Fintech 3.0: Stablecoin Rails

Fintech 1.0 put existing banking products online – think early online banking and payment apps. The user experience moved to web and mobile, but money still flowed over legacy networks like ACH, SWIFT, and card processors. Value creation came from convenience and UI polish, not from changing how money moved. Fintech 2.0 in the 2010s brought mobile-first neobanks and specialized fintechs. New challengers like neobanks targeted niches (students, gig workers, the underbanked) with slick apps, but under the hood they leaned on sponsor banks and card networks for core functions. Differentiation was in branding and features, while legacy rails and regulations kept the innovation “at the top of the stack.”

High fixed costs and licensing hurdles meant only chartered banks or their partners could handle custody and transfers, so fintech startups largely resold the same old rails with a new coat of paint.

By the late 2010s, “embedded finance” and Banking-as-a-Service (BaaS) were heralded as the next phase – call it a legacy view of Fintech 3.0. Any app could plug into banking via APIs and offer accounts, payments, or lending. This did expand distribution, but again, the actual money movement stayed on closed, bank-controlled networks. Over-reliance on a few sponsor banks led to commoditization and concentrated risks. Compliance burdens on those banks grew, raising costs and slowing experimentation. For two decades, fintech innovation remained surface-level – better UX on top of aging infrastructure – because building new rails was nearly impossible outside the banking oligopoly.

Stablecoins mark a turning point → Crypto took the opposite approach

Instead of starting with pretty front-ends, it built new financial primitives from scratch (automated market makers, on-chain lending, etc.). Out of that experimentation, fiat-backed stablecoins emerged as the breakout product with real-world utility. Unlike prior fintech phases, stablecoins aren’t just new skins on old pipes – they are new pipes. They directly perform key banking functions on open networks. In other words, we’re shifting from fintechs as tenants on someone else’s rails to fintechs as owners and builders of new rails. This research note argues that Fintech 3.0 is defined by stablecoin-native infrastructure – programmable digital dollars moving on blockchain-based rails – and that this unlocks an entire wave of specialized fintech opportunities that were not viable before.

What Is Fintech 3.0: Stablecoin Native Infrastructure

Fintech 3.0 refers to financial products and services built on stablecoin and tokenized asset rails as a mainstream foundation, rather than legacy banking networks. The distinguishing feature is that money moves on open, interoperable blockchains. This contrasts with today’s closed, permissioned rails (FedWire, SWIFT, Visa/Mastercard) which are limited by banking hours, geographic silos, and layers of intermediaries. Stablecoin rails operate 24/7/365 with global reach, enabling fast, direct transfers without needing multiple correspondent banks to reconcile. For example, anyone can send a dollar-pegged stablecoin like USDC or USDT across borders in seconds for pennies in network fees, whereas an international wire might take days and incur high charges. Stablecoin transactions are settled in near-real time, typically with finality in a few block confirmations, delivering almost instant peer-to-peer settlement instead of batch processing delays.

Equally important is programmability and composability

Stablecoins are digital bearer instruments that live on public blockchain ledgers, meaning they can interact with smart contracts and other crypto assets. Dollars become software. Businesses and developers can program money movements – for instance, streaming payments by the second, escrow that releases funds on delivery, or complex multi-party trades – which are hard to achieve on traditional infrastructure. Stablecoins can be integrated with on-chain lending, exchanges, or tokenized assets seamlessly, allowing composable finance where various modules plug together. This opens the door to entirely new product structures that were impossible in the legacy system. As one venture analysis put it, stablecoins represent a fundamental architectural shift from batch to real-time, from correspondent banking to peer-to-peer, and from physical to programmable finance.

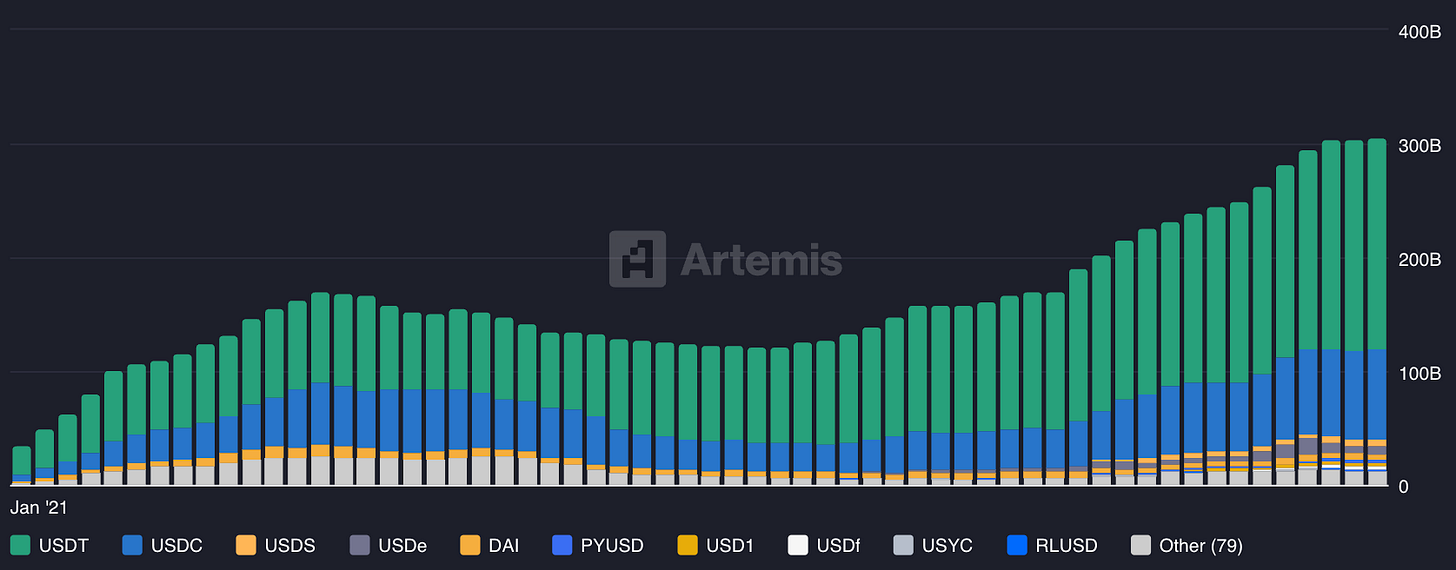

For institutions and regulated enterprises, stablecoin rails also offer benefits like transparent auditability (transactions can be traced on-chain), improved liquidity management, and the ability to operate across jurisdictions without needing local bank accounts in each country. Of course, to reach mainstream adoption, stablecoins must interface with the existing system – on/off-ramps to bank accounts, compliance checks, and regulatory oversight are all evolving. But the core idea is that Fintech 3.0 flips the paradigm: instead of fintechs being clients of banks and networks, the stablecoin era lets fintechs (and even non-financial firms) become providers of fundamental financial infrastructure. A global stablecoin transfer might occur entirely outside of the traditional banking web, yet achieve the same outcome faster and cheaper. Little wonder the value of outstanding stablecoins has exploded to over $230 billion (as of early 2025, a 45x increase since 2019) and monthly on-chain payment volumes are now in the hundreds of billions or more. Fintech 3.0 means these digital dollars are not a crypto novelty but a serious new rail for moving money at scale.

The Stablecoin Stack – Layers and Value Capture

Stablecoin-based finance is forming its own stack of technologies and services. We can think of several key layers, each performing a different function and capturing a different portion of value in the ecosystem. Fintech firms often specialize in one layer, though the lines can blur as companies expand across layers. A simplified stack might include:

Illustration: Layers of the stablecoin financial stack, from base settlement networks up to user-facing applications (conceptualized by Lightspeed Ventures).

Settlement Layer (Base Blockchains)

This bottom layer consists of the public networks where stablecoin transactions are recorded. Examples include general-purpose chains like Ethereum, Solana, Tron, and Layer-2 networks optimized for payments. This layer provides the infrastructure for clearing and settlement of stablecoin transfers. Just as ACH or VisaNet underpins bank payments, blockchains play that foundational role for stablecoins. Value capture here comes from transaction fees and possibly token value of the networks. While many blockchains exist, there is competitive pressure for speed, capacity, and low cost. We see an emerging trend of specialized payment-focused chains and rollups to support high-volume stablecoin flows at minimal cost (for instance, Coinbase’s Base L2 achieving sub-1 cent, sub-1 second USDC transfers). The settlement layer tends to evolve slowly and prioritize security/stability because it underlies everything else.

Issuance Layer (Stablecoin Issuers)

This layer is where trust enters the system, as entities create and manage the stablecoins themselves. Major issuers like Circle (USDC) and Tether (USDT) dominate today, together holding enormous reserves (they’re now among the top 20 holders of U.S. Treasuries globally). Issuers are responsible for backing each token 1:1 with assets, managing liquidity, and complying with emerging regulations for “payment stablecoins.” We also see new issuers coming up: large fintechs (e.g. PayPal’s PYUSD), regional players launching local-currency stablecoins (EURC, etc. on multiple chains), and even corporate or bank-led projects. There is opportunity for specialized stablecoin issuers targeting particular geographies, industries, or use cases – for example, a stablecoin tied to a commodity price for trade settlement, or a fully Sharia-compliant stablecoin for Islamic markets. Issuers can potentially build network effects (a widely used coin becomes more valuable) and regulatory moats (licenses, trust) that make this layer high-margin for the winners. However, it’s capital-intensive (reserves and compliance costs) and only a few will capture most value here.

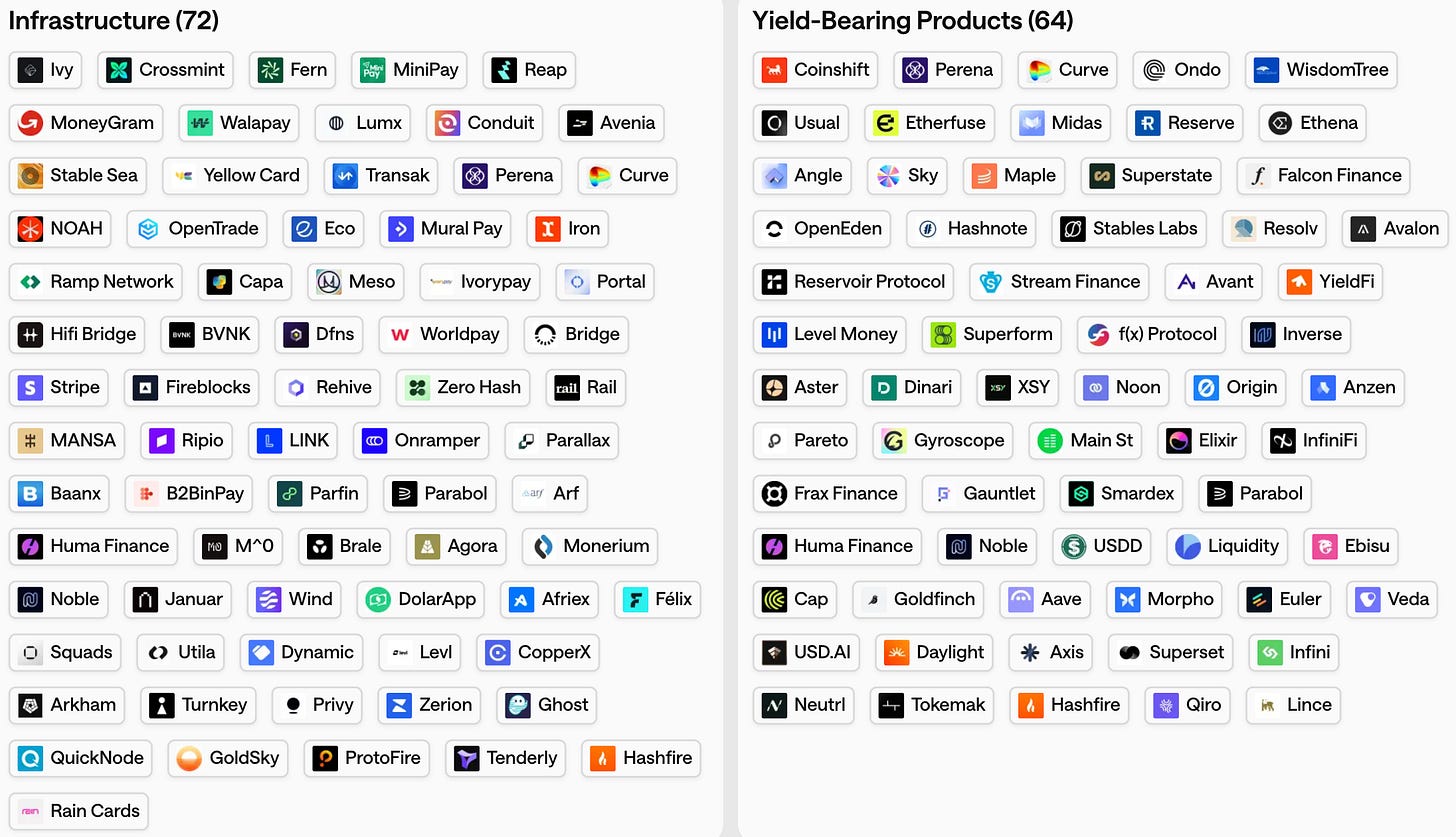

Infrastructure & Orchestration Layer

This middle layer contains the technical and compliance plumbing that fintechs and businesses use to integrate stablecoin rails. It includes wallet platforms, custody providers, API services, on/off-ramp providers, blockchain node infrastructure, compliance and analytics tools, payment processing gateways, etc. Essentially, these are B2B services that abstract the complexity of blockchains and provide building blocks for stablecoin applications. For instance, a fintech might use a custody API to handle private keys securely, a KYC/AML tool to screen addresses, or an “orchestration” API to route payments across multiple chains for optimal speed/cost. This layer also covers things like stablecoin liquidity management and FX (converting between stablecoins and fiat or other currencies). Many startups have rushed into this space because there is immediate demand – every stablecoin project needs some infrastructure. However, infrastructure and middleware can become commoditized; if many companies offer similar APIs and wallet services, margins get squeezed. We’re already seeing intense competition and pricing pressure here. Some infrastructure providers try to differentiate by bundling multiple features (for example, an all-in-one platform for compliance, custody, and on/off ramps) or by supporting certain niche requirements that others don’t. Still, the consensus among investors is that the middle layers face margin compression over time. Many will exist, but value capture may be limited unless they achieve scale or move into proprietary services.

Distribution & Application Layer

At the top are the user-facing fintech applications and services that actually deliver stablecoin-based solutions to end-users or businesses. This includes wallets and payment apps, remittance platforms, merchant payment solutions, lending and savings apps using stablecoins, payroll and treasury services, etc. Essentially, any traditional fintech product can be “reimagined” on stablecoin rails – from neobank-style accounts that hold stablecoins, to cross-border payment apps, to decentralized finance interfaces blending stablecoins with other assets. This layer is where specialized workflows and customer relationships create differentiation. A stablecoin fintech serving, say, export businesses in LatAm or a diaspora community can tailor the product and acquire customers that broad platforms might miss. While the base technology is open, the distribution strategy and niche focus can be a moat. Companies in this layer often achieve scale through superior UX, trust, and integration into communities.

We’re already seeing stablecoin usage growing fastest in segments where legacy options failed – for example, users in emerging markets with volatile currencies, or freelance workers needing quick global payments. Because of that, the distribution layer can capture significant value by solving a real pain for a defined market. However, it requires navigating both crypto and fiat worlds (e.g. integrating with local payment methods, complying with local laws, educating users). Many successful players might start in distribution then backward-integrate into their own infrastructure or issuance to secure more margin. Conversely, some issuers or infrastructure providers also launch user apps to drive adoption. The stack is fluid, but as a rule, the biggest long-term value may lie at the “edges” – the issuance and distribution layers – where companies have either fundamental networks effects or direct user ties.

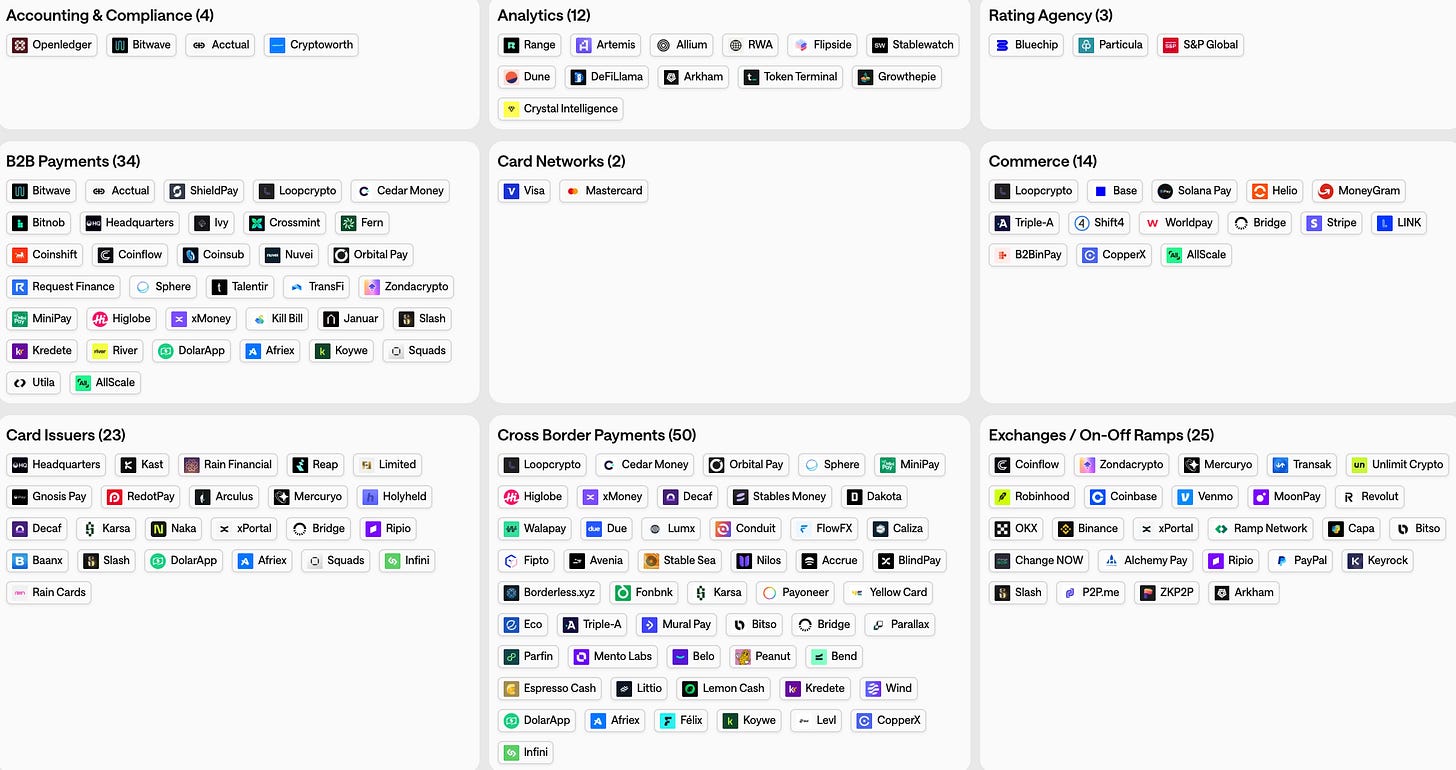

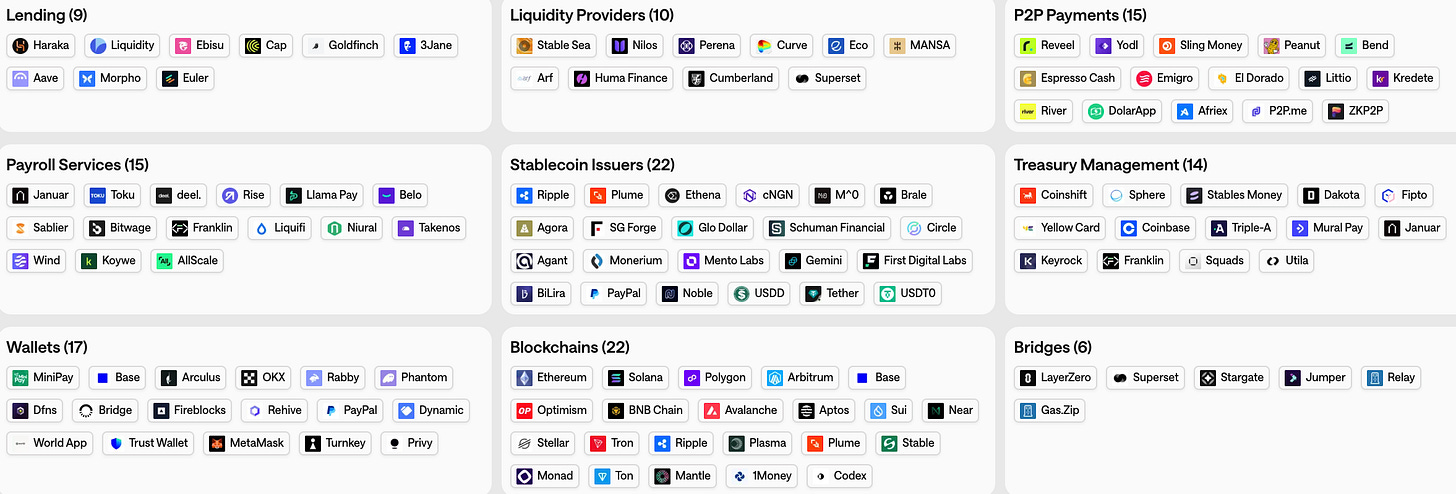

Specialized Stablecoin Fintechs – Who Becomes a Profitable Market?

A core thesis is that dramatically lower infrastructure costs and open access enable niche fintechs to thrive on stablecoin rails. If launching a financial app no longer requires partnering with a bank or spending millions on licenses and integration, a small team can serve specialized user groups profitably. Many customer segments that were historically underserved or unprofitable for big banks could now sustain dedicated fintech solutions. Below are several such segments (from individuals to SMEs) and why stablecoin rails unlock new opportunities for each:

Professional Athletes and Solo Sports Pros

Top athletes often earn income internationally – prize money, sponsorships, or club transfers across borders. Legacy banking makes managing these funds cumbersome (multiple currency accounts, wire delays, high forex fees). A tennis player might wait weeks for an international prize payout and lose a big cut to conversion fees. A stablecoin-based solution could let sports professionals receive earnings in a dollar stablecoin immediately after an event and spend or convert at their convenience. This reduces reliance on costly intermediaries. Additionally, athletes from countries with weak currencies or capital controls may prefer holding stablecoins (digital dollars) to preserve value. A niche fintech could offer athletes a stablecoin wallet linked to a debit card, plus tools to automatically convert portions to local currency when needed. They might monetize via management fees or arranging yield on stablecoin treasuries. The speed and global nature of stablecoin rails particularly suit people who are constantly traveling and earning in different markets. Instead of being at the mercy of slow banking networks, athletes gain more control over their money.

Startup Employees with Illiquid Equity

Consider employees at a high-growth unicorn who are wealthy on paper (stock options) but cash-poor for day-to-day needs. Traditional banks won’t lend against private stock easily, and selling shares is often restricted. Crypto rails can enable creative solutions: for example, a fintech platform could tokenize an employee’s vested options or use them as collateral for a stablecoin loan. The employee effectively borrows USDC against their equity stake, getting liquidity without forcing a stock sale. On legacy rails, such niche collateral would be too complicated for a bank loan, but on stablecoin rails a combination of smart contracts and market-driven lenders (even via DeFi) could support it. A specialized fintech might partner with companies to offer “option liquidity in stablecoins” as a perk to employees. They could charge interest or fees on these advances. The stablecoin angle is crucial because it provides instant, programmatic settlement of the loan and the collateral could even be managed via blockchain escrow. While still an emerging idea, it exemplifies how programmable money can unlock financing use cases for communities (startup operators) that legacy finance under-serves.

On-Chain Builders and Crypto-Native Teams

Ironically, many crypto project teams struggle to get traditional banking (due to unclear regulations or bank policies against crypto businesses). These teams live on stablecoins – paying contractors, cloud bills, and even salaries in USDC/USDT. There’s an opportunity for fintechs that cater to these crypto-native companies by providing better payroll, accounting, and treasury services built around stablecoins. For example, a service could manage multi-currency stablecoin payroll and handle tax reporting in various jurisdictions, making it easier for a globally distributed DAO or startup to compensate contributors. It could also offer secure custody with spending controls (useful for multi-sig treasuries) and perhaps automated conversion to fiat for expenses like office rent. Revenue might come from a SaaS fee or a percentage of payouts. Legacy banks weren’t interested in serving DAO treasuries or dev teams paid in tokens. A stablecoin fintech can fill that gap by combining the trustlessness of crypto (no one can freeze your funds) with added layers of compliance reporting to satisfy auditors. Essentially, it can turn stablecoins into a business banking stack for the crypto sector. Given the hundreds of blockchain teams globally, this niche is growing.

Digital Nomads and Cross-Border Freelancers

The remote work boom produced millions of freelancers and “digital nomads” who earn income from clients abroad. Traditional freelance payment options (international bank transfers, PayPal, Western Union) are often slow and fee-laden. A contractor in Latin America or Africa might lose 8–10% of a paycheck to fees and forex, and wait a week for funds to clear. Stablecoins change the game here by enabling near-instant, low-cost global payouts. Already, nearly a third of freelancers using one global platform have requested stablecoin payments, preferring to receive, for example, USDC which they can then locally convert or spend via crypto debit cards. Specialized fintechs are emerging to serve this demographic: for instance, a wallet that allows a Nigerian or Argentine freelancer to receive USDC, swap a portion to local currency or airtime, and save the rest in a dollar-pegged balance insulated from local inflation. They can be paid on a Sunday at midnight – no waiting for Monday’s bank wire batch. Such platforms can earn money through FX spreads (when users convert stablecoin to another currency) or subscription tiers for faster withdrawal. The value prop is straightforward: faster access to earnings and higher take-home pay for freelancers. By lifting the frictions of time zones and bank fees, stablecoin rails make it viable to build financial services for the long tail of global gig workers.

Sharia-Compliant Finance Segments

Islamic finance operates under religious principles that, among other things, forbid interest (“riba”). This can make it tricky for Muslim customers to use conventional bank products that pay interest or involve certain types of uncertainty. Stablecoins open a new avenue for halal digital finance. For example, a startup could offer savings and payment accounts based on stablecoins where no interest is paid, but perhaps profits are shared in a Sharia-compliant way (through fee-based services or profit-sharing contracts). In fact, we are seeing the rise of Islamic crypto ventures – one recently licensed Islamic digital bank plans to run fully on stablecoin infrastructure to avoid interest-based products. By using stablecoins as a medium, they ensure customers’ funds don’t mingle with interest-bearing instruments, and they can still provide modern payment services with 24/7 access. A stablecoin fintech for, say, Southeast Asian Muslim SMEs might offer trade financing structured as Islamically permissible (no interest, maybe an equity-like arrangement), facilitated by on-chain transparency and smart contracts to enforce profit-sharing. Revenue comes from service fees or margins on trade deals, rather than interest. Legacy banks have been slow to deliver tailored Islamic products in many markets; stablecoin rails allow new entrants to serve these customers with programmable compliance (for example automatically screening transactions for non-halal businesses) built in. It’s a niche where trust and religious adherence are as important as tech, but stablecoins provide the flexibility to design financial services that meet those needs in a digitally native way.

Cross-Border SMEs and Exporters

Small and mid-size businesses engaged in international trade often suffer from very slow, costly B2B payments. An exporter might wait weeks to receive funds from an overseas buyer, tying up working capital, and lose 4–6% in banking fees and FX spreads along the way. These pain points persist because correspondent banking and trade finance for SMEs haven’t improved much – big banks prioritize large corporates, and fintechs like Wise or Payoneer, while better, still rely on intermediate banks. Stablecoin rails can enable instant, secure settlement for B2B transactions at a fraction of the cost. Imagine a specialized platform for exporters that generates an invoice denominated in a dollar stablecoin; the buyer pays that invoice by transferring USDC, and within minutes the seller has a confirmed payment on-chain.

The platform could automatically convert part of it to the local currency or into a treasury management product. Because the payment is near-real-time, the exporter can immediately re-deploy cash into their business (improving cash flow dramatically). Businesses in regions with capital controls (say parts of Africa or Asia) could also benefit from stablecoin channels that are more reliable than volatile local banking systems. A fintech serving this segment could earn revenue on FX conversions or by offering trade financing (for example, advancing stablecoin funds against pending receivables, using the on-chain invoice as collateral). The key win is speed and cost-efficiency: stablecoin transactions can cut cross-border payment costs by 40–70% and reduce settlement time from days to seconds. By focusing on a specific trade corridor or industry, a startup could build workflows (integrations with accounting software, etc.) that big banks never bothered to provide to smaller clients.

Luxury Goods Dealers and High-Value Peer-to-Peer Markets

In the world of high-end watches, jewelry, art, and collectibles, transactions are often high-value and sometimes urgent or discreet. Legacy payments can be a bottleneck – wire transfers might get flagged for manual review due to large amounts, and international buyers face hurdles moving money on short notice (especially on weekends or holidays). Stablecoins act as digital cash for large purchases, enabling a buyer in Hong Kong to instantly send $100,000 in USDC at 2 A.M. to a seller in London, with cryptographic proof of funds. We’re already seeing luxury dealers embrace stablecoin payments. For example, a UK luxury watch retailer partnered with a payment provider to accept USDC and other cryptos, giving clients a faster, flexible way to pay.

A fintech could build a specialized escrow service for luxury asset sales: it would hold a buyer’s stablecoin payment in a smart contract and release it to the seller when the item is received (an automated escrow). For high-ticket items, this adds trust and removes the need for costly letter-of-credit or escrow agents. The service could charge a small percentage fee far lower than traditional escrow or auction house commissions. By using stablecoins, it avoids the risk of chargebacks (unlike credit cards) and doesn’t depend on banks being open. Such a platform could also help with compliance (KYC both parties once) and perhaps offer insurance on shipments. In summary, stablecoin rails can lubricate markets that currently rely on archaic cash or bank wire processes, and a focused startup can capture value by solving specific frictions (speed, trust, global reach) in those niche markets.

Rotating Savings Clubs and Diaspora Families

In many cultures, community savings circles (tandas, susus, chit funds, etc.) are popular – members contribute money to a pool and take turns receiving a payout. Diaspora families also regularly send money back home for support. Traditional systems make these practices inefficient: remittance fees are high, and coordinating a savings club across borders is difficult with cash or bank transfers. Stablecoins present an opportunity to formalize and streamline community finance. For instance, a fintech app could allow a group of friends across different countries to form a savings circle using a USD stablecoin. Each member’s monthly contribution is a stablecoin transfer (nearly free and instantaneous), and the pooled funds are transparently held in a smart contract that rotates the lump-sum payout to each member’s wallet on schedule. This reduces losses from fees (more of the pot goes to members) and provides accountability (all contributions and disbursements visible on-chain).

Similarly, diaspora users could pool funds to support a community project back home, knowing the stablecoin will hold its value against inflation better than local currency. Such an app might monetize through a small admin fee or by holding the pool in a yield-generating stablecoin account during the cycle. The key improvement is accessibility and trust – people who lack formal bank accounts can participate with just a phone wallet, and they don’t have to rely on one “cash holder” in the group to manage funds. Moreover, stablecoins bypass some countries’ restrictions: for example, if a family in country A wants to send money to relatives in sanctioned or economically unstable country B, traditional channels might be blocked, but a properly designed stablecoin solution (compliant with regulations in origin country) could still get aid directly to those in need. We have already seen NGOs use USDC to deliver humanitarian aid to recipients in collapsing economies, precisely because it’s faster and more reliable than correspondent banking. A consumer-focused fintech could apply the same concept for everyday people, providing a faster, cheaper, and more transparent way to do what communities have long done informally.

What Is Interesting to Build Now

Given the landscape described, what kinds of ventures and products should founders and investors be looking at in the stablecoin era? Without hyping any specific company, we can highlight a few opportunity areas that appear promising in Fintech 3.0.

Stablecoin-Powered Vertical Neobanks

Essentially, digital banks or financial apps tailored to specific communities, but running on stablecoin rails. This could mean a wallet+card targeting, say, remote freelancers, expatriate gig workers, or a regional diaspora, where all internal transfers use stablecoins for speed. Such a neobank could offer multi-currency accounts (with stablecoins as a backbone), enabling customers to hold and send dollars without a U.S. bank account. The advantage over a traditional neobank is the dramatically lower cost to serve cross-border needs, since stablecoins provide near-free FX and instant transfers. The business could generate revenue from interchange (via a linked card), subscription fees for premium services, or lending (perhaps offering small advances or credit lines once trust is established).

B2B Cross-Border Payment Tools for SMEs

This involves building software for businesses to use stablecoins under the hood for cheaper and faster cross-border payments. Imagine an accounts payable tool for import/export businesses that automatically converts invoices into stablecoin payments, handles the treasury side (maybe converting some receivables to local currency, hedging if needed), and even offers financing. By combining on-chain settlement with familiar interfaces, these tools can drastically cut payment times and FX costs for SMEs engaged in global trade. Another angle is on-chain invoice factoring or trade finance, a platform that provides liquidity by paying a business’s invoice upfront in stablecoins, then collecting from the counterparty, leveraging smart contracts for enforcement. With stablecoin rails, even short-term credit can be extended more easily across borders, since collateral can be posted on-chain and payout is instant. These kinds of fintech solutions could earn money through discount rates on invoices, subscription fees, or FX spreads, and they address a clear pain: small businesses often struggle with cash flow due to slow international payments.

Infrastructure Bridging Stablecoins and Banks

As much as Fintech 3.0 is about new rails, in practice the world will be hybrid for a while – stablecoins need to plug into bank systems and vice versa. There’s an opportunity for companies that provide “stablecoin as a service” to banks, payment service providers (PSPs), payroll processors, and marketplaces. For example, an API platform could allow any fintech or bank to easily send payouts via stablecoin or accept stablecoin deposits, abstracting all the blockchain complexity behind a simple interface. We see early moves here: some banks (like Cross River) are launching services to unify fiat and stablecoin flows for their fintech clients. A startup could similarly become the Stripe for stablecoin payments, handling compliance, chain selection, and conversion. Revenue would come from API usage fees or a percentage of volume. By making stablecoins plug-and-play for traditional institutions, such infrastructure plays can accelerate adoption. They effectively address the interoperability challenge, ensuring stablecoin rails can connect with existing ledgers and payment methods (ACH, SWIFT, etc.) without each institution building from scratch.

Corporate and Sector-Specific Stablecoin Issuance Platforms

As stablecoins gain acceptance, we might see large corporations, brands, or even governments wanting their own stablecoin or tokenized deposits for specialized uses. There’s room for fintech builders to create toolkits that help others launch and manage stable-value digital tokens. For instance, a platform could help a retail brand issue a dollar-backed loyalty token that doubles as a payment method in its stores (like a private stablecoin, fully reserved). Or a commodity producer might issue tokens redeemable for a quantity of their commodity (a sort of asset-backed stablecoin for trade settlement). These issuers will need technology (smart contract issuance, reserve management dashboards, compliance controls) and possibly ongoing management services. A fintech in this space could charge setup and consulting fees, and a transaction fee for ongoing circulation. Essentially, it’s “stablecoin white-labeling” – lowering the barrier for specialized issuers. While not every company needs its own coin, those with large ecosystems (think Amazon with gift card balances, or airlines with miles) might find value in a branded stablecoin for customer engagement or treasury efficiency. Helping create those safely and in compliance is a niche to build for, especially as regulations clarify the rules for new entrants.

Compliance and Identity Solutions for Stablecoin Finance

One of the risks slowing institutional adoption is how to stay compliant with AML, KYC, tax laws, and similar requirements when using open blockchain systems. There’s a need for tools that make stablecoin flows “legible” and safe for enterprises and regulators without undermining user privacy more than necessary. Opportunities include on-chain identity frameworks (so that wallets can carry attested identity info or risk scores), advanced analytics to detect illicit activity among stablecoin transactions, and reporting tools that integrate a firm’s on-chain transactions into their usual compliance and accounting systems. A fintech focusing here could, for example, provide a dashboard to a fintech’s compliance officer showing every stablecoin payment, the counterparties (with identity verified via NFT-based credentials perhaps), and flags for any risky patterns. Or consider a solution for travel rule compliance where required, transmitting required sender/receiver info alongside the blockchain transaction. As stablecoins go mainstream, regulators will insist on standards here, so building the middleware that satisfies regulatory requirements (while preserving the open access that makes stablecoins attractive) is both important and potentially lucrative. Revenue might be SaaS-based or per-transaction fees for compliance processing. Essentially, these are the picks-and-shovels to ensure Fintech 3.0 can operate within legal guardrails. Those who crack the code of blending on-chain privacy with off-chain compliance will be in demand.

Constraints, Risks, and Why This Transition Is Still Early

The legal status of stablecoins and digital assets varies by jurisdiction. Some countries have clear frameworks (for example, the EU’s MiCA treats certain stablecoins as e-money), while others (like the US, as of mid-2025) are still debating federal stablecoin legislation. This uncertainty can deter institutions from fully embracing stablecoin rails until rules solidify. Moreover, a startup operating globally must navigate a patchwork of regulations: what is allowed in one country (such as offering dollar stablecoin accounts) might be restricted in another. Regulatory crackdowns are a risk; a sudden ban or new requirement could upend a business model. Fintech 3.0 builders need strong compliance strategies and will likely operate in a hybrid mode (using stablecoins in permissive environments, defaulting to fiat where required) until laws catch up. The good news is that momentum is generally toward clearer regulation, not less. In the US, for example, proposals like the “GENIUS Act” aim to provide oversight and reserve standards for payment stablecoins. Still, navigating the legal landscape is a top challenge.

Stablecoin Trust and Technical Risks

Stablecoins themselves carry risks that fintechs must manage. Users and businesses have to trust that a stablecoin is truly backed and redeemable for fiat. Any loss of confidence (for example, a depegging event or issuer insolvency) can destroy the value proposition. While the largest stablecoins have maintained pegs, history has examples of failed stablecoins. Fintechs should probably diversify support across multiple reputable stablecoins and be prepared with contingency plans (such as quickly switching users to an alternate stablecoin if one has an issue). On the technical side, building on blockchain infrastructure introduces smart contract and cyber security risks. Hacks or bugs could lead to loss of funds if not carefully mitigated. There is also the question of scalability: if a fintech scales to millions of users, can the chosen blockchain handle the volume without high fees or slowdowns? Emerging solutions (Layer 2 networks, new protocols) are addressing this, but it is an evolving space. Essentially, stablecoin fintechs must be both financiers and technologists, handling issues that were previously abstracted away by banks (like settlement finality, fraud prevention, and safeguarding funds) now at the protocol level.

User Experience Gaps

Despite the tech advances, using stablecoins and crypto wallets is still not as effortless as using a banking app for average users. Managing private keys, dealing with wallet addresses, and understanding network fees can be daunting. Fintech 3.0’s success will depend on abstracting the blockchain complexity behind familiar, user-friendly interfaces. This means heavy investment in design, education, and customer support. Additionally, converting in and out of stablecoins (fiat on-ramps and off-ramps) needs to be seamless. If your target user has to first figure out how to buy USDC on an exchange to use your app, you will lose many potential customers. Many startups are working on better on-ramps (integrating with local payment methods, for example), but it remains a friction point, especially in emerging markets. Trust is another aspect of UX: new fintechs must build trust that customer funds are safe and accessible. Ironically, while blockchains provide transparency, the average user might still worry about where their money is if they do not understand self-custody. We may see more regulated custodial wallets or insurance offerings to give users peace of mind. In short, bridging the gap between crypto tech and everyday user expectations is a work in progress, and until it is solved, stablecoin fintechs may face slower adoption outside of early tech-savvy groups.

Existing Players and Hybrid Models

Banks and card networks are not sitting still. They are adapting (for example, Visa piloting USDC for payouts, JPMorgan with its own deposit tokens) and will integrate many of stablecoins’ benefits into their offerings. In the near term, we will have hybrid systems. A user might swipe a Visa card, but the backend settles via stablecoin between merchant acquirers, for example. If incumbent financial institutions successfully modernize their rails (even using blockchain tech under the hood), they could negate some of the cost advantages of new fintechs. Also, they have brand trust and massive user bases. Fintech 3.0 startups should be prepared for competition not just from fellow startups but from collaborations between big banks and big tech. The likely scenario is co-existence: stablecoin rails will grow in parallel with improved traditional rails (like faster payments networks and CBDCs). It is not an overnight displacement. Therefore, new fintechs must integrate with existing systems where needed (to achieve reach) and focus on segments that are truly underserved by the incumbents. The transition to wholly new rails is gradual; many users might not even know or care that stablecoins are involved if the front-end product meets their needs. Patience and adaptability are required; the infrastructure revolution is underway, but it will have phases of hybrid innovation.

Conclusion

Fintech 1.0 and 2.0 mostly rented space on banking rails, constrained by the rules and costs of banks and card networks. Fintech 3.0, built on stablecoin rails, turns fintechs into partial owners and rebuilders of the infrastructure itself. Stablecoins and open blockchains create a more level playing field, where a small team can build cross border value transfer that once required a global bank, often faster and cheaper.

The most interesting opportunities are not generic wallets or payment apps, but products aimed at specific gaps left by legacy systems. Use cases like freelance earnings, Islamic finance, or SME trade show how digital dollar rails can provide access or efficiency that was previously out of reach. For investors, the key is to watch how stablecoins are evolving from a trading tool into a wider payment and banking layer. For builders, the challenge is to design products that are only possible with programmable, always on money rather than simply porting old bank products into APIs.

Fintech 3.0 will coexist with traditional finance for many years, but the direction is clear. Stablecoin infrastructure is on track to become a core part of global finance. The winners will be those who combine the efficiency of new rails with tangible solutions to real world problems, while accepting the responsibility that comes with operating critical financial infrastructure.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer’s views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.

Solid breakdown of the infrastructure shift from renting rails to building them. The really intersting part is how stablecoins flip the margin structure for niche fintechs, since the cost of serving cross-border SMEs or freelancers drops so dramatically that previously unprofitable segments suddenly become viable. The specialized examples (athlet payments, sharia-compliant products) show where real product-market fit exists beyond just crypto-native users.