Introduction

Nearly 10 years after the introduction of BitUSD, the first stablecoin, on July 21, 2014, stablecoins, with a total market capitalization of $160.642 billion, have become a crucial component of the decentralized finance (DeFi) ecosystem and offer a potential medium for paying for goods and services. BitUSD, launched on the BitShares blockchain by future crypto leaders Dan Larimer and Charles Hoskinson, lost its 1:1 parity with the US dollar in 2018. In contrast, modern stablecoins like Tether have successfully maintained their value through robust mechanisms and substantial fiat reserves. Currently, stablecoins facilitate trades on crypto exchanges, serve as collateral for loans, and enable market participants to avoid inefficiencies associated with converting back to fiat currency. They aim to maintain a stable value relative to a real-world asset, typically the US dollar, through various stabilization mechanisms.

Overview of Stablecoins

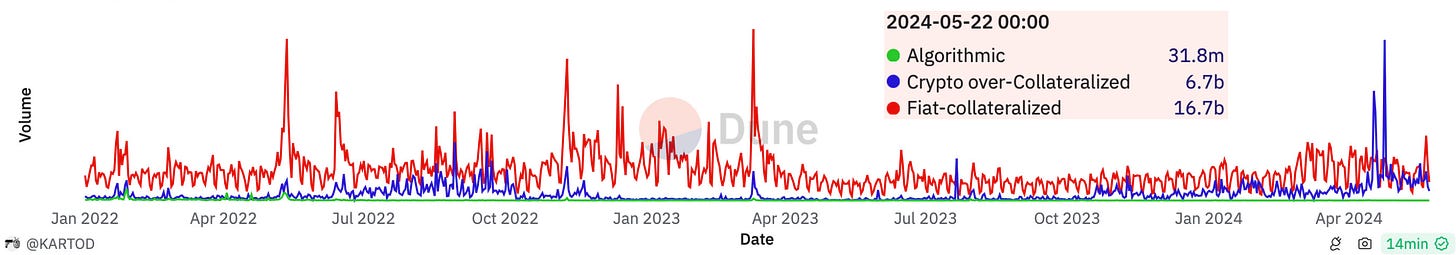

Fiat-collateralized stablecoins are backed by fiat currencies like the US dollar, held in reserve by a central entity or custodian. Examples include Tether (USDT) and USD Coin (USDC). These stablecoins maintain their peg through a reserve of fiat currency that users can redeem for an equivalent amount of stablecoins.

Mechanism: The issuer holds an equivalent amount of fiat currency in a bank account. When users purchase stablecoins, the fiat currency is deposited, and stablecoins are minted. Conversely, when users redeem stablecoins, the issuer releases the equivalent amount of fiat currency from the reserve.

Stability: The stability of fiat-collateralized stablecoins is primarily ensured by the 1:1 backing with fiat currency, providing confidence to users.

Crypto-collateralized stablecoins are backed by other cryptocurrencies. MakerDAO's DAI is a prominent example, where users deposit crypto assets as collateral to mint stablecoins.

Mechanism: Users lock a certain amount of cryptocurrency (e.g., Ether) in a smart contract to mint stablecoins. Due to the volatility of cryptocurrencies, these stablecoins are often over-collateralized, meaning the value of the collateral exceeds the value of the stablecoins issued.

Stability: Stability is maintained through over-collateralization and automated liquidation processes. If the value of the collateral falls below a certain threshold, the collateral is sold to maintain the peg.

Algorithmic stablecoins maintain their peg through algorithms and smart contracts rather than collateral. These stablecoins dynamically adjust their supply to match demand.

Mechanism: The algorithm increases the supply of stablecoins when the price rises above the peg and decreases the supply when the price falls below the peg. This can be done through mechanisms like rebasing (adjusting the balance of all holders) or minting and burning stablecoins.

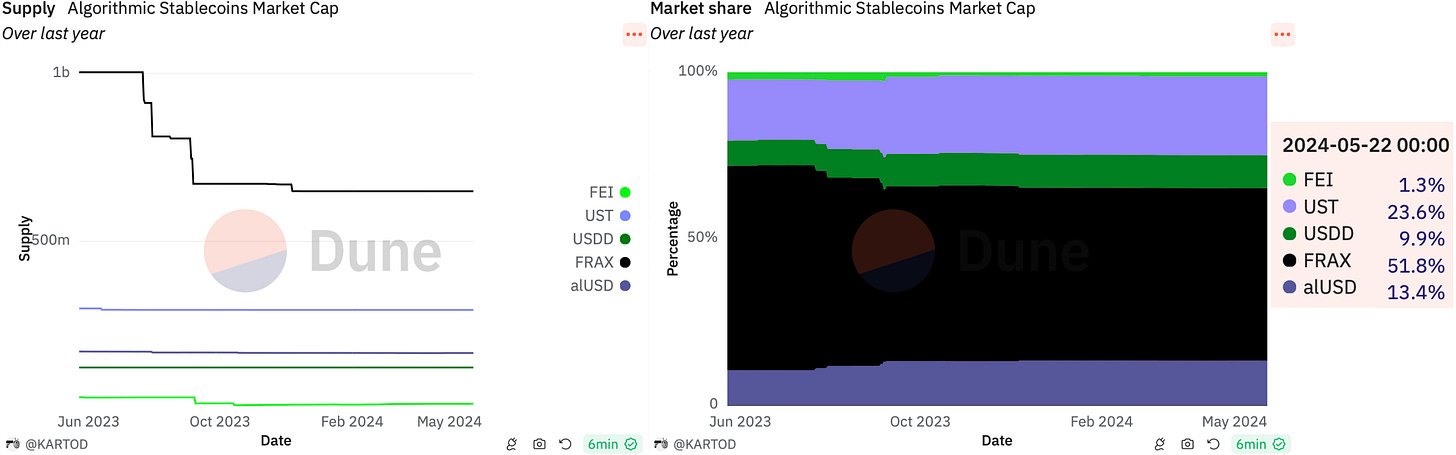

Example: FRAX is an algorithmic stablecoin that maintains its peg to the US dollar through a combination of algorithmic mechanisms and partial collateralization, using both collateral assets and its governance token, Frax Shares (FXS). TerraUSD (UST) employed a seigniorage model, issuing and burning tokens to maintain the peg, though it famously collapsed due to its inability to maintain stability.

Stability: The stability of algorithmic stablecoins heavily depends on market participants' belief in the long-term peg and the robustness of the algorithm.

Mechanism of Stability

Stablecoins employ various stabilization mechanisms to maintain their peg to a reference asset:

Collateralization: Ensuring the stablecoin is backed by a reserve of assets, either fiat or crypto, that users can redeem.

Arbitrage: Market participants can exploit price discrepancies between the stablecoin and its peg, buying low and selling high to bring the price back to the target.

Supply Adjustment: Algorithmic stablecoins adjust the total supply based on market conditions to stabilize the price.

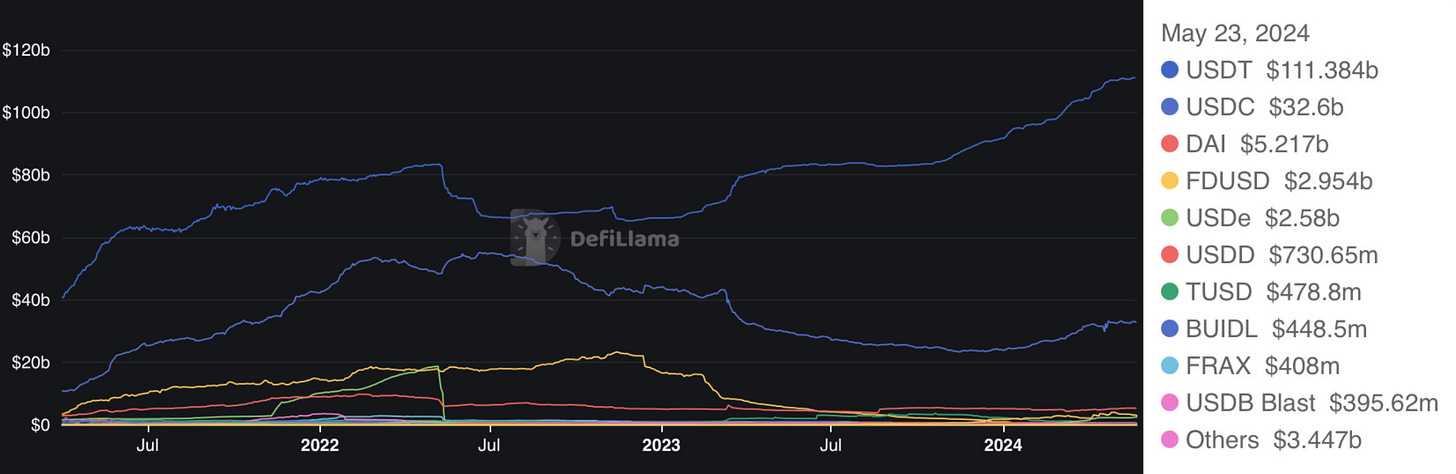

The graph provided illustrates the market capitalizations of various stablecoins from early-2021 to May 23, 2024. The data elucidates the dominance and growth trajectories of major stablecoins, notably USDT (Tether), USDC, and DAI, among others.

Key Observations:

USDT (Tether):

Market Leader: As of May 23, 2024, USDT remains the leading stablecoin with a market capitalization of $111.384 billion. This dominance highlights its firmly established role within the crypto-financial ecosystem.

Growth Trend: The graph indicates a continuous upward trend, reflecting strong market confidence and broad adoption. USDT's stability and liquidity are crucial for trading and liquidity provision across numerous DeFi platforms, cementing its status as a foundational asset in the decentralized finance space.

USDC:

Significant Player: USDC commands a substantial market cap of $32.6 billion, solidifying its role as a major player in the stablecoin market.

Growth Stability: The graph demonstrates a consistent upward trend, akin to USDT, though on a relatively smaller scale. USDC's regulatory compliance and transparency contribute significantly to its adoption by institutions and retail investors alike.

DAI:

Decentralized Stablecoin: DAI maintains a market cap of $5.217 billion. Its decentralized nature, backed by a mix of crypto assets, positions it uniquely in the stablecoin landscape.

Fluctuations: The market cap of DAI shows greater variability compared to USDT and USDC. This reflects the inherent complexities and risks associated with its collateralized and algorithmically managed stability mechanisms. However, its design aligns well with the ethos of decentralized finance.

Stablecoins Transfer Dynamics

Based on the charts above, USDT accounts for approximately 17.88% of the total transfers. While over 80% of all stablecoin token transfers involve USDT, USDC dominates in terms of transfer volume. Although the number of token transfers involving DAI is relatively small, DAI constitutes a significant proportion of the total stablecoin transfer volume.

USDT and USDC Key Metrics

As indicated by its name, downside deviation specifically measures the deviation below $1.00. To present the deviation clearly, a scale of x10000 was applied.

Between April 1, 2024, and May 22, 2024, USDT's volatility was meticulously analyzed by calculating daily returns as the percentage change from the previous day’s closing price. The average of these returns and their standard deviation yielded a volatility of approximately 0.00038, or 0.038%, highlighting USDT's stability during this period.

A Deep Dive into Algorithmic Stablecoins (charts from @Stablecorp)

Understanding Algorithmic Stablecoins

Algorithmic stablecoins are a unique category of cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar, without the need for collateral. Unlike collateralized stablecoins that hold assets in reserve to back their value, algorithmic stablecoins rely on complex algorithms and mechanisms to keep their price stable. They are typically categorized into three types: seigniorage-style, rebase-style, and fractional algorithmic stablecoins.

A seigniorage-style algorithmic stablecoin operates with two tokens: the stablecoin itself and a secondary, volatile cryptocurrency. The protocol uses these two tokens to maintain the peg through arbitrage opportunities. For instance, if the stablecoin's market price rises above its peg, the protocol mints more stablecoins, increasing supply and reducing the price. Conversely, if the price falls below the peg, the stablecoins are bought back and burned, reducing supply and increasing the price.

Previous Failed Algorithmic Stablecoins:

Basis Cash (BAC):

Launched on Ethereum in December 2020 with much anticipation. However, it failed to maintain its peg to the US dollar, crashing to $0.30 by February 2021 and currently trading at $0.0061. CoinDesk recently revealed that Do Kwon, founder of Terra, was also behind Basis Cash, using the pseudonyms "Rick" and "Morty.”

Empty Set Dollar (ESD):

Another seigniorage-style algorithmic stablecoin, launched in late 2020 and peaked at a market cap of $560 million in December 2020. It collapsed to $91 million a month later and currently has a market cap of $650,000.

Iron Finance:

Launched in June 2021, Iron Finance's IRON was the first partially collateralized stablecoin pegged to the US dollar. It was accompanied by TITAN, a token used to absorb IRON's price volatility. As TITAN's price soared, large investors sold off their holdings, triggering panic selling among smaller investors. This caused IRON to lose its peg and initiated a 'death spiral,' marking the first major bank run in crypto.

The Rise and Fall of TerraUSD (UST)

TerraUSD (UST) was one of the most prominent algorithmic stablecoins, launched by Terraform Labs on the Terra blockchain. UST maintained its peg through a burn-and-mint mechanism with its sister token, Luna (LUNA). As UST demand grew, users could always exchange 1 UST for $1 worth of LUNA, and vice versa, keeping the UST price stable under normal market conditions.

UST experienced explosive growth from its launch in September 2020 to its peak in early 2022, largely driven by the Anchor protocol. Anchor offered nearly 20% annual yields on UST deposits, attracting massive inflows of capital. By May 2022, UST had a market cap of nearly $18.6 billion, making it the fourth-largest stablecoin.

The Mechanism Behind UST

The stability of UST depended on the value of LUNA. If the price of UST fell below $1, holders could exchange UST for LUNA at a 1:1 rate, effectively reducing the UST supply and increasing demand. Conversely, if UST exceeded $1, the protocol minted more UST, increasing supply and bringing the price down.

This mechanism, while innovative, relied heavily on the assumption that LUNA’s market cap would always be sufficient to absorb UST's volatility. The health of this system was inherently tied to the market's confidence in both tokens.

The Collapse: Step-by-Step

Initial Imbalance: On May 7, 2022, Terraform Labs withdrew 150 million UST from a liquidity pool on Curve to prepare for another pool. This move reduced liquidity and made the pool more susceptible to large trades.

Large Sales: Shortly after, an anonymous wallet sold 85 million UST into the Curve pool, causing an initial de-peg. Further large transactions exacerbated the situation.

Market Panic: As UST started to lose its peg, market participants rushed to sell UST. Massive redemptions from the Anchor protocol began, where a significant portion of UST was staked. This led to a liquidity crisis as the protocol's reserves dwindled.

Death Spiral: As UST's price fell, more UST was redeemed for LUNA, leading to hyperinflation of LUNA. The increased supply of LUNA caused its price to plummet, further undermining confidence.

Exponential Decline: On May 9, the Luna Foundation Guard attempted to stabilize the market by selling Bitcoin reserves and buying UST. Despite these efforts, the market panic could not be contained. By May 13, UST was trading at a few cents, and LUNA had lost almost all its value.

Lessons and Future Outlook

The collapse of UST underscored the vulnerabilities of algorithmic stablecoins. Despite the allure of a decentralized, capital-efficient stablecoin, the reliance on market confidence and the interplay of arbitrage mechanisms proved too fragile under stress.

The Terra UST collapse serves as a critical case study in the risks inherent in algorithmic stablecoins. While innovations in DeFi will continue, this event highlights the importance of robust risk management and the potential need for collateralization, even in systems designed to operate without it.

Regulatory Landscape of Stablecoins

Stablecoins are designed to maintain a stable value relative to a specific asset or basket of assets. This stability is primarily achieved through reserve backing or algorithmic mechanisms. Among various types, those pegged to a single fiat currency and backed by traditional financial assets are most likely to be used as payment means. Despite their promise, stablecoins have not consistently maintained parity with their pegs, posing risks to holders. Regulatory frameworks aim to address these risks by requiring issuers to maintain adequate reserves and ensuring transparency and accountability in their operations.

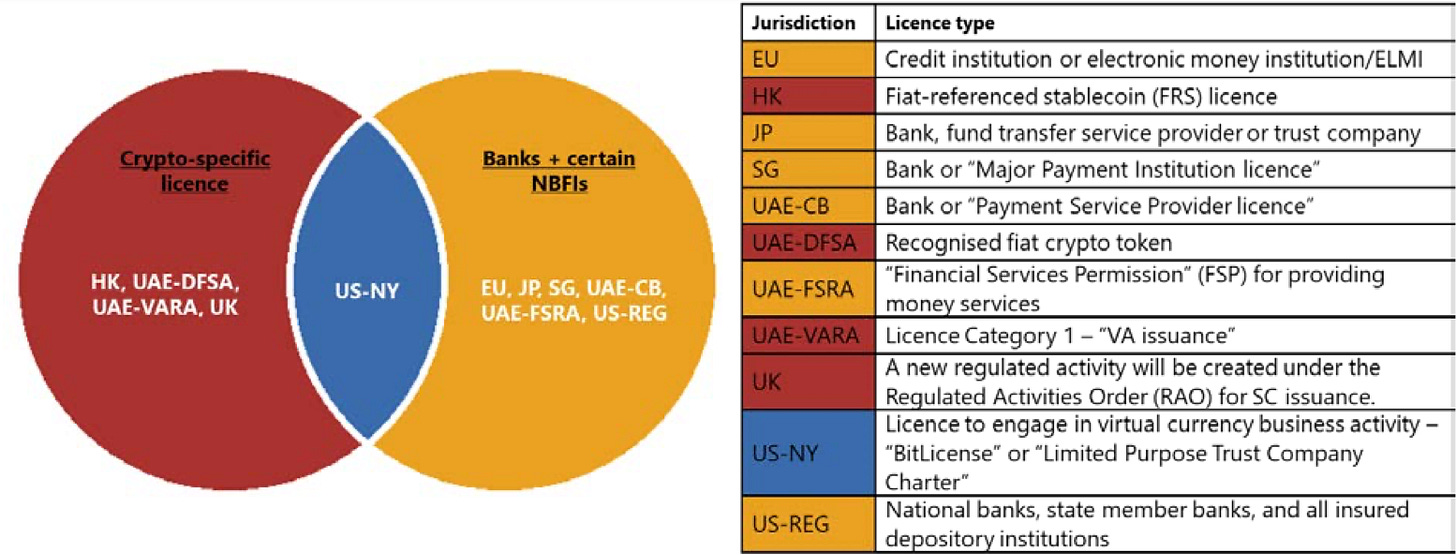

Regulatory Approaches by Jurisdiction

1. United States

Federal Reserve, FDIC, OCC: Only banks are permitted to issue stablecoins, subject to regulatory approval. Issuers must maintain reserves equivalent to the value of the stablecoins in circulation, held in liquid assets. Regular audits and clear redemption policies are mandated.

New York State: Specific asset composition requirements for reserves, including approved collateral for reverse repurchase agreements. Monthly independent audits are required.

2. European Union

European Parliament: Issuers must hold reserves in segregated accounts, with at least 30% in cash. Redemption at par value is guaranteed without fees. Comprehensive disclosure requirements include monthly updates on reserves and stablecoins in circulation.

United Kingdom: Issuers, including banks, must use a separate non-deposit-taking entity. Additional capital requirements apply to systemic stablecoins. Disclosure of detailed redemption policies and monthly reserve audits is required.

3. Singapore

Monetary Authority of Singapore (MAS): Issuers must hold reserves in highly liquid assets and maintain a minimum credit rating for debt securities. Monthly independent audits are required. Redemption at par value within five business days is mandatory.

4. Japan

Financial Services Agency (FSA): Stablecoins must be fully backed by reserves, segregated in separate accounts, and held by authorised custodians. Redemption rights against the issuer are enforced. Annual independent audits are mandated.

5. United Arab Emirates

Central Bank (UAE-CB), Financial Services Regulatory Authority (FSRA), Virtual Assets Regulatory Authority (VARA): Reserve requirements include holding assets in segregated accounts, with restrictions on encumbrances. Monthly or biannual independent audits are required. Redemption at par value without fees is guaranteed.

Regulatory Requirements for Stablecoin Issuers:

Licensing and Authorisation: Jurisdictions follow two main regimes – banks and NBFIs can issue stablecoins, or a new category of entities can obtain a crypto-specific licence.

Reserve Assets: Issuers must maintain reserves equal to the value of issued stablecoins, held in liquid assets. Independent audits and attestations ensure reserve sufficiency and transparency.

Redemption Rights: Clear redemption policies are mandatory, typically guaranteeing 1:1 exchange with the referenced fiat currency. Fees are generally prohibited or strictly regulated.

Prudential and Governance Requirements: Issuers must meet capital and liquidity requirements, implement strong governance structures, and maintain robust risk management practices.

Technological and Cyber Security: Issuers must adhere to stringent IT and cyber security standards, including secure coding, cryptographic key management, and incident response protocols.

AML/CFT: Compliance with AML/CFT standards is essential, including customer due diligence and reporting suspicious activities.

Disclosure and Marketing: Issuers must publish white papers, ongoing disclosures about reserve assets, and risk statements. Advertising must meet financial promotion standards.

Integration Between Traditional Finance and Web3

The integration of traditional finance with web3 technologies is evolving rapidly, driven by innovations in stablecoins. These digital assets promise to merge the stability and trust of conventional financial systems with the efficiency and programmability of blockchain technology.

PayPal's Stablecoin: PayPal USD (PYUSD)

On August 7, 2023, PayPal launched PayPal USD (PYUSD), a stablecoin fully backed by U.S. dollar deposits, short-term U.S. treasuries, and similar cash equivalents. PYUSD, issued by Paxos Trust Company, can be redeemed 1:1 for U.S. dollars. Key features include:

Full Backing and Redemption: Ensures stability and reliability with a 1:1 exchange rate with the U.S. dollar.

Integration and Usability: Allows transfers between PayPal and external wallets, person-to-person payments, funding purchases, and conversions between PYUSD and other cryptocurrencies.

Regulatory Compliance: Issued by Paxos, regulated by the New York State Department of Financial Services, and supported by PayPal’s BitLicense.

Transparency: Monthly Reserve Reports and third-party attestations by Paxos.

PYUSD operates as an ERC-20 token on the Ethereum blockchain, facilitating seamless integration with web3 applications, reducing payment friction, supporting international transfers, and enhancing digital payments' growth.

Visa's Universal Payment Channels

Visa is developing Universal Payment Channels (UPC) to create a network of blockchain networks that supports seamless transfer of digital assets, including stablecoins. This initiative aims to enhance interoperability between various digital currencies and blockchain systems, thus boosting stablecoin liquidity and utility across platforms.

JPMorgan's JPM Coin

JPM Coin, developed by J.P. Morgan, is designed for instantaneous payments and settlements between institutional clients. Part of the Onyx initiative, it leverages blockchain to streamline traditional banking processes, enhancing transaction efficiency and integrating traditional finance with digital assets.

Conclusion

Modern stablecoins like Tether (USDT) and USD Coin (USDC) maintain stability through robust mechanisms, facilitating efficient trading and collateral for loans. However, stability and security challenges necessitate comprehensive regulatory oversight. Jurisdictions have developed diverse frameworks focusing on reserve management, redemption policies, governance, and AML/CFT compliance. Regulatory fragmentation remains a challenge, underscoring the need for consistent international cooperation. As the market evolves, ongoing monitoring and international collaboration will be essential to ensure stability, foster innovation, and integrate stablecoins effectively into the global financial ecosystem.

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

excellent breakdown