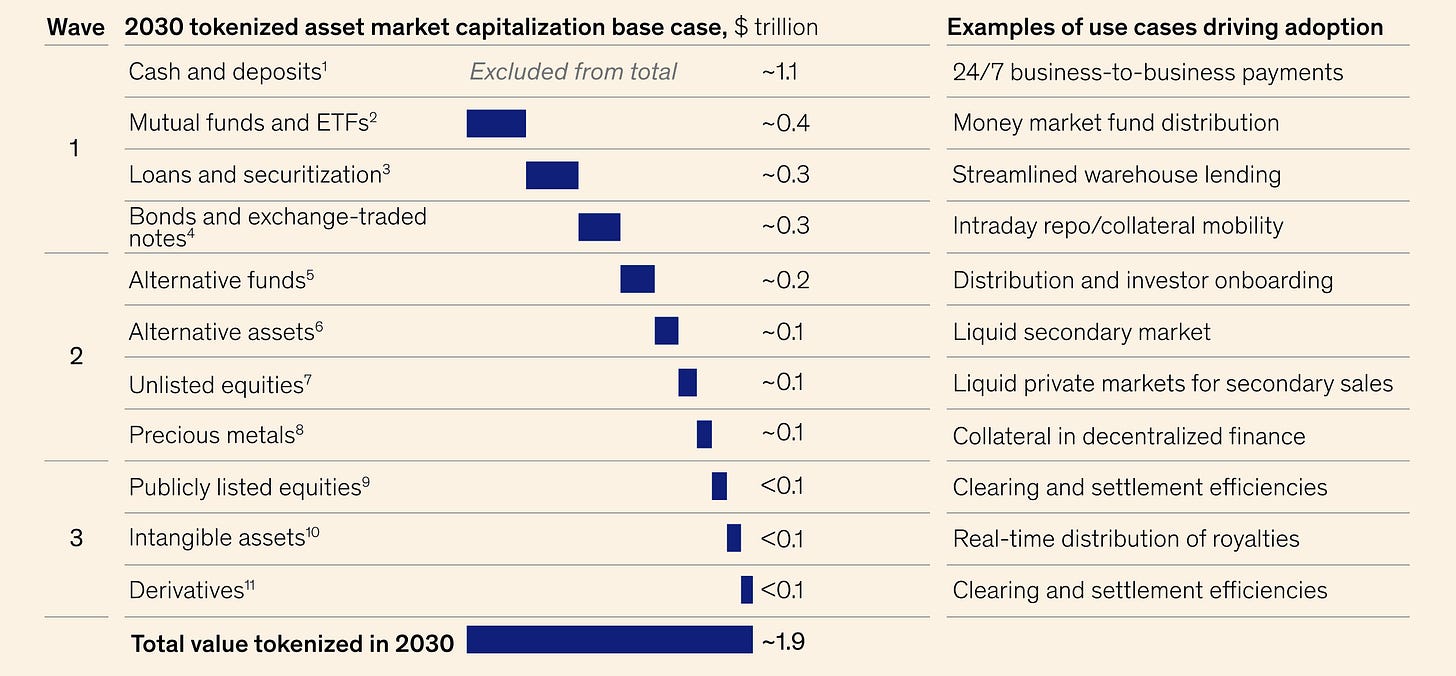

The total market cap of tokenized assets is projected to reach $2 trillion by 2030, excluding cryptocurrencies and stablecoins, according to McKinsey & Company. This growth is expected to be driven by the adoption of blockchain-based mutual funds, bonds, exchange-traded notes (ETNs), loans, and alternative investment vehicles. In an optimistic scenario, the market could expand to $4 trillion, though expectations have been revised downward as the decade progresses.

Financial markets have historically served as engines of economic expansion and capital formation. However, persistent inefficiencies—high transaction costs, settlement delays, limited market access, and operational fragmentation—continue to constrain participation. While fintech innovations have improved user experience, they have yet to address the structural barriers that restrict broader financial inclusion.

Blockchain technology and decentralized finance (DeFi) offer a potential solution by enhancing financial accessibility through programmability, transparency, and interoperability. The evolution of digital assets reflects this shift—Bitcoin introduced peer-to-peer value transfer in 2009, and Ethereum’s smart contracts enabled the programmable exchange of assets in 2015. However, early digital assets lacked direct ties to traditional financial markets, leading to volatility and speculative use. Tokenized real-world assets (RWAs) now represent the next stage in this transformation, bridging blockchain-based financial instruments with institutional capital markets.

Wall Street 2.0

The tokenization of RWAs represents a fundamental shift in financial market structure, often referred to as "Wall Street 2.0." Unlike traditional systems reliant on centralized intermediaries, siloed data, and restricted accessibility, Wall Street 2.0 leverages blockchain technology to enable real-time settlement, frictionless cross-border transactions, and transparent asset ownership.

Historically, financial markets have evolved through incremental advancements—from manual paper-based transactions to electronic trading and high-frequency strategies. However, core inefficiencies remain. The emergence of blockchain-based RWAs offers a paradigm shift by integrating decentralized infrastructure with institutional-grade compliance and security.

Key benefits of Wall Street 2.0 include:

Global Asset Accessibility: Investors can seamlessly access tokenized versions of equities, bonds, and alternative assets without navigating jurisdictional frictions.

24/7 Market Operations: Unlike traditional exchanges with limited trading hours, tokenized assets operate on a continuous, borderless framework.

Enhanced Capital Efficiency: Tokenized RWAs allow for instant settlement and composability across DeFi applications, enabling dynamic asset deployment.

Automated Compliance: Smart contracts facilitate KYC, AML, and regulatory adherence, streamlining asset issuance and investor verification.

For asset managers, tokenization reduces fund administration costs and expands global distribution capabilities. Developers benefit from composable infrastructure that simplifies integration with DeFi protocols. Retail investors gain access to institutional-grade assets and novel yield-generating opportunities previously restricted to high-net-worth individuals.

Tokenized cash/deposits excluded to prevent double counting in settlements.

Investment funds: ETFs, mutual funds, money market funds.

Credit markets: Wholesale loans, mortgages, structured credit.

Bonds: Government, municipal, corporate, commercial paper.

Private equity & VC funds.

Alternative assets: Real estate (REITs), carbon, art, collectibles, commodities (excl. precious metals).

Private equity deals: Unlisted equity, mezzanine financing.

Precious metals: Gold, silver, platinum, palladium.

Public equities: Listed corporate stocks.

Intellectual property: Brands, trademarks.

Derivatives: Options, futures, swaps, warrants, investment certificates (excl. OTC derivatives).

While challenges remain—ranging from legal complexities to technological refinements—the trajectory is clear. The rapid institutionalization of tokenized RWAs signals a shift toward a more open, efficient, and globally integrated financial ecosystem.

The Success of Stablecoins as Tokenized RWAs

Stablecoins, such as USDC and USDT, have emerged as the most successful form of RWAs, providing liquidity and stability within the crypto ecosystem. Their supply has expanded significantly, from $27 billion in 2021 to approximately $215 billion today, with monthly onchain trading volumes averaging $2.2 trillion. This rapid adoption highlights their dual role as both a store of value and a medium of exchange, offering seamless access to USD for individuals and businesses worldwide.

Beyond crypto-native use cases, stablecoins have found utility in regions with restricted access to USD due to capital controls or high inflation. Their ability to facilitate near-instant settlement at minimal cost makes them a preferred instrument for international remittances. The increasing integration of stablecoins into traditional financial institutions, exemplified by PayPal's PYUSD and Stripe’s acquisition of Bridge, underscores their growing relevance beyond the decentralized finance (DeFi) ecosystem.

For a deeper understanding of stablecoins, we recommend reading the paper: "Stablecoins: 2024 Market Trends."

Stablecoins represented the first significant integration of blockchain technology with real-world assets, bridging the gap between traditional finance and digital asset markets. Their success has catalyzed broader RWA tokenization efforts, extending beyond fiat-backed tokens to include fixed-income securities, alternative investments, and structured financial products.

However, this transition has not been immediate. The widespread adoption of RWAs has followed a phased trajectory, shaped by technological advancements, evolving regulatory landscapes, and increasing institutional participation. The key enablers of this evolution include enhanced onchain infrastructure, improved compliance mechanisms, and the growing recognition of blockchain’s ability to facilitate frictionless capital markets. This convergence has given rise to yield-generating tokenized assets—commonly referred to as "Yieldcoins."

The Emergence of Yieldcoins

Despite early tokenization efforts, RWAs initially struggled to gain traction due to liquidity constraints, regulatory uncertainties, and limited use cases. A turning point emerged in 2022 when macroeconomic conditions shifted. Rising interest rates in traditional finance created an opportunity to tokenize U.S. Treasuries, offering an attractive alternative to conventional stablecoins. This laid the foundation for yieldcoins—blockchain-based instruments that maintain real-time accessibility while generating yield for holders.

Ondo Finance pioneered this model with the launch of OUSG, a tokenized representation of U.S. Treasury securities. Designed primarily for institutional adoption, OUSG integrated compliance measures such as KYC verification and regulatory-compliant fund structures. The assets backing OUSG were invested in a BlackRock-managed Treasury ETF, ensuring both transparency and legitimacy. To further expand the utility of tokenized Treasuries within DeFi, Ondo introduced Flux Finance, enabling OUSG holders to use their tokens as collateral in a permissioned lending market.

Ondo Finance and the Rise of Yieldcoins

Recognizing the demand for retail-friendly solutions, Ondo Finance introduced USDY—the first freely transferable yieldcoin available to non-U.S. retail investors. Unlike stablecoins, which serve as non-yielding representations of fiat currency, USDY provides a return on holdings while maintaining broad accessibility across multiple blockchain ecosystems. By integrating with Ethereum, Solana, Sui, Aptos, and other networks, Ondo enhanced the composability of yield-bearing RWAs, increasing liquidity and expanding their use cases.

Yieldcoins offer a compelling alternative to traditional stablecoins, addressing concerns related to fiat reserves, transparency, regulatory oversight, and yield generation. Unlike stablecoins, which typically do not distribute yield to holders, yieldcoins allocate reserves to low-risk assets, such as U.S. Treasuries, passing on interest income to investors. This feature makes them particularly attractive in high-interest-rate environments, where non-yielding assets lose competitiveness.

Institutional Adoption and Market Growth

Yieldcoins have emerged as a transformative category, bridging traditional fixed-income instruments with onchain financial applications. The sector has scaled rapidly, with over $3.5 billion in tokenized Treasuries circulating onchain—achieving this milestone in just 24 months, compared to the 58 months required for stablecoins to reach a similar threshold. The total RWA onchain market now stands at $17.19 billion, demonstrating increasing adoption and institutional interest.

Several institutional players have entered the tokenized asset space, with BlackRock’s BUIDL, Franklin Templeton’s FOBXX, and Ondo Finance’s USDY and OUSG leading adoption. As of October 2024, Ondo Finance holds a 27% market share in tokenized Treasuries, positioning it as the largest issuer in this sector. This rapid expansion signals a broader shift toward blockchain-based financial products, reinforcing the role of RWAs in the future of digital asset markets.

Ethereum dominates the tokenized treasuries market with a significant 68.78% market share and a market cap of $2.47 billion, despite experiencing a 20.65% decline over the past 30 days. Stellar follows as the second-largest network, holding a 10.12% market share and showing strong growth of 27.65%. Other networks like Solana, Aptos, Avalanche, Polygon, and Arbitrum have much smaller shares, with Arbitrum seeing the steepest decline of 43.93%.

Ondo Finance

Ondo Finance is at the forefront of RWA tokenization, focusing on making U.S. Treasuries and other financial instruments accessible onchain. Its key offerings, USDY and OUSG, aim to provide investor protection while integrating seamlessly into decentralized finance (DeFi). Currently, Ondo Finance ranks second globally in terms of Total Value Locked (TVL) in tokenized assets ($653.2M).

The company's roadmap is structured into three phases:

Phase I: Expanding the adoption of tokenized cash equivalents

Phase II: Bringing additional securities onchain

Phase III: Enhancing accessibility by bridging decentralized and traditional financial markets

Additionally, it is worth noting that today, February 6, 2025, Ondo Finance announced Ondo Chain, their new Layer 1 blockchain designed specifically for institutional-grade RWAs. Ondo Finance’s leadership team consists of professionals from Goldman Sachs, BlackRock, McKinsey, and MakerDAO, leveraging expertise across traditional finance and blockchain technology.

Core Team:

Chief Executive Officer – Nathan Allman

President – Justin Schmidt

Chief Risk and Compliance Officer – Chris Tyrell

Chief Strategy Officer – Ian De Bode

General Counsel – Mark Janoff

Managing Director of Client Relations and Strategic Operations – Brendan Florez

Ondo Finance Funding Insights (Total Raised: $46.04M)

Funding Rounds:

Seed Round: Date: August 17, 2021 | Amount Raised: $4.00M

Selected Investors: Pantera Capital (Lead), Digital Currency Group (DCG), CMS Holdings, CoinFund, The LAO, Divergence Ventures, Genesis, Bixin Ventures, Chapter One, Triblock, Diogo Mónica (Angel Investor), Richard Ma (Angel Investor), Josh Hannah (Angel Investor), Stani Kulechov (Angel Investor)

Series A: Date: April 27, 2022 | Amount Raised: $20.00M

Selected Investors: Founders Fund (Lead), Pantera Capital (Lead), Coinbase Ventures, Wintermute, Tiger Global Management, GoldenTree Asset Management, Flow Traders, Steel Perlot

Initial Coin Offering (ICO) | Platform: CoinList

Date: May 12, 2022 | Amount Raised: $22.00M | Price: $0.055

ONDO Token Overview

ONDO is the governance token for Ondo DAO and Flux Finance.

Token address:

0xfAbA6f8e4a5E8Ab82F62fe7C39859FA577269BE3Fixed supply of 10 billion tokens with no inflation planned | As of Feb 6 – Unlocked: 3.39B (34%)

Distribution & Unlocking:

ONDO became freely transferable on January 18, 2024, following DAO approval (FIP-08).

Locked tokens can still vote in the DAO, influencing Ondo's future governance.

Investor Allocations:

Coinlist Tranche 1: ~0.3% (1-year lock + 18-month release)

Coinlist Tranche 2: ~1.7% (1-year lock + 6-month release)

Seed Investors: <7% ($4M equity, 1-year lock + 48-month release)

Series A Investors: <7% ($20M equity, 1-year lock + 48-month release)

Ondo Finance’s Core Products:

Ondo US Dollar Yield Token (USDY)

USDY is a tokenized asset backed by short-term U.S. Treasuries, offering yield accrual while maintaining accessibility for non-U.S. investors. With a market cap of $440 million and over 7,000 holders, it is the second-largest tokenized yield-bearing asset after BlackRock’s BUIDL.

Minting & Redemption: Investors complete KYC verification and deposit USDC. Following a 40-50 day processing period, they receive USDY, which can be held or transferred within eligible regions.

Yield Distribution: USDY compounds interest daily and can be converted into rebasing tokens (rUSDY on Ethereum and mUSD on Mantle), offering flexibility in yield accrual mechanisms.

Ethereum dominates the Ondo U.S. Dollar Yield ($USDY) market with the largest share, holding $192.70M in value. Solana follows as the second-largest network with $108.40M, while other networks like Mantle, Noble, Sui, Aptos, and Arbitrum hold significantly smaller portions. This distribution highlights Ethereum and Solana as the primary ecosystems for USDY adoption, with other networks playing a more niche role.

Ondo Short-Term US Treasuries Fund (OUSG)

OUSG is designed for institutional investors seeking exposure to short-term U.S. Treasury products. It is backed by a mix of BlackRock’s BUIDL, FedFund (TFDXX), bank deposits, and USDC. As of October 2024, it holds a market cap of $210 million.

Minting & Redemption: Institutional investors onboard through Ondo’s Qualified-Access Funds and can mint/redeem OUSG via a web interface. Instant minting is available on Ethereum, while larger orders are supported on Ethereum, Polygon, and Solana.

Revenue Distribution: NAV updates daily, with rebasing tokens (rOUSG) automatically reflecting accrued interest.

Ethereum overwhelmingly dominates the Ondo Short-Term US Government Bond Fund ($OUSG) market, holding $247.10M in value. Solana follows with a much smaller share at $21.30M.

First-Party Protocols

Ondo Finance is not only a key player in tokenizing real-world assets (RWAs) but has also developed proprietary protocols to enhance the utility and security of its assets within the DeFi ecosystem. These first-party protocols enable seamless asset integration, liquidity management, and accessibility while maintaining regulatory compliance.

Flux Finance

Flux Finance operates as a decentralized lending market governed by the Ondo DAO. It is based on a fork of Compound V2, with a specific focus on integrating tokenized securities such as OUSG.

Decentralized Repo Market: Enables the borrowing and lending of tokenized assets, facilitating liquidity similar to traditional repurchase agreements.

Expanded Asset Support: In addition to Ondo’s offerings, Flux Finance supports various stablecoins (DAI, USDT, USDC, FRAX) to provide broader market utility.

Governance by Ondo DAO: Uses the $ONDO token for governance, allowing token holders to vote on protocol parameters and updates.

Ondo Global Markets

Ondo Global Markets (Ondo GM) is designed to onboard traditional public securities into blockchain networks, responding to increasing demand for tokenized assets.

Institutional-Grade Onchain Access: Aims to provide global investors with seamless, instant access to tokenized financial instruments.

Bridging Web2 and Web3: Enhances liquidity and accessibility of traditional financial products while ensuring compliance with regulatory standards.

Expanded Use Cases: Supports deeper integration of tokenized securities within DeFi applications, unlocking new financial opportunities.

Ondo Bridge & Ondo Converter

Ondo Finance has developed infrastructure to ensure smooth asset movement across blockchain networks, enhancing the utility of tokenized RWAs.

Ondo Bridge:

Built in collaboration with Axelar, enabling secure cross-chain transfers.

Uses a verification mechanism to ensure safe minting and burning of assets between different chains.

Implements daily transfer limits and multi-signature approvals to mitigate security risks.

Ondo Converter:

Ensures seamless asset interactions without slippage, improving investor experience.

Allows conversion between different yield accrual mechanisms (e.g., rebasing vs. non-rebasing tokens).

Ecosystem

Ondo Finance is pioneering the tokenization of real-world assets (RWA), bridging traditional finance (TradFi) with decentralized finance (DeFi) to enhance liquidity, accessibility, and utility. By integrating treasury management solutions and crypto-based payment infrastructure, Ondo is expanding its role across financial verticals.

Institutional reluctance toward crypto adoption is driven by revenue uncertainty rather than technological barriers. While asset tokenization improves efficiency, its success hinges on market demand and distribution channels. Ondo Finance addresses this by integrating its offerings with over 70 DeFi protocols across eight blockchain networks. USDY, a flagship tokenized asset, is utilized in decentralized exchanges (DEXes) such as Jupiter Exchange and Raydium, as well as in perpetual futures trading platforms like Drift Protocol. Future collaborations with platforms like Pendle could further optimize yield through the separation of principal and interest components.

Treasury Management

Efficient treasury management is essential for both traditional and decentralized entities. USDY has gained traction as a preferred reserve asset due to its stability and yield potential. In July 2023, Arbitrum DAO allocated 17% of its treasury diversification program (6 million ARB) to USDY under the STEP initiative. Ondo Finance has also proposed USDY and OUSG for MakerDAO’s Tokenization Grand Prix, positioning its products within institutional-grade RWA portfolios.

Payments Infrastructure

The adoption of crypto-based payments is accelerating, with fintech firms like PayPal and Stripe entering the space. Ondo Finance has expanded its presence in the payments sector through collaborations within the Solana ecosystem. Partnerships with Helio and Sphere have facilitated USDY’s integration into retail services, including Shopify, promoting blockchain-based transactions as viable alternatives to credit card payments.

Security, Compliance, and Asset Management

Ensuring security, compliance, and interoperability is central to Ondo’s strategy. USDY’s underlying U.S. Treasury assets are custodied by Morgan Stanley and StoneX, with deposit management by Morgan Stanley and First Citizens Bank. Daily independent verification by Ankura Trust and NAV assessments reinforce asset quality. Digital custody is maintained through partnerships with Arculus, Coinbase, and Squads Protocol, while smart contract audits by Halborn Security mitigate blockchain-related risks.

Cross-Chain Interoperability

As blockchain ecosystems diversify, interoperability is critical. Ondo integrates its assets across Ethereum, Solana, Aptos, Sui, Mantle, Polygon, Arbitrum, and Noble. Cross-chain infrastructure partners such as LayerZero, deBridge, and Switchboard enable seamless asset transfers, while price reliability is ensured through oracles like Pyth Network and Supra.

Liquidity and Accessibility

Seamless user experience is vital for adoption. Ondo Finance expands accessibility by integrating with Web3 wallets, including OKX Wallet, Binance Web3 Wallet, MetaMask, and Phantom. USDY’s listing on major centralized exchanges (CEXes) like Bybit further strengthens liquidity and institutional reach.

Conclusion

Ondo Finance illustrates how tokenization can go beyond asset digitization to improve liquidity, accessibility, and investor safeguards. While many tokenization initiatives have faced challenges in establishing a clear value proposition, Ondo Finance has gained a significant presence in the market for tokenized U.S. Treasuries.

Through a combination of regulatory compliance, industry partnerships, and DeFi integration, Ondo Finance contributes to the development of tokenized real-world assets (RWAs). Its approach highlights blockchain’s potential to facilitate liquidity between digital and traditional financial systems. As the sector evolves, Ondo Finance’s role in advancing tokenized securities may influence broader adoption and innovation within financial markets.

Links

Sources

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Good overview. I have a similar one. 🫡