Stablecoins & T-Bills: A $900 Billion Demand Shock

For the first time, the U.S. Treasury Borrowing Advisory Committee (TBAC) has formally examined U.S.-dollar stablecoins—treating them as an emergent payment rail and a potentially material, sustained source of demand for Treasury bills (T-bills). For a deep-dive on stablecoins, see our 20 March insights4vc report. The full TBAC slide deck is linked in the Sources section at the end of this newsletter.

Key takeaways:

Material reserves already in place: Stablecoin issuers now hold more than $120 billion in T-bills to back their tokens.

Meaningful incremental demand: TBAC modelling indicates that continued organic expansion of stablecoins could create up to $900 billion of additional demand for T-bills, versus today’s $6.4 trillion bill market.

Growth linkage: Exponential scaling of stablecoins would translate into commensurate demand for U.S. Treasuries—likely siphoning funds from commercial-bank deposits.

2030 horizon: Under a “regulatory-breakthrough” scenario, the stablecoin market could reach $2 trillion in circulation by the end of the decade.

Banking-sector impact: Persistent deposit outflows toward tokenised dollars could tighten banks’ funding bases and accentuate competition for retail savings.

8 May Update: The Wall Street Journal says Coinbase will buy Deribit for $2.9 billion—$700 million in cash plus 11 million COIN shares—the largest crypto M&A deal to date. Full analysis in the next issue.

USDT and USDC together account for about 88 % of all outstanding supply, underscoring the U.S. dollar’s dominance as the settlement currency of the crypto economy. Non‑USD stablecoins represent well under 1 % of market value, meaning dollar‑denominated tokens are more than 200 times larger than their non‑dollar peers.

Structural Trends

Treasury‑heavy reserves. A majority of backing assets—well over $120 billion—are parked in short‑term U.S. Treasuries, effectively turning stablecoin issuers into major holders of government bills.

Exploding on‑chain usage. Annualised transfer volume has grown into the tens of trillions of dollars, reflecting a transition from trading collateral to a general‑purpose digital cash instrument for payments, remittances, payroll, and treasury operations.

Market resilience. Stablecoin velocity and adoption have continued to rise even during periods of crypto‑asset price stagnation, illustrating that the demand for a 24/7, dollar‑denominated settlement layer is decoupling from broader crypto‑market cycles.

TBAC Insights: Regulation, Treasury Demand, and Monetary Implications

On 30 April 2025, the U.S. Treasury Borrowing Advisory Committee — a group of industry advisors that informs the Treasury Department — delivered a special presentation on stablecoins and their impact on financial markets.

GENIUS Act and Regulatory Clarity

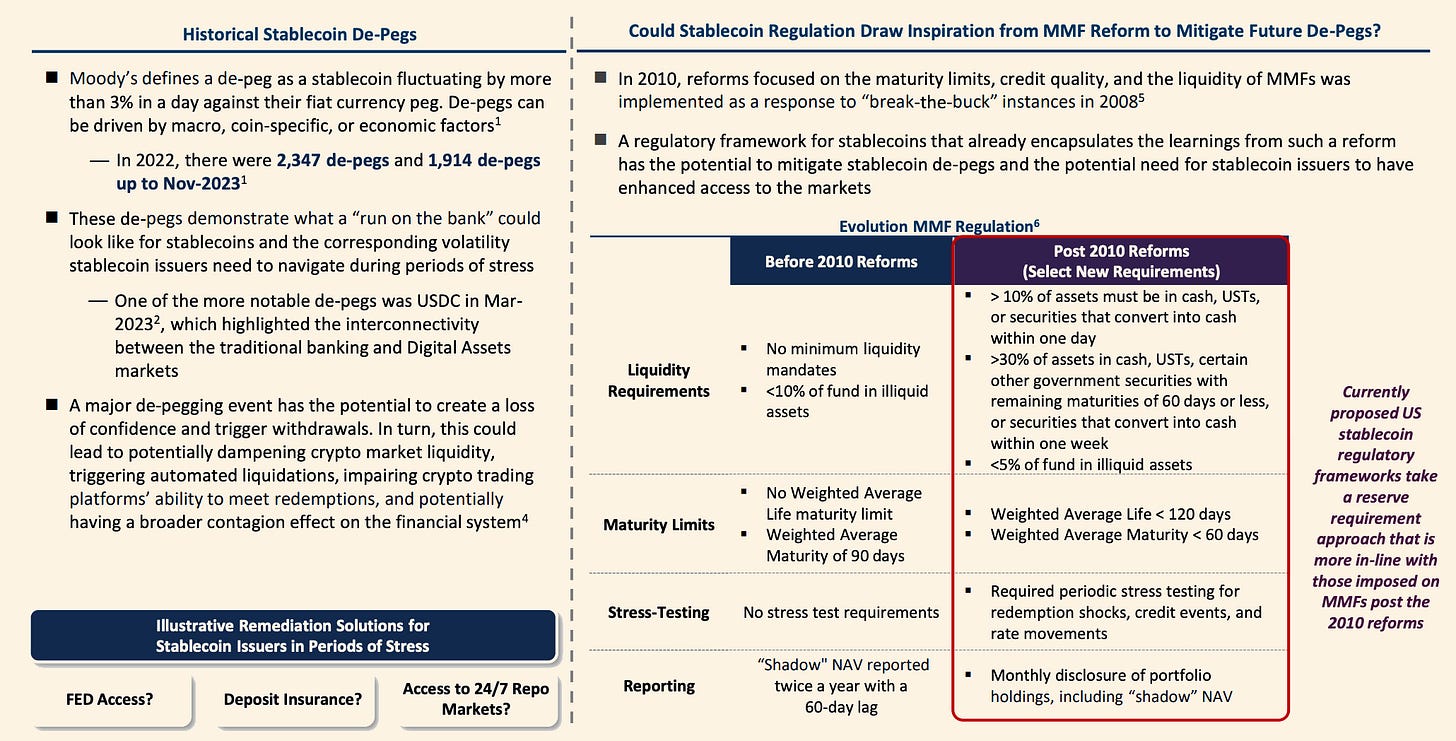

The TBAC noted that USD‑stablecoin dominance is driving urgency for a federal regulatory framework. In March 2025, the Senate Banking Committee advanced the “GENIUS Act,” a bill that would establish the first comprehensive U.S. stablecoin regime. The Act defines a new class of payment stablecoin and sets strict requirements: issuers must be licensed (as bank subsidiaries or specially chartered non‑banks) and maintain 1:1 reserves in safe, liquid assets.

Allowable reserves would be limited to U.S. currency, Federal Reserve deposits, and short‑term Treasuries or equivalents (e.g., sub‑93‑day T‑bills, overnight repos, money‑market funds holding Treasuries). Issuers would also face monthly disclosure requirements and must have the technical ability to freeze or cancel tokens for legal compliance.

Importantly, the Act prohibits stablecoins from paying interest to holders. This “yield ban” is intended to preserve stablecoins strictly as cash equivalents, not investment products, and to mitigate bank‑disintermediation risk. TBAC members observed that the GENIUS Act, if enacted, “would provide a clear framework for payment stablecoins, eliminating ambiguity.” Greater legal clarity is expected to encourage more mainstream institutions to engage with stablecoins and solidify the sector’s growth trajectory.

Stablecoins, USD Hegemony & Treasury Demand

A strategic theme in the TBAC discussion was how stablecoins can reinforce U.S.‑dollar hegemony and demand for U.S. government debt. The White House has explicitly prioritized the growth of dollar stablecoins outside U.S. borders as a national economic strategy. By expanding global access to dollar liquidity, USD stablecoins increase foreign demand for dollar assets — in particular, the reserve assets backing those coins (mostly U.S. Treasuries). Approximately $120 billion of stablecoin reserves are currently invested in short‑dated U.S. Treasuries. As usage grows, this figure is poised to balloon. TBAC cited research projecting that, assuming the GENIUS Act passes and adoption accelerates, stablecoin supply could reach ~$2 trillion by 2028 (an ~8× increase), implying ~$1 trillion of Treasuries held by issuers. Such demand growth could help stabilize or lower government borrowing costs over time, while also exporting dollars digitally to preserve U.S. currency influence.

David Sacks, the White House’s crypto advisor, was quoted as saying the goal is to increase demand for Treasuries through wider stablecoin adoption. In short, dollar stablecoins are seen as a tool to bolster USD supremacy in the digital era, embedding the dollar in global crypto commerce and funnelling worldwide liquidity into U.S. debt.

Impact on Bank Deposits (Narrow‑Banking Concerns)

A major concern discussed at TBAC is whether stablecoin growth simply redistributes money within the financial system (from bank deposits and money‑market funds into stablecoin reserves) or brings net‑new liquidity into Treasuries. Currently, stablecoins do not pay interest, making them less attractive as a savings vehicle for many U.S. customers; they primarily serve transactional and liquidity needs on‑chain. TBAC noted that roughly $6.6 trillion in U.S. commercial‑bank transactional deposits (non‑interest‑bearing accounts) could be “at risk” of migrating to stablecoins over time. If even a fraction of that moved, banks could face a funding squeeze. Bank regulators and lobbyists have therefore opposed allowing stablecoins to pay interest, arguing that interest‑bearing stablecoins would accelerate deposit outflows into uninsured crypto accounts.

This is likely why the GENIUS Act explicitly bans interest, to prevent an outright “deposit flight” from the traditional banking system. TBAC members weighed scenarios of interest‑bearing vs. non‑interest‑bearing stablecoins and their implications for credit markets. If stablecoins remain non‑yielding, growth may draw more from new money (e.g., foreign investors or cash currently outside banks), resulting in net‑new demand for Treasuries. If they could eventually pay interest, stablecoins might swell even faster but largely by cannibalizing bank deposits and money‑market funds, potentially shrinking traditional credit availability. The report ultimately flagged that “transactional deposits are most at risk,” though banks are exploring mitigations such as issuing their own stablecoins.

Tokenized Money Funds vs. Stablecoins

TBAC compared tokenized money‑market funds (MMFs) with stablecoins. Large asset managers have launched tokenized Treasury funds—e.g., Franklin Templeton’s BENJI and BlackRock’s BUIDL—that do pay yield on‑chain, whereas stablecoins do not. Both serve similar liquidity use‑cases, but stablecoins are explicitly designed as cash/payment tools (transferable 24/7 at a fixed $1 value), whereas tokenized MMFs are tokenized securities—shares in a fund—with daily NAV‑based redemption and access restrictions.

Tokenized MMFs let market participants park idle cash in a yield‑bearing, low‑risk asset on‑chain. Stablecoins, by law, cannot offer that yield directly. This suggests a future in which on‑chain “cash” and on‑chain “savings” coexist: users might pay and settle with stablecoins, then sweep excess balances into tokenized funds for yield. Notably, BlackRock and Franklin Templeton have already partnered with blockchain firms to tokenize their funds. TBAC’s point: if regulators keep stablecoins yield‑less, some liquidity could shift into tokenized funds instead—still holding Treasuries on‑chain but changing who earns the interest. Traditional financial products are beginning to live on blockchain rails alongside stablecoins, and both may draw money out of bank deposits (one in exchange for a stable token, the other for a tokenized fund share).

Opportunities for Banks and Policy Adjustments

While risks to banks dominated the discussion, TBAC also emphasized opportunities. Banks and other financial institutions could issue stablecoins or provide stablecoin‑related services, thereby participating in growth rather than losing out. Several U.S. banks are exploring “deposit tokens” (tokenized deposits) or white‑labelled stablecoins. If banks issue fully‑reserved digital dollars, they could retain customer balances and gain new fee opportunities. TBAC also floated policy ideas such as granting stablecoin issuers access to Federal Reserve services or insurance. Holding reserves at the Fed or obtaining FDIC coverage could virtually eliminate run‑risk and make stablecoins safer, though it might blur the line between banks and non‑bank issuers. Political headwinds have since slowed the GENIUS Act, but the direction is set: stablecoins are systemically important enough that U.S. policy is actively being crafted to integrate them into the financial framework.

In sum, the TBAC’s April 2025 session underscored that stablecoins have matured from a niche crypto product into a macro‑scale monetary phenomenon. Regulators view them as both an opportunity (to strengthen the dollar and modernize payments) and a potential disruption to legacy banking. Forthcoming legislation, such as the GENIUS Act, will likely formalize stablecoins’ role, bringing clearer rules for issuers, reserve holdings and compliance.

That clarity, in turn, is expected to unlock even greater institutional participation—from banks, fintechs and possibly the Treasury or Federal Reserve themselves. We are effectively witnessing the birth of a new narrow‑bank‑like sector (fully reserved digital‑currency issuers) and its integration with traditional markets. The next section looks at how major traditional‑finance players are already stepping into the on‑chain‑asset arena via strategic investments and product launches in Q1–Q2 2025.

Tokenization in TradFi: Securitize’s $47 M Round Led by BlackRock

One of the most significant institutional moves in April 2025 was BlackRock’s lead investment in Securitize, a leading digital‑asset tokenization platform. On 30 April, Securitize announced a $47 million strategic funding round spearheaded by BlackRock. The round drew a who’s‑who of TradFi and crypto players: Tradeweb Markets (a major electronic bond‑trading marketplace), Hamilton Lane (global private‑markets specialist), ParaFi Capital (crypto‑focused investment firm) and others, alongside strategic backers such as Aptos Labs (blockchain tech), Circle (issuer of USDC) and Paxos (issuer of USDP and PYUSD). The infusion will fund new products, global expansion and deeper partnerships across the financial ecosystem—accelerating the bridge between traditional securities and blockchain technology.

For BlackRock, the world’s largest asset manager, the deal reflects its conviction that tokenization can “drive a significant transformation in capital‑markets infrastructure.” Joseph Chalom, BlackRock’s global head of strategic ecosystem partnerships, called the investment “another step in the evolution of our digital‑assets strategy.” BlackRock not only invested; it also took a board seat at Securitize (with Chalom joining) and launched its first tokenized fund—the BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”)—on Ethereum. BUIDL is a tokenized share class of a short‑term U.S.‑Treasury liquidity fund. Qualified investors subscribe via Securitize and receive on‑chain shares recorded on Ethereum’s ledger. The product showcases a top‑tier traditional firm issuing a regulated financial instrument natively on a public blockchain. Notably, BNY Mellon is custodian and Securitize the tokenization agent for BUIDL, underscoring the involvement of multiple established institutions.

Securitize has long been a key player in tokenizing real‑world assets (RWAs). It has facilitated offerings for private‑equity and credit funds (including portions of KKR and Hamilton Lane vehicles) and tokenized U.S.‑Treasury products through partners like Arca. To date, more than $600 million in assets have been tokenized on its platform. By investing, BlackRock and co‑investors are positioning themselves at the forefront of on‑chain finance, shifting tokenization from experiment to “industrialization.” They are not alone: industry giants—JPMorgan, Goldman Sachs, Citi and UBS, among others—are also advancing tokenization initiatives. JPMorgan’s Onyx division operates a permissioned blockchain for institutional payments; Goldman Sachs launched its GS DAP platform and executed tokenized bond issuances; Citi is working on blockchain‑based trade finance and custody; and UBS issued a $50 million tokenized bond in 2022. Together, these moves signal that tokenized finance is entering a mature phase.

Hamilton Lane’s participation is telling: in 2023 it tokenized feeder funds for private‑credit and equity strategies with Securitize, lowering investment minimums on‑chain. Tradeweb’s involvement hints at future secondary‑market venues for tokenized securities. Imagine trading a tokenized bond on‑chain as seamlessly as on Bloomberg or Tradeweb—only with faster settlement and streamlined custody.

From the crypto‑native side, investments by Circle and Paxos align with their interest in expanding the stablecoin and tokenized‑asset ecosystem. Their stablecoins (USDC, USDP, PYUSD) provide a settlement rail for tokenized‑securities transactions, paving the way for atomic delivery‑versus‑payment on‑chain. Aptos Labs’ presence suggests Securitize may deploy on multiple blockchains and pursue interoperability or enhanced smart‑contract functionality.

Zooming out, BlackRock’s bet follows CEO Larry Fink’s repeated advocacy of “tokenizing stocks and bonds” to modernize markets. The Deloitte “Performance Magazine” (June 2024) described BlackRock’s investment as “engaging the fund industry in a new evolution,” expanding access to assets for savers. Tokenization promises fractional ownership, 24/7 markets, faster settlement and automated compliance. Those benefits are already emerging: Securitize enables fractional access to private credit, and tokenized bonds have settled in minutes rather than days.

Other institutions are moving too:

HSBC partnered with Metaco to launch a digital‑asset custody service.

Société Générale (SocGen), via its Forge unit, issued a €10 million tokenized bond and created its own euro stablecoin for settlement.

Visa and Mastercard are integrating stablecoins into payments, complementing tokenization by providing a digital‑cash leg.

Overall, Securitize’s funding round and related tokenization efforts in spring 2025 mark a pivot point: TradFi incumbents are shifting from pilots to meaningful equity stakes and live blockchain‑based products. They are bridging conventional investments and their digital counterparts, building the infrastructure for a future in which stocks, bonds, funds and other assets are issued, traded and settled on‑chain under full regulatory compliance. We are witnessing the early stages of a substantial re‑platforming of financial services onto blockchain rails, with pioneers such as BlackRock and Hamilton Lane leading the charge.

Stablecoins in Payments

Stablecoins aren’t just abstract balance-sheet entries or investment holdings – they are increasingly being woven into the payments and banking fabric by large fintechs and financial institutions.

Stripe, the Silicon Valley payments giant, unveiled a major expansion of its money-management offerings by launching Stablecoin Financial Accounts for businesses in 101 countries. This move effectively allows Stripe’s business customers to hold balances in dollar-backed stablecoins and seamlessly transact between crypto and traditional payment networks. With these new accounts, a company can, for example, receive funds via ACH bank transfer or via on-chain USDC, store the funds as stablecoin balances, and then send payments out globally in stablecoin or convert back to fiat as needed. Stripe is initially supporting USD Coin (USDC) and a Stripe-issued stablecoin USDB (which came from its acquisition of the startup “Bridge” earlier in 2025). The strategic intent here is to leverage stablecoins to offer faster, cheaper global payments for businesses. Many firms in emerging markets face volatile local currencies and high friction in cross-border flows – by holding value in a USD stablecoin via Stripe, they can hedge inflation and access the global economy more easily.

Stripe’s CEO Patrick Collison framed the context well: “There are not one, but two, gale-force tailwinds … AI and stablecoins … Our job is to pull these technologies forward so businesses can benefit right away.”

In practice, Stripe’s integration of stablecoins puts a user-friendly face on crypto for millions of businesses – they may interact with a Stripe dashboard and API, not realizing that under the hood value is moving via blockchains. Critically, Stripe also partnered with Visa to link these stablecoin accounts to traditional card networks. In late April, Stripe’s crypto unit (formerly Bridge) and Visa announced the first global issuance of stablecoin-linked Visa cards, enabling fintechs to issue Visa cards that spend directly from stablecoin wallets. When a cardholder uses such a card, the system will instantly convert the stablecoin to fiat at the moment of transaction behind the scenes. This means a user could hold USDC on Stripe and spend it at any Visa-accepting merchant worldwide, with the merchant receiving fiat and never knowing crypto was involved. The implication for payments is profound: stablecoins are being made “as easy to spend as fiat” through existing networks, erasing the gap between digital-dollar liquidity and everyday commerce.

Visa & Mastercard Embrace Stablecoin Payments

Visa

In partnership with Stripe/Bridge, Visa’s program to roll out stablecoin-linked cards across multiple countries was highlighted at the end of April. This followed Visa’s earlier pilots using USDC for settlement. Visa’s head of crypto has been outspoken that Visa aims to be network-agnostic: if stablecoins are how people want to pay, Visa will carry those value flows. By enabling issuance of cards that directly debit stablecoin balances, Visa is effectively decoupling the payment card from a traditional bank account – you could have a “crypto checking account” in the form of a USDC wallet with a Visa card attached. This extends dollar stablecoins’ utility to anywhere Visa is accepted (70 + million merchants).

Mastercard

On April 28, 2025, Mastercard announced an “end-to-end stablecoin payments” capability, unveiling partnerships with crypto firms OKX and Nuvei to create a “seamless ecosystem where consumers can spend stablecoins and merchants can receive them.” In Mastercard’s scheme, a few components come together: wallets and exchanges (like OKX) will issue branded cards allowing users to spend their stablecoin balances; simultaneously, Mastercard is working with payment processors (like Nuvei) to enable merchants to opt to receive settlement in stablecoin (not just in fiat). For instance, a merchant could choose to get paid in USDC for an online sale, even if the customer pays with a traditional credit card – Mastercard’s network would do the currency swap on the backend. This creates a closed loop where stablecoins can be the unit of account on both sides of a transaction. Mastercard specifically highlighted working with Circle’s USDC and Paxos to facilitate this. By integrating stablecoins into its network, Mastercard aims to offer the benefits of crypto (fast settlement, lower-cost cross-border) under the familiar hood of card payments. It also introduced solutions like Mastercard Crypto Credential for identity verification on blockchain transactions (to satisfy compliance when using stablecoins for remittances). The key takeaway is that both Visa and Mastercard are betting on stablecoins as the next evolution of digital money. They are actively ensuring that if value shifts from bank deposits to stablecoins, their networks will still carry those transactions. This is also a defensive moat – by providing on- and off-ramps for stablecoins through cards, they keep fintechs and crypto wallets tied into the card networks rather than bypassing them entirely.

PayPal’s PYUSD Gains Traction

PayPal, one of the first big fintechs to launch its own USD stablecoin (PYUSD, issued by Paxos), saw important developments in this period. In late April 2025, the U.S. SEC formally closed its investigation into PayPal’s stablecoin with no enforcement action. This removed a regulatory cloud that had been hanging over PYUSD since its launch, effectively “removing a key regulatory hurdle” for PayPal. With the SEC’s blessing (or at least no objection), PayPal has a green light to integrate PYUSD more deeply into its products. Indeed, PayPal had already been exploring incentives to drive adoption: as noted, PayPal is offering a 3.7 % yield on PYUSD holdings for its users.

This is notable because it blurs the line between a stablecoin and a bank deposit – PayPal is using interest (funded presumably by the T-bill yields earned on PYUSD reserves) to attract customers to hold money in PYUSD rather than in a bank account. For retail users, a 3.7 % yield on a stable, cash-equivalent asset is highly attractive in the current environment. This move by PayPal can be seen as an experiment in stablecoin-driven banking: users keep their dollars in PYUSD within the PayPal wallet, earn interest (as a “reward” to sidestep the letter of the no-interest rule), and can spend or transfer that PYUSD freely in the crypto ecosystem. The strategy might be starting to work – PYUSD’s market cap, while under $1 billion, has been gradually climbing.

Additionally, Coinbase in April added support for PYUSD and even waived fees for trading it, indicating a growing acceptance of PayPal’s coin in the crypto industry. All of this points to a convergence where fintech firms like PayPal and Coinbase are collaborating to push stablecoins into mainstream payments (e.g., enabling PYUSD as an option for checkout or P2P transfers between PayPal and Coinbase users).

Other Financial-Institutional Moves

Beyond the headline grabbers above, there were other disruptive innovations in TradFi during March–May 2025 that tie into the stablecoin narrative:

U.S. bank regulators eased certain restrictions on bank crypto activities in late April. Notably, the FDIC and OCC rolled back some of the 2022-era “crypto guardrails,” potentially allowing banks to more freely custody crypto or stablecoin reserves and engage in stablecoin issuance under proper oversight. This policy shift (“banks get crypto green light”) was cited in industry reports as a reason crypto usage could grow. It suggests that regulators, in tandem with pushing specific stablecoin legislation, are also opening the door for banks to participate, mitigating the disintermediation concern by letting them compete in the stablecoin arena.

Internationally, European lawmakers in Q1 2025 implemented MiCA (Markets in Crypto-Assets regulation), which provides a clear framework for stablecoin issuers in the EU. This encouraged some European financial institutions to consider issuing euro-denominated stablecoins or integrating with USD stablecoins for cross-border uses. For example, Italy’s central-bank governor commented in April that U.S. stablecoin policy (or lack thereof) could drive Europeans to use dollars for cross-border payments – implicitly a call for Europe not to lag behind.

Crypto-industry lobbying for interest-bearing stablecoins also made news. In early April, ahead of the GENIUS Act markup, executives from crypto companies (like Coinbase’s CEO) urged Congress to allow stablecoin issuers to pay interest to users. They argued that preventing interest puts stablecoins at a competitive disadvantage and isn’t necessary if issuers are regulated. This was met with skepticism by bank lobbyists who reiterated that yield-bearing stablecoins could siphon bank deposits into “uninsured crypto accounts.” While the outcome was that the draft bill kept the interest ban, this episode shows the dynamic tug-of-war between innovation and cautious regulation. It also reflects that some crypto firms want to offer bank-like services (like interest) and are actively negotiating the rules that will shape stablecoin-based banking.

All these developments are interconnected in that they illustrate a rapid mainstreaming of stablecoins and blockchain-based finance within the existing financial system. Stablecoins have evolved into a core element of fintech innovation: where just a couple of years ago they were primarily used on crypto trading platforms, now they are integrated into PayPal’s wallet, woven into Stripe’s global payments toolkit, being cleared on Visa and Mastercard’s networks, and being eyed by banks and governments alike. For a TradFi-savvy institutional audience, the implication is clear: stablecoins (and the tokenization of assets that goes hand-in-hand with them) are no longer peripheral experiments, but central to the future of money and markets.

Institutions need to formulate strategies around this reality – whether it’s adapting treasury management (e.g., investing operational cash in stablecoins or tokenized funds for yield), leveraging stablecoins for faster settlement and FX, or even issuing their own tokenized liabilities. The period of March–May 2025 may be looked back on as an inflection point when stablecoins truly went mainstream. The total stablecoin market topping $218 billion with accelerating volume, the U.S. government actively crafting legislation, and blue-chip financial companies launching stablecoin-enabled products all reinforce a narrative: digital dollars on blockchain are here to stay, and they are reshaping the global financial landscape.

Moving forward, we can expect competition in this space to further heat up – more fintechs offering stablecoin accounts (Stripe’s peers will not sit idle), more banks issuing or using stablecoins (especially once a law is in place), and continued growth in tokenized real-world assets that complement the stablecoin ecosystem. For the institutional audience, the key will be to harness these innovations to improve efficiency and access, while managing the new risks they introduce. As of May 2025, the direction of travel is unmistakable: finance is embracing on-chain dollars and assets, blending the trust and scale of TradFi with the speed and programmability of crypto. The winners in this new landscape will be those who adapt and find opportunity in the disruption – much as BlackRock, Visa, Mastercard, Stripe, and others have signaled with their bold moves in early 2025.

Sources

U.S. Treasury Borrowing Advisory Committee (TBAC):

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.