night to Oct 11 early morning EDT - Containment and stabilization: Through Friday night into Saturday morning, auto-liquidation engines continued to cycle. Some platforms, notably decentralized protocols, handled the turmoil relatively smoothly. Aave automatically liquidated about $180 million in under-collateralized loans during the chaos without manual intervention or downtime. Uniswap processed over $10 billion in trading volume on Oct 10 alone, a new daily record, as bargain-hunters and arbitrage bots finally stepped in to buy oversold tokens. Bitcoin oscillated in the $105k to $110k range, finding a floor as derivative funding rates reset and panic subsided. Ether similarly stabilized near $3,800. Many altcoins, however, remained 20 to 30% below their pre-crash levels even after bouncing, which reflected more lasting damage in the long tail of crypto assets.

Oct 12, 04:00 EDT - Aftershocks and retracement: By Sunday pre-dawn in New York, the acute crisis had passed. President Trump struck a conciliatory tone over the weekend (“China will be fine,” he remarked) which helped sentiment somewhat. Bitcoin recovered to about $112k, and global crypto market cap rose back above $4 trillion after dipping under $3.8 trillion at the peak of the crash. Still, market participants remained jittery. No major exchange insolvencies or fund blow-ups had come to light by this time, which eased systemic fears. Industry data later confirmed the event’s historic scale. About $19.3 billion in futures positions were liquidated, roughly 87% of it longs, and over 1.6 million trader accounts were affected in 24 hours. Analysts labeled the episode a controlled detonation. Painful but possibly cleansing, as it flushed out reckless leverage without toppling any large institutions.

Mechanics that Amplified the Crash

Several structural weaknesses turned a sharp sell-off into a vicious liquidity spiral

Illusory Liquidity and Market-Maker Retreat

The crash exposed how thin crypto order books can become under stress. Many assets appeared liquid in calm times but had very shallow true depth. When prices started falling fast on Oct 10, market makers either pulled their bids or hit risk limits, leaving a vacuum of buyers. This was not malicious, it was a protective reaction. Liquidity providers were effectively “inventory trapped”: those making markets on altcoin pairs suddenly found themselves long rapidly-devaluing coins with no immediate hedging available, as other venues’ prices diverged or halted. Others voluntarily went risk-off by widening spreads or withdrawing quotes entirely. The result was a one-sided market where sell orders met no resistance, causing assets to gap down dramatically until some bottom-fishing orders hit. For example, in the height of the panic, Kraken’s BTC/USD price was nearly $10k higher than Coinbase’s, a roughly 9% gap, because each venue’s order book collapsed to different levels. Such fragmentation meant even arbitrageurs couldn’t fully capitalize, especially with exchange transfers delayed. This liquidity evaporation is a textbook cause of flash crashes, once the first drop started, everyone tried to get out or went idle, accelerating the plunge.

Cascade of Margin Calls and Oracle Feedback Loops

The sell-off was heavily leveraged, turning it into a self-reinforcing cascade. As initial price drops pushed many long positions below maintenance margin, exchanges began mass liquidating those positions into falling markets. These liquidations themselves added more sell pressure, driving prices even lower and triggering yet more margin calls, a classic doom loop. Importantly, cross-venue price oracles and index pricing mechanisms struggled in this environment. Some price oracles misfired, feeding outlier prices into DeFi platforms. In one case, a major oracle reportedly published a Bitcoin price nearly 10% away from the real market mid, causing excessive collateral calls on-chain. On Binance, the index price for certain derivatives, which included a thinly traded exchange, nosedived, leading to a temporary depeg of staked assets, for example staked ETH and staked SOL on Binance saw prices diverge about 5–7% from their underlying due to index calculation quirks. These pricing gaps meant some traders were liquidated even though broader market prices hadn’t gone as low, effectively an unfair wipe-out due to oracle issues. The use of many altcoins as collateral made matters worse. When an altcoin used in lending platforms or margin accounts crashed in value, even if momentarily, it led to forced selling of other assets to shore up collateral ratios, spreading the pain system-wide. The ATOM token falling to $0.01 on one exchange, for example, instantly impaired anyone using ATOM as loan collateral, loans were liquidated and those ATOM were fire-sold, further hammering the price. This cross-asset contagion via collateral liquidation was a major amplifier.

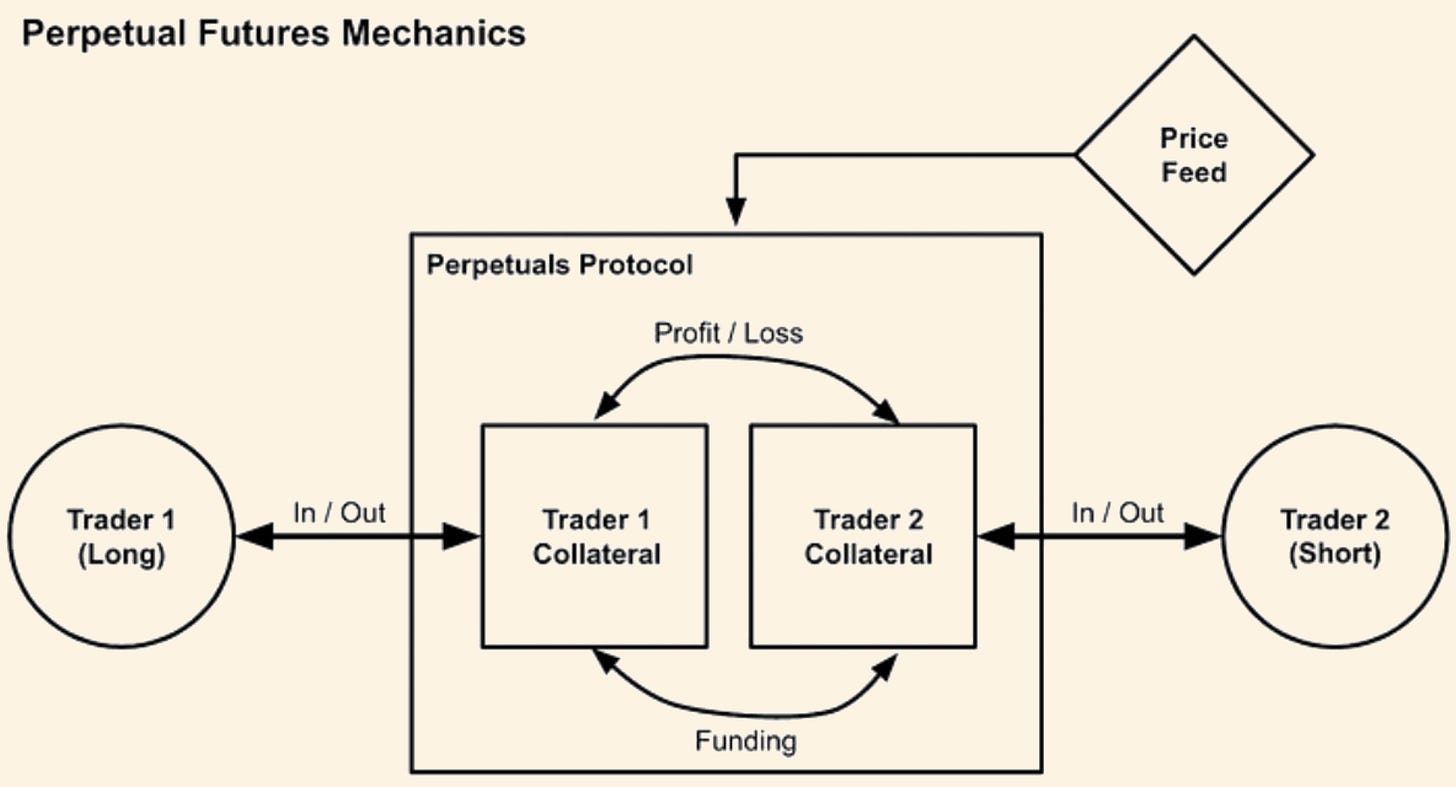

Auto-Deleveraging (ADL) and “Socialized” Losses

The final backstop, when there were no buyers and insurance funds were depleted, was automatic deleveraging of counterparty positions. In extreme moments on Oct 10–11, several platforms had to invoke ADL, closing profitable short positions to balance the books. This occurs because in a zero-sum derivatives market, if longs go bust and no new longs step in, there isn’t enough money to pay out all the winning shorts. Exchanges like Binance and Hyperliquid use ADL as a last resort to maintain solvency. On this day, that last resort was broadly needed. Hyperliquid’s founder noted that their exchange hit ADL for the first time in years during the crash, as thousands of liquidations per second left a gap in counterparties. Binance likewise saw its ADL indicators flash as certain large shorts were reduced without their consent. ADL doesn’t discriminate fundamental vs. opportunistic trades, it simply starts closing the most profitable or leveraged shorts until balance is restored. While this prevented unchecked contagion, it effectively capped the gains of traders who bet correctly, and it introduced confusion as positions vanished. The lack of transparency around ADL triggers on some CEXes fueled anger; users weren’t sure why their shorts closed early or at what price. ADL events also had a perverse effect: by cutting shorts, they removed buy orders, short covers, that might have helped rebound prices, possibly slowing the recovery. In summary, ADL saved platforms from default, but it amplified individual losses and highlighted opaque risk controls.

Insurance Funds and Minimal Backstops

Underpinning the above, the industry’s insurance funds, capital pools set aside by exchanges to absorb liquidation losses, proved to be relatively small compared to the carnage. Binance’s insurance fund paid out about $188 million in covering negative balances on Oct 10, a significant sum but only around 8% of the roughly $2.4 billion liquidated on Binance. Other exchanges saw similarly limited fund usage. This implies that beyond those buffers, the remaining losses had to be handled by ADL or were simply passed onto the traders who were liquidated, their collateral absorbing the hit. Encouragingly, no exchange reported a major sustained shortfall, the system, while messy, cleared without obvious bankruptcy. For instance, Hyperliquid’s on-chain design resulted in zero permanent bad debt and the platform kept 100% uptime through the event. However, these minimal backstops meant that most of the burden was borne by traders rather than exchanges. It underscores how, unlike traditional markets with clearinghouses or Fed backstops, crypto exchanges rely on rapid self-correction, liquidate now, ask questions later. It worked, but at the cost of extreme volatility.

Exchange Infrastructure and Withdrawals

The mechanical issues on centralized exchanges also played a key amplifying role. The inability to transfer funds or execute trades in the heat of the moment locked the system into its trajectory. Market makers couldn’t arbitrage between venues when API feeds were down or withdrawals stuck in queues. For example, Bitcoin traded 5–10% higher on some exchanges than others during the chaos, because nobody could quickly move capital to arbitrage the gap, inter-exchange transfers were effectively frozen by the combination of human risk aversion and system overloads. This fragmentation worsened oracle discrepancies and led to further panic, traders saw prices diverging wildly and assumed the worst. Some participants have alleged that certain exchanges intentionally froze withdrawals or trading to stem their losses, though hard evidence is lacking. What’s clear is that the lack of coordinated circuit breakers or halts meant the crash played out fully in real time. Each venue fended for itself, sometimes by pausing, which hurt user confidence, or staying open, which led to outlier trades. Both approaches had drawbacks, and neither prevented the cascade in a multi-venue market.

In sum, the crash was not triggered by a fundamental collapse of crypto assets’ value, but by structural and mechanical forces. Too much leverage on too many correlated assets, fragile liquidity that vanished under duress, and automated risk management that functioned bluntly all combined to produce an outsized move. As one analysis put it, this was a “technical” crash rather than a fundamental one, akin to a 1987 or 2010-style flash crash, and it exposed the plumbing issues of the 24/7 crypto market.

Who Was Hit Hardest, and Who Weathered It

Leveraged Longs and Retail Traders: The overwhelming majority of losses came from bullish bets that went wrong. Data show 87% of liquidated value was from long positions. Many were held by retail traders who had piled into futures or margin loans as Bitcoin and other coins hit all-time highs earlier that week. When the market turned, these highly levered longs were the first to go. Over 1.6 million individual accounts were liquidated, implying a vast number of small players got wiped out. Sadly, there were reports of extreme personal fallout, for example, one prominent trader reportedly took his own life after incurring catastrophic losses during the crash.

The event was indiscriminate at the retail level, anyone on high margin, 10x or 20x leverage, was likely wiped out in minutes once prices fell 15% or more. Many traders lost even more due to platform issues, for example couldn’t manual close, and the speed of the drop. Stop-loss orders that were supposed to limit damage often failed to execute or filled far below the stop price, deepening losses. In a stark example, a trader on a decentralized exchange lost an entire $19 million position virtually instantly as on-chain liquidators cleared his collateral. This illustrates how little recourse overleveraged users had once the cascade began.

Altcoin Holders and “Yield Farmers”: Holders of smaller-cap coins experienced the most brutal percentage declines. While Bitcoin and Ether dropped 12–17%, the average altcoin plunged about 33% in the worst 25-minute window. Many thinly traded tokens like meme coins or newly listed alts fell 70–90% at the extreme. Even those not using leverage effectively suffered leveraged-like losses on their spot holdings. Furthermore, a specific cohort of sophisticated traders, basis traders and liquidity providers in DeFi, got caught by a one-two punch. These traders often run market-neutral strategies, for example shorting perpetual futures while holding the equivalent amount of the spot asset to earn funding yields, or providing liquidity in AMM pools hedged by shorts.

The crash broke many of those hedges. For instance, auto-deleveraging closed out shorts on Hyperliquid and other exchanges, which suddenly left some players naked long the asset on the spot side, because their short hedge vanished. Simultaneously, if those spot assets were financed by loans, the loans got liquidated due to price drops. Delta-neutral yield farmers found one leg of their trade, the short, disappeared via ADL, and then their collateral on a lending protocol was liquidated as its value tanked. This was an unprecedented scenario, normally uncorrelated legs became correlated through the forced unwind. Several crypto funds that specialize in such arbitrage reportedly suffered major losses as a result, essentially becoming long altcoins at the worst moment without wanting to. These hidden leverage points, using DeFi loans to fund basis trades, meant that even market-neutral players were not safe. The more exotic or lower-liquidity an asset, the more severe the impact. By contrast, traders focused purely on Bitcoin fared better. Bitcoin’s month-to-date drop by Oct 12 was relatively modest, and its quick rebound meant any unlevered holder of BTC only saw a roughly 10% drawdown, comparable to a stock market move. This divergence, BTC resilience vs. altcoin collapse, underscores a flight to quality during the rout.

Whales and Institutional Traders: Large players were not spared. In absolute terms, whales lost the most dollars. The single largest known liquidation was a $200 million long position in ETH on Hyperliquid that was erased in one go. At least one major crypto fund is rumored to have been margin-called into insolvency, though as of mid-October no firm publicly admitted such a collapse. On the flip side, some whales profited massively by being on the right side, at least initially. One widely discussed case was a short seller who had built roughly $1.1 billion in short positions across BTC and ETH ahead of the crash, reportedly making on the order of $80–200 million in profit as the market tanked. However, even some of these winning shorts couldn’t realize all gains: several saw their positions auto-closed by exchanges’ ADL, or they faced huge slippage getting out. In one anecdote, a whale who shorted BTC from about $122k covered too late and then went long near $105k expecting a bounce, only to see their new long liquidated as the market dipped a bit further, a double loss scenario. This underlines that timing and execution were extremely difficult even for seasoned players.

Market makers themselves, such as Wintermute, faced scrutiny and speculation. Wintermute’s CEO publicly denied that the firm was in trouble, stating it remained business as usual through the volatility. Nonetheless, some on-chain analysts pointed out that Wintermute had sent hundreds of millions of dollars of BTC to exchanges just before the crash, implying they might have been positioning for, or inadvertently exacerbating, the move. Wintermute’s leadership later suggested the crash was triggered by external events, for example tariffs, subtly pushing back on the narrative that any single whale or insider caused it. Regardless, liquidity providers like Wintermute and Amber likely endured substantial losses on altcoin inventories and saw sharply negative PnL on Oct 10 due to being forced to absorb sales at dislocated prices. The fact that such firms survived indicates they were adequately capitalized, but it was clearly a painful day for them as well, described by leadership as one of the messiest events in years.

Resilient Segments, DeFi Protocols and Long-Term Holders: Amid the chaos, the decentralized finance infrastructure proved relatively robust. Uniswap’s automated market makers functioned continuously, and volumes hit record levels as users traded through decentralized liquidity when centralized venues faltered. Major DeFi lenders liquidated risky loans exactly as designed; while users lost collateral, the protocols themselves did not seize up nor incur bad debt beyond normal parameters. In fact, large lenders emerged with minimal or zero bad debt thanks to high collateralization standards and immediate on-chain auctions. This contrasts with past episodes, for example 2022’s CeFi failures, and was a reassuring sign that on-chain risk controls can handle even violent market swings.

Additionally, long-term investors, unlevered, were largely unfazed in a practical sense. Those who simply held BTC or ETH in cold storage saw a drawdown but nothing catastrophic, and many holders took the opportunity to buy the dip. On-chain flow data indicated that Bitcoin inflows remained steady during and after the crash, a sign that conviction investors were not running for the exits. Some institutional buyers even stepped in, with reports of large spot purchases during the turmoil, interpreting it as an oversold opportunity. Whether or not exact figures are accurate, it’s clear that spot buyers with dry powder helped cushion the bottom. The fact that no major stablecoin broke its peg materially and no major exchange needed a bailout suggests the system’s core remained intact. In comparison to the contagious collapses of 2022, this event, while dramatic, did not spread beyond the trading arena, an encouraging sign of compartmentalization.

Recommendations

Implement Circuit Breakers & Auction Mechanisms

Crypto exchanges should adopt market-wide circuit breakers similar to equities. For example, a 5–10 minute trading halt if an index of major crypto prices drops more than a set percentage (say 7%) in a short span. This pause would prevent the instantaneous cascade of liquidations and allow order books to refuel. Additionally, introducing volatility auction mode for price discovery could help: during the halt, let participants submit buy/sell interest, then reopen with an auction-determined price. This could have mitigated the extreme wick trades (e.g. ATOM at $0.01) by finding a fairer clearing price instead of executing into a vacuum. Some decentralized exchanges already use similar mechanisms in their design. Major venues like Binance and OKX should coordinate on triggers for halts on flagship assets (BTC, ETH, top alts) to ensure no venue becomes a lone source of wildly divergent prices during turmoil.

Strengthen Insurance Funds and Last-Resort Liquidity

Exchanges must bolster their insurance funds and consider new backstop liquidity programs. The fact that only ~$200M was available on the largest platforms to absorb losses is not sufficient for a market of this size. We recommend significantly increasing these reserve funds (through allocating a higher fraction of trading fees to them) so that in future crashes, insurance can cover more losses before ADL is needed. Alongside this, venues could establish optional programs where market makers pre-commit capital to handle liquidations. For example, an exchange could invite professional liquidity providers into a “Liquidation Consortium” that agrees to take on a chunk of liquidated positions at a slight discount, in exchange for a fee or profit share. This is analogous to how some stock exchanges have designated market makers who maintain orderly markets. By having MMs assume some liquidation risk, the load on the exchange engine and risk of auto-deleverage could be reduced. Such programs would need transparency (which MMs are involved, how prices are determined for transfer of positions, etc.), but could turn forced selling into negotiated block sales rather than instantaneous dumps.

Transparent and Fair ADL Rules

Auto-deleveraging was a central pain point, so reforms here are crucial. Exchanges should publish clear ADL policies – including the exact waterfall of actions (insurance fund usage, partial versus full position ADL, how they rank which shorts to cut first). If any ADL exemptions exist (for instance, perhaps VIP clients with portfolio margin may have different treatment), those need disclosure to avoid perceptions of unfairness. One proposal from industry experts is to move toward a “socialized loss” model in extreme cases as an alternative to per-account ADL. This would mean spreading the loss across all profitable traders proportionally, rather than completely nuking a few large shorts. While socialized losses have their own downsides (good actors bailing out bad), it might be seen as more equitable than the current all-or-nothing ADL system. At minimum, users should be able to monitor ADL triggers in real-time – e.g. an exchange could display a real-time gauge of insurance fund health and the likelihood of ADL (some already have indicators, but more granularity would help traders manage risk). Finally, index pricing improvements tie in here: exchanges should use more robust price indices (with outlier filtering and perhaps time-weighted smoothing) for margin calculations so that one freak trade doesn’t set off a chain of liquidations. Using decentralized oracles like Chainlink’s aggregated feeds could add an extra layer of sanity checks on price inputs.

Oracle and Stablecoin Resilience Measures

Oracle providers and stablecoin issuers need to review this incident. The USDᴇ stablecoin depeg and the staked token pricing issues indicate that index design flaws and slow oracle updates exacerbated the chaos. Going forward, oracles should incorporate circuit-breaker logic: e.g. if a price feed deviates by more than X% from median global price in a few seconds, pause updates or consult additional data sources. Pyth Network and Chainlink have both been exploring more adaptive or “slow” oracles for such cases. These efforts should be accelerated. For stablecoin protocols, especially algorithmic or low-liquidity ones, having explicit emergency mechanisms to halt mint and burn or to tap extra collateral during extreme market moves would prevent confidence crises. Binance’s handling of the USDᴇ and WBETH depeg, where they reportedly refunded ~$250M to users after the fact for those anomalies, is not a sustainable solution. Instead, stablecoin and derivative designs should aim to avoid such pegs snapping in the first place, possibly via wider collateral baskets or dynamic fees during volatility. Regulators will also likely push for this, as stablecoin instability is a systemic concern.

Cross-Exchange Coordination and Standards

The industry would benefit from more coordinated safeguards. Crypto markets are unique in their fragmentation; dozens of venues globally trade the same assets 24/7. Creating a formal or informal communication channel among major exchanges for crisis moments could help. For example, if a major shock hits, exchange operators could quickly share data on market health and even agree on synchronized halts or reopenings for key trading pairs. While antitrust and competitive concerns make this tricky, there are precedents in traditional finance such as intermarket circuit breakers. At the very least, establishing common reporting standards for incidents would improve transparency. One problem on Oct 10 was that different exchanges reported conflicting numbers for liquidations, leading to confusion. Hyperliquid’s CEO noted that some CEXs dramatically under-report liquidation figures. Going forward, all major venues should publicly release liquidation totals, insurance fund usage, and ADL activations promptly after an event, using a consistent format. This will enable better analysis and accountability. In addition, exploring on-chain clearing or settlement for trades could add robustness. If more of the trading flow moved to on-chain DEXs or hybrid models, every order and liquidation would be transparently verifiable, which can deter manipulation and build trust. Embracing such transparency might be uncomfortable for some centralized players, but it could ultimately stabilize the market by aligning everyone to a single source of truth.

Post-crash winners

Hyperliquid

DeFi venues that stayed solvent and transparent

Solana - Good performance under stress

Assets with real cash flow

Post-crash losers

Binance brand and Launchpool model in the short run. Listing terms and oracle choices drew heat

Leveraged retail and funds farming perp points

Long tail alts with paper valuations and no structural bid. Many still trade below pre-crash prints

“Revenue meta” tokens near term since their users and volumes were hit

Delta-neutral basis trades across venues that ADL’d on the short leg

Conclusion

In summary, this flash crash provided a harsh lesson in where crypto market infrastructure needs improvement. By implementing traditional safeguards like circuit breakers, enhancing risk funds, making deleveraging rules fairer, tightening oracle designs, and fostering exchange cooperation, the industry can greatly reduce the risk of a similar liquidity crisis happening again. Crypto will likely always be volatile, but the goal is to avoid self-inflicted cascades that undermine confidence. The next 1–3 months present an opportunity, and an imperative, to shore up these weaknesses before the market’s next big test.

Sources:

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer’s views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.