Tether explores $15 to $20B round at about $500B valuation

Tether was founded in 2014 by Craig Sellars, Brock Pierce, and Reeve Collins. It is incorporated in the British Virgin Islands and now operates under an El Salvadoran stablecoin license, planning to move its headquarters to El Salvador. Tether’s parent, iFinex (also owner of Bitfinex exchange), controls its business and a U.S.-focused unit is being set up (“Tether USA”) for a compliant U.S. dollar token. Other affiliates include its venture arm (Tether Investments) and gold- and currency-backed token issuers (for example XAU₮ for gold, EUR₮, CNH₮, MXN₮ for other currencies).

Tether’s main product is USD₮ (USDT), a dollar-pegged stablecoin. It also issues XAU₮ (Tether Gold, each token equals 1 troy ounce of gold) and stablecoins pegged to the euro, Chinese yuan, Mexican peso, and others. A new over-collateralized USD token (Alloy aUSDT) backed by Tether Gold was launched in 2025. A euro token (EUR₮) was discontinued by November 2025 under EU rules. Tether is rolling out USA₮, a US-regulated dollar stablecoin via Anchorage Bank, to comply with new U.S. laws.

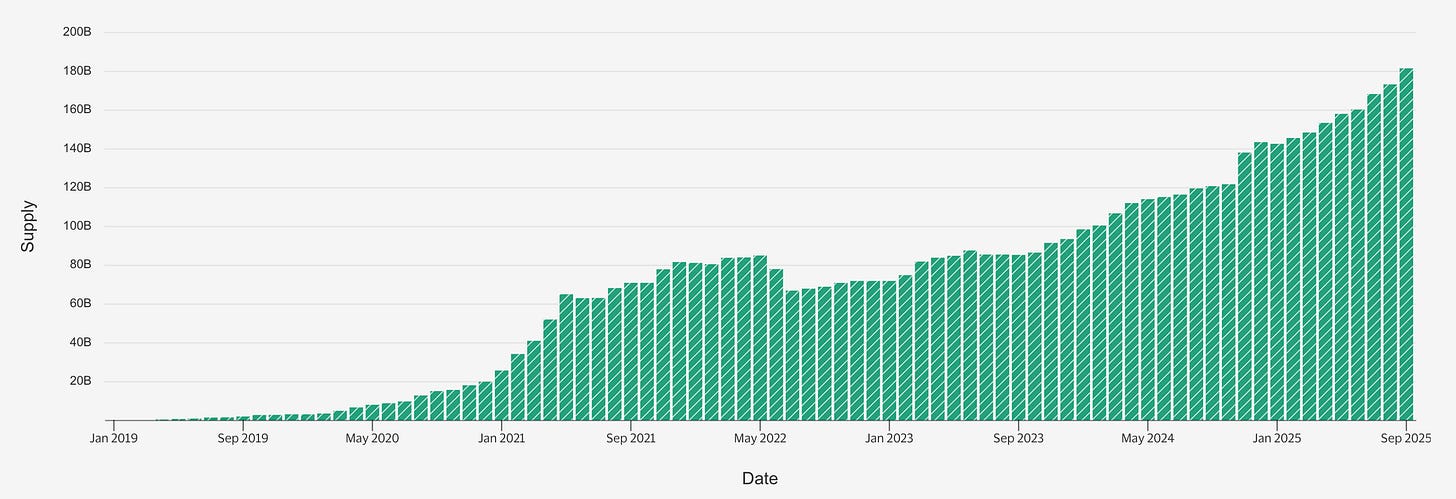

USDT dominates the stablecoin market. Its circulating supply is 180 billion dollars as of Sep 25, about 70 percent of all stablecoins. By contrast, Circle’s USDC is about 74 billion dollars, roughly 30 percent of the market. USDT is issued on many blockchains, including Ethereum, Tron, EOS, Algorand, and Solana. Its 24 hour on-chain trading volume is on the order of 100 billion dollars, and Chainalysis reports USDT flows around 1 trillion dollars per month in 2024 to 2025.

Tether began as Realcoin on Bitcoin and Omni in 2014 and rebranded to Tether Limited in 2015, integrating with the Bitfinex exchange. It expanded quickly, launching on Ethereum in 2017 and other networks. A key pivot came in 2022 to 2025 as it emphasized transparency and diversification. In late 2024 it obtained an El Salvador payment license and announced relocating its team there. Regulatory steps included shifting to quarterly attestations of reserves by BDO and cooperating with U.S. stablecoin rules.

Tether has reinvested profits into new verticals. Its 2025 reports highlight billions deployed in strategic initiatives, including tech startups, renewables, and finance. By mid-2025 Tether’s CEO noted about 4 billion dollars had been deployed to U.S. tech ventures, including the Rumble project. In April 2025 Tether co-founded Twenty One Capital, a Cantor and SoftBank backed SPAC, to hold Bitcoin. Tether contributed 1.6 billion dollars of bitcoin. It also invested in agriculture and renewables, for example acquiring significant stakes in Adecoagro and elemental altitude royalties. Although an earlier crypto mining venture with Swan Bitcoin in 2022 was wound down, the firm continues funding R&D in data, AI, and communications as described in company disclosures.

On the payments side, Tether has broadened integrations. It partners with exchanges, wallets, and chains globally. It works with Anchorage Bank and Cantor Fitzgerald in the United States for USA₮ issuance and treasury custody. It launched novel token formats such as Alloy aUSDT and is planning a USDC competitor in USA₮. It also supported MiCA compliant stablecoins, USDQ and EURQ via Quantoz in November 2024. Tether’s evolution spans from a single token issuer to a global payments platform and investment group, while generally maintaining its peg and market leadership.

Reserves, Backing, and Transparency

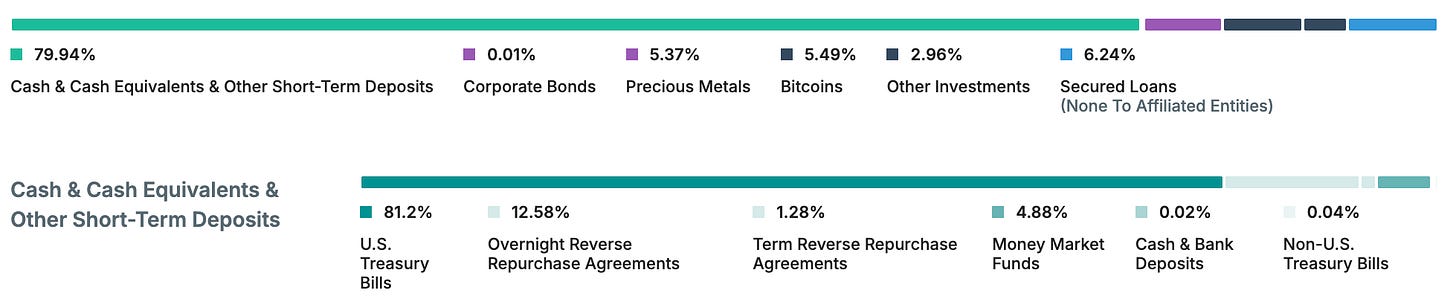

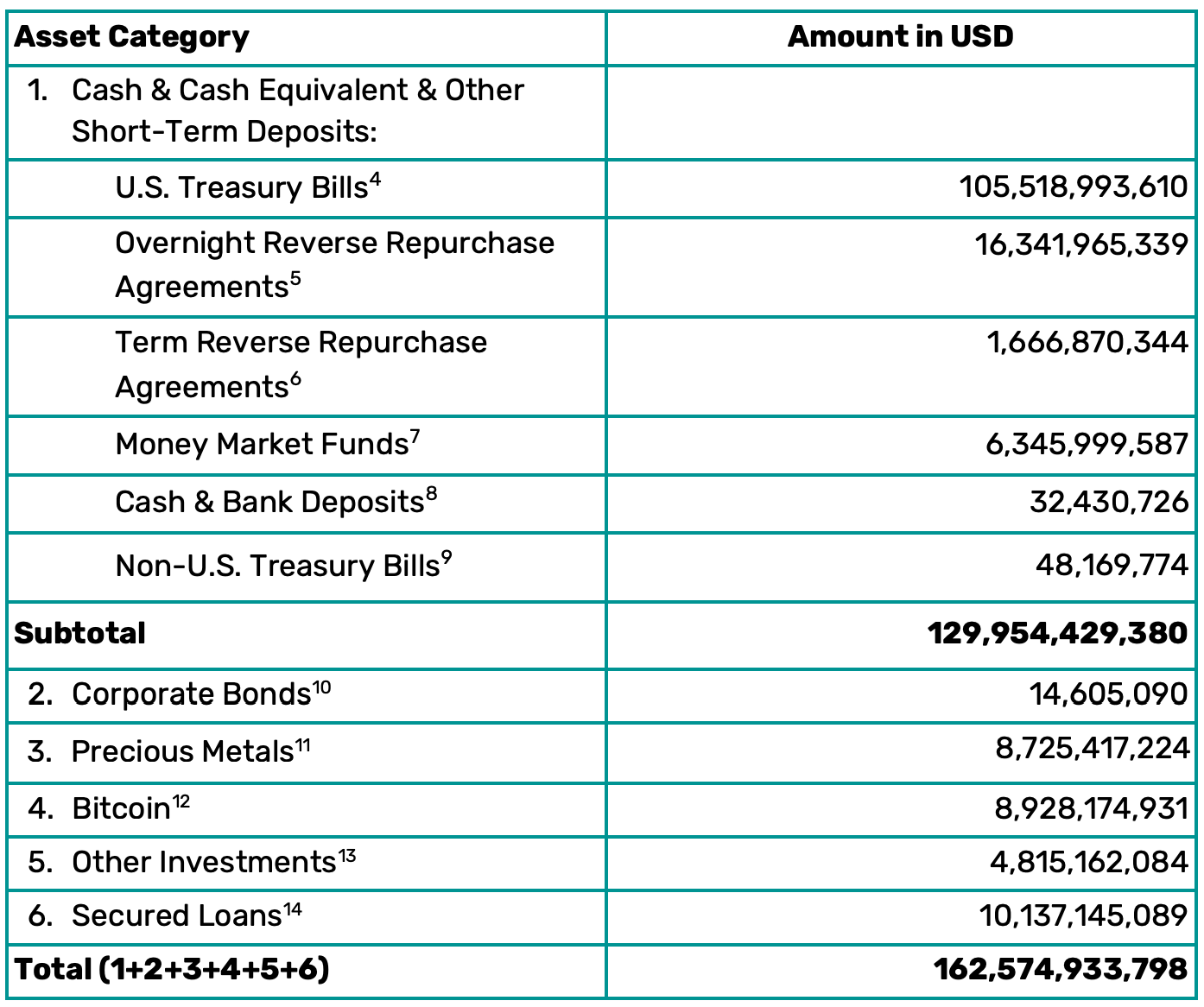

Tether states that all USDT are backed one to one by reserves. Its reserve composition has shifted toward safer assets. About 78 percent of reserves are now held in U.S. Treasuries, both direct and indirect. At June 2025 Treasuries totaled about 126.8 billion dollars out of about 162.6 billion dollars in assets. Other reserves include secured lending, about 8.8 billion dollars in the first quarter of 2025 labeled as loans, 7 to 9 billion dollars in Bitcoin, and 6 to 7 billion dollars in gold. Cash and bank deposits are minimal, under 0.1 percent of assets. Over 2024 to 2025, Treasuries have grown from about 97.6 billion dollars in mid-2024 to about 127 billion dollars by mid-2025, with other holdings reduced.

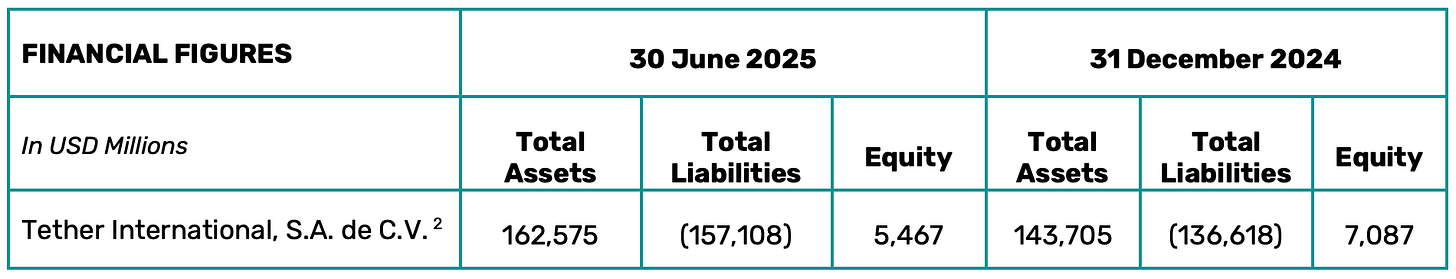

Tether provides detailed attestations. Quarterly third party reviews by BDO confirm the assets backing USDT. The June 30, 2025 attestation verified assets of 162.57 billion dollars against liabilities of 157.11 billion dollars, with liabilities approximately equal to token supply. This created a shareholder buffer of 5.47 billion dollars to cover shocks. Earlier, the fourth quarter of 2024 attestation reported about 7 billion dollars in excess reserves. Critics note that some prior obligations are treated as excess equity. For instance, secured loans of about 8.8 billion dollars remain on the books despite an earlier pledge to eliminate them. Management argues loans are offset by the equity buffer, while transparency advocates regard such items as risk factors.

Redemptions are permitted for large holders via OTC with identity verification. Tether’s liquid reserves, mostly Treasury bills, are marketable and provide near term liquidity. In an extreme stress scenario a massive sell off of USDT would require selling these assets into markets. Tether’s custodian concentration is notable. Ninety nine percent of its U.S. Treasury holdings are booked through Cantor Fitzgerald. Any disruption at a single custodian or counterparty, or new regulatory limits on money market liquidity, could pose concentration risk. In practice, USDT remains highly liquid in normal conditions and is frozen only when required. The company’s transparency page publishes daily snapshots of reserve balances, which is more frequent disclosure than most peers.

Financial Profile and Economics

Tether’s revenue is driven chiefly by interest on reserves. With roughly $127B in Treasuries and similar short-term securities, and front-end yields around 4–5%, gross interest income is on the order of $5–6 billion per year. In 2024 this translated to record profits: Tether reported about $13 billion net profit for the year. First-half 2025 profit was about $5.7B. Much of these gains come from sustained interest spread. Volatility-driven gains from Bitcoin and gold holdings added about $2–3B in 2024–25. The company does not charge retail fees for USDT minting or transfers; any token conversion fees go to counterparties, so fee income is minimal.

Profitability is sensitive to interest rates. Higher yields in 2024–25 boosted income significantly. If rates fall, interest income and profit would decline proportionally. For example, a 1% drop in yields on $100B equates to about $1B less annual income. Tether’s costs are low, so most interest translates to profit. There is little in the way of dividends or buybacks publicized; instead Tether has stated it reinvests profits into capex (data centers, mining ventures, infrastructure) and its portfolio, including roughly $775M in Rumble and others. Any undeployed profits accumulate as the equity reserve shown in attestations. No formal financial statements have been released, but these figures emerge from attestation reports.

Latest Fundraising: Private Placement

In September 2025 it was reported that Tether was in talks to raise $15–20 billion for about a 3% equity stake, implying a valuation near $500 billion. The reporting, attributed to people familiar with the matter, would place Tether among the world’s most valuable private companies. Multiple outlets said the offer is aimed at a small group of strategic investors. Tether’s CEO acknowledged on social media that the company is evaluating a potential investment with key investors, but provided no details. No official prospectus or confirmation has been published. If true, this round would far exceed Circle’s June 2025 IPO raise and valuation.

Potential investors would likely be large institutions or sovereign funds. There is precedent for partnerships with major tech investment firms. The scale, up to $20B, implies interest from sovereign wealth funds in the Middle East or Asia, or large technology investors. In fintech, Stripe and SpaceX previously had private rounds near or above $100B valuations, though $500B is unprecedented outside of trillion-dollar giants. The implied valuation would dwarf other payment fintechs.

A large primary round like this could force governance changes. Investors of that size would demand audited financial statements, board seats, and stronger oversight. Tether may need to transition from attestations to full audits, adopt stricter financial disclosures, and formalize risk controls. It could also prompt expansion of the board and compliance policies to meet international investor standards. Details of any such arrangements are not public.

IPO Pathways and Jurisdictions

An IPO of a stablecoin issuer on Nasdaq would require meeting U.S. exchange and SEC rules. Nasdaq listing demands audited financials under U.S. GAAP, Sarbanes-Oxley compliance, independent directors, and extensive disclosures such as MD&A, risk factors, and internal controls. Tether would likely need to prepare an SEC S-1 filing with GAAP statements beyond current attestations and a full audit of its balance sheet. Its reserves and liquidity would have to satisfy SEC scrutiny. Recent laws in 2025 mandate detailed reserve disclosures and capital restrictions. A U.S. listing could provide vast capital access and prestige, but brings liability through SEC enforcement and loss of privacy.

Alternative venues include Europe, where MiCA-compliant stablecoin issuers may list on regulated exchanges, but Tether would have to restructure. Asia, including Hong Kong, has allowed some crypto listings but remains cautious. Staying offshore, for example in London or Singapore, would avoid the SEC but could face weaker valuation. Many fintech IPOs choose the U.S., as seen with Coinbase and others.

Key IPO readiness items include audited GAAP financials, extensive risk disclosures covering reserve risk, regulatory risk, and competition, and mature governance. The board would need seasoned independent directors. Policies for AML and KYC, cybersecurity, and financial controls must be documented and tested. Given its El Salvador licensing, Tether might also need to demonstrate compliance with U.S. stablecoin regulations for Nasdaq’s comfort. No formal roadmap has been announced; the company has said it currently has no plans to IPO.

Regulatory and Legal Overview

Major enforcement actions include a 2021 New York Attorney General settlement and a 2021 CFTC order. In February 2021, the NY AG fined iFinex, Tether and Bitfinex’s parent, $18.5 million for commingling $850M of client funds and misleading on reserves. In October 2021, the U.S. CFTC fined Tether $41 million for falsely claiming USDT was fully backed by dollars. These agreements imposed no admission of wrongdoing but required attestations. Tether has since committed to regular reserve reports and to halt New York dealings. No known SEC or DOJ charges have been publicly announced.

Ongoing dialogues center on stablecoin legislation. In the U.S., Congress passed a stablecoin law in July 2025, effective in early 2026, imposing reserve, disclosure, and capital requirements on stablecoins, effectively treating issuers like narrow banks. Tether plans to comply via USA₮ and enhanced disclosures. In the EU, MiCA, adopted in 2023 and effective in 2025, requires e-money licenses and high-reserve ratios; it has led Tether to shutter its EUR₮ token and support MiCA-compliant USDQ and EURQ. Other jurisdictions, including the UK and Singapore, also have or are drafting crypto payment regulations that could impact USDT listings.

Tether maintains compliance controls. Its issuance requires KYC and AML for institutional users. It partners with blockchain analytics firms to monitor transactions and screen for sanctions. Tether actively freezes and blacklists wallets linked to illicit activity, including addresses tied to sanctions or hacks. In 2023–25 it blocked significant amounts in laundered funds on-chain. It has an internal financial-crime unit that cooperates with law enforcement globally. These measures exceed many competitors, including voluntary freezing of SDN addresses.

Future frameworks to watch include U.S. stablecoin rules and potential digital dollar initiatives. U.S. lawmakers are debating stablecoin charters or bank sponsorship requirements. Globally, FATF may update crypto travel rule implementation. Such developments could affect how USDT is issued, how reserves are held, and where it may list publicly.

Risks and Watch Items

Reserve Quality and Liquidity: With about 80% in U.S. Treasuries, reserves are liquid and sovereign-backed, but subject to interest-rate risk. A spike in redemptions would force asset sales. While Treasuries are marketable, this could stress yields. Any significant losses in gold or crypto holdings, estimated at 5–6% of assets, or defaults on secured loans, around 5% of assets, would impair liquidity. The small cash buffer, roughly $0.05B, offers little cushion.

Banking and Custody: Tether relies on key partners for custody and market access. A banking crisis or regulatory freeze on a primary dealer or a key custodian could disrupt operations. The company has limited traditional bank partners. Loss of key partners would hamper reserve management.

Peg Stability: USDT has held its USD peg closely, but extreme scenarios could trigger de-peg pressure. On-chain arbitrage usually enforces the peg, but if confidence erodes, market-makers might widen spreads. High-volume stress events should be monitored.

Stablecoin Competition: USDC is the main rival, with stricter reserve rules and a U.S. charter. Emerging products could chip at market share over time, especially in regulated markets. Adoption of CBDCs or other money-market vehicles also poses substitution risk. Tether remains dominant by volume.

Policy and Regulatory Shocks: Changes to stablecoin laws could force Tether to change structure or shorten supply. For example, some regimes require higher bank deposit ratios, which could strain banking relationships. U.S. proposals that require FDIC-insured banks to hold reserves, or that limit foreign stablecoins, could challenge the current model. Shifts in U.S. interest rates directly affect interest income and profitability.

Key Metrics (2024–25 Highlights)

USDT supply: ~157 B (June 30, 2025); ~$180 B (Sep 2025).

Market share: ~66–70% of global stablecoins (USDC ~30%).

24h on-chain volume: ~$110 B in 2025. USDT processes >$1 trillion per month (peak ~$1.14 T).

Interest income: At ~5% yields, ~$10 B of reserves produce ~$500 M per year (≈$42 M per month). For perspective, 2024 total interest was roughly $7–8 B based on reported profits.

Issuance: +$20 B net USDT supply year to date (Jan–Jun 2025).

Profit: ~$13 B net in 2024; Q2 2025 profit ~$4.9 B (H1 ~$5.7 B).

Comparables and Benchmarks

Compared to other stablecoin issuers, Tether is far larger. Circle (USDC) has transparent reserves and U.S. banking, but only ~$74 B supply, with a market cap around $7 B after its IPO. Paxos’s stablecoin is smaller and has pivoted. USDC undergoes monthly audits and holds all cash and short-term Treasuries; Tether now similarly holds mostly Treasuries and reports quarterly attestation. Unlike purely algorithmic or crypto-backed coins, Tether’s model most closely resembles a money-market fund or bank. In that light, an implied valuation near $500 B would dwarf even large financial institutions managing similar capital. For context, BlackRock’s money-market funds hold more than $1 T in assets, but BlackRock’s market cap is about $100 B. Visa’s market cap is about $300 B. Even if a portion of USDT’s roughly $162 B reserves yields 4–5%, the net interest (about $6 B per year) resembles a small bank’s earnings rather than a tech giant’s. A $500 B valuation would imply a multiple of current earnings that is aggressive for stablecoins and more typical of high-growth tech.

Sources:

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer’s views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.

Hello friend, I’ve noticed we have similar interests so I thought I’d introduce myself with a article.

This one is on the Aether, and the Monad:

https://open.substack.com/pub/jordannuttall/p/the-reality-of-the-ther?r=4f55i2&utm_medium=ios