7 Industries Already Being Reshaped by Blockchain

Fifteen years after powering Bitcoin, blockchain has evolved into the back-office backbone of global commerce - doing for value transfer what the internet did for information and mobile did for access. By 2025, blue-chip companies are harnessing its decentralisation, immutability, transparency and programmability to eliminate legacy frictions and surface new profit pools.

Stripe, whose rails already touch ~1 % of global GDP, underscored the shift by acquiring stable‑coin specialist Bridge for US $1.1 billion in February 2025, enabling any merchant to accept and retain dollar‑backed stablecoins at checkout.

That momentum went public today (5 June 2025): Circle - the issuer of USDC - debuted on the NYSE under the ticker CRCL, raising about US $1.1 billion at a roughly US $7 billion valuation. Stable‑value tokens have officially entered the big leagues.

You can find links to deep dives into Stripe’s stablecoin strategy and the Circle IPO below:

Stripe’s Stablecoin Strategy

This month, Stripe finalized the $1.1 billion acquisition of Bridge. This strategic move signals Stripe’s commitment to blockchain-based payments, positioning it as a key player in the evolving digital finance landscape. Stablecoins (now a $200 billion market

Circle’s IPO: USDC’s Next Chapter

Circle Internet Financial was founded in October 2013 by Jeremy Allaire (a serial internet entrepreneur) and Sean Neville. Allaire’s vision was to harness cryptocurrency technology to revolutionize online payments.

Why Blockchain, Why Now?

Institutional momentum

JPMorgan now settles intraday repos on-chain; Visa tokenises cross-border flows; global clinical-trial consortia share patient data on private ledgers. The “experimental” label no longer applies.

Enterprise-grade tooling

Layer-2 roll-ups, proof-of-stake consensus and cross-chain messaging have removed early speed and interoperability constraints. Permissioned frameworks such as Hyperledger Fabric interoperate with greener public chains, while modern UX hides wallet complexity. Coupling blockchain with cloud, AI, big data and IoT multiplies the return potential.

Regulatory clarity

Sharpened licensing regimes, legal recognition of tokenised securities and the courtroom admissibility of ledger records have reduced compliance drag. Patchy, but material progress across jurisdictions now gives CFOs the certainty required to commit capital at scale.

Bottom line: The question for finance executives is no longer whether to move on-chain, but where the remaining first-mover alpha resides.

Key Highlights

Finance: Banks and fintechs use blockchain to accelerate payments, settlements, and asset issuance. Spot-Bitcoin ETF approvals unlocked mainstream legitimacy; meanwhile, JPM Coin–style bank tokens and large-scale asset tokenization point to trillions of dollars moving on-chain this decade. The line between “crypto” and conventional finance is disappearing as firms pursue instant liquidity and 24/7 global reach.

Technology: Big Cloud is now Big Web3. Google, Amazon, Microsoft, IBM, and Oracle all sell blockchain-as-a-service while integrating decentralized storage, compute, and identity into their own offerings. A convergence with AI and IoT is birthing new data-marketplaces and security primitives, positioning tech titans both as builders and power-users of Web3 infrastructure.

Energy: Distributed ledgers underpin peer-to-peer power trading, renewable-certificate tracking, and carbon-credit tokenization. Projects like Power Ledger and LO3 demonstrate cheaper local energy markets; utilities and oil majors now explore blockchain for grid balancing, green hydrogen tracing, and commodity trading. The sector is steadily migrating toward decentralized, transparent energy ecosystems.

Consumer & Luxury Goods: Brands deploy blockchain for provenance, anti-counterfeiting, and customer engagement. LVMH’s product passports, Walmart’s farm-to-fork tracking, and Nike’s NFT sneakers exemplify a shift toward transparent supply chains and phygital loyalty programs. Early movers are setting industry standards; laggards face higher compliance and reputational risk.

Logistics: From cargo shipping to last-mile retail, blockchains cut paperwork, trace provenance, and create neutral data-sharing consortia. TradeLens’ rise-and-fall proved governance matters; GSBN, FedEx initiatives, and blockchain trade-finance networks show where inclusive models succeed, reducing disputes and speeding customs clearance.

Healthcare: Hospitals, insurers, and pharma giants pilot blockchains for secure patient records, claims automation, and drug traceability. Patient-controlled data wallets, on-chain clinical trials, and medicine provenance systems aim to slash fraud, errors, and counterfeit losses while meeting strict privacy laws.

Sports & Entertainment: Teams, leagues, and studios issue fan tokens, NFT tickets, and digital collectibles to monetize fandom and grant voting rights or VIP perks. Blockchain also enables direct royalty flows to creators and tamper-proof ticketing that curbs scalping. The result is a more interactive, tokenized fan economy.

Drawing on mid-2025 market data and the OKX × Blockworks study (link provided at the close of this paper), this brief analyzes how eight sectors are translating distributed-ledger technology into enduring strategic advantage.

Finance Sector: Blockchain in Banking and Capital Markets

The financial sector was one of the earliest and most heavily impacted by blockchain, given the technology’s origin in cryptocurrency. As of 2025, finance remains the most practical and mature use case for blockchain technology, where it is driving innovation in payments, trading, lending, and asset management. Traditional banks, stock exchanges, clearinghouses, and fintech startups are all deploying blockchain in various forms – often under the umbrella of “distributed ledger technology (DLT)” to differentiate from public, permissionless blockchains.

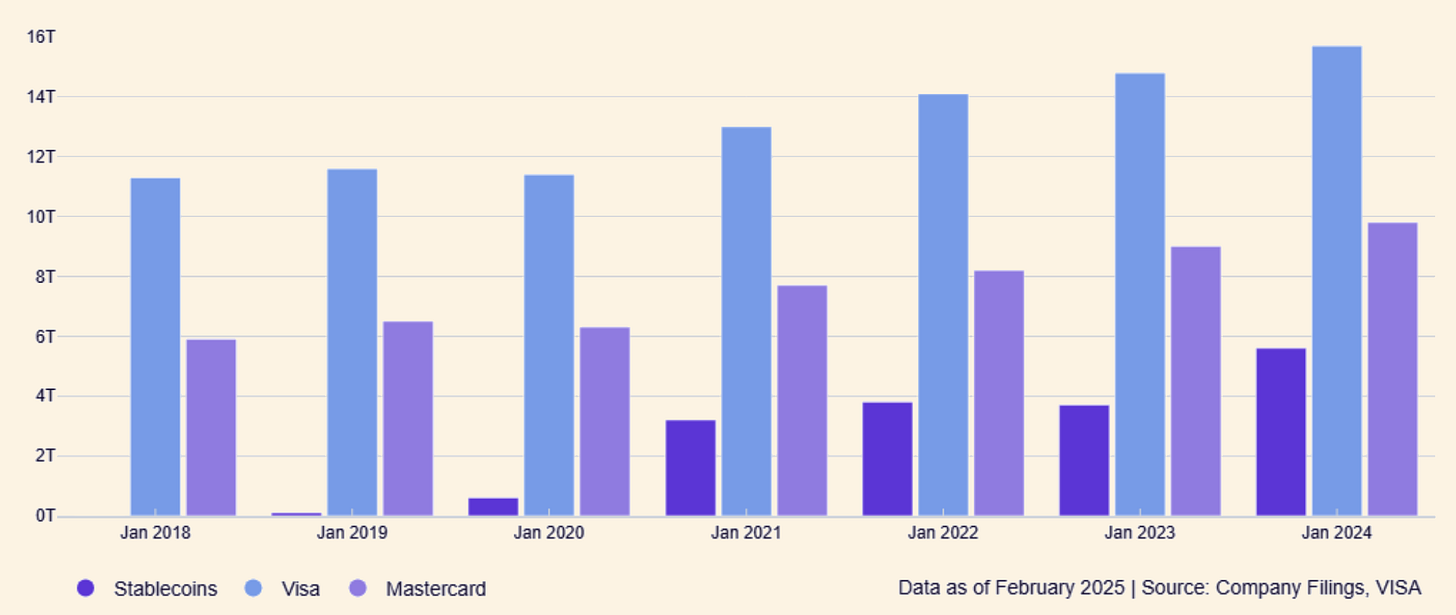

A watershed moment came with regulators starting to approve mainstream crypto investment vehicles. In a development foreseen by analysts, the U.S. SEC approved the first spot Bitcoin ETFs in early 2024, allowing retail and institutional investors to gain direct exposure to Bitcoin through regulated stock-market instruments. This signaled a new level of acceptance of digital assets in traditional finance and helped boost confidence among banks and asset managers that blockchain-based assets are here to stay. Concurrently, stablecoins (blockchain-based digital currencies pegged to fiat) have grown into a ~$180 billion market, dominated by USD-backed tokens like USDT and USDC. Stablecoins are increasingly used for settlement by fintech companies and even some banks, thanks to their speed and 24/7 availability. Some issuers are working closely with regulators and diversifying reserves to address concerns, positioning stablecoins as an important bridge between crypto and traditional money.

One of the most notable banking innovations is the rise of blockchain-based interbank payment networks. JPMorgan’s Onyx division pioneered JPM Coin, a permissioned blockchain system enabling instant value transfer between JPMorgan and client accounts globally. This effectively allows corporate treasurers to move dollars in real-time on a ledger, bypassing slower legacy networks. Other banks have followed suit: Goldman Sachs, HSBC, and Wells Fargo have each tested or launched tokenized deposit systems or internal settlement coins. The motivation is clear – by using a shared ledger, banks can settle obligations in seconds with finality, reduce reconciliation work, and operate outside of limited operating hours. Central banks are not far behind, working on Central Bank Digital Currencies (CBDCs) that use DLT for wholesale or retail payment systems (e.g., Project Jura, Project mBridge). The end-state could be a highly efficient global network of interconnected ledgers for money movement.

In capital markets, tokenization of securities and other assets has moved from trial to reality. Several stock exchanges (Deutsche Börse, Singapore SGX, Switzerland’s SDX) have either launched digital asset exchanges or integrated DLT for settlement and custody. Private markets are also being tokenized – everything from real estate to fine art to venture capital funds – typically in the form of security tokens that are sold to accredited investors. The appeal is increased liquidity and fractional ownership. Commodity-backed tokens have emerged, representing gold, oil, or other commodities; their combined market cap topped $1.1 billion and is conservatively expected to exceed $10 trillion by 2030 according to analysis. Such projections, while ambitious, highlight the vast scope of assets that could be digitized on blockchains, unlocking capital from traditionally illiquid holdings. In fact, a report predicts tokenized real-world assets under management reaching ~$0.6 trillion by 2030, and other studies suggest even an order of magnitude higher if adoption accelerates.

Decentralized Finance (DeFi), a blockchain-native financial sector, also influences the traditional finance (TradFi) world. DeFi platforms – basically smart contracts on public blockchains offering services like lending, trading, and derivatives without intermediaries – demonstrated new models of liquidity pooling and automated market making. Forward-looking banks are studying how to integrate or harness DeFi concepts. Some have launched permissioned DeFi pools or liquidity networks for interbank lending. Custody and brokerage for digital assets have become mainstream offerings: banks like BNY Mellon and Fidelity now provide crypto custody, and dozens of startups offer institutional-grade custodial solutions (with insurance and compliance). Lending against crypto collateral, once the domain of crypto firms, is being considered by banks, especially as they partner with fintechs.

Strategic Implementations and Case Studies:

Virtually every major financial institution has a blockchain strategy today. Some illustrative examples:

Interbank Payment & Settlement: JPM Coin and the Partior network (led by DBS, JPMorgan, and Temasek) are facilitating cross-currency settlements using blockchain in place of the SWIFT messaging system. FNALedger in Europe is experimenting with digital euro tokens for instant settlement of securities transactions.

Trade Finance: Blockchain consortia such as Contour and we.trade have sought to digitize trade finance workflows like Letters of Credit and open account trading. While these networks faced scaling or governance challenges, the underlying efficiency improvements (cutting processing time from days to hours) are proven.

Securities Tokenization: Société Générale issued bonds and structured products as security tokens, even leveraging them as collateral in DeFi protocols. In the U.S., Figure Technologies issued digital mortgage-backed securities, and the Nasdaq and London Stock Exchange are exploring platforms for tokenized private company shares and end-to-end blockchain trading.

Asset Management and Funds: BlackRock and Hamilton Lane have tokenized portions of their fund units to expand access. Switzerland’s SDX exchange listed tokenized bonds such as UBS’s CHF 150 million offering, enabling broader participation in bond markets.

Cross-Border Payments and Remittances: Ripple and Stellar are powering real-time blockchain-based transfers. SWIFT has run trials connecting CBDCs and tokenized assets across blockchain networks, positioning itself as a connector in a future tokenized finance system.

These implementations are already yielding tangible benefits: reduced settlement times, lower operational costs, new revenue opportunities, and increased automation. A survey by the World Economic Forum found that banks expect 5–10% reductions in back-office costs from blockchain integration within five years. Strategically, traditional banks are racing to adopt blockchain to avoid being disrupted by crypto-native or fintech challengers. As one report concluded, the distinction between “crypto banks” and traditional institutions is likely to disappear as both converge on blockchain infrastructure.

Regulatory and Risk Considerations:

Financial services are highly regulated, and blockchain adoption must navigate several key issues:

Compliance (KYC/AML): Public blockchains raise challenges for identifying users, prompting institutions to adopt permissioned networks or compliance layers. Blockchain analytics firms like Chainalysis support this by tracing on-chain flows for regulators.

Custody and Security: Digital asset custody introduces novel risks. Regulators require qualified custodians, and many banks have received approvals to offer crypto custody under strict guidelines. Regulation like MiCA in the EU will enforce governance and prudential rules on stablecoin issuers and service providers by 2025.

Securities Laws: Many crypto tokens may qualify as securities, requiring registration or exemptions. This affects how institutions handle tokenization and DeFi projects. Broker-dealer and ATS licenses have been granted in some jurisdictions, and countries like Switzerland have pioneered DLT-specific regulatory frameworks.

Systemic Risk and Interoperability: Interoperability between blockchains (e.g., Corda vs. Hyperledger) remains a challenge. Industry bodies are working on standards to avoid fragmentation. Regulators are also stress-testing potential blockchain failure scenarios to prepare for systemic risks.

Despite challenges, regulatory momentum is positive. Governments in Asia and the Middle East, such as Hong Kong and Dubai, have actively embraced crypto firms and built dedicated regulatory regimes. Western regulators are being encouraged to keep pace to avoid losing innovative businesses.

Future Outlook in Finance:

Over the next 5–10 years, the boundary between TradFi and blockchain-native finance will blur:

Tokenized Deposits and CBDCs: Banks may issue large portions of their deposits on-chain. A digital dollar or euro could enable real-time, cross-border settlement as the new standard.

Asset Tokenization at Scale: Large-scale tokenization of real estate, REITs, syndicated loans, and equities is plausible. Public stock exchanges may begin offering after-hours trading via tokenized securities.

DeFi and Traditional Integration: Regulated DeFi environments could emerge, enabling verified users to trade via smart contracts. Banks may incorporate DeFi tools to manage liquidity, collateral, or FX swaps.

Hyper-connected Global Markets: In a blockchain-powered future, 24/7 trading, instant payments, and inclusive access to financial products could become the norm. Smart contracts might automate everything from insurance payouts to dividend distribution.

Technology Sector: Big Tech and the Internet’s Web3 Evolution

The technology sector – including software firms, cloud providers, hardware manufacturers, and telecom companies – plays a dual role in blockchain adoption. First, tech companies are often enablers of blockchain solutions, providing the infrastructure and tools that other industries use. Second, they are adopters in their own operations, using blockchain to augment products or improve processes. By 2025, all major “Big Tech” firms (Google, Amazon, Microsoft, IBM, Oracle, Alibaba, etc.) have developed strategies around blockchain and Web3, ranging from offering enterprise blockchain cloud services to integrating blockchain into consumer-facing platforms.

One of the clearest trends is the integration of blockchain with cloud computing services. Recognizing that most enterprises prefer not to manage their own blockchain nodes, cloud providers have stepped in. Amazon Web Services (AWS) introduced Amazon Managed Blockchain, a service that simplifies launching and managing permissioned blockchain networks using frameworks like Hyperledger Fabric or Ethereum. AWS also partnered with public blockchain projects to facilitate node deployment on its cloud. Microsoft Azure, which had an early blockchain-as-a-service offering, shifted focus after 2021 to supporting blockchain development via its Azure cloud. Google Cloud has been particularly active: it launched a Blockchain Node Engine for hosting dedicated nodes, formed a Web3 team that partnered with over 70 blockchain networks by 2024, and became a validator on networks like Solana. Google’s approach emphasizes bridging Web2 and Web3, including building a connector to Filecoin’s storage network, enabling customers to use familiar Google Cloud interfaces while seamlessly writing data to decentralized networks.

Beyond cloud, tech companies are embedding blockchain into various services:

Identity and Security: Microsoft and IBM have championed decentralized digital identity solutions. Microsoft’s ION project, built on the Bitcoin blockchain, creates decentralized identifiers (DIDs) that users own. IBM has worked on blockchain-based credential management (e.g., digital health credentials during the COVID-19 pandemic). These solutions aim to return control of personal data to users.

Data and Cloud Decentralization: Startups are offering decentralized alternatives like Filecoin and Arweave (file storage), Livepeer and Theta (video streaming), and Helium (IoT wireless networks). Some large firms integrate with or join these efforts. Amazon, for example, partnered with the DIMO network for automotive data. Meta and Twitter explored decentralized social media protocols or NFT integrations before shifting focus. Peer-to-peer internet services, blockchain DNS, and decentralized web hosting are also being tested.

Enterprise Software and SaaS: Business software leaders like SAP, Oracle, and Salesforce have added blockchain features. Oracle Blockchain Platform supports supply chain use cases, Salesforce launched NFT Cloud, and SAP links ERP data to blockchain for traceability and automation. These integrations are often quiet but significant for adoption.

Silicon and Hardware: Hardware companies are indirectly affected. NVIDIA’s GPU demand shifted from mining to AI, but its software contributions (e.g., CuOpt) intersect with blockchain logistics. Intel’s SGX is used in confidential computing for blockchain, and Samsung has built blockchain features into phones. Telecoms like Verizon and SK Telecom use blockchain for 5G security and mobile payments.

Tech companies see blockchain as core to the Web3 vision, a decentralized and user-owned internet. Google Cloud, for instance, addressed the complexity of blockchain data by making crypto datasets queryable via BigQuery and predicts the convergence of generative AI and blockchain analytics to solve UX issues. AI is also being used for smart contract audits and natural language blockchain queries.

Strategic Implementations and Case Studies:

Google’s Web3 Initiatives: Google supports multiple chains through its Blockchain Node Engine, partners with Chainlink for oracles, and integrates with Ethereum. It aims to be the infrastructure layer for Web3. Clients include financial services and retail exploring loyalty tokenization and supply chain tracking.

IBM and Enterprise Blockchain: IBM initially led with Hyperledger Fabric. Some projects, like TradeLens, ended, while others like Food Trust remain active. IBM now focuses on digital credentials, supply chain, and government applications. Projects like IPwe (tokenizing patents) show blockchain paired with AI and IoT.

Oracle and SAP: Oracle helped build the Global Shipping Business Network (GSBN), which is active in Asia. SAP Ariba added blockchain features for authenticity and payment automation. These firms emphasize modular blockchain add-ons for their vast enterprise client bases.

Consumer Tech – Loyalty and Creator Economies: Companies like Tencent, Alibaba, Samsung, and Adobe have integrated blockchain into consumer experiences. Samsung phones store NFTs, Adobe uses blockchain to verify content provenance, and Twitter previously supported NFT verification. Starbucks uses NFTs for customer rewards via Polygon.

Telecom and Infrastructure: Helium, a decentralized wireless network, is expanding into 5G. Telecom incumbents like Deutsche Telekom and Verizon are operating validators and filing blockchain patents. These firms see value in securing infrastructure and content authenticity.

A recurring theme is how decentralized alternatives could compete with Big Tech, especially in storage or social networking. Big Tech responds by integrating these ideas or investing in decentralized projects. They aim to remain relevant, much like their embrace of open-source software over the past decade. Google describes a “hub-and-spoke” Web3 model, where it connects users to decentralized services without losing platform control. Microsoft sees Web3 as part of the tech evolution alongside the metaverse.

Regulatory and Ethical Considerations:

Data Privacy: Blockchain’s immutability complicates compliance with GDPR’s right to erasure. Tech firms are exploring off-chain data storage and privacy tech like zero-knowledge proofs. “Self-sovereign identity” could solve some issues, but standards like W3C’s DIDs are still maturing.

Antitrust and Decentralization: Web3 could disrupt Big Tech monopolies. Tech firms may embrace blockchain to preempt regulatory scrutiny. Still, if a single company dominates blockchain infrastructure (e.g., cloud node hosting), concerns about re-centralization may arise.

IP and NFTs: NFT platforms must handle intellectual property responsibly. Legal clarity is evolving, and firms are implementing safeguards to avoid unauthorized use. This is increasingly a concern for platforms like Coinbase and OpenSea.

Cybersecurity: Integrating blockchain introduces new risks, from smart contract bugs to quantum threats. Tech leaders contribute to formal verification methods and are developing quantum-resistant cryptography to future-proof systems.

Future Outlook in Technology:

Web3 UX Improvements: Mainstream adoption requires ease of use. Browsers and operating systems may embed blockchain features. Apple has laid groundwork for NFTs in its App Store, and AI agents could automate crypto interactions behind the scenes.

Metaverse and Digital Assets: If the metaverse succeeds, blockchain will anchor ownership of virtual goods. Companies like Meta and Microsoft are building frameworks that integrate NFTs and decentralized identity into immersive environments.

Decentralized Internet Infrastructure: Parts of the internet backbone may shift to decentralized protocols. Companies like Cloudflare are already enabling blockchain access via traditional web pathways. The future will likely blend centralized and decentralized services.

Enterprise IT Integration: Blockchain may become an invisible but essential layer in enterprise software, supporting workflows, provenance, and real-time coordination. Companies will increasingly use blockchain without needing to talk about it – much like how internet protocols work today.

Energy Sector: Powering a Sustainable Future with Blockchain

The energy sector is undergoing a paradigm shift as it grapples with decarbonization, decentralization, and digitization. Blockchain is emerging as a critical tool to modernize energy markets and grids, facilitating everything from peer-to-peer renewable energy trading to carbon credit management. By enabling direct, trust-minimized transactions, blockchain allows new business models that were previously difficult due to the need for centralized intermediaries.

Last November we sketched a power sector at an inflection point and teased the ideas in our Decentralized Energy Protocols primer (Nov-2024). Since then, the macro numbers have sprinted ahead: the International Energy Agency now expects global energy investment to set a fresh record of USD 3.3 trn in 2025, with fully two-thirds about USD 2.2 trn channelled into clean-tech, grids and storage.

Electricity alone will gulp USD 1.5 trn, 50 % more than is flowing into fresh oil, gas and coal supply, yet the cash devoted to wires is stuck near USD 400 bn a year, a level the IEA warns must at least double by the early-2030s to keep the lights on for AI data-centres, EV fleets and on-shored fabs.

Demand is more restless than ever: global power use jumped 4.3 % in 2024 and is primed to rise ~4 % annually to 2027, adding the equivalent of Japan’s consumption every twelve months.

That growth is already re-wiring the mix. Renewables and nuclear delivered 80 % of 2024’s generation increase and collectively reached 40 % of all electricity for the first time, with wind-and-solar alone touching a record 32 % share.

Even so, bottlenecks interconnection queues, transformer shortages, sluggish permitting are binding. This is where the “DePIN” playbook we outlined last year matters. Blockchain-enabled, token-incentivised infrastructure can turn latency into liquidity: data becomes a revenue stream, kilowatts become tokens, and households morph into grid apps that flex consumption or export surplus on command. The idea has moved from rhetoric to revenue. Market researcher VPP Analytics pegs the virtual-power-plant (VPP) market at USD 5 bn today, compounding 22 % a year to USD 16.6 bn by 2030.

Below is a quick state-of-play for the six protocols we have tracked since the primer, plus one publicly traded bell-wether. Think of them as live case studies of capital formation in the new grid-as-market paradigm.

Project Zero (Fuse) – London-based Fuse closed a USD 12 m strategic round in late-2024 and has since rolled its Solana-based reward token into a licensed retail-supply business that now covers >50 k UK meters and 450 MW of solar-wind-storage under development. CEO Alan Chang told Decrypt that regulatory filings for an Ireland supplier licence and an EU cross-border VPP passport are in flight.

Daylight – The “Lumens” test-net went live in February 2025. Home-owners connect thermostats, EVs or inverters and earn an in-app credit redeemable at USD 0.01, effectively boot-strapping a DER data market ahead of main-net (“Daybreak”) later this year.

Starpower – Raised USD 2.5 m seed in January, led by Framework Ventures and Solana Ventures, bringing total funding to USD 4.5 m. The network has passed 100 k connected devices and targets 1 GW aggregated capacity by year-end.

Plural Energy – Issued what it claims are the first on-chain cash distributions for a solar portfolio (Apr 2025) and acquired FINRA-regulated Northstar to run its own broker-dealer rails. Early data show the Ace Portfolio paid +11 % above forecast in its inaugural period.

Glow – Fresh off a USD 30 m raise (Oct 2024), Glow has tripled its weekly carbon-credit output and showcased Glow V2 at DePIN Day during ETHDenver 2025, outlining an India expansion and updated auditing stack for its GCC tokens.

Sourceful – Beta rewards via Helium’s LoRaWAN end 8 Jan 2025; the team confirms an ENERGY token launch in Q3 2025 and a fully fledged VPP dashboard for European smart-meter users in Q4.

Power Ledger (POWR) – The sector’s liquidity proxy trades at USD 0.164 (5 Jun 2025) for a market cap near USD 93 m, down from USD 124 m at our last note but still the most visible price signal for peer-to-peer energy apps.

What ties these efforts together is not just novel tokenomics but an architectural shift: data loops and micro-markets sit at the edge, while blockchain acts as an auditable settlement and incentive layer. The motifs we highlighted in last year’s paper prosumer empowerment, real-time settlement, fractionalised project finance are moving from thesis to throttle.

Looking forward, two constraints loom. First, capital: at USD 400 bn, grid spend now equals barely 18 % of total power-sector outlays, insufficient for the conductor, semiconductor and software upgrades that a bidirectional grid demands.

Second, policy: although Europe is issuing “15-minute” market rules and the US Treasury has clarified transferability for many clean-energy tax credits, securities law for energy tokens remains patchy. Still, the model is proving it can raise non-dilutive capital, crowd-in retail savers and surface device-level flexibility in ways that copper alone cannot.

For founders, the lesson is timing: pair a hard-asset wedge (PV, battery, gateway) with a clear token utility, then grow into grid-service revenue as regulations unblock. For investors, the message is diversification: risk is shifting from fuels to firmware, from turbines to telemetry. And for regulators, the takeaway is urgency: every month grids stay analog is a month of stranded clean-generation and scrapped AI compute plans.

Consumer & Luxury Goods: Provenance, Authenticity, and Digital Engagement

In the consumer and luxury goods sector – spanning retail, FMCG, high-end fashion, jewelry, and automotive – blockchain has become essential in two areas: supply chain transparency and brand authenticity/engagement. Consumer brands are facing increasing pressure to ensure ethical sourcing and product authenticity. Simultaneously, the rise of NFTs and the metaverse has introduced new ways to engage consumers. Blockchain technology enables traceability of physical goods and the creation of digital assets and experiences that align with modern consumer expectations.

On the supply chain side, around a quarter of retail and CPG companies exploring blockchain focus on transparency and production tracking. Brands use blockchain to log each step of a product’s journey from raw materials to final delivery. For instance, a fashion brand might track the cotton source, manufacturing location, and shipment details on a shared ledger accessible via QR code. Food safety and provenance are major priorities. Grocers and producers are using blockchain to record farm origin, batch numbers, processing, and shipping data. Walmart, for example, cut food recall trace times from days to seconds. Carrefour increased customer trust and sales by offering blockchain-verified product histories. Unilever piloted blockchain to verify sustainable tea sourcing, ensuring that data cannot be tampered with.

In the luxury space, counterfeiting and gray markets are key challenges. Blockchain provides digital twins a virtual certificate for each physical luxury item. The Aura Blockchain Consortium (LVMH, Prada, Cartier, etc.) issues these certificates to verify authenticity and ownership, even in secondary markets. LVMH also uses blockchain to trace components during manufacturing. Mercedes-Benz applied blockchain to verify ethical sourcing of raw materials for EV batteries.

Another emerging use is digital product passports, which record post-sale data such as refurbishment, resale, or recycling. Prada and LVMH are trialing this. In automotive, BMW and Ford use blockchain to trace minerals and store tamper-proof service histories, which boosts resale value.

On customer engagement, blockchain-based loyalty and digital collectibles are growing fast. One example is Starbucks Odyssey, where users earn and buy NFT “stamps” through brand interactions. These unlock unique rewards like virtual classes or exclusive trips, simplifying Web3 through intuitive design.

NFTs have become a revenue and engagement channel. Nike, after acquiring RTFKT, launched CryptoKicks - NFT sneakers that sometimes include a physical pair. The company generated over $180 million in NFT sales. Adidas partnered with NFT communities to release collections granting access to exclusive products. Luxury brands like Gucci and Dolce & Gabbana launched NFT couture and virtual goods. These projects serve both as marketing and a testbed for future digital commerce.

Consumer goods firms also benefit from blockchain in data and marketing. Coca-Cola has used blockchain for rebate campaigns. Anheuser-Busch InBev tracked ad impressions via blockchain to fight fraud and ensure value for advertisers.

Case Studies and Examples:

Walmart and Food Trust: After successful pilots tracing mangoes and pork, Walmart mandated blockchain use among suppliers and expanded it across categories. Results include faster recalls, better inventory management, and audit cost reduction. Carrefour saw similar gains and boosted customer trust through blockchain-labeled products.

Carrefour’s App: By scanning a product, shoppers can view its full blockchain-traced journey—origin, farming methods, dates-which gives the retailer valuable feedback and strengthens sourcing strategies.

LVMH’s Aura and Hublot: Hublot introduced blockchain-based e-warranties that update after servicing or resale, deterring counterfeit resale. Louis Vuitton added blockchain to smart luggage trackers, offering tamper-proof travel logs.

Sneaker Resale Innovation: StockX used NFTs as proxies for physical sneaker ownership, enabling trading without repeated shipping. eBay acquired KnownOrigin to integrate NFTs into its marketplace.

Tokenized Engagement: Beyond Starbucks, Coca-Cola issued event NFTs offering access to merchandise or experiences. McDonald’s in China launched anniversary NFTs. Rakuten launched its own NFT marketplace and is experimenting with blockchain loyalty systems.

Automotive Use Cases: Ford tested a system where lease terms adjust based on blockchain-recorded mileage and maintenance. Volkswagen is tracking EV battery lifecycles for resale and recycling. These strengthen consumer confidence in used vehicles.

Brands are using blockchain to build trust-in product authenticity, sustainability claims, and supply chain integrity. This is critical as Gen Z and Millennials increasingly demand transparency. As one Unilever executive said: “If you say your product is sustainable, you better have the data; blockchain can provide that data in an immutable way.”

Challenges and Considerations:

Costs and Scalability: Adoption is expensive for smaller suppliers. Middleware and IoT help automate integration, but many mid-tier companies struggle with the complexity and cost.

Interoperability: Multiple blockchain platforms cause fragmentation. Standards from organizations like GS1 are emerging to unify data formats and improve ecosystem compatibility.

User Experience: Mass adoption depends on making blockchain seamless. Terms like “NFT” are often avoided in favor of “digital collectible.” Many brands hide the technical layer with email-based logins and custodial wallets.

Regulatory Risks: Tokenized loyalty points and NFTs could fall under securities laws if they imply investment returns. Most brands avoid this by not promising ROI and issuing tokens for free. Privacy is also a concern-especially if competitors can access on-chain data. Permissioned or hybrid chains mitigate this.

Future Outlook in Consumer & Luxury:

Transparency Becomes Standard: Blockchain traceability may become as common as ingredient labels. Governments could mandate it for ESG or carbon compliance purposes.

Digital Twins by Default: High-end goods will likely include blockchain-based certificates. These will help with resale, insurance, and service history.

Metaverse Integration: Virtual fashion and goods will grow. NFT wearables, avatar cosmetics, and interoperable virtual merchandise could become major revenue lines.

Tokenized Brand Communities: Brands may issue proprietary tokens that reward engagement and content creation. Blockchain enables fairness, traceability, and interoperability.

Smart Product Integration: Connected products will generate on-chain records. Warranty triggers, usage milestones, or customer rewards tied to real-world activity may become standard.

Blockchain is becoming foundational for trust, engagement, and innovation in consumer and luxury sectors. As pioneers like Walmart, Carrefour, LVMH, and Nike scale their blockchain use, others will follow. What began as experiments is quickly evolving into infrastructure-reshaping how consumers interact with products in the physical and digital worlds alike.

Logistics Sector: Streamlining Supply Chains and Global Trade with Blockchain

The global logistics chain - shipping, freight, warehousing, and trade finance -has long suffered from paperwork, disconnected databases, and manual checks. Since 2017, dozens of blockchain pilots have tried to fix that by creating a single, tamper-proof record shared by every party. Results are mixed but instructive:

TradeLens (Maersk/IBM, 2018-22) proved blockchain could slash document turnaround by ~40 % and onboard 300+ carriers, ports, and customs agencies. Yet it folded when rivals balked at a Maersk-centric platform and the business model couldn’t reach critical mass.

GSBN (non-profit, Hong Kong) picked up the baton. Its electronic bill-of-lading service now processes thousands of Asian shipments, cutting title transfers from days to hours. Broad, neutral governance and permissioned Fabric tech helped overcome data-privacy and trust hurdles.

Provenance & tracking. BMW’s PartsTrace, FedEx/UPS/DHL standards in the Blockchain in Transport Alliance, and IoT-linked cold-chain pilots (e.g., Walmart/UPS vaccines) show incremental wins in recall speed, damage disputes, and compliance.

Trucking & freight marketplaces. Smart-contract escrow schemes (Shipchain, DexFreight) highlight both promise (automated payment on proof-of-delivery) and pitfalls (regulatory fines, uneven adoption).

Trade finance consortia such as Marco Polo and Contour demonstrated real-time data sharing for letters of credit but struggled to achieve sustainable scale; several have been sold or wound down.

Ports and customs. Rotterdam’s DELIVER project replaced PIN codes with digital tokens for container pickup; UK, Singapore, and other regulators now legally recognize digital trade documents, accelerating uptake.

Key lessons

Governance over gimmicks: Neutral, industry-wide control matters more than flashy tech.

Privacy is non-negotiable: Permissioned chains, data channels, and zero-knowledge proofs ease competitive fears.

ROI is indirect: Savings come from fewer disputes, faster financing, and network effects, not immediate fees.

Standards decide winners: Alignment with UN/CEFACT, ISO, and DCSA is essential for interoperability.

Looking ahead

By 2030, most trade documents should be digital, smart contracts may automate freight penalties and insurance, and IoT sensors will feed trusted data straight to customs or insurers. Blockchain won’t replace existing systems, but it is steadily becoming the backbone that links them—quietly boosting transparency, compliance, and coordination across the supply chain.

Sports & Entertainment: Tokenizing Fan Experiences and Creative Content

Sports and entertainment – encompassing professional sports leagues, teams, esports, music, film, and other media – have eagerly embraced blockchain as a means to engage audiences, create new revenue streams, and empower content creators. By 2025, it’s common for a sports fan to hold a fan token or NFT collectible related to their favorite team, or for a music fan to own an NFT that represents a special album edition or backstage pass. These industries thrive on fan communities and intangible value (loyalty, fandom, experiences), and blockchain provides tools to monetize and enhance those in ways not previously possible.

In sports, one of the most prominent developments has been the issuance of fan tokens via platforms like Socios.com. Major sports teams across soccer, esports, MMA, and Formula 1 have launched fan tokens that allow token holders to participate in certain club decisions, get exclusive content, or access VIP rewards. For example, football clubs like FC Barcelona, Paris Saint-Germain, and AC Milan have fan tokens that let fans vote on things like jersey designs, stadium music, or award titles – essentially minor but meaningful decisions – and offer chances to win meet-and-greets or signed merchandise. These tokens trade on exchanges, often seeing significant market activity. Socios has partnered with over 100 teams globally, and even some U.S. teams via sponsorships. By giving fans a symbolic stake in decision-making and unique perks, teams deepened engagement and monetized globally dispersed fanbases in a new way – a digital evolution of fan clubs.

Sports NFTs have also taken off, particularly with digital collectibles like trading cards and moments. NBA Top Shot, launched in 2020, is a famous case: it turns highlight video “moments” into limited-edition NFTs that fans can buy, trade, and showcase. Top Shot saw explosive growth and became a template that other leagues followed – the NFL and UFC launched similar NFT platforms. By 2025, collectible NFTs are common for major events. These collectibles often include gamification and community features, modernizing the classic sports card hobby.

Ticketing is another area being transformed. Blockchain addresses entrenched problems like scalping, high fees, and counterfeit tickets. Tickets issued as NFTs can include smart rules to limit resale markup or ensure royalties for event organizers. NFT tickets also become digital memorabilia and unlock future value. Trials include NFT tickets at the Super Bowl and major events. Companies like Ticketmaster are expanding blockchain ticketing capabilities. Over time, fans may store their concert and game tickets in blockchain wallets, adding value beyond just entry.

In the music industry, artists and labels are experimenting with NFTs and tokenized communities to change how music is distributed and monetized. Artists have released albums as NFTs, sold royalty shares via tokens, or offered access via social/community tokens. Platforms enable fans to buy a stake in a song’s streaming income. Labels and platforms are cautiously exploring Web3 for virtual concerts, NFT-based merchandise, and fan token clubs.

Film and TV are exploring blockchain through fractional film ownership and NFT-based marketing. Films have raised funds through NFT sales or tokenized future earnings. Studios use NFTs to create exclusive collectibles or digital merchandise. Streaming services may eventually offer NFT passes for interactivity, allowing fans to vote on content or access exclusive scenes.

Importantly, blockchain is seen as a tool to rebalance revenue shares towards creators. If artists can sell directly to fans via NFTs or tokens, they bypass traditional middlemen. In sports, athletes have released personal NFT collections or even tokenized future earnings. The direct-to-fan model is a paradigm shift, giving fans not just content but symbolic ownership and deeper connection.

Case Studies and Examples:

Chiliz/Socios Fan Tokens: Socios’s fan token launches include fan polls honored by clubs. For example, FC Barcelona’s token sold out quickly and now plays a role in marketing and community engagement. Even smaller clubs benefit by raising funds directly from fans.

NFT Collectibles and Moments: NBA Top Shot passed $1 billion in marketplace transactions by 2025. Leagues like the NFL followed suit. Collectors display their moments like digital trading cards, and clubs have integrated them into fan recognition and engagement strategies.

OKX and McLaren Racing Collectibles: McLaren F1 launched a “Race Collectibles” NFT program, issuing mystery box NFTs that reveal race highlights and offer exclusive rewards. The strategy deepened fan engagement and targeted a younger digital-native audience.

Esports and Gaming Creators: Teams like Team Vitality and NAVI have launched tokens and collectibles. Fantasy and betting platforms using crypto are emerging, and streaming platforms are exploring blockchain-based tipping. Some crypto-native platforms offer better revenue share models.

Music Artist Tokens: Artists like 3LAU and RAC pioneered music NFTs and social tokens, selling exclusive content and royalty rights. Though niche, these models are gaining traction among superfans.

Film NFTs and Crowdfunding: Directors like Kevin Smith sold exclusive film editions as NFTs. Some projects used NFTs to crowdfund movies and grant creative input to token holders. Studios are testing NFTs as digital merchandise, raising new legal and IP considerations.

Challenges and Considerations:

Volatility and Fan Backlash: Token prices can be unstable. If tied too closely to team or artist performance, fans may see losses. Some groups resisted token models as creating inequalities in fandom. Education and careful design are key.

Regulation: Authorities are evaluating fan tokens and NFTs under securities and gambling laws. Messaging has shifted to emphasize fandom utility over investment. Ticketing also raises privacy and anti-scalping law issues.

Environmental Concerns: While energy use was a concern, most NFTs now use energy-efficient chains. Still, some artists face backlash due to lingering perceptions.

IP and Rights Clarity: NFT buyers often misunderstand what they’re purchasing. Legal clarity and smart contracts are essential, especially for IP-heavy industries like film and music.

Future Outlook in Sports & Entertainment:

Holistic Fan Ecosystems: Fans could accumulate loyalty points or tokens across games, broadcasts, and social media. These could be exchanged for access or rewards, turning fandom into a multi-platform economy.

Decentralized Content Platforms: Artists may release content directly to fans on Web3 platforms, with governance tokens for community input. Streaming could be reimagined through blockchain-enabled voting and direct payments.

Metaverse Events: Virtual concerts and shows will increasingly use blockchain for access, collectibles, and fan interaction. NFTs can mark attendance or unlock future benefits.

Royalty Automation: Blockchain enables near-instant revenue sharing. Artists could receive royalties in real-time based on consumption data, creating more transparent and fair systems.

Global Monetization: Blockchain removes geographic constraints, allowing global fan communities to engage and transact in unified digital economies. This favors mega-brands but also pressures mid-tier creators to innovate.

2025 and Beyond: Convergence and the Tokenized Economy - A Concise Outlook

Across Finance, Technology, Consumer & Luxury, Sports & Entertainment, Gaming, Logistics, Healthcare, and Energy, one story dominates: blockchain-driven tokenization is making assets, rights, and data more liquid, transparent, and inclusive. Below is a streamlined view of how these forces combine-and what leaders should watch next.

Convergence in Action

Industry walls are dissolving as tokens move freely across domains. By 2030 a single wallet might hold:

fractional real-estate shares

NFT sports memorabilia

personal carbon credits

health-data access tokens

rewards from a solar co-op

Value earned in one arena can seamlessly fund activity in another. For enterprises, that means cross-sector consortia: auto makers and utilities rewarding EV charging; banks, cloud providers, and hospitals launching a tokenized health-ID network. Blockchain serves as the common ledger, aligning incentives among previously siloed players.

Market Trajectory and Sector Pace

Forecasts differ on magnitude, but all point to exponential uptake. Finance still leads-live systems in payments and settlement are proof-points-while consumer NFTs, gaming, and energy trading could spark the next mass-adoption waves. Early movers (e.g., big banks, tech giants, brand leaders) enjoy network-effect advantages; latecomers may need to buy in rather than set the standards.

Capital Strategies

VC and PE: Shift from speculative coins to “picks-and-shovels” infrastructure and tokenizing existing portfolios for liquidity.

Corporates: Over half of Fortune 100 now back blockchain ventures, eyeing M&A and strategic stakes in critical stack layers.

Asset Managers: Increasingly hold and even govern DeFi protocols, merging traditional activism with on-chain voting.

Risk & Governance

Security breaches, policy reversals, or renewed congestion remain threats. Another challenge: preventing a drift toward de-facto centralization if a handful of tech or finance firms dominate node hosting. Strong, transparent governance will be essential to keep networks open and competitive.

The Bottom Line

Like the internet before it, blockchain is on track to fade into the background while powering a tokenized economy. Executives and investors who focus now on practical, value-creating applications-faster settlement, richer fan engagement, streamlined healthcare, greener energy trading-will set the pace for the 2030s. Today’s groundwork will decide tomorrow’s market leaders.

Sources

OKX & Blockworks Research, "The Future of Blockchain Applications: Reshaping Global Industries," 2024:

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be taken as any form of professional advice. We do not advocate for any investment actions, including buying, selling, or holding digital assets.

The content reflects only the writer's views and not financial advice. Please conduct your own due diligence before engaging with cryptocurrencies, DeFi, NFTs, Web 3 or related technologies, as they carry high risks and values can fluctuate significantly.

Note: This research paper is not sponsored by any of the mentioned companies.

More Blockchain hype. Almost of the examples mentioned here are limited or not commercially scalable. Eleven years and we have still not found a clear case for using blockchain in mainstream industries.