Memecoins: A Decade of Disruption—What's Next?

Introduction

Dogecoin, a cryptocurrency born from a meme featuring a Shiba Inu dog, was launched on December 6, 2013, by Jackson Palmer and Billy Markus. It not only sparked the memecoin phenomenon but also demonstrated the potential of cryptocurrencies to garner massive cultural appeal. Ten years later, the landscape of memecoins has evolved dramatically, influencing various sectors of the crypto world including NFTs and DeFi, while also posing challenges and revealing new opportunities for funding public goods.

The Genesis and Evolution of Memecoins

Cultural Impact: Originally a playful alternative to Bitcoin, Dogecoin's rapid adoption underscored the power of internet culture in driving cryptocurrency popularity.

Technical Shifts: The introduction of Ethereum's ERC20 token standard significantly reduced barriers to cryptocurrency creation, leading to a wave of both utility-focused and meme-based tokens.

Memecoins through Different Eras

ICO Boom: Despite the rise of utility tokens during the ICO craze, memecoins like the Dentacoin (the chart below) captured public attention, the latter reaching a $2 billion market cap in 2018.

NFT and DeFi Integration: Early meme-based NFTs like Rare Pepes and subsequent integration into DeFi protocols during the 2020 DeFi summer highlighted the synergistic potential between memecoins and emerging crypto sectors.

Current Landscape and Opportunities

Top 10 Memes Tokens by Market Capitalization (02.05.2024; via: coinmarketcap.com)

Market Dynamics: As of 2024, memecoins have shown resilience, adapting to market trends with innovations that maintain user engagement and relevance.

Charitable and Social Impact Initiatives: Newer memecoins are attempting to align with charitable causes, with some success in merging meme appeal with substantial contributions to public goods.

The Dynamics of Attention in Memecoin Markets

Attention as Currency: The valuation of memecoins is intrinsically tied to the attention they receive. For instance, a memecoin community raised $700,000 for an advertising blitz on the Las Vegas Sphere, which spiked the token’s value by 25%. This highlights how visibility can directly impact market performance.

Leveraging Current Events: Memecoins like 'Politifi', which are tied to political events, capitalize on the heightened public interest during election seasons, using platforms like PredictIt and Polymarket to engage users and drive speculation.

Strategic Community Engagement and Token Distribution

Creative Marketing Strategies: Memecoin communities often deploy inventive promotional tactics that go beyond standard social media engagement. These include large-scale fundraisers and public stunts designed to boost token visibility and attract investors.

Tokenomics: Successful memecoin projects strategically allocate tokens for various purposes—including marketing, incentivizing the team, and funding DAO operations—which helps align long-term interests and sustains project growth.

The Broader Impact of Memecoins

Supercharged Distribution: Memecoins have revolutionized the way digital assets are distributed, influencing sectors like NFTs through mechanisms like ERC-404s, which facilitate fractional ownership and broader accessibility.

Revitalization of Blockchain Ecosystems: In the aftermath of the FTX collapse, memecoins like the orange dog memecoin on Solana played a pivotal role in rejuvenating the platform’s ecosystem by boosting both community engagement and developer activity.

Addressing the Criticism

Community Backlash: Recent criticisms, particularly around non-innovative or culturally insensitive memecoins, have sparked concern within the community. Influential figures like Ethereum's Polynya have voiced dissatisfaction with the current trajectory of memecoins, calling for a reevaluation of their societal contributions.

Positive-Sum Alternatives: There is a growing interest in charity coins, which allocate a significant portion of their supply or transaction fees to charitable causes. Successful examples include the Dogelon Mars token, which has fostered a mutually beneficial relationship with the Methuselah Foundation.

Future Directions

Enhancing Game Mechanics: There is significant potential in developing games that integrate memecoin economies to offer both entertainment and economic benefits, particularly for lower-income participants.

Balancing Fun and Impact: The challenge remains to create engaging platforms that are enjoyable yet contribute meaningfully to societal benefits without fostering speculative bubbles.

Infrastructure Developments: Tools such as Bonkbot and platforms like Pump.fun have streamlined the trading and launching of memecoins, significantly enhancing liquidity and generating substantial daily revenues.

Innovation Through Game Theory and Charity Integration

Charity Coins: Initiatives like GiveWell Inu and Fable of the Dragon Tyrant have tried to marry tokenomics with philanthropy, though with mixed results due to issues like maintenance and community engagement.

Robin Hood Games: The concept of creating engaging, blockchain-based games that provide financial benefits, especially to lower-income players, presents a novel approach to using memecoins for public good.

Gaming Integration: Proposals to develop complex, immersive games akin to World of Warcraft on the blockchain suggest a future where memecoins can offer both entertainment and tangible benefits, potentially transforming the way we think about engagement in the crypto space.

Community and Charity Synergy: Integrating gaming successes with mechanisms for charity funding could allow players to influence where and how funds are distributed, thereby enhancing the impact of their gaming achievements.

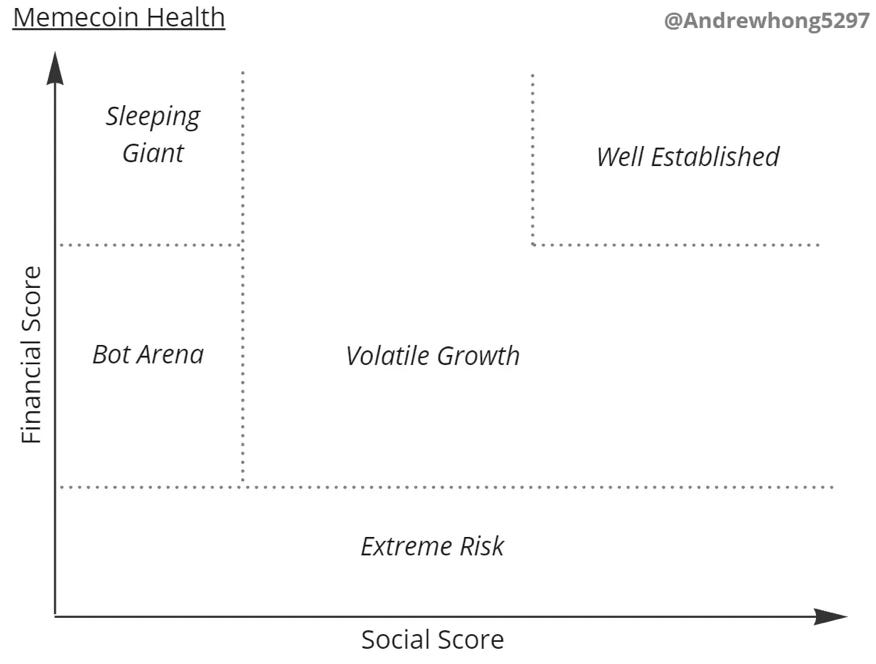

Analytical Framework Overview (via @ilemi)

Despite the speculative nature and unpredictability of memecoins, there are methodologies available that can systematically evaluate the potential of specific tokens. A prime example is the analytical framework developed by Andrew Hong (@ilemi), which aims to dissect memecoin projects through a dual-category analysis: Social Score and Financial Score. This method provides a structured approach to measure both the social engagement and financial health of memecoins, offering a more empirical basis for assessing investment risks and opportunities in this volatile segment.

To provide a clearer understanding of the diverse landscape of memecoins, they can be categorized into five distinct segments based on their social and financial metrics:

Extreme Risk: These memecoins have minimal liquidity and volume, presenting high risks of market manipulation or rug pulls.

Bot Arena: A crowded segment where numerous memecoins compete for visibility, often without distinguishing features.

Volatile Growth: Memecoins that achieve initial success face extreme price volatility and high influencer activity.

Well Established: Leading memecoins that show stable growth and sustained market presence.

Sleeping Giant: Previously popular memecoins that are currently less active but maintain potential for resurgence.

Methodology for Social and Financial Scoring (via @ilemi)

Social Score Construction:

Casters: Number of individuals actively discussing the memecoin using its ticker symbol.

% Recipients: Proportion of discussion participants who have previously transacted the token.

Casts: Frequency of the ticker symbol's mention across various platforms.

Channels: Diversity of communication channels featuring the ticker symbol.

Activity Level: Combination of engagement metrics and network spread (calculated as casts * cube root of casters * cube root of channels).

Financial Score Metrics:

Fully Diluted Value (FDV): Total token supply multiplied by its current price.

Price Changes: Daily, weekly, and monthly price fluctuations.

Liquidity: Assessment of market depth, focusing on non-token elements (e.g., WETH in a DEGEN-WETH pool).

Trades and Transfers: Trading and transaction frequency over the last 30 days.

Total Volume: Cumulative trading volume in USD over the past week.

Key Insights from Current Data

Performance Distribution: Analysis of Farcaster memecoins reveals a broad spectrum of performance, with a majority stuck in the 'Bot Arena' while a few, like DEGEN, exhibit characteristics of 'Volatile Growth' or even 'Well Established' segments.

Bot and Sybil Influence: Some social scores may be artificially inflated due to bot activity, suggesting that raw social data should be approached with caution.

Further Research and Data Improvements

Sybil Attack Filters: Future enhancements should include mechanisms to filter out artificial inflations caused by Sybil attacks or bots to ensure the authenticity of social metrics.

Longitudinal Studies: Monitoring the progression of memecoins across different market conditions could provide deeper insights into the factors driving transitions between categories.

Key Takeaways

Potential for Public Good: Memecoins have the potential to support significant social and environmental causes, provided they are aligned with clear charitable goals and community governance structures.

Innovative Funding Mechanisms: The unique properties of blockchain and tokenomics open up new possibilities for creating engaging platforms that transcend traditional funding methods, offering both entertainment and practical benefits.

Community Engagement: Developing a supportive community that actively participates in projects combining fun and functionality is crucial for transitioning from speculative to impactful crypto initiatives.

Conclusions

Despite their market growth, memecoins face sustainability and viability concerns due to their reliance on hype and speculative trading, which raise issues around market stability and investor risk. Recently, A16z crypto’s CTO Eddy Lazzarin criticized memecoins, stating they undermine the long-term vision of cryptocurrency, tarnish the industry’s image among the public, regulators, and entrepreneurs, and essentially function as a casino for a relatively small population. However, amidst these challenges, it's still worthwhile to analyze and follow certain innovative projects within this niche. By identifying memecoins that demonstrate potential for genuine utility, investors can uncover opportunities where these assets might evolve beyond fleeting trends into more stable, valuable contributions to the broader crypto ecosystem.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.