The New Era of Finance: Institutional Paths to Crypto Integration

Introduction

In the dynamic realm of financial technologies, institutional investors are spearheading the integration of digital assets through diverse tokenization initiatives. Prominent institutions like BlackRock, JP Morgan, and others are heralding a revolution in core financial operations such as payments, wealth management, and other crucial Wall Street functions.

Key Developments in Tokenization

Tokenized Funds and Securities

BlackRock's Initiative: The launch of a blockchain-based tokenized fund backed by U.S. Treasuries has accumulated over $1 billion in assets, demonstrating substantial adoption and operational efficiencies.

Other Major Players: Entities like Franklin Templeton, KKR, Apollo, and Hamilton Lane have embraced digital assets by tokenizing investment funds, marking a significant trend across the financial industry.

Tokenized Bonds and Mortgages

Global Efforts: Firms such as Societe Generale and HSBC have issued tokenized bonds, with HSBC tokenizing a HK$600 billion government bond, which notably reduced settlement times.

U.S. Developments: Figure Technologies has taken the lead in tokenizing mortgages and HELOCs in the U.S., potentially disrupting traditional mortgage registries.

Stablecoins: The Backbone of Digital Finance

Market Presence: With a market cap of $157 billion, stablecoins play a crucial role in the ecosystem of digital finance.

Institutional Adoption: Major entities like JP Morgan and Societe Generale have launched their own stablecoins, significantly enhancing settlement processes and achieving considerable cost savings.

Regulatory Landscape: Recent U.S. legislation aims to enforce strict backing for stablecoins, highlighting a cautious approach to financial stability.

Implications for Venture Capitalists

Innovation Opportunity: The shift toward tokenization unveils substantial opportunities for VCs, particularly in developing solutions that bridge traditional finance with blockchain technology.

Regulatory Challenges: VCs must remain vigilant of the changing regulatory environment, which will critically influence the scalability and adoption of tokenized assets and stablecoins.

Key Ways Institutional Investors Access the Digital Assets Market

Institutional investors have diversified their approaches to integrating cryptocurrency and blockchain technology into their portfolios. Here’s how:

Venture Capital:

Investment as limited partners (LPs) in crypto-focused venture capital firms allows institutions to tap into emerging technologies and startups within the blockchain sphere without direct market exposure.

Liquid Funds:

Involvement with advanced investment firms, including hedge funds that employ strategies like Cross Exchange Arbitrage and Market Making, targeting market inefficiencies and aiming for market-neutral positions.

Direct Exposure:

Direct investments in crypto mutual funds, ETFs, or equities linked to the crypto market, such as Coinbase and Microstrategy, align closely with market movements and offer high potential returns but with greater volatility.

Tokenization:

Engagement in issuing or investing in digital tokens that represent real-world assets on a blockchain, including stablecoins and private credit, merging traditional asset classes with digital innovations.

Crypto Custody

Crypto Custody, or Digital Asset Custody, ensures the safe storage and protection of digital assets. Custody services manage the private keys on behalf of clients, mitigating risks such as theft or unauthorized access. The integrity of these services, given the irreversibility of blockchain transactions, is paramount.

Types of Crypto Custody Solutions

Cold Wallets: Completely offline, providing maximum security against hacks.

Warm Wallets: Online but require manual transaction verification, balancing security with convenience.

Hot Wallets: Always online, offering ease of use at the expense of higher security risks.

Advanced features like multi-signature (Multisig) and multiparty computation (MPC) enhance security by distributing control over assets, ensuring that no single party can manage the assets independently.

Evolution of Digital Asset Custody

From rudimentary self-custody options and exchange wallets to sophisticated third-party cold storage solutions, digital asset custody has evolved to meet the growing needs of institutional investors. The launch of products like Bitcoin Futures by CME Group in December 2017 further spurred this development, highlighting the necessity for secure, institutional-grade custody services.

Importance of Digital Asset Custody

Security and Control: "Not your keys, not your coins" underscores the importance of holding private keys to truly control one's digital assets.

Rising Security Incidents: The increasing frequency of high-profile hacks and the collapse of major platforms due to mismanagement emphasize the need for independent custody solutions.

Crypto Custody Providers:

Insights and Trends for Institutional Investors in DeFi

Initial Forays and Current Trends:

Institutional investors initially favored venture capital due to its stability compared to direct market investments.

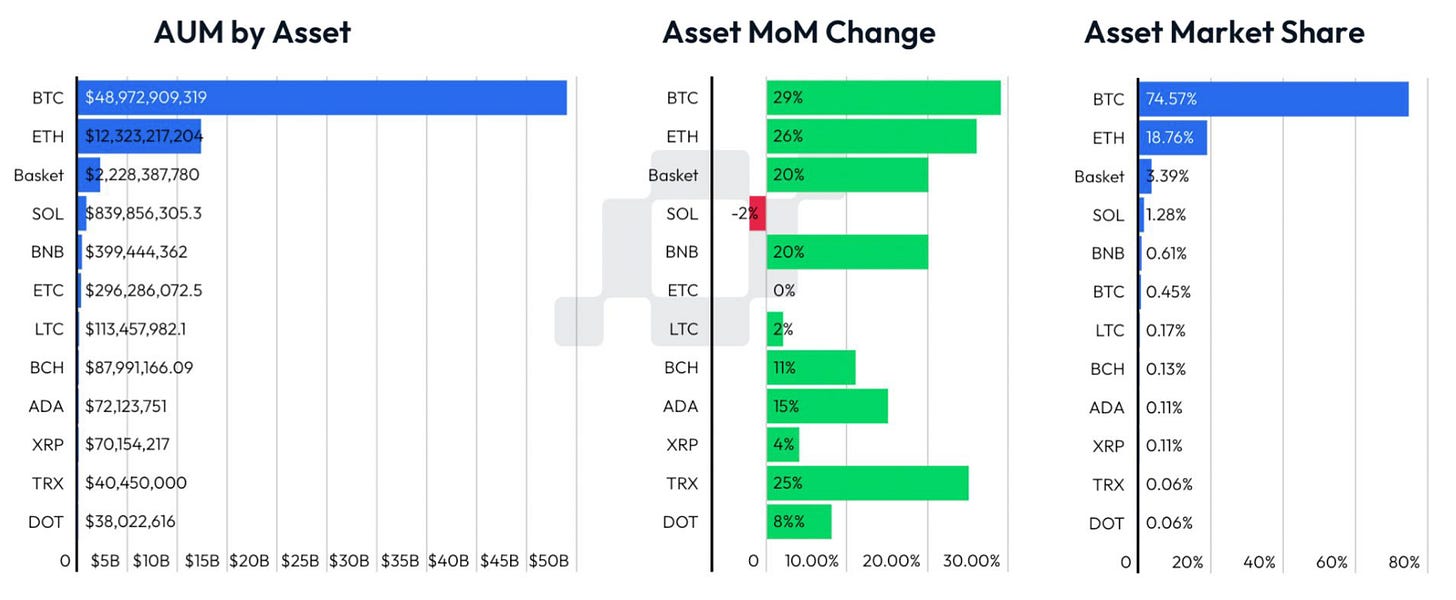

Despite a slowdown in crypto asset commitments influenced by macroeconomic factors and market volatility, institutional interest remains resilient, with significant AUM in strategies like directional exposure surpassing $60 billion.

Performance and Market Impact:

Hedge funds have managed to occasionally outperform Bitcoin with considerably lower volatility, aligning with institutional risk management preferences.

The performance of crypto funds and the growth in assets like ETH and stocks such as Coinbase underscore the profound impact of institutional investments on the crypto market.

Tokenization and Real-World Assets (RWAs):

Fiat-backed stablecoins have achieved the most success among tokenized assets, propelled by network effects and broad adoption.

Other tokenized assets, including real estate and private credit, face adoption challenges due to additional risks and unfavorable market conditions.

The Role of Institutions in Crypto:

Institutional capital is essential for the maturation and stabilization of the crypto market, bridging centralized finance (CeFi) with decentralized finance (DeFi) and enhancing overall market legitimacy.

Summary:

Venture Capital remains a favored entry for institutions, offering lower volatility and high-quality investment opportunities.

Direct exposure and liquid funds are preferred by institutions seeking active positions in crypto assets.

Tokenization provides a promising path for merging traditional assets with digital innovations, though adoption rates vary.

Despite challenges, institutional investors play a crucial role in shaping the crypto landscape, influencing everything from market stability to DeFi integration.

Conclusion

The engagement of institutional investors in the crypto market is multifaceted and evolving, reflecting a cautious yet strategic approach to this burgeoning asset class. As the market matures and regulatory frameworks become clearer, these investors are poised to play a transformative role in shaping the future of finance.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.